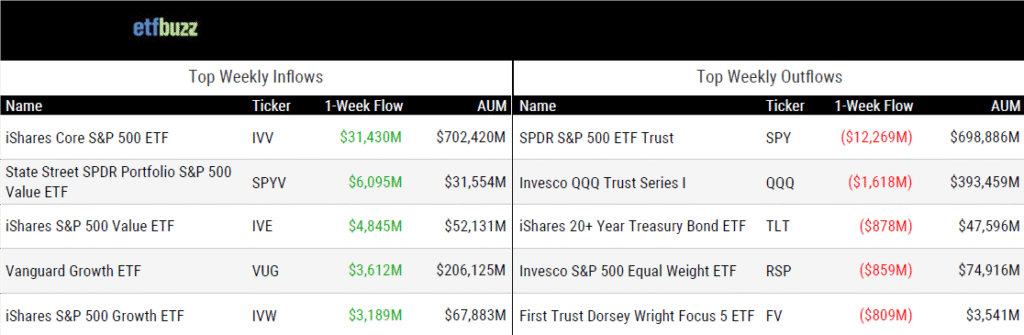

ETF Inflows & Outflows

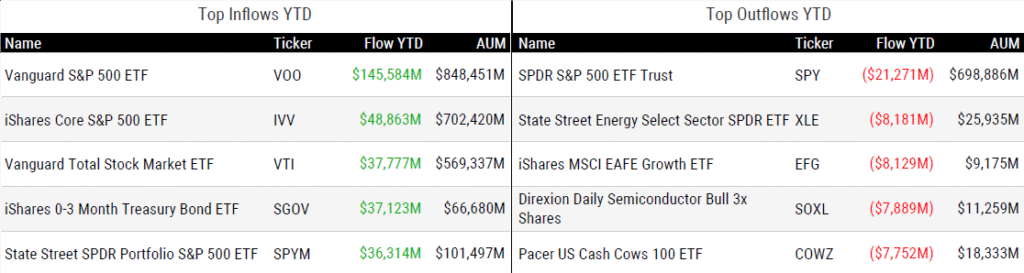

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 12/18/25; performance data excludes leveraged and inverse products

Weekly ETF Reads

The Best and Worst New ETFs of 2025 by Bryan Armour

“ETF issuers are firing the spaghetti cannon at the wall in the hopes that a couple of noodles stick, even if they don’t benefit investors in the long run.”

Baron Capital rolls out five active ETFs, SpaceX becomes the firm’s biggest investment by Yun Li

“Baron said the firm’s long-term performance supports the move into ETFs.”

Invesco Wins Approval to Convert QQQ Into a Standard ETF by Sumit Roy

“QQQ will operate as a standard open-end ETF with a stated expense ratio of 0.18%, down from its current 0.20%.”

RBC Warns ‘Finite’ Market-Maker Capital For ETF Share Class by Katie Greifeld

“Market-makers don’t have unlimited capital to devote to trading ETFs intraday and seeding new fund launches.”

Cannabis ETFs Stay High on Drug Rescheduling News by Emile Hallez

“It’s a highly volatile category due to the political uncertainty around legalization.”

Is Crypto a Good Gift for Your 60/40 Portfolio? by Stephen Margaria

“Just because an asset holds a certain weight doesn’t mean the risk it contributes to the portfolio is equivalent.”

ETF Post of the Week

Bitwise predicts that more than 100 crypto-linked ETFs will launch next year in what it’s calling an “ETF-palooza.” Last week, I pointed out that 125 crypto-related ETFs are already sitting with the SEC, a figure that’s likely to rise quickly. So, the math definitely checks out.

2026 PREDICTION: More than 100 crypto-linked ETFs will launch in the U.S.⁰⁰In October 2025, the SEC published generic listing standards, allowing ETF issuers to launch crypto ETFs under a general set of rules. A clearer regulatory roadmap in 2026 is why we see the stage being… pic.twitter.com/rQbcWe6JE4

— Bitwise (@BitwiseInvest) December 17, 2025

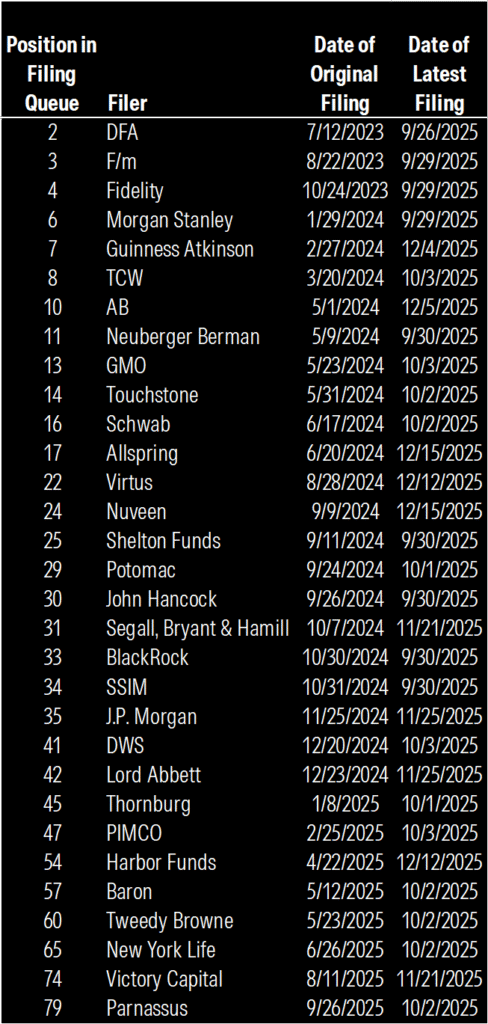

ETF Chart of the Week

Morningstar’s Ben Johnson notes that 31 of the 91 firms that have filed for exemptive relief to offer ETF share classes of mutual funds (or vice versa) have now received SEC approval, after the regulator greenlit another 30 applications this past week. The approved firms include some of the biggest names in asset management, such as BlackRock, State Street, Fidelity, Schwab, JPMorgan, Pimco, and Morgan Stanley.

On last week’s ETF Prime (which you can watch below), Ben called the ETF share class trend the industry’s story of the year. If you haven’t been paying attention, now is definitely the time as this is shaping up to be one of the biggest ETF stories of 2026 as well.

(Note: I’ll be joined by Brittany Christensen, Head of Business Development at Tidal Financial Group, on next week’s ETF Prime to dive deeper into the topic.)

Source: Morningstar’s Ben Johnson

ETF Prime Podcast

Last week’s ETF Prime featured Ben Johnson, Head of Client Solutions at Morningstar, who recapped the year in ETFs, shared his picks for ETF Story of the Year, ETF of the Year, ETF Issuer of the Year, and more. He also looked ahead to 2026, highlighting the key industry trends and developments he’s watching.

Crypto Prime Podcast

Samir Kerbage, Chief Investment Officer at Hashdex, joined me on last week’s Crypto Prime to explain crypto’s “new normal” and outline three key themes shaping the future of digital assets heading into 2026.