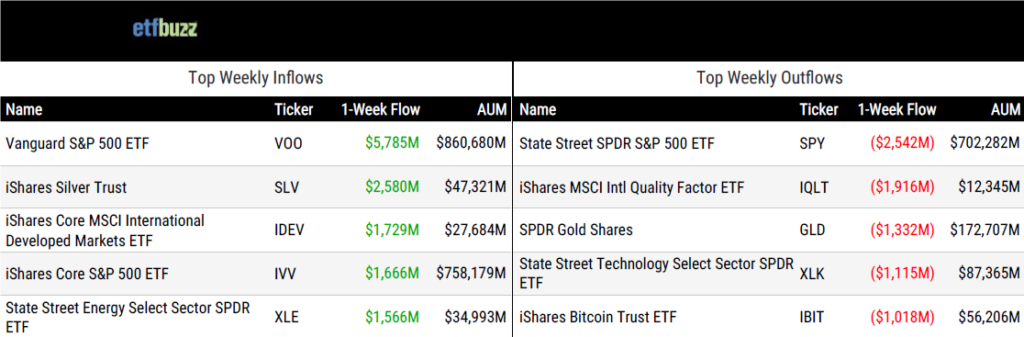

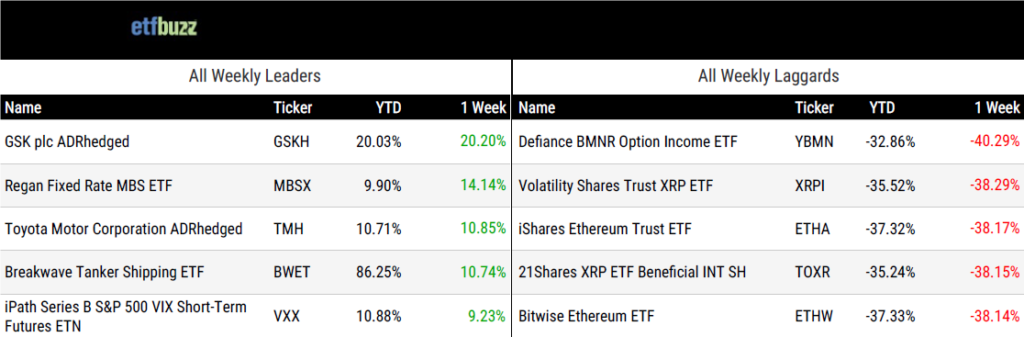

ETF Inflows & Outflows

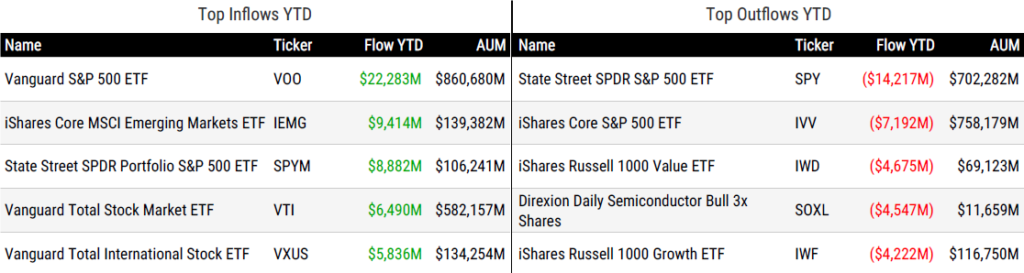

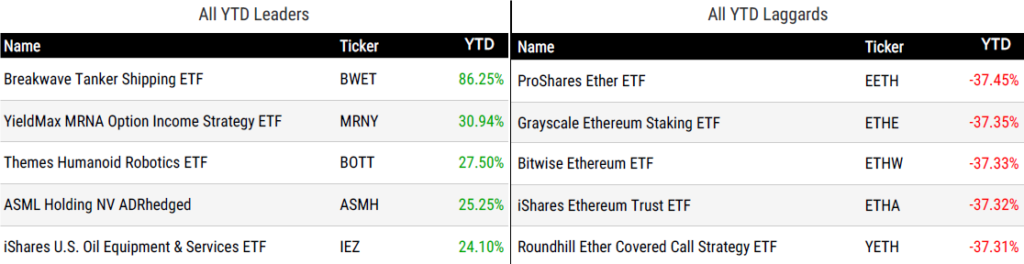

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 2/5/26; performance data excludes leveraged and inverse products

Weekly ETF Reads

Vanguard Cuts Fees on 53 Mutual Funds and ETFs for 2026 by Daniel Sotiroff

“Vanguard estimates its clients will pocket around $250 million through the end of 2026.”

Brokerage Firms May Start Charging ETF Distribution Fees. Who Will Pay. by Andrew Welsch

“Our view is that ETF managers will all eventually pay ETF distribution fees, because financial intermediaries such as brokerage firms and custodians have enough influence over shelf space to influence market share shifts.”

Ron Baron’s Mega SpaceX ETF Stake Skirts SEC Illiquid Assets Cap by Katie Greifeld

“Most funds are afraid to bet 15% on any stock, let alone a privately held one.”

Yeehaw: Trump’s Truth Social Funds to Acquire God Bless America ETF (YALL) by Griffin Kelly

“This kind of one-off ETF acquisition is unusual.”

Active ETFs step out of the shadows as advisors rethink portfolio construction by Steve Randall

“If the pace seen over the past three months continues, State Street estimates full-year inflows into active ETFs could reach $620 billion in 2026, pushing total active ETF assets toward $2 trillion.”

How a Leveraged ETF Amplified Silver’s Historic Selloff by Sumit Roy

“Going into Friday, AGQ managed approximately $5.2 billion in assets. By the end of the trading day, that figure had fallen to roughly $1.9 billion.”

Opportunities & Evolving ETF Solutions in Derivative Income by Cinthia Murphy

“Product innovation has been steady and robust in the options-based ETF space.”

Retail Traders Lashed by Crypto Rout After Wall Street Bet Big by Isabelle Lee, Vildana Hajric, and Olga Kharif

“Bitcoin and a slew of newly minted altcoin exchange-traded funds have crashed, erasing all gains made since just before Donald Trump retook the White House.”

(Programming note: I had the unique opportunity to attend the inaugural DEX ETF Summit in São Paulo, Brazil last week. It was a whirlwind 48 hours, and I walked away with plenty of insights that I think ETF Educator followers will appreciate. Stay tuned for my full write-up next week!)

ETF Post of the Week

Assets in the iShares Bitcoin ETF (IBIT) have fallen from $100 billion in early October to roughly $50 billion today (down from $60 billion earlier this week), largely reflecting bitcoin’s 45% decline over the same period.

Remarkably, total IBIT outflows during this period are only about $800 million, suggesting ETF investors aren’t the ones panicking.

More mind-boggling is the success IBIT had prior to this recent bloodbath, which Bloomberg’s Eric Balchunas highlights below.

$IBIT hit $100b for a hot second, which in retrospect exactly marked the top. Down to $60b today, which is still wild for a 500 day old ETF. For context, it could stay stuck at this level for the next three years and it would STILL be the all time fastest ETF to hit 60b pic.twitter.com/WrH1ey7P3j

— Eric Balchunas (@EricBalchunas) February 4, 2026

ETF Chart of the Week

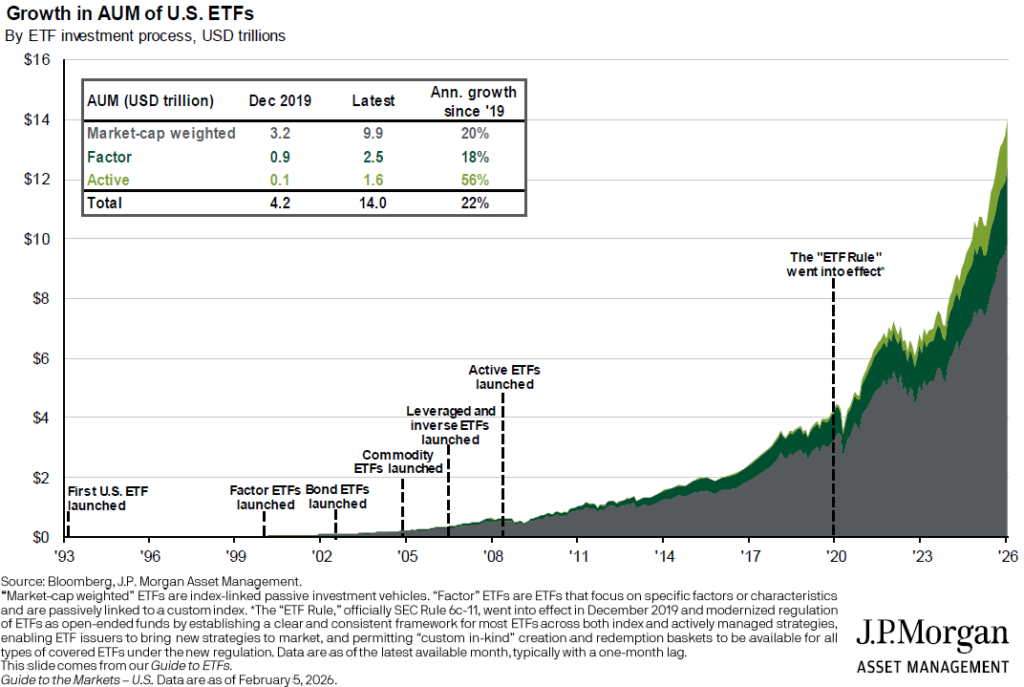

ETF assets overall have surged to $14 trillion, fueled recently by nearly $40 billion of inflows over the past week and a record-setting $165 billion in January alone. State Street’s Matt Bartolini noted that January’s inflows were “more than the last three Januarys combined—illustrating ETFs’ new parabolic trend.”

This J.P. Morgan chart shows you what that trend looks like.

Source: J.P.Morgan Daily Guide to the Markets

ETF Prime Podcast

Last week’s ETF Prime featured Todd Rosenbluth, Head of Research at VettaFi, walking through five of the most noteworthy ETF flow stories so far this year. Plus, Chris Getter, Managing Director and Portfolio Manager at Simplify Asset Management, unpacked private credit and the Simplify VettaFi Private Credit Strategy ETF (PCR).