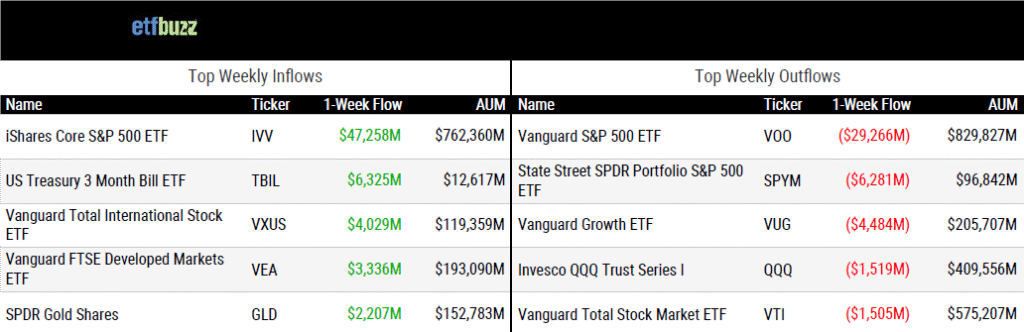

ETF Inflows & Outflows

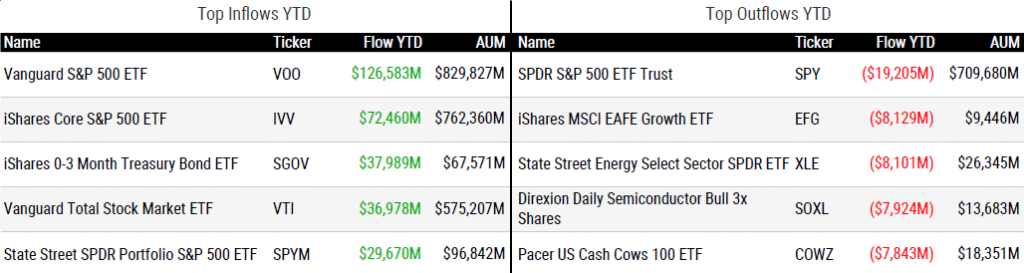

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 12/25/25; performance data excludes leveraged and inverse products

Weekly ETF Reads

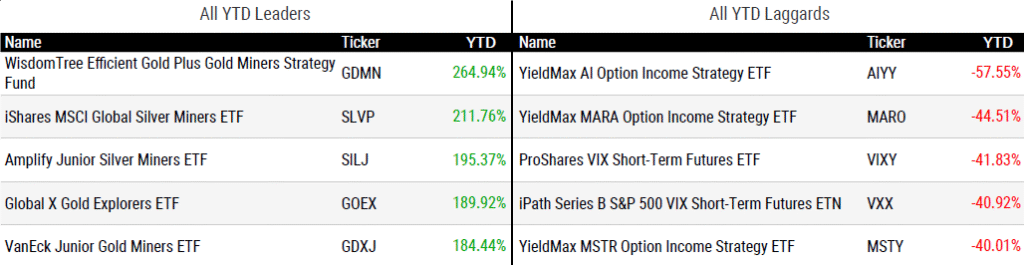

Peak ETF Mania? Flows, Launches and Volume Shatter All Records by Katie Greifeld

“At some point over the next couple of years, the industry may mature enough for the growth rate to slow down and plateau, but I think innovation will continue regardless of net inflows.”

The Fab 5: Todd Rosenbluth’s Top ETF Stories of 2025 by Todd Rosenbluth

“The tremendous growth in active ETFs was one of the major stories of the year, with this category gathering more than $400 billion in the first eleven months of 2025.”

State Street Private Credit ETF Stalls in Year of Industry Snags by Emily Graffeo

“Just because they figured out the legalese of everything doesn’t mean that people care about it or want it.”

Big Changes For Invesco QQQ: What Investors Should Know by Zachary Evens

“The outgoing UIT structure was a relic from the early days of exchange-traded funds.”

Advisors lukewarm as SEC clears path for dual‑share‑class ETFs by Leo Almazora

“Recent data from Fuse Research show that more than half of advisors (51%) say they prefer standalone ETFs over ETF share classes.”

A New Era for Bond ETFs: What Investors Need to Know by Lan Anh Tran

“Compared with the vast universe of strategic-beta stock ETFs, investors’ options for bond ETFs are limited.”

BlackRock names bitcoin ETF a top 2025 theme despite price slump by Helene Braun

“For investors who still see crypto as speculative or fringe, BlackRock’s positioning of bitcoin alongside cash and stocks may shift that perception.”

$34 Billion Entered Crypto ETFs in 2025, But Investors Still Lost by Sumit Roy

“2025 was a year of contrasts for crypto ETFs.”

To lower crypto investment risk, the market is starting to diversify its digital asset bets by Cheryl Winokur Munk

“The crypto ETF landscape has significantly expanded since the Securities and Exchange Commission approved 11 spot bitcoin exchange-traded funds in January 2024.”

ETF Post of the Week

As 2025 comes to a close, BlackRock continues to hold a narrow lead over Vanguard in the U.S. ETF market. BlackRock’s U.S. ETF assets stand at just over $4 trillion, slightly ahead of Vanguard’s $3.9 trillion. Despite the gap, Vanguard has outpaced BlackRock in year-to-date flows, attracting $413 billion compared with BlackRock’s $372 billion. Industry observers have long suggested that it is only a matter of time before Vanguard overtakes BlackRock as the ETF asset leader. Still, BlackRock has made it clear it is not prepared to surrender the top spot easily. The battle for ETF dominance remains one of the more compelling industry storylines to watch heading into 2026.

BlackRock actually held its 1% lead over Vanguard in US ETF market share this year. And both of them increased their share (albeit barely) by 0.2%. BLK is 30% and Vgrd 29%. Then you need binoculars to see 3rd place and a telescope to see 4th. Nice note on this from @JSeyff pic.twitter.com/XcHgxkZVVU

— Eric Balchunas (@EricBalchunas) December 23, 2025

ETF Chart of the Week

Was 2025 the ETF industry’s best year ever? With record inflows, launches, and trading volume, the industry achieved what Bloomberg’s Eric Balchunas calls the “ETF Triple Crown.” The only question is which ETF category matches each Triple Crown race. Here’s my take:

Kentucky Derby = ETF flows

Preakness Stakes = Launches

Belmont Stakes = Trading Volume

Secretariat would be proud.

Source: Bloomberg’s Katie Greifeld

ETF Prime Podcast

Last week’s ETF Prime featured Cinthia Murphy, Investment Strategist at VettaFi, and Brittany Christensen, Head of Business Development at Tidal Financial Group. Cinthia broke down new survey data on how financial advisors are thinking about equities, fixed income, and crypto heading into 2026. Brittany highlighted her top ETF stories to watch in the year ahead.

Crypto Prime Podcast

Michael Willis, CEO & Co-Founder Cyber Hornet ETFs, joined me on last week’s Crypto Prime to spotlight the firm’s S&P 500 and Bitcoin 75/25 Strategy ETF (BBB) and discuss the investment case for bitcoin and broader crypto assets.