ETF Inflows & Outflows

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 2/19/26; performance data excludes leveraged and inverse products

Weekly ETF Reads

(Note: The biggest ETF story last week was three issuers filing for funds tied to event contracts traded on prediction market platforms. An event contract is a financial instrument that pays out based on whether a specific, clearly defined event occurs. These contracts trade on platforms such as Polymarket and Kalshi. The first four links below provide a nice snapshot of the filings and the initial industry reaction – including some early backlash.)

Wall Street Wants to Bring Election Bets Into Brokerage Accounts by Isabelle Lee and Denitsa Tsekova

“This is yet another example of pushing the ETF envelope.”

Bitwise seeks SEC nod for 2028 election prediction market ETFs as Wall Street pushes to wrap bets by Naga Avan-Nomayo

“The move is another signal of a growing financialization and ETF-ization of everything.”

Wall Street’s newest gamble: election bets in an ETF wrapper. Should we cheer? by Bob Pisani

“Does the world really need every flavor of ETF?”

Prediction Market ETFs by Joe Saluzzi

“An ETF wrapper doesn’t hide the fact that these are gambling instruments that have no place listing on a US stock exchange.”

ETFs push at SEC limit in rush to buy private stocks and debt by Steve Johnson

“We are not seeing the SEC push back on this at all, so it’s not unreasonable to expect to see more ETFs pushing the envelope.”

How the Largest Buffer ETF Providers Stack Up by Zachary Evens

“Predictability is the main selling point for defined outcome ETFs.”

Wall Street ETF Complex Muscles Into the Digital Dollar Market by Isabelle Lee

“ProShares is launching what it says is the first money market ETF designed to hold reserves for stablecoin issuers.”

(Note: The ProShares GENIUS Money Market ETF (IQMM) launched on Thursday and has already amassed a mind-boggling $17.5 billion in assets. You read that right: $17.5 billion! Bloomberg’s Eric Balchunas initially flagged the massive trading volume on the day of the fund’s debut. Where is the money coming from? Morningstar’s Ben Johnson connected the dots, showing that ProShares is using IQMM for cash management within its other ETFs. It should be noted that ProShares is not double-dipping on fees: “As part of its advisory agreement with each Fund, the Advisor has agreed to assume all the management fees associated with investments in this affiliated money market ETF.” The interesting question now is whether ProShares can attract stablecoin issuers to the ETF.)

First spot SUI ETFs debut as Canary Capital and Grayscale launch funds with staking by Sarah Wynn

“Sui is a Layer 1 blockchain primarily developed by Mysten Labs.”

ETF Post of the Week

With prediction market ETF filings stealing headlines this week, I loved this post from Morningstar’s Ben Johnson. My initial reaction to the filings was that everything is starting to look like DraftKings. The lines between gambling and investing have completely blurred, which is why neither Ben nor I can completely rule this out…

Casino Capital has just filed for its first ever GambleShares ETFs:

— Ben Johnson, CFA (@MstarBenJohnson) February 19, 2026

– GambleShares Wen Baby Swift ETF $BBTT

– GambleShares Wut Bitcoin Do in Next 5 ETF $HFSP

– GambleShares Hoo Winz Next Powerball ETF $MUNY

No link because this is a joke (for now).

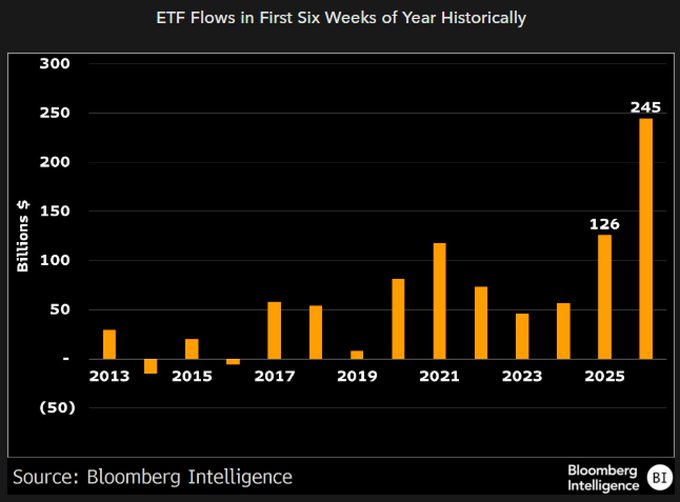

ETF Chart of the Week

ETFs have already pulled in a staggering nearly $280 billion this year. ETF Chart and Post of the Week regular Eric Balchunas shared a visual earlier in the week when year-to-date flows were “only” $245 billion, underscoring just how quickly assets are pouring in.

As Balchunas noted:

“Here’s ETF flows for the first six weeks of the year historically. This year is off to the best start almost by double. One reason is growing depth of cash vacuum cleaners. VOO, SPYM hoovering as always but there’s already over 500 ETFs with >$100m in flows, many you’ve never heard of. Model portfolios, BYOA and legacy active are giving ETFs a big extra wave of money.”

That breadth is striking. It’s not just the mega-ETFs like Vanguard’s VOO or State Street’s SPYM doing the heavy lifting. I actually now count nearly 600 ETFs with more than $100 million in inflows year to date.

What a start to 2026.

Source: Bloomberg’s Eric Balchunas

ETF Prime Podcast

Last week’s ETF Prime featured Craig Ebeling, Head of ETF Strategists at Fidelity Investments, and Roxanna Islam, Head of Sector & Industry Research at VettaFi. Craig delivered an ETF “State of the Union,” outlining the key trends and themes shaping the industry today. Roxanna examined the record surge in international equity ETF inflows, analyzed the drivers behind the category’s performance, and highlighted standout funds beyond the ETF leaderboard’s biggest names (nice read here from Roxanna on “democracy-focused” emerging market ETFs).