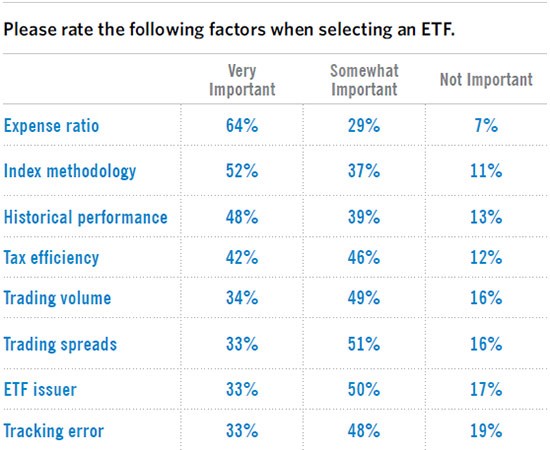

In partnership with Brown Brothers Harriman, ETF.com conducts an annual survey of ETF investors (primarily investment advisors). I would call this the “Cadillac” of ETF surveys given the well-informed ETF audience trafficking ETF.com. Their fifth annual survey was released today and included several noteworthy nuggets, not the least of which was the increased focus on ETF fees. An ETF’s expense ratio, or fund fee, was cited as the single most important factor when selecting an ETF:

Source: ETF.com

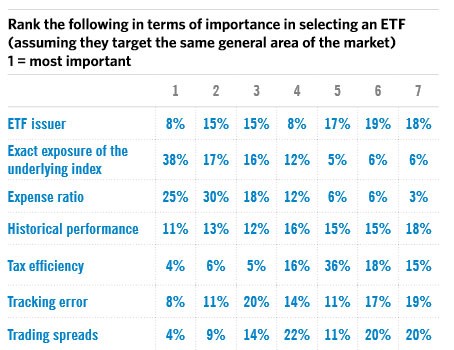

While this doesn’t necessarily come as a surprise, consider that expense ratio wasn’t cited as the most important factor in last year’s survey (though the question was posed a bit differently):

Source: ETF.com

Why the difference? Perhaps the biggest driver is the increased awareness the DOL fiduciary rule has generated around investment advisor obligations and investment costs. The Wall Street Journal’s Daisy Maxey explains this well:

“Another change since last year’s survey is the initial implementation of the Labor Department’s fiduciary rule, which requires advice on retirement accounts to be in investors’ best interest. While the Trump administration has delayed the rule’s full implementation, it nevertheless spurred growing awareness of fiduciary obligations and the toll fees take on investment portfolios.”

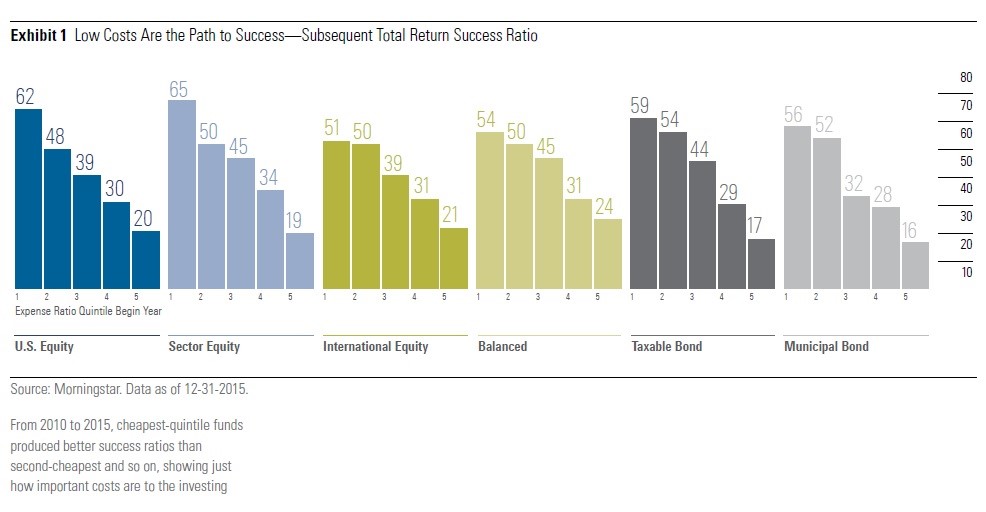

The DOL fiduciary rule, which was partially implemented earlier this year, currently requires brokers and advisors to “adhere to a best interest standard when making investment recommendations, charge no more than reasonable compensation for their services, and refrain from making misleading statements.” While full implementation of this rule has been delayed until July 2019 and the potential exists that it’s scrapped altogether, just the debate around this rule has generated invaluable awareness (think LaVar Ball type awareness – free advertising!). While cost is certainly not everything when selecting investments, consider that Morningstar, a leading fund research company, concluded a fund’s expense ratio is “the most proven predictor of future fund returns”:

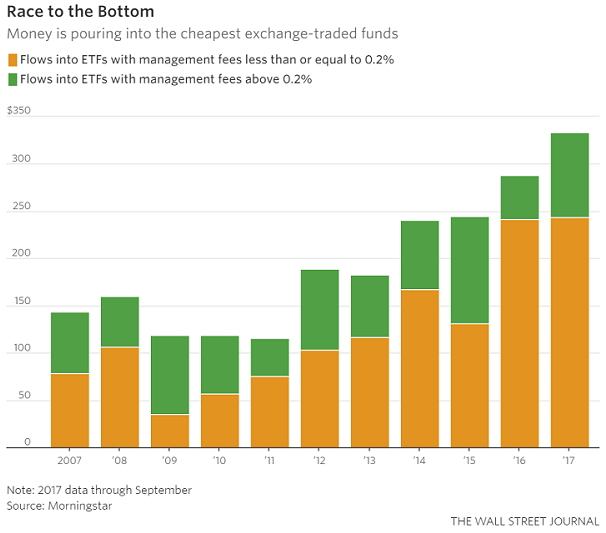

With that in mind, more advisors are recognizing that if they are truly going to place their clients’ best interests ahead of their own, cost has to be an important factor in the fund evaluation process. With that realization, money is now flowing into the lowest cost ETFs. Through the end of the third quarter, 75% of new ETF money found its way into ETFs charging 0.2% or less (in other words, $20 for every $10,000 invested):

Source: WSJ

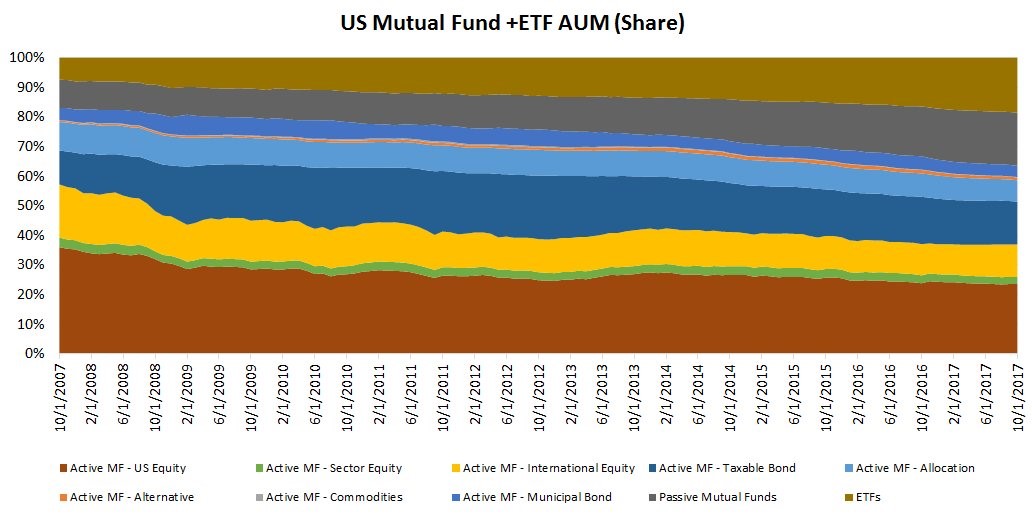

With advisors and the general investing public more aware of the importance of fund fees, a vicious fee war has ignited among fund providers, to the huge benefit of investors (not so good for fund companies). However, while it may seem obvious to many reading this that fund costs are clearly the biggest story in investing right now – the “mother of all trends” – keep in mind the vast majority of investor assets are still held outside of ETFs, many in significantly more expensive investment vehicles:

Source: @EconomPic

While trending in the right direction, there is still a lot of work to do around educating investors on the importance of fund costs. The fact that advisors are now placing a greater emphasis on fees is a good start.