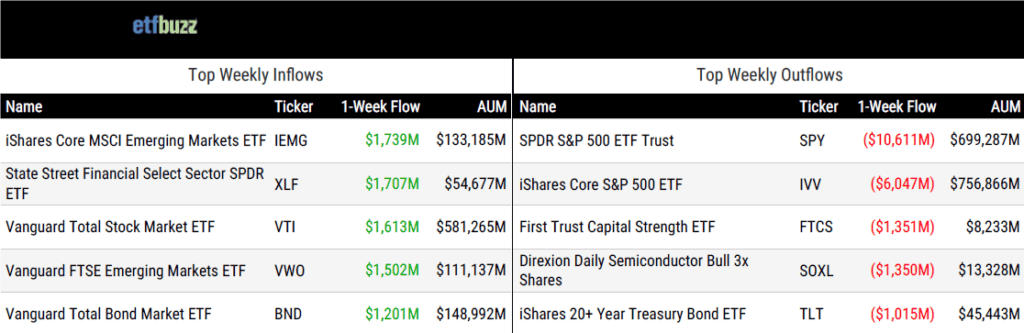

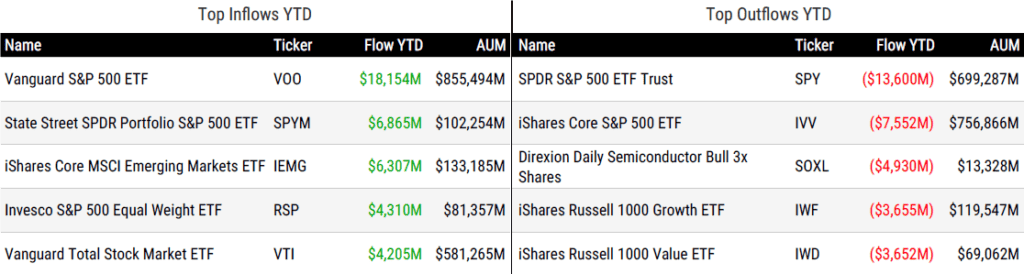

ETF Inflows & Outflows

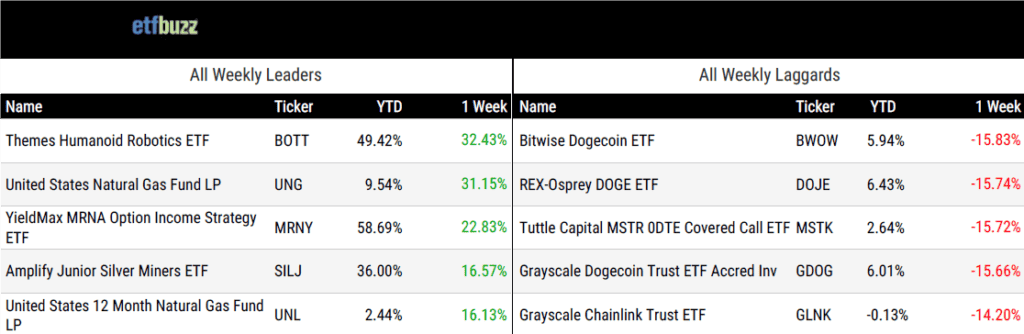

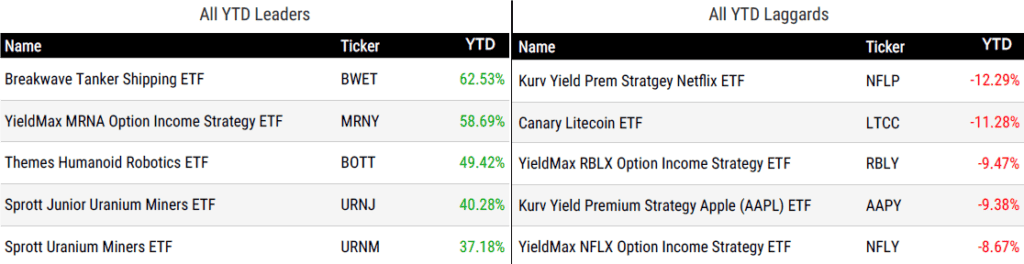

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 1/22/26; performance data excludes leveraged and inverse products

Weekly ETF Reads

ETF Investors’ Identity Crisis by Elisabeth Kashner

“Bogleheads’ dominance shows up in flows data, not headlines.”

What Drives Gen Z’s ETF Choices? by Lilly Riddle

“75% of Gen Z holds ETFs in their retirement accounts, second only to millennials.”

Investors Are Overlooking a Big Problem With New ETFs by Daniel Sotiroff

“The potential for extreme out- or underperformance at the tails of a bell curve informs a lot of the new ETFs that trade today.”

Active Investing Maintains Edge Over Smart Beta by DJ Shaw

“Strategies that blend data-driven models with managers’ judgment calls are gaining ground over purely passive approaches.”

Why Some Active ETFs Fail in 9 Charts by Stephen Welch

“About half of roughly 2,700 active ETFs had more than $50 million in assets as of the end of 2025, leaving 1,260 strategies with less than $50 million.”

Why fixed-income ETFs are exploding in popularity by Elijah Nicholson-Messmer

“59% of ETF issuers say U.S. fixed income is a priority for new product development.”

F/m Investments seeks to become first ETF issuer to tokenize shares by RT Watson

“If granted, the requested relief would allow TBIL’s existing ETF shares to be represented on a permissioned ledger under the same CUSIP, with the same rights, fees, voting rights, and economic terms as TBIL shares today.”

New York Stock Exchange Reveals Trading Platform for Tokenized Stocks and ETFs by Logan Hitchcock

“The city that never sleeps may soon have a stock exchange that runs all night, powered by blockchain.”

Crypto ETFs: XRP and Next-Gen Finance by Roxanna Islam

“While Canary’s XRPC has the most assets ($374 million), the rest follow closely behind with all around $250 million in assets or higher.”

ETF Post of the Week

ETF nerds, this one’s for you. ETF Action’s Mike Akins shares musings on everything from buffer ETFs to synthetic income ETFs to leveraged ETFs. Enjoy (click post to read entire thread)!

🧵 I woke up at 3 AM thinking about ETF plumbing again. I know, I’m a blast at parties. 🤓

— Mike Akins (ETF Action) (@etfAction) January 18, 2026

While most people are dreaming about vacations, I’m fixated on why the market feels so "stable" right now. It’s essentially a giant Mechanical Shock Absorber. Every time the market dips,… pic.twitter.com/9LlXnOF9XC

ETF Chart of the Week

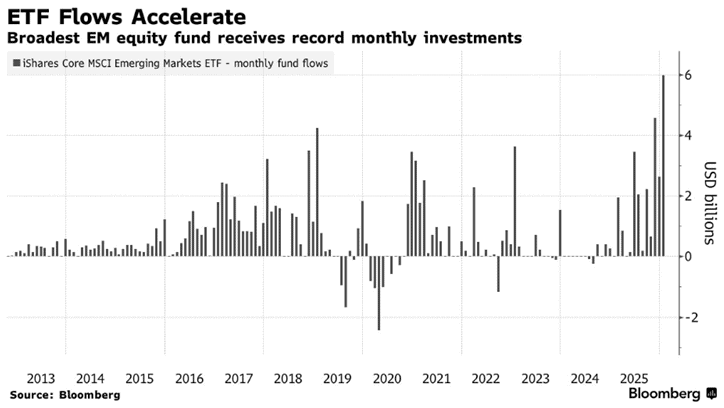

Who could have seen this coming? Emerging market ETFs are on pace to obliterate their monthly inflow record. The iShares Core MSCI Emerging Markets ETF (IEMG) alone has pulled in nearly $7 billion so far in January, good for third place on the ETF inflow leaderboard out of more than 4,900 ETFs.

Here’s what I wrote in my 2026 ETF Predictions:

“I think the composition of the ETF leaderboard changes in 2026, with ETFs such as the iShares Core MSCI Emerging Markets ETF (IEMG) and iShares Core MSCI EAFE ETF (IEFA) joining VXUS in the top 10. International equity ETFs pulled in about $250 billion last year, besting 2021’s record $198 billion. My prediction is international equity ETFs easily shatter that record.”

So far, so good.

If you haven’t been following closely, IEMG is up more than 40% since the start of last year – more than double the S&P 500’s 19% gain. That kind of performance tends to get investors’ attention, especially among those who have long been waiting for international equities to turn.

(Note: VettaFi’s Kirsten Chang offers a nice look at some recent drivers of emerging market performance here, while ETF.com’s Sumit Roy dives into the composition of IEMG here.)

Source: Bloomberg’s Srinivasan Sivabalan

ETF Prime Podcast

Last week’s ETF Prime featured Cinthia Murphy, Investment Strategist at VettaFi, and Matt Bartolini, Global Head of Research Strategists at State Street Investment Management. Cinthia delivered early grades on my five ETF predictions for 2026. Matt shared three key ETF and market themes on his radar.

Crypto Prime Podcast

There were two episodes of Crypto Prime last week! First, Alex Thorn, Head of Firmwide Research at Galaxy, joined me to provide an update on the CLARITY Act, a bill designed to establish a clear regulatory framework for digital assets. He covered the legislation’s background, why it matters, key sticking points, and what comes next. Then, James Seyffart, Senior Research Analyst with Bloomberg Intelligence, unpacked the latest on crypto ETFs, including pending SEC filings, flows into existing products, and what he’s watching next.

ETF Zoo

Last week, I also entered the ETF Zoo, joining ETF.com host Dave Nadig, President and Director of Research; Sumit Roy, Senior ETF Analyst at ETF.com; Kirsten Chang, Senior Industry Analyst at VettaFi; and Mike Akins, Founding Partner of ETF Action. We debated the resurgence of international equity ETFs, the outlook for fixed income ETFs, whether small cap stocks are back, and what’s next for bitcoin and digital assets.