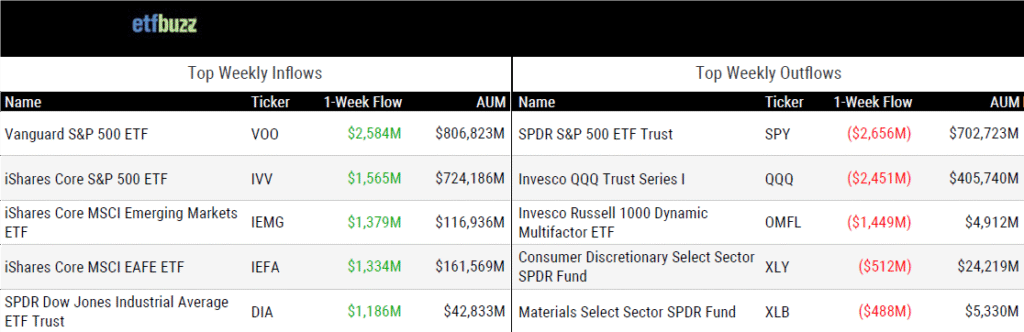

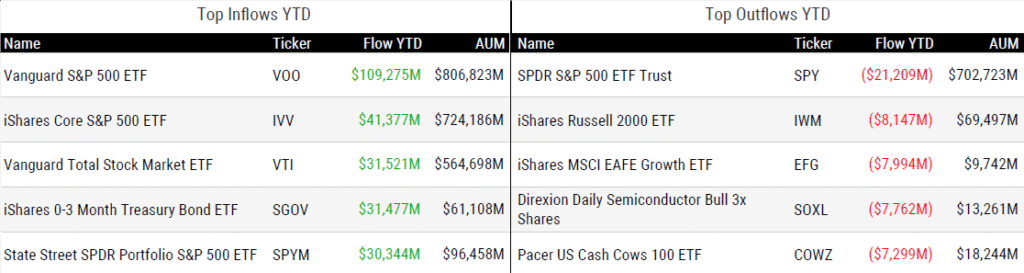

ETF Inflows & Outflows

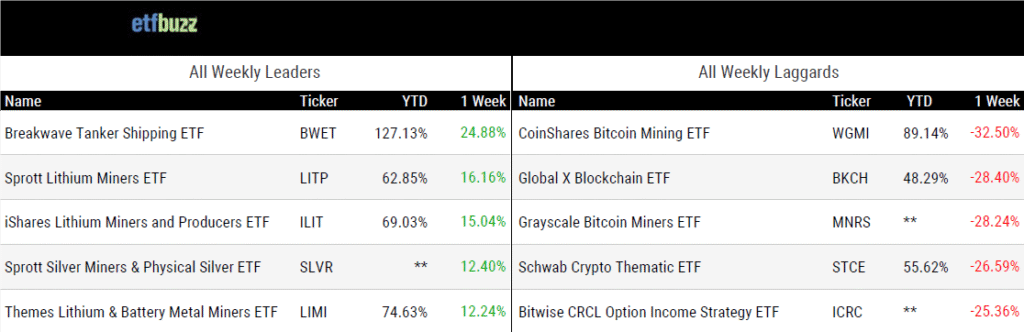

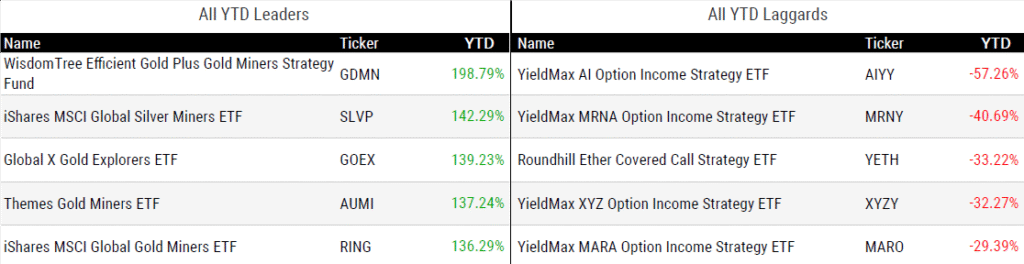

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 11/13/25; performance data excludes leveraged and inverse products

Weekly ETF Reads

YieldMax’s “Income” Illusion by Sumit Roy

“YieldMax sells away a huge chunk of your upside and hands it back to you in monthly ‘income’ payments.”

‘Cannibalization’ Fears Haunt Stockpickers Seeking ETF Lifeline by Katie Greifeld

“The two-way traffic suggests that this isn’t active management making a grand comeback — it’s largely investors shifting to the ETF wrapper from mutual funds.”

State Street Renames Dozens of ETFs Ahead of 401(k) Play by Emile Hallez

“The itsy-bitsy SPDR went off the ETF.”

Bitwise sparks industry scramble with Solana ETF launch by Suzanne McGee

“The stakes are high for anyone who can seize first-mover advantage.”

Canary’s spot XRP ETF generates $58 million in day-one trading volume surpassing Bitwise’s SOL ETF launch total by Jason Shubnell

“The median opinion of a crypto asset does not determine an ETF’s success.”

Lastly, the latest J.P. Morgan Guide to ETFs is out… always worth a look.

ETF Post of the Week

The U.S. Treasury Department and the IRS released new guidance this week providing long-awaited clarity on how staking rewards in crypto ETFs will be taxed. The new revenue procedure outlines key requirements that ETFs must meet to qualify, including holding only a single type of digital asset and maintaining robust liquidity risk policies and procedures.

This guidance opens the door for crypto ETF issuers to confidently incorporate staking, giving investors access to the full range of crypto benefits – including staking rewards.

Bill Hughes of Consensys commented:

“The impact on staking adoption should be significant. This safe harbor provides long-awaited regulatory and tax clarity for institutional vehicles such as crypto ETFs and trusts, enabling them to participate in staking while remaining compliant. It effectively removes a major legal barrier that had discouraged fund sponsors, custodians, and asset managers from integrating staking yield into regulated investment products.”

Overall, this marks yet another strong step forward for the evolution of crypto ETFs.

Today @USTreasury and the @IRSnews issued new guidance giving crypto exchange-traded products (ETPs) a clear path to stake digital assets and share staking rewards with their retail investors.

— Treasury Secretary Scott Bessent (@SecScottBessent) November 10, 2025

This move increases investor benefits, boosts innovation, and keeps America the…

ETF Chart of the Week

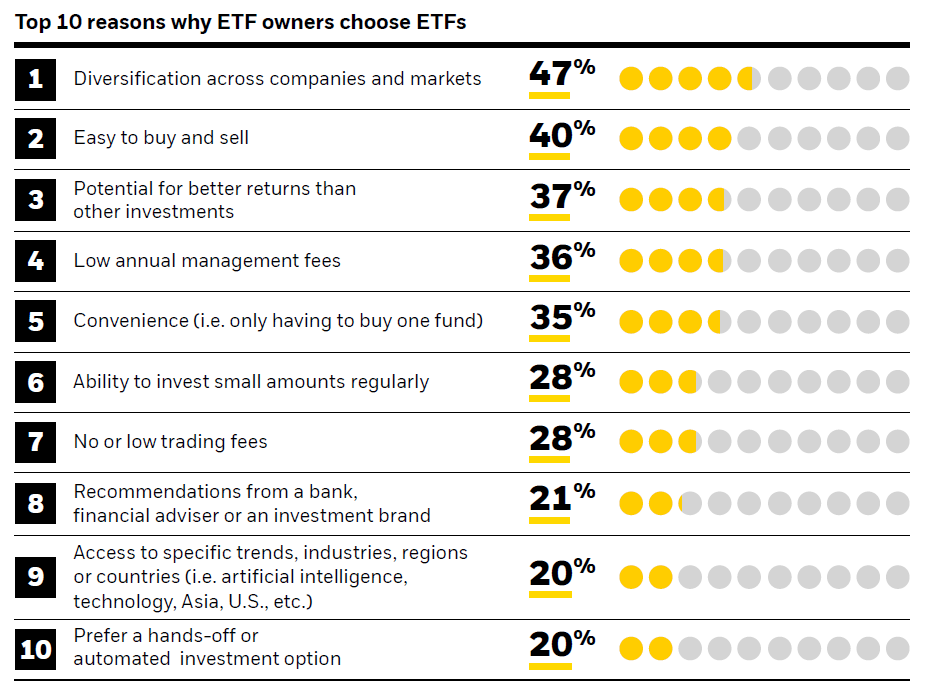

BlackRock released its inaugural “People & Money” report last week, featuring insights from a survey of more than 5,000 U.S. adults. Some key findings:

-ETFs are the fastest-growing product on retail investment platforms in the last five years.

-An estimated 19 million U.S. adults are very likely to buy ETFs in the next 12 months. Of those buyers, 44% are predicted to be first-time ETF investors – 71% of which will be under 45 years of age.

-Those aged 18–34 are more likely to hold ETFs than those aged over 35 (28% vs. 20%).

-Equity and crypto will be the most popular asset classes among those intending to invest in ETFs/ETPs in next 12 months. 47% of first-time ETF investors are expected to allocate to crypto ETPs in the next 12 months.

-Over 24 million people in the U.S. are estimated to own ETFs. The most common reasons U.S. investors choose ETFs is to benefit from their diversification, ease, and value.

There are numerous takeaways from the report, but an obvious one is the surging retail appetite for ETFs – particularly among younger investors – with millions of first-time buyers expected to enter the market in the next year, many eyeing crypto exposure.

Combined with the fact that ETFs are on track to shatter last year’s annual inflow record (having already surpassed 2024’s total), the outlook for the industry remains bright!

Source: BlackRock

ETF Prime Podcast

Last week’s ETF Prime featured Todd Rosenbluth, Head of Research at VettaFi, and Paul Baiocchi, Head of Fund Sales & Strategy at SS&C ALPS Advisors. Todd discussed recent ETF milestones and the top stories from ETFTrends.com, while Paul shared his key ETF takeaways from 2025 and offered a look ahead to 2026.

Crypto Prime Podcast

Steven McClurg, Founder & CEO of Canary Capital, joined me on last week’s Crypto Prime to unpack the launch of the Canary XRP ETF (XRPC) – the first-ever spot XRP ETF under the 1933 Act. He also discussed the investment case for XRP and shared insights into Canary’s broader spot crypto ETF strategy.

Bonus Podcast!

I recently joined etf.com’s “ETF Zoo”, which contained an exotic mix of my industry friends talking all things ETF: private credit, international equities, single-stock covered call products, crypto, and small caps. Enjoy!