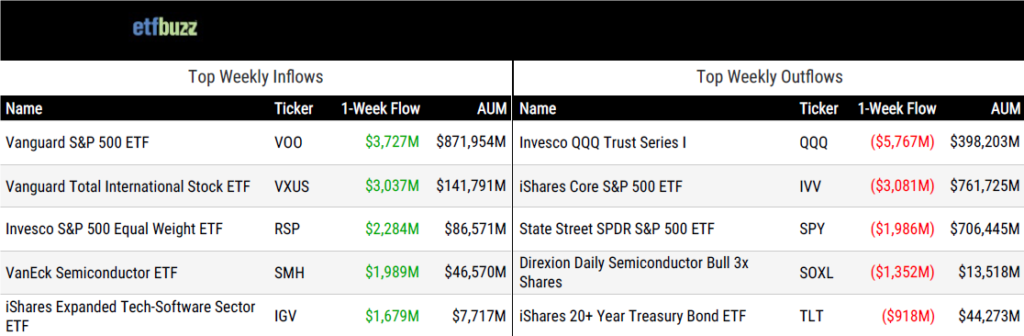

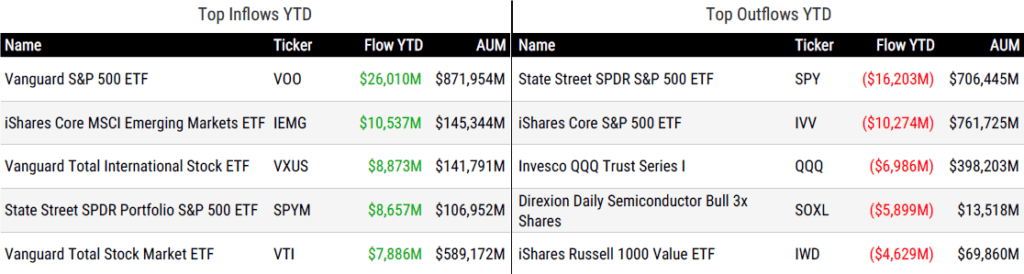

ETF Inflows & Outflows

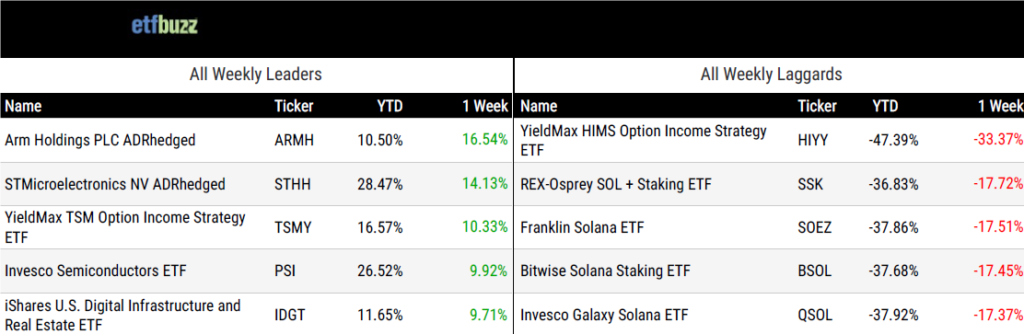

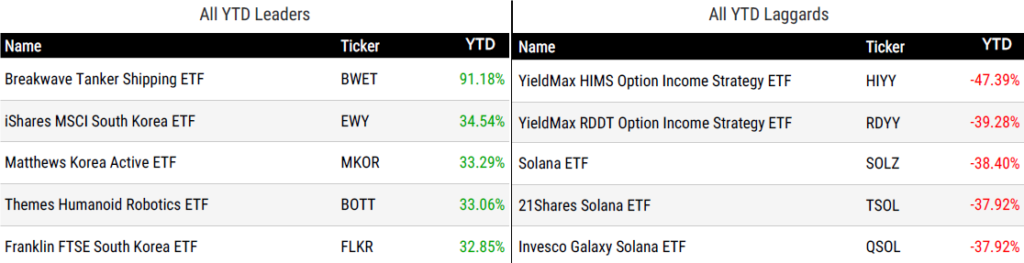

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 2/12/26; performance data excludes leveraged and inverse products

Weekly ETF Reads

Vatican Bank makes first foray into equity indexes, setting stage for potential ETF launches by Liz Napolitano

“Its first foray into thematic investment products sets the bank up to potentially roll out other financial products, including ETFs in the future.”

Upstart Issuer F/m Says It Found a Way to Fit ETFs In 401(k)s by Katie Greifeld

“The retirement marketplace is entirely off-limits to us. That’s a mutual-fund only community.”

Buffer ETFs Are Not for Everyone. Here’s How to Use Them in Your Portfolio by Zachary Evens and Lan Anh Tran

“Defined-outcome ETFs are not for everyone. For the right investor in the right circumstance, they can be an effective tool to control risk.”

Redesigning the Implementation of Taxable Fixed Income by Matt Zenz

“Rotational fixed‑income ETFs offer a way to preserve the role of bonds—stable returns, lower volatility, and diversification—while removing the predictable tax drag that has weighed on returns for decades.”

ETF Issuers Press Ahead With Crypto Funds Despite Selloff by Melos Ambaye

“The filings land in a crowded market, where more than 140 crypto-focused US ETFs already trade.”

Tokenization: Real, Important, and Not For You by Dave Nadig

“Tokenization is real—for stocks, for ETFs, for pretty much anything we can create a legal ownership chain for.”

From Podcast Stage to Study Hall: Nate Geraci & Todd Sohn Gear Up for Exchange by Elle Caruso Fitzgerald

“Exchange is the conference where all roads of the ETF universe connect.”

(Note: I look forward to seeing many of you at Exchange in March. This is a nice preview of the sessions I’ll be involved in. Or, I’m sure you can find me at the bar!)

Finally, if you missed the recap of my recent trip to Brazil, you can find that here… Viva o Brasil: The Rise of ETFs.

ETF Post of the Week

Last week, I noted how spot bitcoin ETF investors have largely stayed put despite experiencing a 45% drawdown since the digital asset hit a near-term price peak on October 6. Spot bitcoin ETF assets were approximately $160 billion on that day and have since fallen to around $83 billion. However, over the same period, spot bitcoin ETFs have seen only $5.7 billion in outflows. In other words, the vast majority of the category’s asset decline has come from negative price performance, not investors fleeing the ETFs.

It’s a similar story with spot ether ETFs. The price of ether has plummeted 57% since hitting a near-term peak on the same day as bitcoin. During that time, spot ether ETF assets have gone from around $32 billion to a little over $11 billion. As James shows below, the category has seen only about $3 billion in outflows.

At least for now, spot ether ETF investors aren’t panicking.

Still, the vast majority of buyers have stayed put. The net inflows into the ETH ETFs have gone from about $15 billion down below $12 billion. This is a much worse selloff than the Bitcoin ETFs on a relative basis but still fairly decent diamond hands in grand scheme (for now) pic.twitter.com/iBoi5BP9z8

— James Seyffart (@JSeyff) February 10, 2026

ETF Chart of the Week

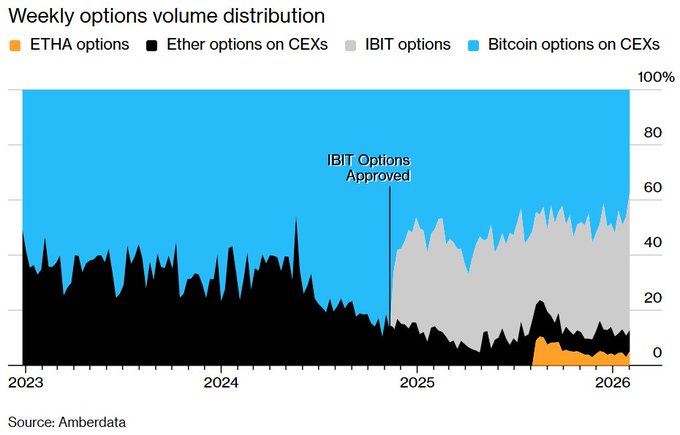

Speaking of spot bitcoin and ether ETFs, I found this chart astounding – though not entirely surprising. From Bloomberg:

“Since options were approved on US-listed Bitcoin and Ether funds, those venues have overtaken crypto-native exchanges. Contracts linked to IBIT and ETHA now account for more than half of total options volume in their respective tokens, according to Amberdata.”

The ETF wrapper has quickly become a primary venue for crypto price discovery and options activity. Liquidity is compounding within the ETF ecosystem. As volume concentrates in ETF-linked options, tighter spreads and deeper markets draw in even more participation.

Liquidity begets liquidity… and ETFs now sit at the center of that flywheel.

Source: Bloomberg’s Sidhartha Shukla

ETF Prime Podcast

Last week’s ETF Prime featured Chris Tessin, Founder and Portfolio Manager at Acuitas Investments, and Bill Mann, Chief Investment Strategist at Motley Fool Asset Management. Chris discussed Acuitas’ multi-manager approach to global small- and micro-cap investing, as well as the launch of its first ETF, the Acuitas Small Cap Active ETF (AIMS). Bill broke down three recently launched factor-based ETFs and how they bring The Motley Fool’s “Foolish” investment philosophy to life through systematic stock selection.

Crypto Prime Podcast

After a brutal crypto selloff, Adrian Fritz, Chief Investment Strategist at 21shares, joined me on last week’s Crypto Prime to explain what went wrong – and the catalysts that could reignite momentum.