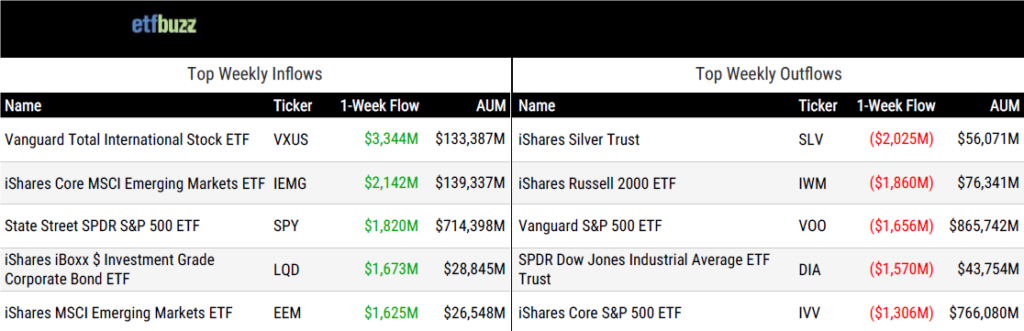

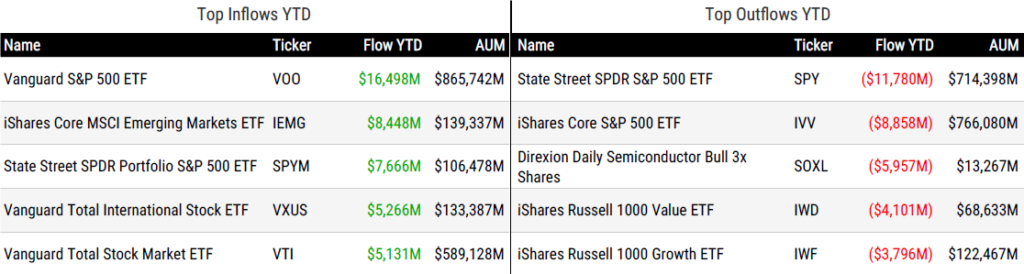

ETF Inflows & Outflows

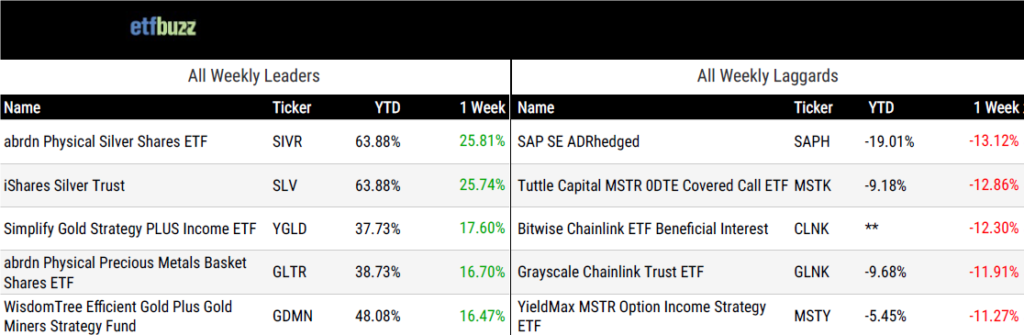

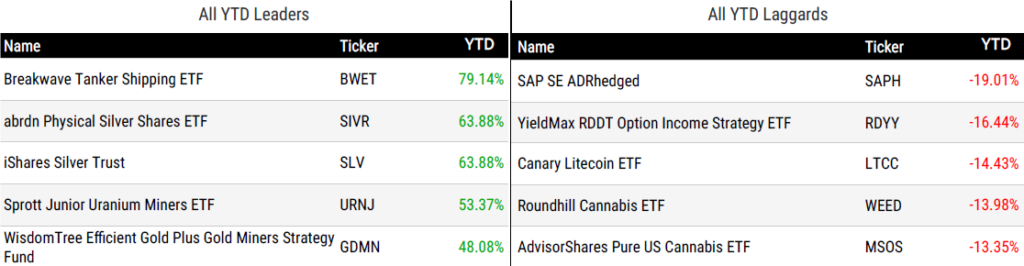

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 1/29/26; performance data excludes leveraged and inverse products

Weekly ETF Reads

Rick Rieder’s Fed Candidacy Clouds Outlook for His Hit ETF at BlackRock by Katie Greifeld

“As more star managers enter the ETF arena, the concept of ‘key man risk’ will only become a bigger topic of conversation.”

(Note: While Kevin Warsh was ultimately tapped for Fed Chair, this article does an excellent job of highlighting an important consideration for ETFs that rely on well-known portfolio managers for both performance AND marketing.)

When It’s Worth Paying Up for Funds, and When It’s Not by Jeffrey Ptak

“In a lot of these instances, the selling points really boil down to attributes like convenience and peace of mind.”

Record-setting surge in active ETFs redefines 2025 product landscape by Steve Randall

“Equity-focused strategies and ‘other’ categories, which include short-term trading, tactical, and niche approaches, led the charge in new launches.”

Private Market ETFs: Democratizing Access by Roxanna Islam

“How far can you push private assets into vehicles that investors expect to behave like ETFs?”

(Note: Chris Getter, Managing Director and Portfolio Manager at Simplify Asset Management, will join me on next week’s ETF Prime to discuss four key considerations when evaluating private credit investment vehicles and to spotlight the Simplify VettaFi Private Credit Strategy ETF.)

Crypto ETF Boom Fizzles in 2026 After Two Blistering Years by Sumit Roy

“It’s possible that soaring precious metals prices are pulling capital away from crypto.”

ETF Post of the Week

The iShares Silver ETF (SLV) posted a staggering $40 billion in trading volume last Monday. As Bloomberg’s Eric Balchunas noted, that’s more than SLV traded during ALL of the first quarter of last year.

For additional context, Bloomberg pointed out that this puts SLV’s activity nearly on par with the SPDR S&P 500 ETF – one of the largest ETFs in the world – and well ahead of individual stocks like Nvidia ($23 billion) and Tesla ($22 billion) in daily turnover. Just a few months ago, SLV’s typical daily trading volume was closer to $2 billion.

The price action has been just as extreme. Ahead of Friday’s session, SLV was up roughly 300% since the start of last year. Silver prices hit a record high on Thursday before plunging 31% on Friday, their worst single-day drop since March 1980. SLV closed the day at a 19% discount to NAV. This was driven by a timing mismatch (its NAV is struck using London silver prices), but the gap underscored just how chaotic trading had become.

Adding another wrinkle: despite the surge in volume and volatility, SLV has seen $3 billion in outflows so far in 2026.

One thing is already clear: silver ETFs are the early ETF Story of the Year.

Even more impressive is its total value traded (turnover) today of over $39B. pic.twitter.com/uO4s9S1XPI

— Jim Bianco (@biancoresearch) January 27, 2026

ETF Chart of the Week

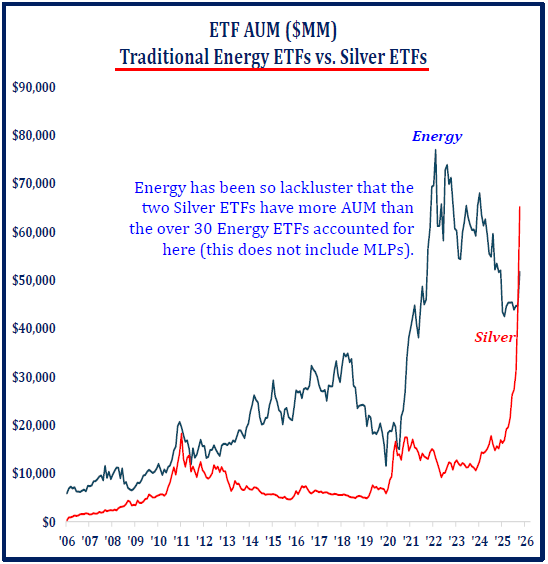

Speaking of silver ETFs, Strategas’ Todd Sohn points out that the two physical silver ETFs – the iShares Silver ETF (SLV) and the abrdn Physical Silver Shares ETF (SIVR) – now hold more assets than the entire energy ETF complex, which includes more than 30 funds. That group spans ETFs such as the Energy Select Sector SPDR (XLE) and the VanEck Oil Services ETF (OIH). Speaks volumes about the recent performance of both categories!

Source: Strategas’ Todd Sohn

ETF Prime Podcast

Last week’s ETF Prime featured Matt Bucklin, Founder of ExchangiFi, and Paul Marino, Chief Revenue Officer at Themes ETFs. Matt went in depth on 351 exchanges and explained how his firm helps facilitate this increasingly popular, tax-efficient strategy. Paul discussed the firm’s expanding lineup of thematic and leveraged ETFs, including the Transatlantic Defense ETF (NATO) and a broad suite of leveraged single-stock offerings.

Crypto Prime Podcast

David Dziekanski, CEO and Chief Investment Officer of Quantify Funds, joined me on last week’s Crypto Prime to discuss the firm’s expanding lineup of crypto-related ETFs, including the IncomeSTKd 1X Bitcoin & 1X Gold Premium ETF (ISBG) and the Quantify 2x Alt Season Crypto ETF (QXAS).