As usual, let’s start with a recap of my prediction track record:

2022: 3 for 4 (one incomplete)

2024: 1 for 5 (yikes, but my spot bitcoin ETF prediction should count as 2 or 3)

2025: 2 out of 5 (though if you add my crypto ETF predictions, it’s 10 out of 15!)

It’s been a rough few years for my predictions, which is why I always say: Nobody. Knows. Anything. Still, predictions are fun and I love covering the ETF space, so I’m not about to let a few lean years stop me from making my annual prognostications. My industry friends might be saying “what have you done for me lately”, but I’m more of a long-term track record guy. And that long-term record still sits at close to 70% accuracy. I’d be rich if this were sports gambling. Add in the fact that I hit 80% of my crypto ETF predictions last year, and that bumps my overall track record to nearly 80%! It’s also worth mentioning that I’ve been early on numerous predictions over the years. I know being early is the same as being wrong, but again, I’m focused on the long-term (at least that’s what I keep telling myself to feel better). Before I unveil my latest prognostications, I have to offer the two usual disclaimers: 1) Nothing here should be construed as investment advice. Do your own homework! 2) No excuses, but I always attempt to go out on a limb and make at least a few bold(er) calls. In that spirit, I’m setting aside several obvious topics, including the ETF share class structure, the GROWTH Act (which would allow mutual fund investors to defer capital gains taxation until they sell their shares), 351 exchanges, private assets in ETFs, whether Vanguard will FINALLY surpass BlackRock in ETF market share, and the continued momentum in gold and silver ETFs. All of these will remain top-of-mind across the industry. With that, my 2026 ETF predictions…

1) Uptick in ETF Issuer M&A

In early December, Goldman Sachs announced it would acquire Innovator Capital Management in a $2 billion deal expected to close in the second quarter of this year. Innovator, which oversees $30 billion in assets, pioneered defined outcome ETFs – a category that has since grown to more than $80 billion industrywide.

Despite Goldman’s pedigree, distribution, and investment capabilities, its ETF business has largely been treading water for years, failing to meaningfully climb the industry rankings. The fix? Buy an established ETF issuer with a fast-growing, specialized product suite and a proven track record.

As Goldman Sachs Chairman and CEO David Solomon put it:

“By acquiring Innovator, Goldman Sachs will expand access to modern, world-class investment products for investor portfolios. Innovator’s reputation for innovation and leadership in defined outcome solutions complements our mission to enhance the client experience with sophisticated strategies that seek to deliver targeted, defined outcomes for investors.”

Over the past several years, many of the biggest names in asset management have entered the ETF arena. While these firms bring deep pockets, they often arrive with shallow, undifferentiated product lineups. With competition as fierce as ever, the path of least resistance to compete in the ETF Terrordome is crystal clear in my opinion: acquire, rather than build. That dynamic bodes very well for smaller ETF issuers with genuinely differentiated offerings.

My first prediction for 2026 is that the industry will see multiple transactions, with larger asset managers scooping up smaller ETF issuers. I’m not entirely sure how to quantify this, so I’ll simply say there will be several transactions significant enough to capture the attention of my industry friends – who can judge the accuracy of this prediction at year-end.

As for potential acquisition targets, I have no direct insight. That said, several firms stand out as differentiated, cash-generative businesses that could integrate smoothly into an established distribution platform: NEOS, GraniteShares, Roundhill, and BondBloxx. Regardless, 2026 is shaping up to be an active year for industry M&A.

2) Smart Beta ETFs Make Comeback

Remember smart beta ETFs? Considered “ETFs 2.0”, these rose to prominence 10-15 years ago by claiming to offer the best of both worlds between traditional passive indexes and active management. They typically tilt towards factors such as value, momentum, quality, size, dividend, and low volatility. Despite the initial hype, new launches in the category have basically flatlined over the past six years and asset growth has been subpar overall. Why? Well, it’s tough to sell investors on doing something different when market cap weighted indices are rocketing higher.

However, I noticed a trend in the back half of 2025, with several prominent asset managers launching ETFs that smell very much like smart beta.

Kelsey Mowrey, President of Motley Fool Asset Management, who rolled out three rules-based ETFs in early December:

“By expanding our passive lineup into value, momentum, and growth opportunities, we’re helping investors build portfolios that reflect both discipline and conviction — hallmarks of our Foolish approach to investing.”

Tim Coyne, Global Head of ETFs at T. Rowe Price, who launched two ETFs shortly after Motley Fool:

“Our Active Core ETFs uniquely blend the benefits of passive index portfolios with fully active strategies, adding a compelling new dimension to our ETF lineup. By combining T. Rowe Price’s active management expertise with robust quantitative research, these ETFs give investors access to our portfolio managers’ best ideas and the potential to outperform benchmarks—while maintaining disciplined risk controls and a cost-efficient structure.”

A week later, Cambria launched an equal weight ETF (which also leverages the 351 exchange). Meb Faber, Cambria’s Founder and Chief Investment Officer, commented:

“Due to the market’s run-up over the last several years, many investors are trapped in concentrated positions in stocks that have become too large a portion of their portfolios.”

While some of these ETFs aren’t “pure” smart beta in the sense that they retain active discretion, they still feel very much in line with the spirit of smart beta. That active discretion allows for greater flexibility around portfolio management, such as rebalancing or risk control during market dislocations (for example, the GameStop episode). It may also allow managers to adjust factor exposures in response to changes in correlations, valuations, or broader market structure. An issuer like Dimensional would be “Exhibit A” here. Regardless, these strategies are best described as systematic, factor-targeted portfolios that depart meaningfully from traditional cap-weighted approaches.

The smart beta ETF category currently holds roughly $1.1 trillion* in assets and attracted about $37 billion* in net inflows last year – but, again, this doesn’t include active ETFs masquerading as smart beta. Against a backdrop of elevated equity valuations, historically high concentration in cap-weighted indices, and growing investor caution after cumulative S&P 500 returns of approximately 90% over the past three years, I’m betting that ETF issuers will continue leaning into systematic, factor-targeted portfolios, with investor interest rising meaningfully.

Once again, I’m not exactly sure how to quantify this prediction given the line between “smart beta” and various forms of quantitative active management has become increasingly blurred. To keep things clean, I’ll say 2026 smart beta ETF inflows double to $75 billion (the record is $103 billion in 2022). Regardless, you get the idea. Smart beta, enhanced, quantitative, whatever you want to call it – it’s BACK.

3) Crypto Index ETFs Boom

Despite lackluster performance, spot crypto ETFs attracted roughly $35 billion in inflows in 2025, building on a historic 2024 debut that brought spot bitcoin and ether ETFs to market. Donald Trump’s November 2024 election victory marked a clear turning point for crypto policy in the U.S. A changing of the guard at the SEC quickly shifted the regulatory stance from extremely hostile to very friendly. New leadership moved swiftly, approving in-kind creations and redemptions, staking, and – most importantly – generic listing standards for spot crypto ETFs.

Those generic listing standards opened the floodgates. ETF issuers subsequently launched spot crypto ETFs tied to assets such as solana, XRP, HBAR, and dogecoin. Several index-based spot crypto ETFs were also approved or allowed to expand beyond bitcoin and ether, including offerings from Grayscale, Bitwise, Hashdex, Franklin Templeton, and 21Shares.

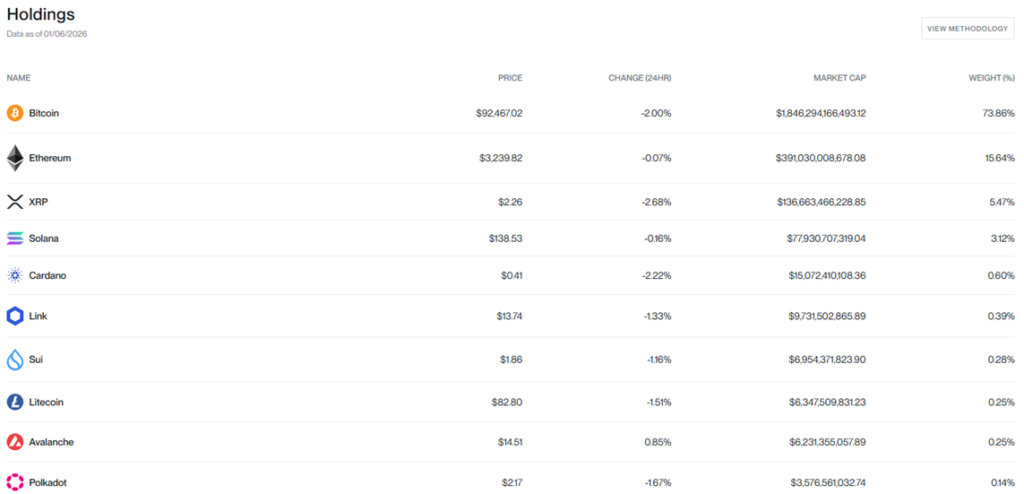

Those crypto index ETFs, currently led by the Bitwise 10 Crypto Index ETF (BITW), have approximately $1.7 billion in assets. Here’s what BITW’s holdings look like today:

Source: Bitwise

More investors and advisors are growing comfortable allocating to crypto. For example, a recent Charles Schwab survey found that 45% of ETF investors plan to invest in crypto, second only to U.S. equities. Even more importantly, a rising number of advisors are now actually permitted to recommend crypto allocations to clients. Even Vanguard now allows brokerage clients to buy and sell crypto ETFs. There’s just one problem: many traditional investors and financial advisors still aren’t fully confident navigating the crypto landscape. They’ve heard of bitcoin, and probably ethereum, but I’ll go out on a limb and suggest most have little to no idea what Sui or Avalanche actually do.

The solution is straightforward: spread your bets by taking an index-based approach. It’s no different than using index-based stock or bond ETFs to gain diversified exposure to those market segments. The fact is investors – and particularly advisors – LOVE diversification. And they love it even more in emerging categories like crypto.

With over 125 crypto-related ETF filings currently sitting at the SEC, advisors are about to be absolutely inundated with new products. Most want no part of navigating that complexity. What they do want is a simple, portfolio-ready solution. Crypto index ETFs provide exactly that.

These products can also address practical portfolio challenges, such as diversifying investors who already hold spot bitcoin and ether ETFs, which together now represent nearly $135 billion in assets. For instance, an investor sitting on embedded gains in bitcoin within a taxable account can achieve broader crypto exposure by allocating to a product like the 21Shares FTSE Crypto 10 ex-BTC Index ETF (TXBC). My prediction is that the crypto index ETF category will triple this year, with assets reaching over $5 billion. This feels like the natural next step in crypto’s continued march into the mainstream.

4) International Equity ETFs Smash Record Inflows

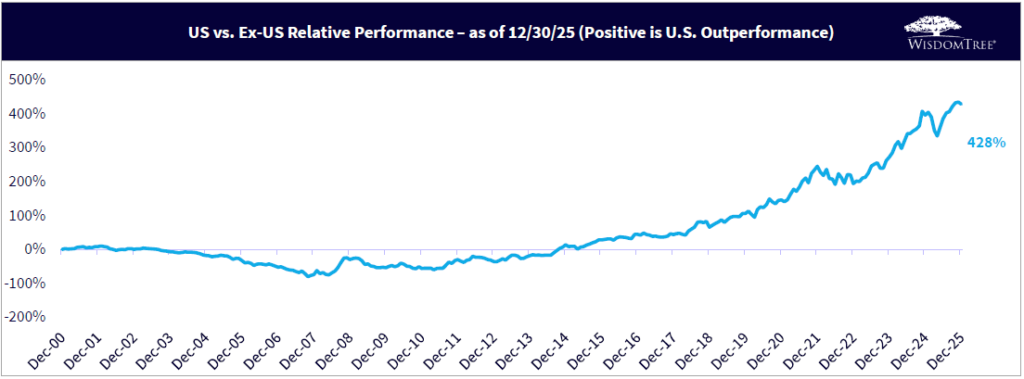

It seems like nearly every year over the past 15+ years, investors declare it will finally be the “year for international stocks,” and most years they end up being wrong. The track record for international stocks over this timeframe is brutal, with US stocks outperforming by a cumulative nearly 430%!

Source: WisdomTree

However, if you look closely at the above chart, you’ll see a slight tick down. That’s because international stocks FINALLY did outperform US stocks last year.

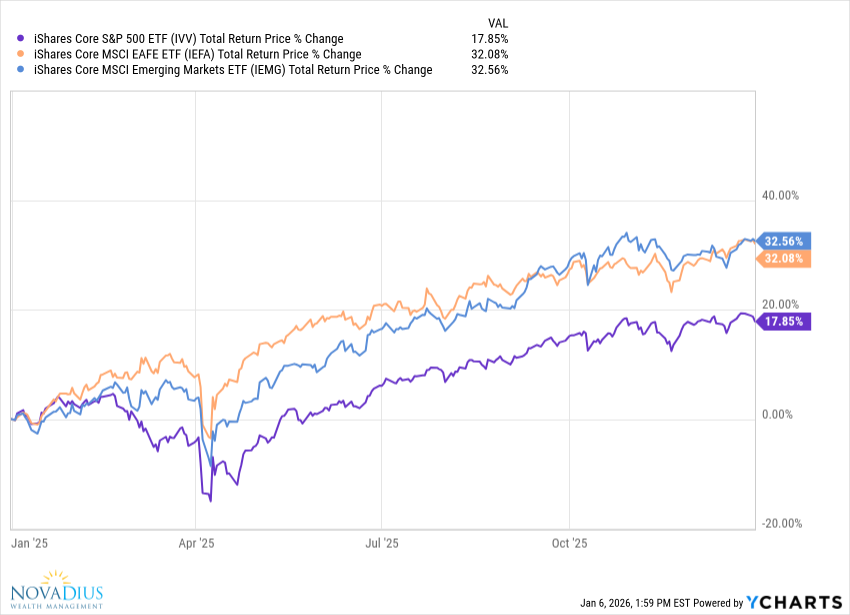

Despite foreign equities consistently outshining their U.S. counterparts in 2025, U.S. equity ETFs continued to dominate investor flows. In fact, among the top 10 ETFs by inflows last year, three tracked the S&P 500 (VOO, IVV, SPYM), one covered the total U.S. stock market (VTI), and another represented the Nasdaq-100 (QQQ). The only international ETF on the list was the Vanguard Total International Stock ETF (VXUS). I think the composition of the ETF leaderboard changes in 2026, with ETFs such as the iShares Core MSCI Emerging Markets ETF (IEMG) and iShares Core MSCI EAFE ETF (IEFA) joining VXUS in the top 10. International equity ETFs pulled in about $250 billion* last year, besting 2021’s record $198 billion*. My prediction is international equity ETFs easily shatter that record.

After being repeatedly burned by international stocks over the past 15 years, many investors and advisors have understandably taken a wait-and-see approach to the category. They wanted proof that the recent outperformance was real and sustainable.

While some skepticism remains, I believe a few forces are now converging that could push investors to reallocate their U.S.-heavy portfolios: last year’s international outperformance, increasingly stretched U.S. equity valuations, and President Trump’s stated desire for a weaker U.S. dollar.

As President Trump put it last July:

“You make a helluva lot more money with a weaker dollar. When the dollar is strong, you don’t do any tourism, you can’t sell tractors, you can’t sell trucks, you can’t sell anything.”

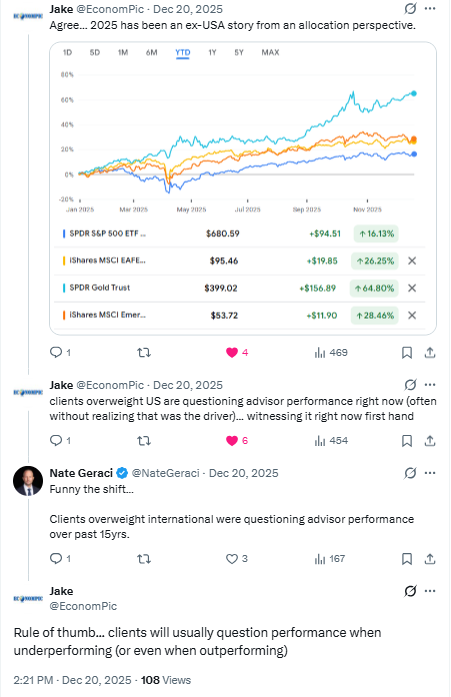

I’ll take him at his word. A weaker greenback would be a meaningful tailwind for international stocks and, by extension, international equity ETFs. To be clear, I’m not making a call that US stocks are headed for a downturn. I’m simply suggesting that international stock performance could remain strong, and if that happens, I expect investors – and particularly advisors – to allocate accordingly. Why? This brief exchange on X succinctly explains:

5) The Year of Fixed Income ETFs

Admittedly, this isn’t the most exciting prediction – but it may be the most consequential if it plays out. Fixed income ETFs took in roughly $450 billion* last year, shattering the prior annual record set in 2024 of just over $300 billion.

Flows were broad-based. Short-term government bond ETFs had a standout year, most notably the iShares 0–3 Month Treasury Bond ETF (SGOV), which attracted the third-most inflows of any ETF. Aggregate bond ETFs, corporate bond ETFs, and even international bond ETFs also posted strong inflows. Actively managed fixed income ETFs were clear standouts as well, accounting for 40% of all bond ETF inflows. Money flowing into products such as the iShares Flexible Income Active ETF (BINC) and the Janus Henderson AAA CLO ETF (JAAA) underscored investors’ growing appetite for active management in bond portfolios.

If you thought 2025 was a strong year for fixed income ETFs, you haven’t seen anything yet. My prediction is that 2026 will easily eclipse last year – in inflows, new launches, and general investor interest in the category.

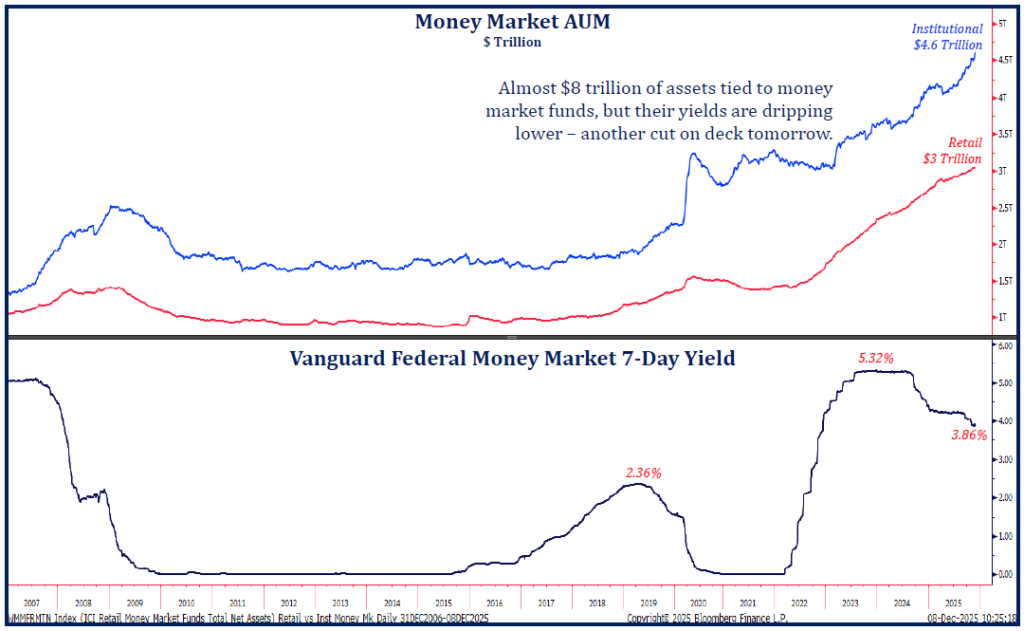

I see two primary drivers: 1) Meaningful flows out of money market funds, and 2) Lower interest rates, particularly along the front and intermediate portions of the yield curve. A record $7.6 trillion currently sits in money market funds, where average yields have already fallen below 4%. I’m betting a meaningful portion of that capital migrates into fixed income ETFs in search of better income opportunities. Some may argue this money will chase high-flying stocks or crypto, but there’s usually a reason it was parked conservatively in the first place. It’s far more likely to move into fixed income vehicles than into full risk-on assets.

Source: Strategas’ Todd Sohn

At the same time, the Fed is expected to cut rates at least twice in 2026. While I’m not in the business of making precise rate forecasts, expectations matter – and the expectation is clearly for lower rates ahead. VettaFi recently surveyed advisors on where they see interest rates by the end of 2026, with the results as follows:

Lower: 75%

Higher: 7%

No Change: 18%

If that’s the consensus, advisors won’t wait around. They’ll be proactive in reallocating portfolios today, seeking higher yields while they still can. Fixed income ETFs stand to be a major beneficiary.

Beyond those two primary drivers, it’s also possible we see a stock market pullback after three consecutive years of exceptionally strong gains. If that happens, fixed income ETFs stand to benefit even more.

I hereby proclaim 2026 as the “Year of Fixed Income ETFs”.

*Based on State Street ETF classifications