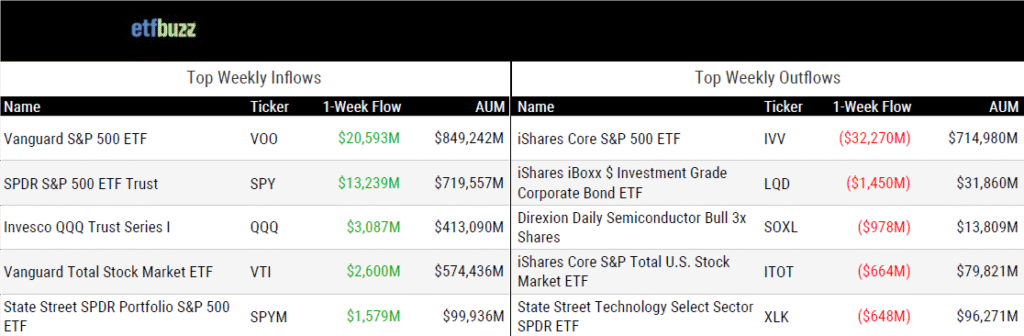

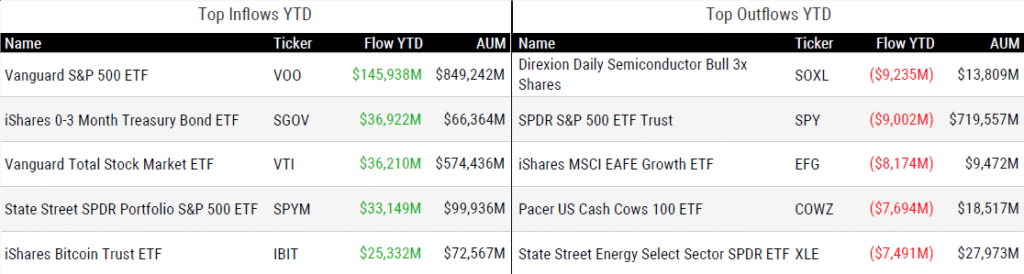

ETF Inflows & Outflows

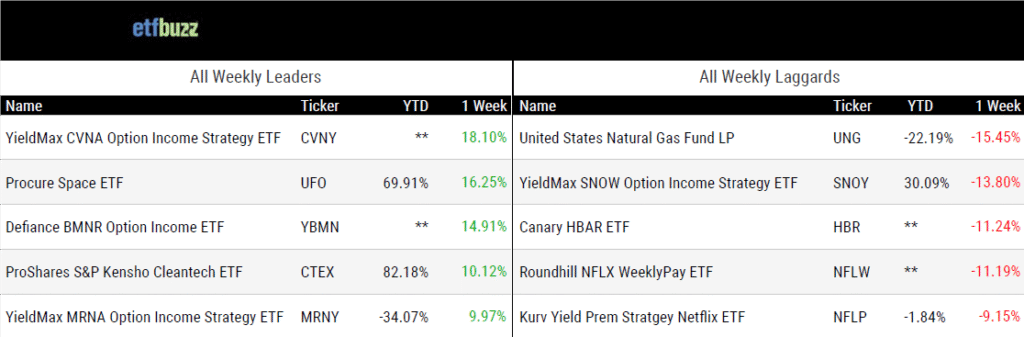

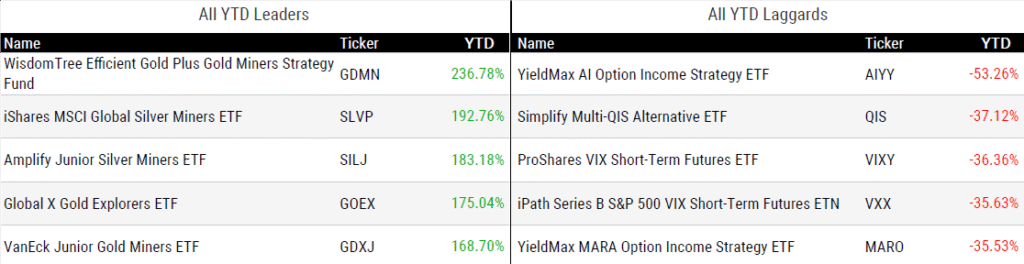

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 12/11/25; performance data excludes leveraged and inverse products

Weekly ETF Reads

Few ETFs Project Capital Gains Distributions in 2025: Key Takeaways for Investors by Brendan McCann

“Only 6% of US exchange-traded funds surveyed anticipated any capital gains distribution in 2025, and just 2% expected amounts above 1% of net asset value.”

How Goldman’s $2B Innovator Deal Could Reshape ETF Consolidation by Lilly Riddle

“Issuer consolidation is expected to become a mainstay in the industry in the years to come.”

Single-stock ETFs can amplify returns, analyst says, but there’s ‘significant risk that the bet goes wrong’ by Lorie Konish

“Single-stock ETFs have had about $44 billion in all-time cumulative flows.”

Private Credit ETFs 101: Business Development Companies by Conor MacWilliams

“Prior to this growth, the segment probably wasn’t big enough to sustain the potential needs of an ETF.”

A Bitcoin ETF Doubled in Value. Its Investors Made Only One-Fourth of That by Jeffrey Ptak

“The large gap between the ETF’s dollar-weighted and total return underscores the importance of staying the course.”

Night owl bitcoin traders: Soon there’ll be an ETF just for you by Liz Napolitano

“Hypothetically, an investor who had been buying shares of the iShares Bitcoin Trust ETF (IBIT) when U.S. markets formally close, and selling them at the next day’s open, would have scored a 222% gain since January 2024.”

Crypto ETFs: Crypto Index ETFs Quietly Emerge by Roxanna Islam

“Crypto index ETFs and multi-token ETFs may eventually earn more inflows as advisors and investors attempt to navigate the rapidly growing field of crypto ETFs.”

ETF Post of the Week

One of my 2025 ETF predictions was that 351 exchanges would go mainstream. What’s a 351 exchange?

Here’s how I described it:

“Let’s say an investor has a sizeable individual stock portfolio held in a taxable account. Let’s also assume those stocks have large capital gains overall. If the investor were to sell positions, they would be on the hook for paying taxes to Uncle Sam. A 351 exchange allows this investor to instead contribute those stocks into an ETF. Instead of owning a portfolio of individual stocks, the investor now simply owns ETF shares. Importantly, this investor doesn’t pay any taxes until they actually sell those ETF shares. There’s another benefit. It’s possible (likely) their individual stock portfolio had become overly concentrated because remember… if they sold positions, they paid taxes. However, the ETF shares they now hold can allow for greater diversification via the magic of creation and redemption. Their legacy individual stock holdings will be swallowed into a broader ETF and ultimately purged as necessary. Plus, the investor will receive the tax benefits of the ETF structure itself. Sounds pretty attractive, doesn’t it?”

And this isn’t theoretical anymore. Alpha Architect just launched the Alpha Architect US Equity 2 ETF (AAEQ) with nearly $500 million in assets out of the gate. Meanwhile, Cambria’s Meb Faber has suggested that future 351 exchange ETFs, such as the Alpha Architect U.S. Equity 3 ETF (AAUA), could potentially launch with $1 billion or more.

No argument here. I’ve been paying attention.

Are you paying attention yet?!

— Meb Faber (@MebFaber) December 12, 2025

2026 will see these grow into the billions at launch. https://t.co/QgyrRbBQBx

ETF Chart of the Week

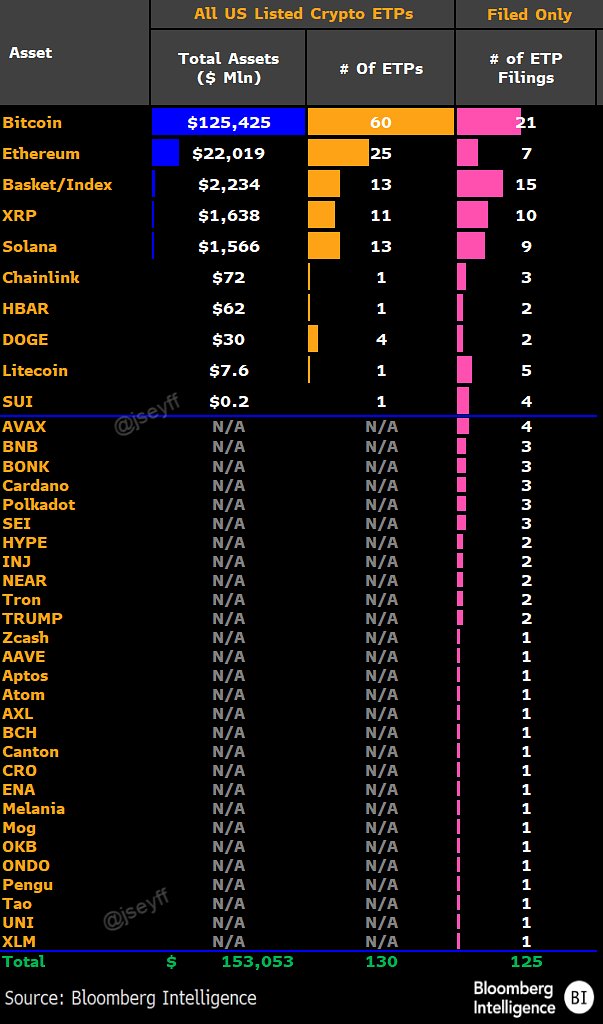

Take a close look at the bottom of the far right column below, which shows the number of crypto-related ETFs currently filed with the SEC. Yes, you’re reading that correctly… 125! That number is likely already higher since this chart was posted mid-last week.

I called 2025 “The Year of Crypto ETFs“. Now that the crypto ETF floodgates have finally opened, 2026 will be more about which products actually survive and thrive.

Source: Bloomberg’s James Seyffart

ETF Prime Podcast

There are two ETF Prime podcasts to enjoy this week. First, I was joined by Clark Allen, Head of Product at Horizon, and Mike Hagopian, Institutional Portfolio Manager at Fidelity. Clark discussed Horizon’s ETF entrance earlier this year and how its model portfolio business shapes product development. Mike highlighted Fidelity’s actively managed Enhanced ETF lineup, which aims to deliver outperformance and offer a thoughtful alternative to traditional passive investing.

Then, I was joined by Roxanna Islam, Head of Sector and Industry Research at VettaFi, and Petra Bakosova, CEO of Hull Tactical and Portfolio Manager of the Hull Tactical U.S. ETF (HTUS). Roxanna shared her perspective on several recent ETF developments, including Vanguard opening brokerage access to spot crypto ETFs, Goldman Sachs’ acquisition of Innovator ETFs, and the SEC’s pushback on filings for 5x leveraged products. Petra explained Hull Tactical’s approach to delivering risk-managed S&P 500 exposure.

Crypto Prime Podcast

Christopher Jensen, Portfolio Manager and Director of Digital Asset Research at Franklin Templeton, joined me on last week’s Crypto Prime to discuss the firm’s approach to the crypto space, the strategy behind the Franklin Crypto Index ETF (EZPZ), the investment cases for bitcoin, ether, solana, and XRP, and the key trends to watch as we head into 2026.