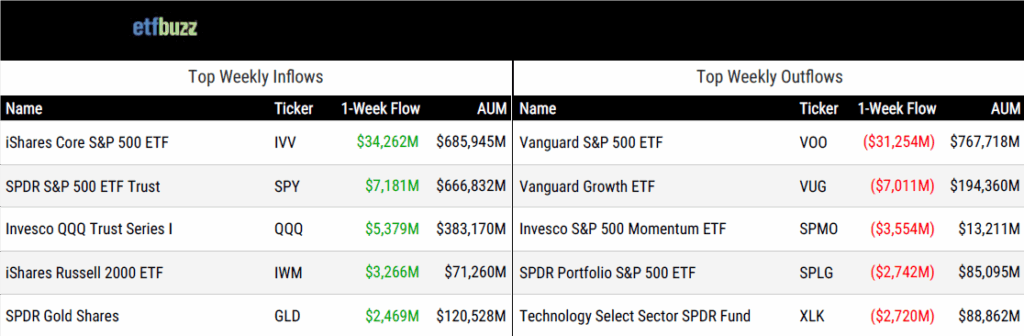

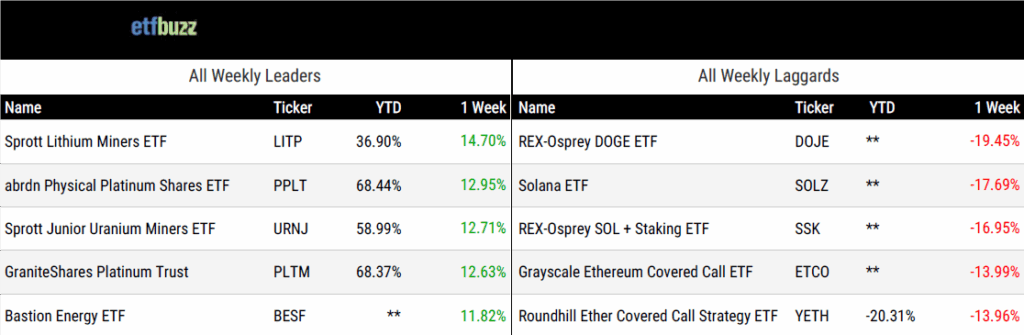

ETF Inflows & Outflows

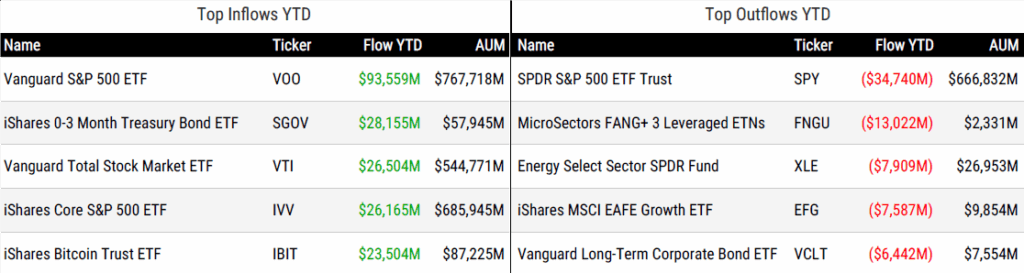

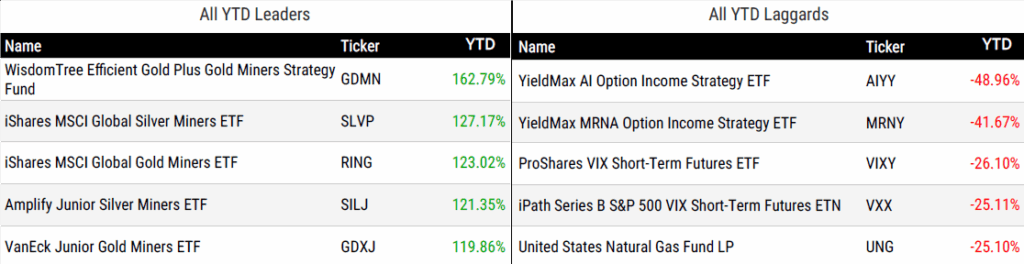

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 9/25/25; performance data excludes leveraged and inverse products

Weekly ETF Reads

ETFs 2025: Cheap, Fat, Starving for Attention by Dave Nadig

“The problem with ETFs is that they’ve been too successful.”

How can advisors keep pace with the evolution of ETFs? by Steve Randall

“The challenge for advisors is how to reconcile ETFs that use sophisticated investment concepts compared to simpler strategies that offer similar exposures.”

Boutique Firm to Become $12 Billion ETF Power Player Overnight by Emily Graffeo

“Akre will instantly scale up the league table to a top-40 US ETF issuer, with a footprint comparable to that of Nuveen and Morgan Stanley.”

Your Active ETF Is Cheap, But Your Trade Might Not Be by Robby Greengold

“Active ETF fees are often cheaper than mutual funds, but your all-in cost includes trading frictions.”

Tired of Paying Investment Taxes? There’s an ETF for That by Jason Zweig

“If these funds pass the test of time—no unexpected tax glitches, no big deviations from the return of the underlying assets, no interventions from the IRS—they could earn their place as a welcome innovation.”

Dan Ives, Tom Lee Bypass Wall Street With Social Media Megaphone by Isabelle Lee and Alexandra Semenova

“Lee and Ives have both benefited from that climate, using their social media bullhorns to bypass the gatekeepers active managers typically depend on — broker-dealer platforms, consultants, retirement plans — and appeal directly to potential clients.”

Crypto ETFs set to flood US market as regulator streamlines approvals by Suzanne McGee and Hannah Lang

“Those filings are pretty far along in the review process.”

Ethereum ETFs now account for 15% of spot market volume, up from 3% at launch by Brandon Kae and Ivan Wu

“This steady climb reflects growing institutional and retail preference for regulated exposure to Ethereum rather than direct token ownership.”

Tokenization Is Finance’s Next ETF Moment, And Wall Street Isn’t Ready by Nick Cherney

“Skepticism is the leading response to virtually every breakthrough innovation in finance.”

ETF Post of the Week

Since the launch of spot bitcoin ETFs in January 2024, and the subsequent debut of spot ether ETFs in July 2024, Vanguard brokerage clients have been blocked from accessing these products – a position that felt increasingly out of step with the broader financial industry.

At the time of the spot bitcoin ETF launch, I said the following about Vanguard’s stance:

“A move like this simply doesn’t resonate in 2024. The financial services industry continues moving towards greater accessibility and investor empowerment, not away.”

Beyond that, I believed – and still believe – there’s a large segment of investors who appreciate Vanguard’s low-cost stock and bond ETFs and want the option to allocate a small portion of their portfolios to spot crypto ETFs. Vanguard’s decision to play the role of nanny was, frankly, a bad look.

Here’s how Vanguard justified the crypto block at the time:

“It’s an immature asset class that has little history, no inherent economic value, no cash flow, and can create havoc within a portfolio.”

Has Vanguard changed its investment thesis? I’m not convinced. But what’s clear is that maintaining a restrictive policy had become untenable – especially from a competitive standpoint.

Their biggest rival, BlackRock, has embraced both bitcoin and ether ETFs without hesitation. And with the SEC’s recent approval of generic listing standards for spot crypto ETFs, Vanguard’s stance was only going to look more outdated by the day.

🚨SCOOP: Vanguard Eyes Crypto ETF Access for Brokerage Clients

— Eleanor Terrett (@EleanorTerrett) September 26, 2025

The world’s second-largest asset manager, @vanguard, is preparing to allow access to crypto ETFs on its brokerage platform, according to a source familiar with the matter.https://t.co/MDOft0PLXN

ETF Chart of the Week

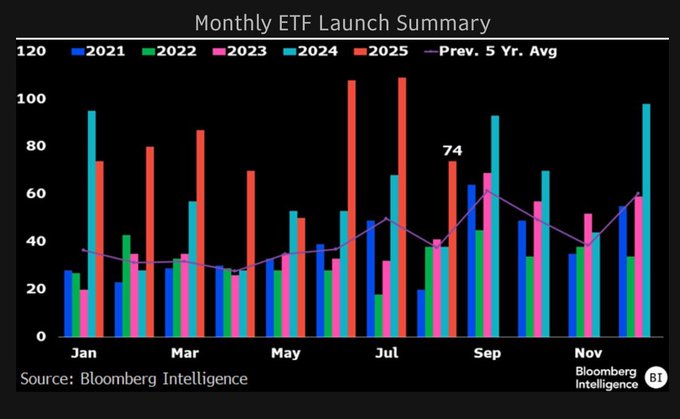

An additional 74 ETFs launched in August, marking yet another monthly record. Bloomberg’s Eric Balchunas notes that ETF launches in 2025 are now 55% ahead of 2024’s record pace and likely headed toward 1,000 for the year – a mind-boggling average of four ETF launches per business day!

Source: Bloomberg’s Eric Balchunas

ETF Prime Podcast

Last week’s ETF Prime featured Cullen Rogers, Chief Investment Officer at Wedbush Fund Advisers, highlighting the Dan Ives Wedbush AI Revolution ETF (IVES) and exploring the broader investment thesis fueling interest in artificial intelligence. Craig Ebeling, Head of ETF Strategists at Fidelity Investments, outlined key factors to consider when evaluating income-generating ETF strategies and offered timely guidance on tax-loss harvesting ahead of year-end.

Crypto Prime Podcast

Robbie Mitchnick, Global Head of Digital Assets at Blackrock, joined me on last week’s Crypto Prime to highlight the massive success of the iShares Bitcoin Trust (IBIT) and iShares Ethereum Trust (ETHA). He also shared insights into BlackRock’s views on crypto ETF product development, tokenization, and the evolving landscape of stablecoins.