Another eventful year in ETFs is one best experienced in pictures. If you missed my earlier ETF pictorials, see here:

Without further ado, let’s look back at the year that was in ETFs. Enjoy!

ETF Growth

ETF assets hit record highs in 2018 and inflows (new $$) are on track for the 2nd or 3rd best year ever.

Source: ETFGI

Source: ETFGI

ETF Heat Map

ETF growth is impressive given nearly every asset class is negative for the year…

Source: Finviz; price returns through 12/11/18

Source: Finviz; price returns through 12/11/18

“ETF Terrordome”

New investor dollars continue flowing into the lowest cost ETFs – those with fees of 0.20% or less. Bloomberg’s Eric Balchunas refers to the ETF industry as “The Terrordome” given the brutal fee competition.

Source: @EricBalchunas

Source: @EricBalchunas

A Game of Survival

Balchunas also has this to say about large asset managers entering the ETF Terrordome: “They come in looking like Tom Hanks at the beginning of Castaway and, three years later, they’re like him three years later on that island spearfishing, weighing like 100 pounds, and being completely self-efficient and hardcore.”

Source: @EricBalchunas

Source: @EricBalchunas

Win-Win

Despite ruthless fee competition, the significant ETF asset growth and lower fees results in a win-win for ETF providers AND investors.

Source: Bloomberg TV

Source: Bloomberg TV

Terrordome vs. Country Club

While ETFs operate in the Terrordome, mutual funds still enjoy a country club atmosphere.

Source: Nate Geraci

Source: Nate Geraci

Don’t Forget the Tax Man

Costs aren’t the only difference between ETFs and mutual funds. An estimated 500+ mutual funds will pay capital gains distributions in excess of 10% of net assets. Investors fleeing actively managed stock mutual funds and a long running bull market are resulting in nasty tax bills. Meanwhile, only 14 ETFs from the largest providers are expected to pay cap gains greater than 2%!

Link: Morningstar; Adam McCullough

Link: Morningstar; Adam McCullough

Why are Fees & Taxes So Important?

Source: Morningstar; Jeffrey Ptak

Source: Morningstar; Jeffrey Ptak

Buh-bye

Higher fees, tax inefficiency, and lack of performance has resulted in huge outflows from actively managed stock mutual funds, though investors still have faith in active bond managers.

Source: Bloomberg TV

Source: Bloomberg TV

Fighting Back

Mutual fund companies are beginning to fight back, though. Perhaps the biggest story of the year was Fidelity launching the first free index mutual funds, beating ETFs in the race to zero. Will running loss leaders help revive actively managed mutual fund flows?

Source: Nate Geraci

Source: Nate Geraci

JPMorgan

Fidelity isn’t the only asset manager apparently pursuing a loss leader strategy. JPMorgan made an ETF splash in 2018, launching 9 low cost ETFs which quickly vacuumed-up over $8 billion. There’s talk they could launch the first zero fee ETF (incidentally, I predicted this back in August).

Source: ETF.com; flows from 1/1/18 – 12/11/18

Source: ETF.com; flows from 1/1/18 – 12/11/18

Ultra & Short-Term Bond ETFs

Besides Fidelity going to zero and JPMorgan’s aggressive move into ETFs, the story of the year was investors’ insatiable appetite for shorter-term bond ETFs. Rising interest rates and market volatility pushed investors to the shorter-end of the yield curve.

Source: Tom Psarofagis

Source: Tom Psarofagis

Active Joining ETF Party?

Despite investors’ focus on low cost, index-based ETFs, fund companies are increasingly launching active ETF strategies – an area where I believe tremendous opportunity exists.

Source: Tom Psarofagis

Source: Tom Psarofagis

Thematic ETFs

Another area of growth has been thematic ETFs focusing on niche areas like cybersecurity or robotics.

Link: Bloomberg

Link: Bloomberg

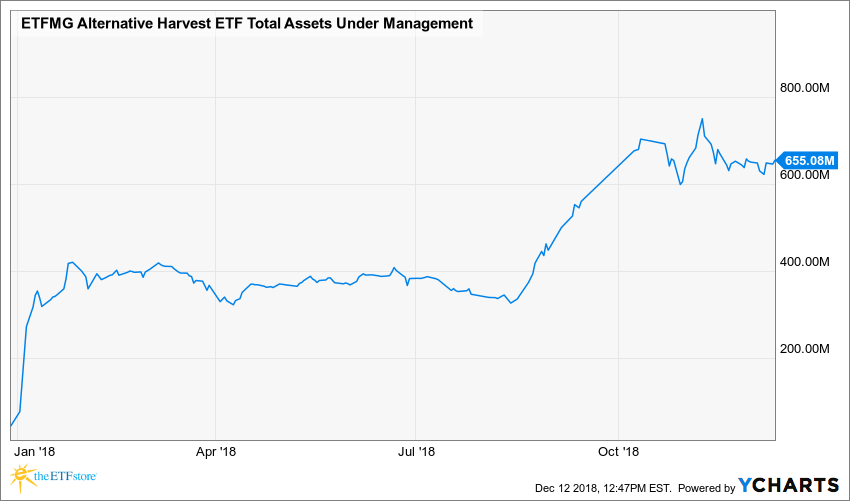

Getting High

The most high-profile thematic ETF in 2018 was the ETFMG Alternative Harvest ETF, which raked in hundreds of millions of dollars despite differing opinions on the investment merit of marijuana.

Bitcoin ETF

2018 will also go down as the year a certain ETF didn’t launch. Despite significant effort, particularly from the team behind the VanEck SolidX Bitcoin ETF, the Securities & Exchange Commission passed on approving a bitcoin ETF. Proponents are asking whether this is really any different than other existing commodity ETPs.

Source: SEC

Source: SEC

RIP “Smart Beta”?

Another noteworthy ETF story in 2018 was debate over the term “smart beta”. While investors continue plowing money into these products, some are questioning what “smart beta” even means. Alpha Architect’s Ryan Kirlin says, “Smart beta is — and always has been — a marketing term. From an investment process standpoint, smart beta is — and always has been — active investing with an algorithm.”

Source: Alpha Architect; Ryan Kirlin

Source: Alpha Architect; Ryan Kirlin

Year of ESG ETFs?

While debate rages over the term “smart beta”, Bloomberg’s Eric Balchunas commented that people supporting ESG ETFs would kill for a term like that. Even with heavy media coverage and lower fees, socially-responsible ETFs failed to gain significant traction.

Source: Bloomberg TV

Source: Bloomberg TV

ETF Innovation

One of my favorite ETF stories this year was WisdomTree launching the 90/60 U.S. Balanced Fund (NTSX) ETF based on Twitter feedback. ETF innovation knows no bounds.

Source: Bloomberg TV

Source: Bloomberg TV

Innovation & Growth Accelerating

The pace of ETF growth is quickening, as expected from a disruptive technology.

Source: Toroso Asset Management; Michael Venuto

Source: Toroso Asset Management; Michael Venuto

“Household Bubble”?

Concerns over ETF growth have resulted in claims of an “ETF bubble”. Is there a bubble in “households” or mutual funds as well??

Source: Teddy Vallee

Source: Teddy Vallee

Speaking of Households…

Ones owning ETFs tend to be younger, more highly educated, have higher incomes, and more confident about investment decision-making than mutual fund-owning households.

Source: ICI; Strategic Business Insights

Source: ICI; Strategic Business Insights

ETF Future is Bright

Link: iShares

Link: iShares

ETFs Not Without Their Faults

While ETFs have “democratized” access to institutional caliber strategies, they also bring additional risks to investors. During February’s market turmoil, the VelocityShares Daily Inverse VIX Short Term ETN (XIV) blew-up. This product functioned exactly the way it was supposed to, but highlighted the importance of knowing what you own.

Source: MoneyWeek

Source: MoneyWeek

Could Better ETF Labeling Help?

To better inform investors on products like XIV, BlackRock proposed new labeling as part of the ETF rule. As ETFs grow in popularity, every bit of education helps.

Source: BlackRock

Source: BlackRock

My ETF Chart(s) of the Year

You might have noticed the abundance of Bloomberg-related charts. That’s not intentional. Quite simply, Bloomberg’s ETF team has the best visuals around. My chart(s) of the year are also courtesy of Bloomberg (I copped-out and picked two)…

Chart #1: 95% of media attention is focused on ETFs comprising 5% of your portfolio. I’m as guilty of this as anyone. Marijuana, bitcoin, and robotics ETFs are fun to talk about, but should only represent a small fraction (if any) of investors’ portfolios.

Source: Bloomberg TV; Eric Balchunas

Source: Bloomberg TV; Eric Balchunas

Chart #2: Whenever you hear someone say ETFs are driving the market and/or distorting stock prices, show them this…

Source: @JSeyff

Source: @JSeyff

Look forward to seeing the ETF visuals produced in 2019!!