It’s that time of year… a look back at some of my favorite charts and pictures from the year in ETFs. Enjoy!

ETF Story of the Year

This one wasn’t even close. The spot bitcoin ETF saga had more twists and turns than a Quentin Tarantino flick.

ETF story of the year?

— Nate Geraci (@NateGeraci) December 20, 2023

-Multi-share class structure filings (Dimensional, Fidelity, etc; Vanguard patent expires)

-QQQ performance (↑ 55% ytd)

-Rise of active ETFs (80% of new launches, outsized inflows)

-Spot bitcoin ETF drama (Grayscale court victory, BlackRock files, etc)

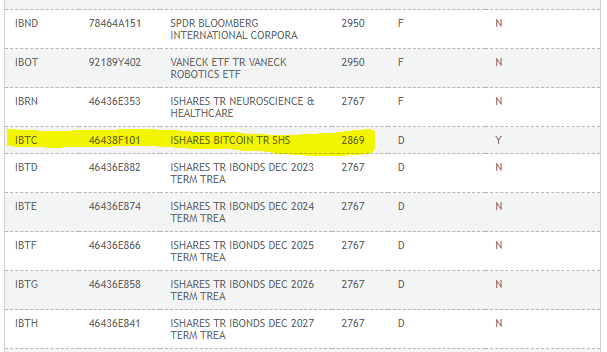

BlackRock filed for a spot bitcoin ETF on June 15th, kicking-off an absolutely wild back half of 2023 that featured: 1) An additional eleven entrants joining the race (ARK already had a live filing and Grayscale views their filing as live), 2) Grayscale winning their lawsuit against the SEC over the conversion of the Grayscale Bitcoin Trust (GBTC) into an ETF, 3) the prospective iShares Bitcoin ETF being “listed on” the DTCC, which some assumed meant a launch was imminent, 4) A false Cointelegraph tweet stating the SEC had approved the iShares Bitcoin ETF.

I could keep going (SEC meetings with issuers, cash versus in-kind creations and redemptions, etc), but the list of plot twists would occupy this entire 2023 lookback.

Source: SEC

Source: US Court of Appeals

Source: Bloomberg’s Eric Balchunas

Speaking of Twitter, or X, one of my favorite side hobbies is following the spot bitcoin ETF drama on the platform. As promised, here is the best meme submitted to me on the topic. There is still some uncertainty over whether Grayscale will be able to uplist GBTC on the same day as other spot bitcoin ETFs launch. This captures the sentiment, or shall we say conspiracy theory, well…

Source: Bloomberg’s Athanasios Psarofagis

It has now been over ten years since the Winklevoss twins filed for the first spot bitcoin ETF. Ten years and… Still. No. Spot. Bitcoin. ETF. That said, the SEC did allow the Volatility Shares 2x Bitcoin Strategy ETF (BITX) to begin trading. That’s right. Investors were given a double leveraged bitcoin futures ETF before a spot bitcoin ETF. Only Quentin Tarantino could come up with something as sadistic as that. The good news? This all looks set to change as we kick-off 2024.

Rise of Active ETFs

Without question, the rise of actively managed ETFs was one of 2023’s biggest stories. The category represents less than 7% of industry assets, but accounted for nearly 25% of all inflows and 80% of new ETF launches this year. The SEC’s 2019 approval of Rule 6c-11 (better known as the “ETF Rule”) initially set the table for the rise of active ETFs as it streamlined the process of bringing these products to market and allowed for additional operational efficiencies (such as the use of custom baskets). That opened the floodgates for firms such as Dimensional, JPMorgan, and Avantis to aggressively launch low cost, systematic, actively managed ETFs (versus traditional active stock picking ETFs).

In summary, the rise of active ETFs comes down to a combination of 1) More active ETFs available to investors, 2) Last year’s tumultuous market environment (which resulted in investors looking to active management), 3) Traditional mutual fund firms transferring clients/assets from their existing mutual funds to the new ETFs, and 4) Perhaps most importantly, falling expense ratios.

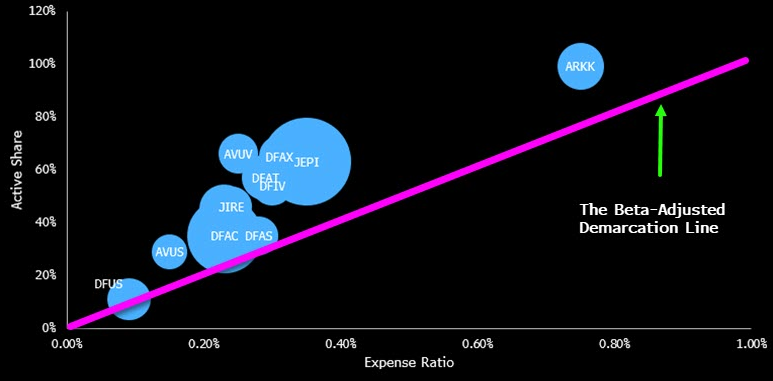

Regarding expense ratios, my favorite chart explaining the rise of active ETFs comes courtesy of Bloomberg’s Eric Balchunas. If an active ETF is seeking a greater likelihood of success, issuers need to land above the “Beta-Adjusted Fee Demarcation Line”. A simple way to think about this? Investors are no longer willing to pay up for closet indexing. Active ETFs either need to be cheap or offer high active share. A number of ETF issuers have finally figured this out, propelling the active ETF category higher.

Source: Bloomberg’s Eric Balchunas

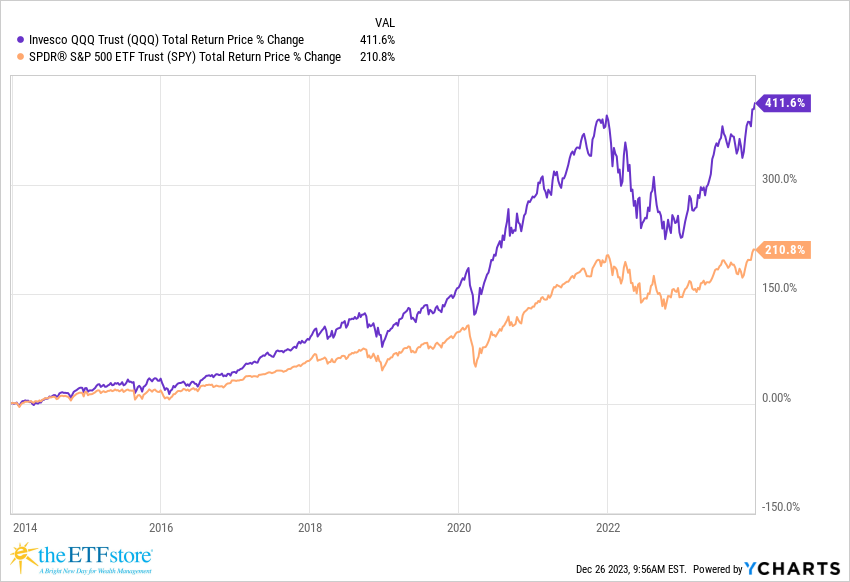

QQQ Performance

The Invesco QQQ ETF (QQQ), which tracks an index of 100 of the largest non-financial companies listed on the Nasdaq Stock Market, is up 55% this year. That marks its best year since 1999. Very few, if any, investors would have predicted that coming into 2023. QQQ has destroyed all comers. The S&P 500, which itself is difficult to beat, is trailing QQQ by 200%+(!) over the past ten years. Cathie Wood’s flagship ARK Innovation ETF (ARKK) is trailing QQQ by 150% since its 2015 inception.

The 24-year old ETF has become quite the story.

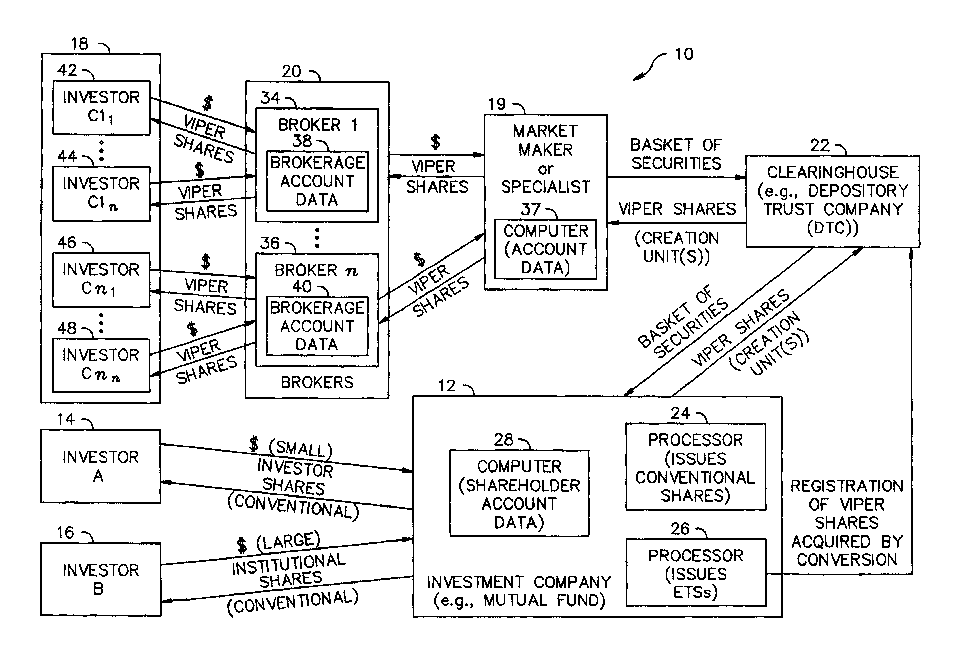

Multi-Share Class Filings

Vanguard’s multi-share class fund patent expired in May. Very simply, this structure has allowed Vanguard to offer ETFs as a share class of existing mutual funds. For example, the Vanguard S&P 500 ETF (VOO) is a share class of the Vanguard 500 Index mutual fund – it’s the same pool of assets. This structure offers several important advantages including the ability to better leverage economies of scale, which allows Vanguard to reduce backend costs and charge lower fees to investors. This structure has also helped Vanguard minimize capital gain distributions from its mutual funds since it can wash gains through the ETF share class. With Vanguard’s patent expiring, three firms filed with the SEC this year for exemptive relief to offer ETF share classes of their existing mutual funds: PGIA, Dimensional, and Fidelity. Interestingly, F/m Investments filed to do the opposite where they would offer a mutual fund share class of their single treasury bond ETFs.

Ultimately, the goal for all of these firms is the same. An ETF share class would allow mutual fund companies to maintain their lucrative 401k business while also pursuing the higher growth ETF market (or vice versa in F/m’s case). The challenge will be getting the SEC on board since Vanguard is only approved to use the ETF share class structure for index-based products, whereas these other issuers are seeking to use it for actively managed products. The SEC has expressed concern over what they call share class subsidization where ETF shareholders could be negatively impacted by mutual fund shareholders. An example would be if the mutual fund share class has significant outflows, then that could trigger negative tax consequences and higher transaction costs for ETF shareholders. If approved, this could be an enormous tailwind for ETF growth.

Source: Google

TLT = Cash Incinerator

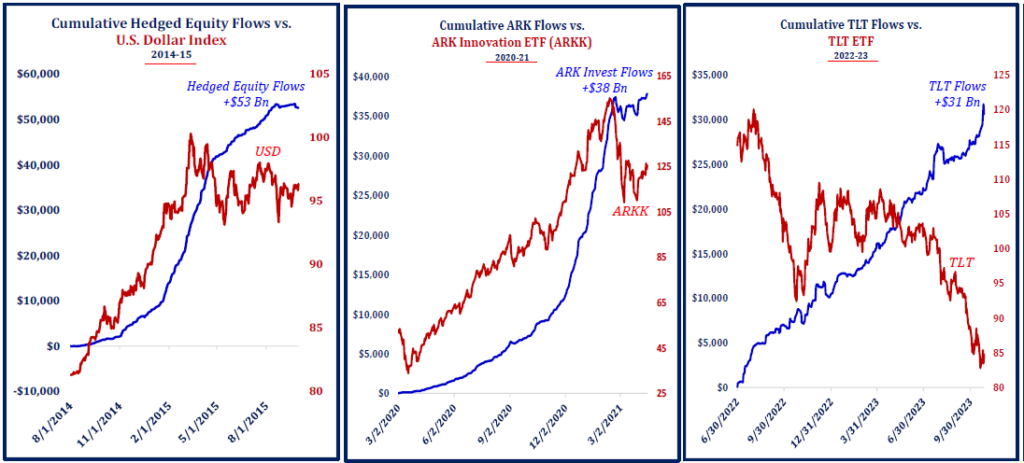

Since the first Fed rate hike in March 2022, the iShares 20+ Year Treasury Bond ETF (TLT) has taken in over $40 billion in new investor money. That includes a whopping $24 billion this year, the fourth most inflows of any ETF in 2023. All of this is despite the fact that TLT is down 22% since the Fed began raising rates and only up 3% this year (compared to 26% for the S&P 500). One of my favorite charts depicting this phenomenon was from Strategas’ Todd Sohn, who compared TLT to past ETF manias such as the WisdomTree Japan Hedged Equity ETF (DXJ) and ARK Innovation ETF (ARKK). Sohn:

“What do currency hedged, ARK products, and TLT have in common? Vertical-like inflows as investors piled into them. Clearly different portfolio applications, but perhaps similar investor psychology.”

Investors piling into TLT and fighting the Fed earlier this year (and potentially still betting against a soft landing or even economic acceleration), paid for their duration play by incinerating cash – or at the very least, missing out on portfolio gains elsewhere.

Source: Strategas’ Todd Sohn

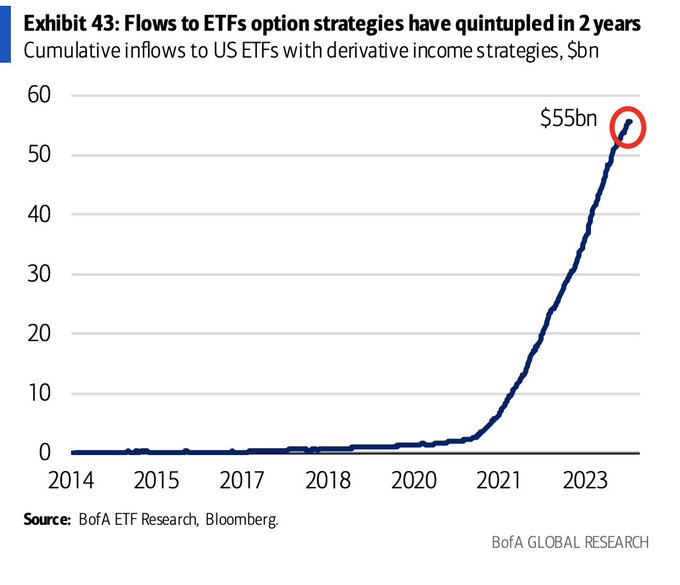

JEPI & the Copycats

“JEPI and the Copycats” sounds like a 1980s pop band, but was one of the biggest ETF stories of the year. The JPMorgan Equity Premium Income ETF (JEPI) had a TLT-like 2023, taking in $13 billion while underperforming the S&P 500 by 17%. In the process, it overtook the JPMorgan Ultra-Short Income ETF (JPST) as the largest actively managed ETF on the market (the Dimensional US Core Equity 2 ETF also surpassed JPST). The massive success of JEPI led to a wave of copycat, options-based ETF strategies. These ETFs seek to enhance income, limit volatility, or both – all of which can be appealing to pre-retirees or investors already in retirement. Bloomberg’s Eric Balchunas calls these ETFs “boomer candy”. JEPI launched in May of 2020 and the options-based ETF category hasn’t looked back.

Morningstar’s Jeffrey Ptak highlighted that JEPI gathered nearly $26 billion in net inflows over the first 36 months of its existence.

“That easily tops the charts, arguably making it the most successful launch of a U.S. ETF in history.”

Source: Morningstar’s Jeffrey Ptak

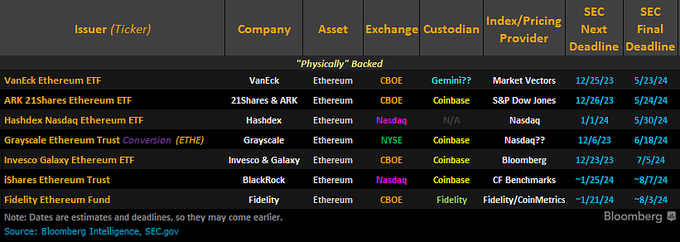

Into the Ether

In July, Volatility Shares quietly filed for an ethereum futures ETF. That led to a rash of ethereum futures-related ETF filings. Back in May, there was actually a smaller wave of ethereum futures ETF filings which were quickly withdrawn after some stern feedback from the SEC. However, the SEC had a change of heart and, in August, told asset managers they were now “ready to review such filings”. The first ether futures ETF launched in October and to say their debut has been disappointing would be an understatement.

There are currently ten ether futures-related ETFs. Those ETFs only have $72 million in combined assets, half of which came from Valkyrie’s BTF ETF – which simply updated its existing bitcoin-only strategy to include ether futures. There are several theories on why these ETFs have not resonated, but I think it comes down to investors waiting for spot ethereum ETFs. On that note, there are now filings for seven spot ether ETFs and the case for their approval seems relatively straightforward: Grayscale court victory + SEC approval of ether futures ETFs + SEC approval of spot bitcoin ETFs = SEC approval of spot ether ETFs.

Source: Bloomberg’s James Seyffart

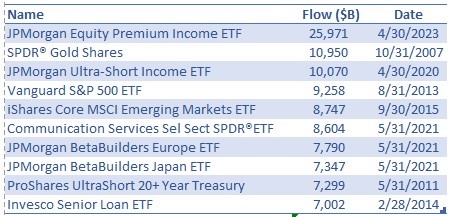

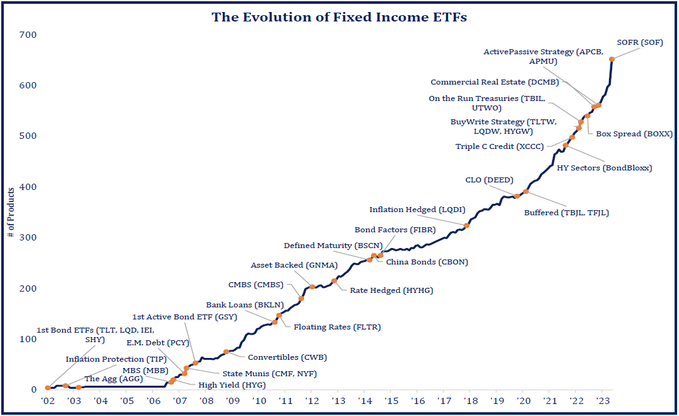

Money Market Funds, Bond ETFs & Innovation

Over $200 billion went into bond ETFs this year, including a record $100 billion into US Treasury products. In the first half of 2023, it appeared as though ultra-short term Treasury bond ETFs might be the industry’s story of the year. Investors were content (excited?) to scoop-up 5% risk-free yields, or “T-bill and chill”. Related, one of the year’s biggest ETF stories wasn’t even ETF associated. It was the $1+ trillion that went into money market funds, siphoning flows away from ETFs. After a decade-plus of paltry yields, 5% was simply too enticing for some investors to pass up.

In any event, investors of all stripes have clearly become much more comfortable with bond ETFs and the industry has responded with its usual innovation. The first bond ETFs debuted in July 2002 with iShares launching TLT (20+ Year Treasury Bond ETF), LQD (Investment Grade Corporate Bond ETF), IEF (7-10 Year Treasury Bond ETF), and SHY (1-3 Year Treasury Bond ETF). Since then, there has been a never-ending parade of new ideas as ETF issuers have sliced and diced the fixed income market in every way imaginable. There are now nearly 700 bond ETFs with over $1.5 trillion in assets.

Source: Strategas’ Todd Sohn

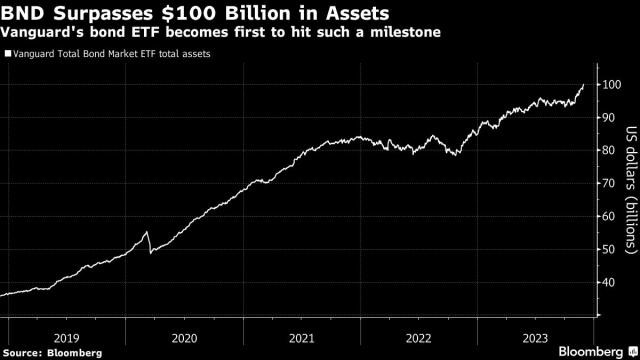

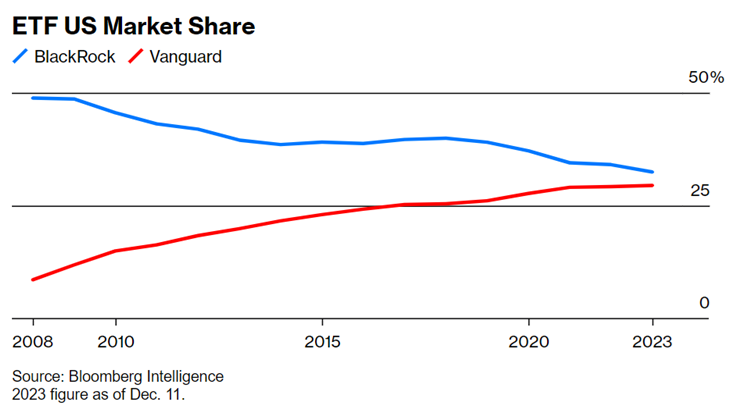

Vanguard’s Big Year

Every year is a good one for Vanguard, but 2023 brought several key milestones for the low-cost ETF issuer including surpassing $2 trillion in US ETF assets and watching the Vanguard Total Bond Market ETF (BND) become the first bond ETF to hit $100 billion. Overall, Vanguard has taken in $151 billion this year, compared to $94 billion for second-place BlackRock. This will mark the fourth consecutive year that Vanguard has topped BlackRock on the ETF leaderboard. Notably, Vanguard only offers 83 ETFs versus BlackRock’s 400+. Could Vanguard finally steal BlackRock’s ETF crown? That will be a story to watch in 2024.

Sources: Bloomberg’s Katie Greifeld

SPY Celebrates 30th Birthday in Style

The US ETF industry turned 30 years old this year. The first US-listed ETF, the SPDR S&P 500 ETF (SPY), launched on January 22nd, 1993 and has never looked back. SPY currently sits atop the ETF throne with $494 billion and is poised to become the first ETF to hit $500 billion in assets. One of my 2023 ETF predictions was that SPY would lose its ETF crown to IVV, VOO, or both. Instead, the ETF has celebrated its 30th birthday in style by raking-in over $50 billion in assets, good enough for first place on the ETF inflows leaderboard.

Source: Pensions & Investments / Intercontinental Stock Exchange

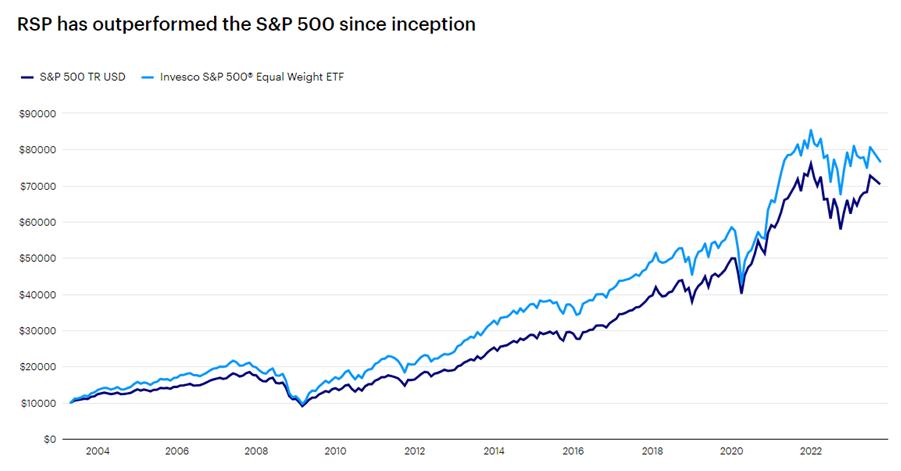

Smart Beta ETFs Turn 20 Years Old

The first smart beta ETF celebrated its 20-year anniversary in 2023. The Invesco S&P 500 Equal Weight ETF (RSP) launched in 2003, pioneering an ETF category. Invesco:

“The ETF transformed how investors could access the S&P 500 Index. At the time, the term Smart Beta was intended as shorthand to concisely explain to investors the benefits of breaking the link between market capitalization and weight.”

Today, there are all flavors of smart beta ETFs – from equally-weighted to factor-based to fundamentally-weighted. I’ve always referred to smart beta as active management without the human emotion and bias. When combined with the typically lower cost, tax efficient ETF wrapper, smart beta can be an attractive value (pun intended) proposition to investors. That said, there is an interesting story brewing with the rise of traditional active ETFs and whether smart beta can regain its momentum (again, see what I did there) in terms of investor interest.

Source: Invesco

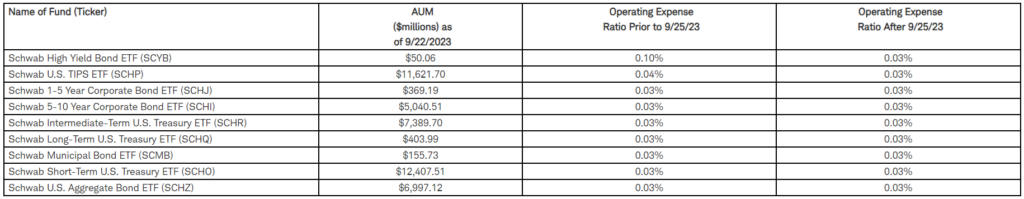

ETF Fee War Quietly Rages On

Lost in the hype around spot bitcoin ETFs, actively managed ETFs, and some of the other ETF stories I’ve covered here is the ongoing ETF fee war. There were several noteworthy fee cuts in 2023 with Exhibit A residing in the high yield bond ETF space. State Street chopped the expense ratio on its SPDR Portfolio High Yield Bond ETF (SPHY) to 5 basis points. Charles Schwab responded by reducing the fee on its High Yield Bond ETF (SCYB) to 3 basis points. As a matter of fact, Schwab’s entire bond ETF lineup is now priced at 3 basis points. 3 basis points!

Between index-based ETF issuers slashing fees and the rise of low cost actively managed ETFs from issuers such as Dimensional and Avantis, there is more fee pressure than ever within the industry. The ETF space has been called the Terrordome for a reason and, if anything, it’s becoming even more brutal.

Source: Charles Schwab

ETFs Surpass $8 Trillion in Assets

There were several other noteworthy stories catching my attention in 2023. The slow death of ESG ETFs, the SEC “Names Rule”, several of the largest ETF issuers offering proxy voting options for investors, ETFs successfully passing another crisis (this time, regional banking turmoil), the first quadruple leveraged ETF (XXXX), Pacer’s astounding success (see CALF or COWZ), currency-hedged ETFs coming back en vogue (see DXJ), the first 100% downside buffer ETF, etc. It was another remarkable year for an industry clearly poised for future success.

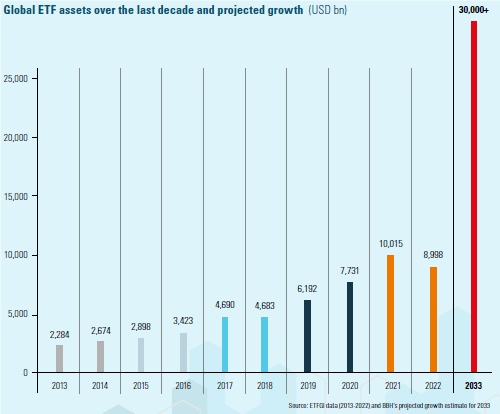

US ETFs recently surpassed $8 trillion in assets. The industry was only half that size four years ago. On a global basis, ETFs hit a record $11 trillion in assets at the end of November. 30 years after the launch of SPY, the industry is still accelerating. In their latest ETF investor survey, Brown Brothers Harriman projects global ETF assets could eclipse $30 trillion over the next decade:

“Given the enhanced investor education and continual product evolution within the ETF wrapper, by 2033, we believe the ETF market could be worth $30+ trillion. Market inflows from the last few years support this growth projection, and year after year, a majority of investors plan to maintain or increase their use of ETFs.”

The party is just getting started.

Source: BBH

See you in 2024!

Previous “ETFs in Pictures”:

ETFs in Pictures: Fee Wars & the Future