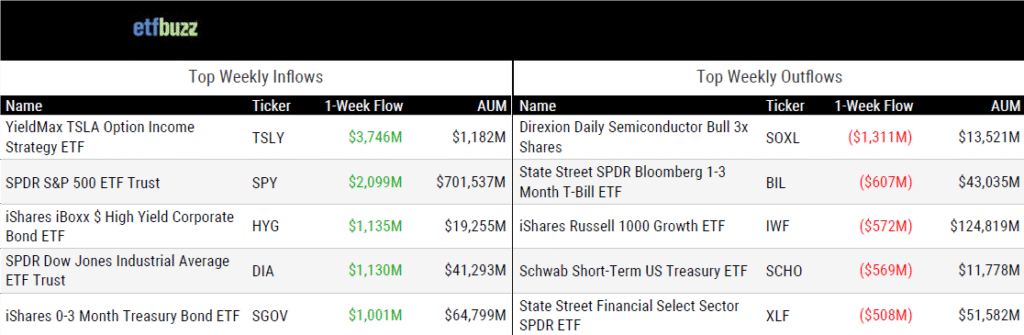

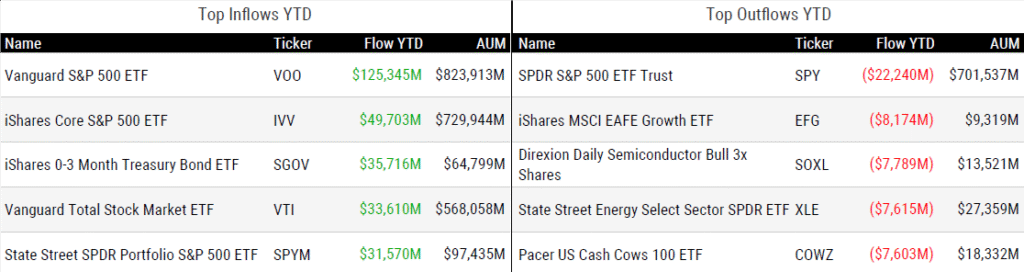

ETF Inflows & Outflows

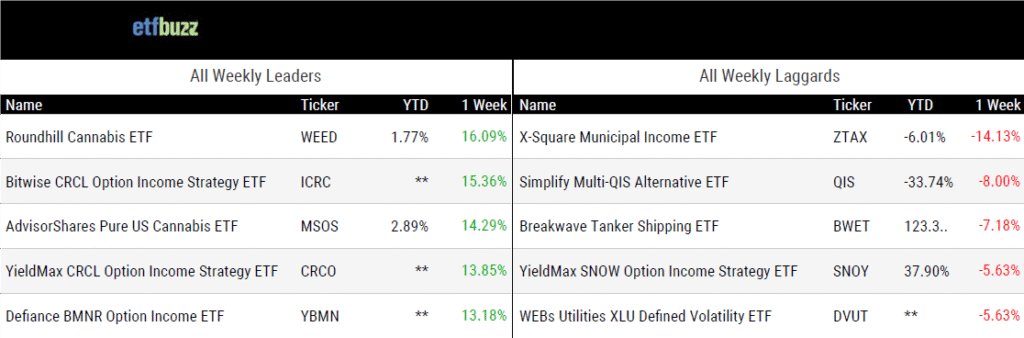

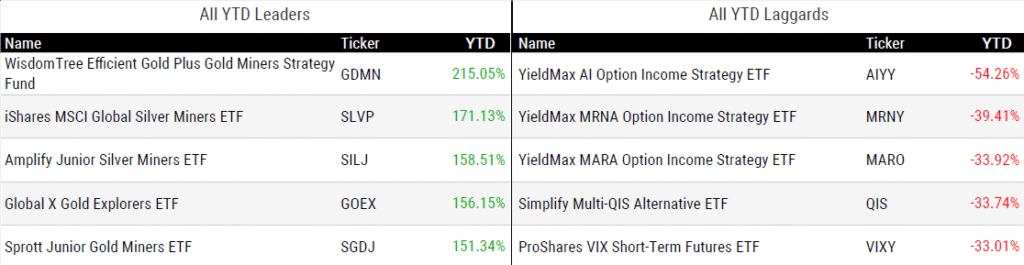

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 12/4/25; performance data excludes leveraged and inverse products

Weekly ETF Reads

U.S. ETF Monthly Summary: November 2025 Results by Jose Paulo Tolentino

“U.S. ETF assets under management hit another record at $13.2 trillion in November.”

Goldman Sachs to Pay $2 Billion for ETF Issuer Innovator Capital by Emily Graffeo, Todd Gillespie, and Katie Greifeld

“They already have $28 billion and have a broad following around the adviser community. That head start does matter.”

(Note: Emily Graffeo and Katie Greifeld penned a nice follow-up piece titled Goldman’s $2 Billion Innovator Deal Mints Rare ETF Billionaire.)

SEC halts review of highly leveraged ETF plans, citing risk exposures by Shashwat Chauhan

“Some funds have sought to track as much as fives times the performance of the underlying stock.”

(Note: Again, another nice follow-up piece… ProShares withdraws some highly leveraged ETF plans after SEC review halt.)

Model Portfolios Decide Which ETFs Succeed. That Might Not Be a Good Thing by Lilly Riddle

“We just think that the relationship of who’s designing the model for the advisor should be one that suits the advisor, not the asset manager.”

Is bitcoin really digital gold? In 2025, the leading crypto has failed to answer that question by Krysta Escobar

“While spot bitcoin ETFs have seen billions in outflows over the past month, since the beginning of the year, they have attracted roughly $22 billion in inflows.”

ETF Post of the Week

Back in September, Crypto In America’s Eleanor Terrett reported that Vanguard was “quietly preparing to offer crypto ETFs on its brokerage platform”:

“According to a source familiar with the company’s plans, who spoke on condition of anonymity, Vanguard has begun laying the groundwork and holding external discussions in response to strong client demand for digital assets and a shifting regulatory environment. The source said there are currently no plans for Vanguard to launch its own products, as BlackRock has done. Instead, the firm is considering letting brokerage customers access select third-party crypto ETFs, though it remains unclear when a decision will be made or which products would be offered.”

This past Monday, those early indications became official, as Vanguard opened brokerage access to several spot crypto ETFs:

“When it comes to investment products we create, our posture has not changed; we focus on products that generate cash flow in a transparent way, such as interest payments and dividends. At this time, Vanguard has no plans to launch our own cryptocurrency ETFs or mutual funds. Just as we do with all investment vehicles and asset classes, Vanguard consistently monitors the cryptocurrency space. This ongoing analysis has informed our decision to allow most third-party cryptocurrency ETFs and mutual funds on our brokerage platform. These products have been tested through periods of market volatility, performing as designed while maintaining liquidity; the administrative processes to service these types of funds have matured; and investor preferences continue to evolve.”

Who could have seen this coming? As I told Barron’s in January of last year, when Vanguard first gated access to spot bitcoin ETFs:

“This decision by Vanguard is absolutely an unforced error and one that I believe will put the company at a longer-term disadvantage relative to competitors.”

Geraci said the move “will likely alienate younger investors.”

It’s never too late to correct a bad decision… and spot crypto ETF issuers didn’t miss the chance to poke fun.

You can call your parents and let them know Grayscale products are live on @Vanguard_Group.

— Grayscale (@Grayscale) December 2, 2025

ETF Chart of the Week

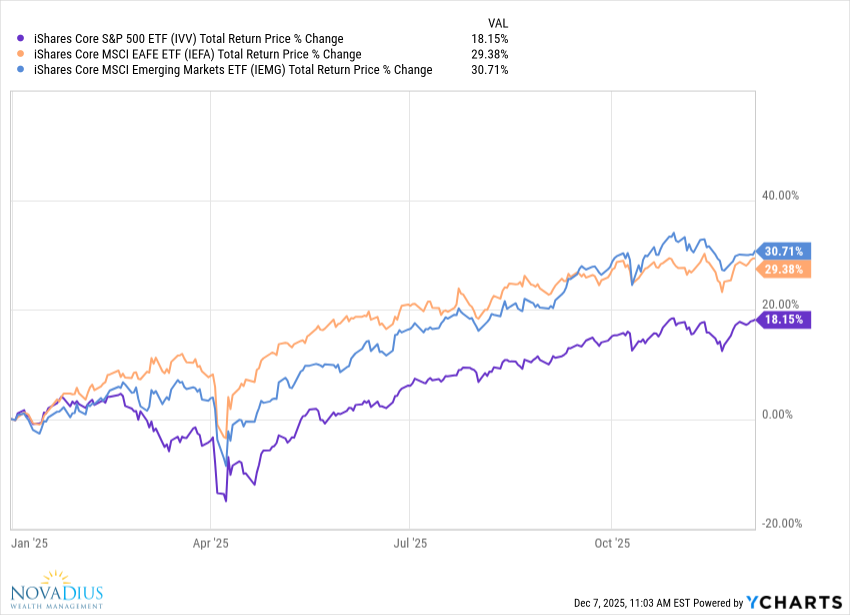

One story I’m watching through the rest of this year and into 2026 is whether international stocks can sustain their recent outperformance. Despite foreign equities consistently outshining their U.S. counterparts in 2025, U.S. equity ETFs continue to dominate investor flows. In fact, among the top seven ETFs by inflows this year, three track the S&P 500 (VOO, IVV, SPYM), one covers the total U.S. stock market (VTI), and another represents the Nasdaq-100 (QQQM).

Still, just outside that top tier sit several notable international equity ETFs, including VXUS, IEMG, VEA, and IEFA. The big question: Will they keep climbing the ETF leaderboard?

CNBC ETF Edge

I recently had the pleasure of joining CNBC’s Dominic Chu, along with OpenInterest.Pro Co-Founder & CNBC contributor Mike Khouw, to discuss leveraged and inverse ETFs, recent crypto price action, and more. Enjoy!