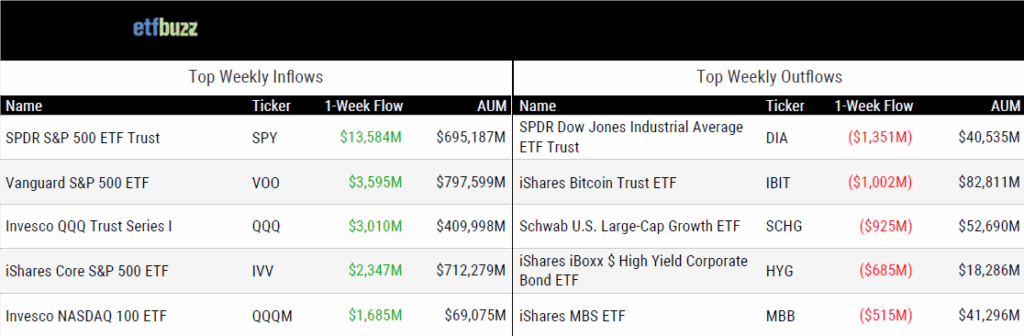

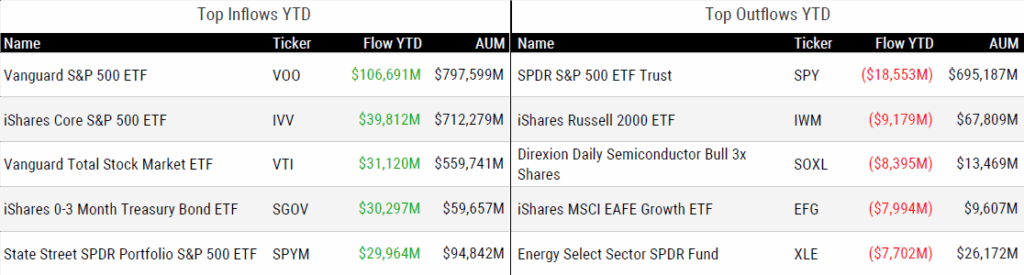

ETF Inflows & Outflows

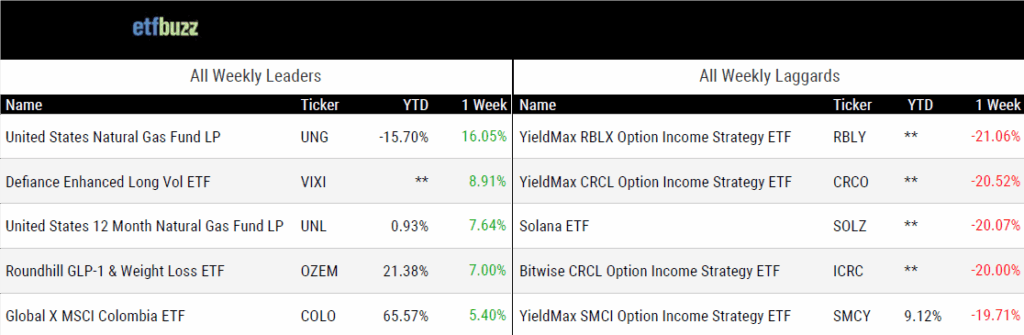

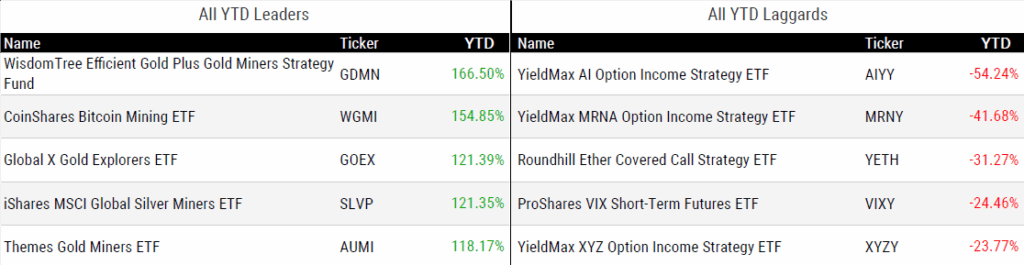

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 11/6/25; performance data excludes leveraged and inverse products

Weekly ETF Reads

U.S. ETF Monthly Summary: October 2025 Results by Jose Paulo Tolentino

“October saw a record month of 137 ETF launches.”

Wall Street Upstarts Shake Up ETF World as Big Three Lose Ground by Isabelle Lee

“BlackRock Inc., Vanguard Group and State Street Investment Management drew just 57% of investor flows this year, their lowest share on record.”

It’s Part of the Game: Matt Tuttle on Closing ETFs and Looking to the Stars by Griffin Kelly

“The S&P 500 is great, but launching an S&P 500 fund is never going to work from our standpoint.”

These ETFs Had One Job. They Didn’t Do It, Costing Traders Billions by Jeffrey Ptak

“That would mean the ETF incurred nearly $740 million in frictional costs unexplained by standard management and other fees.”

Schwab to Introduce ETF Rev-Sharing Fees by Daniel Gil

“Smaller shops can’t really say no. It’s an old pay-to-play model.”

TXSE’s Jeb Hensarling Says Battle for ETFs Will Be a Key Focus of New Stock Exchange by Glenn Hunter

“‘Where is it best for my ETP to trade?’ And we think a whole lot of them are going to conclude that it’s ‘Tex-see.’”

You Might Not Always Get the Returns Your Active ETF Earned by Robby Greengold

“Due diligence should focus on the volatility of a fund’s price/NAV gap over time, not just averages.”

Institutional Investors Begin to Embrace ETFs by Debbie Carlson

“ETFs remain only a small part of institutional investors’ holdings, but that could change.”

Low-cost ETFs in 401(k) retirement plan? Fund giant State Street says you may soon see something like it by Krysta Escobar

“In my view, the retirement industry is not benefitting from the innovation that the ETF industry is bringing to the market and is benefiting from.”

Spot ETFs Give Rise to Crypto Basis Trading by Mark Pilipczuk and Oliver Andrews

“The ETF structure provided institutions with a regulated and liquid spot leg, making basis trading more scalable.”

Bonus article: This past week, I had the pleasure of visiting the campus of Missouri Military Academy, where I spoke with faculty, staff, and cadets about the importance of financial literacy and answered questions on a range of topics, including ETFs. You can read a very thoughtful (and flattering) recap of the visit here.

ETF Post of the Week

I always love a good ETF success story. Roundhill recently surpassed $10 billion in assets after pulling in a staggering $5.5 billion in inflows so far this year. Leading the way are the Roundhill Magnificent Seven ETF (MAGS) and the Roundhill Generative AI & Technology ETF (CHAT), which have gathered $1.5 billion and $750 million in new assets, respectively. In addition, I count 13 other Roundhill ETFs that have each taken in at least $100 million – about half of which come from the firm’s WeeklyPay ETF suite.

As Roundhill CEO Dave Mazza commented:

“Roundhill was built to challenge the traditional ETF playbook, and we’re proud that investors have responded to that approach. As we continue to expand our lineup across both thematic and income-focused ETFs, our focus remains on delivering innovative, high-conviction products that connect with today’s investors.”

It’s been well documented how difficult it is to survive in the ETF Terrordome, especially for smaller, upstart issuers. Congratulations to Roundhill on not only surviving, but thriving!

Incredibly proud to share that @roundhill has officially surpassed $10 billion in AUM.https://t.co/VSXHZVTHl7

— Will Hershey (@maybebullish) November 6, 2025

ETF Chart(s) of the Week

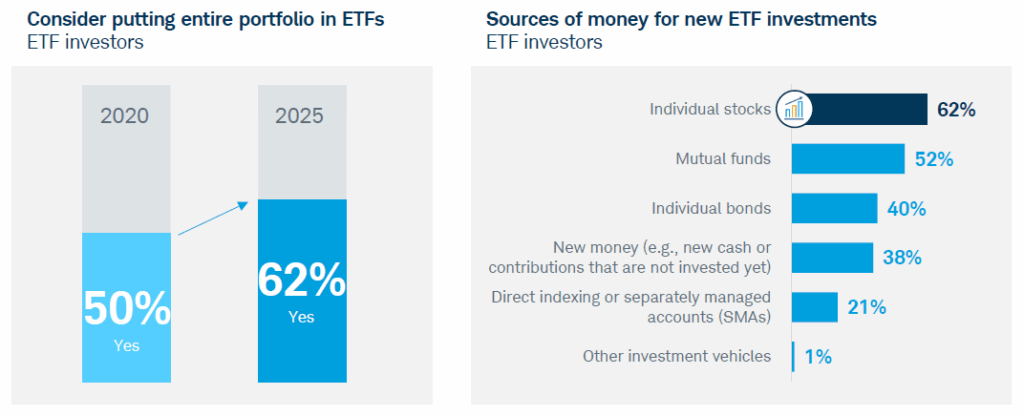

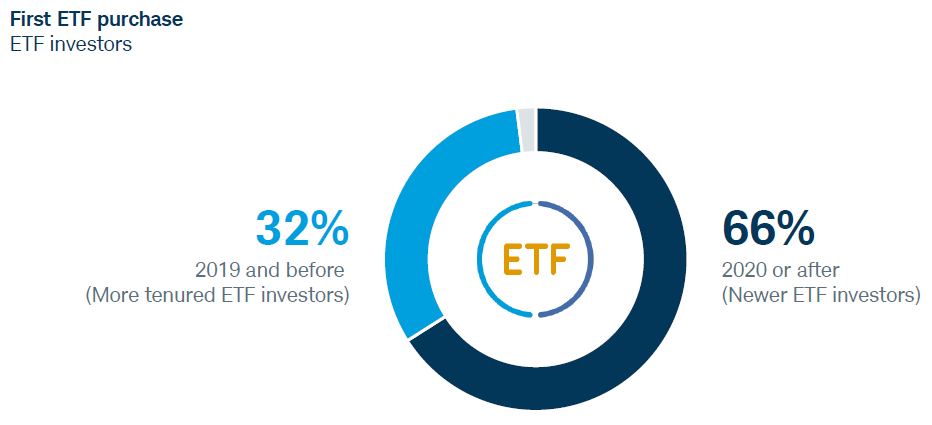

Charles Schwab’s latest ETF study is out, and it’s clear that ETFs are continuing to eat the investment world.:

“Most ETF investors (62%) can envision putting their entire investment portfolios into ETFs – with half (50%) saying they could be fully invested in ETFs in the next five years, signaling growing affinity for and reliance on the products to meet a wide range of investing needs. At the same time, many investors are just discovering ETFs. Most ETF investors (66%) responding to Schwab Asset Management’s latest study started investing in ETFs within the past five years.”

The entire study is well worth a read.

ETF Prime Podcast

Last week’s ETF Prime featured Eric Balchunas, Senior ETF Analyst at Bloomberg Intelligence, offering a tour through the ever-evolving world of ETFs – covering crypto funds, the rise of exotic products, industry flows, the coming multi-share class structure, and more.

Bonus Podcast!

I recently joined my friend and longtime ETF industry veteran Phil Bak to discuss podcasting, ETFs, and the current markets.

You can watch the entire conversation by clicking the link below. Enjoy!

PODCAST: Nate Geraci explains the ETF industry by Phil Bak

An in-depth look at everything happening in and around ETFs

Read on Substack