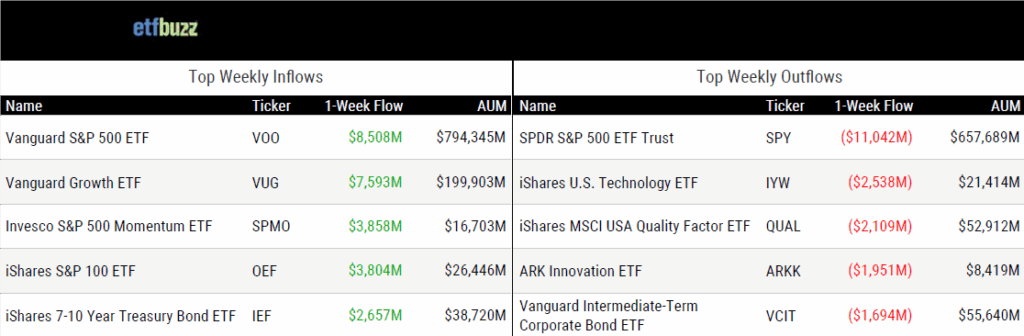

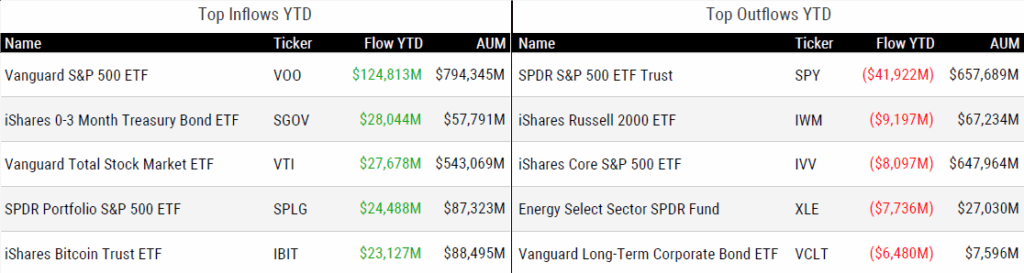

ETF Inflows & Outflows

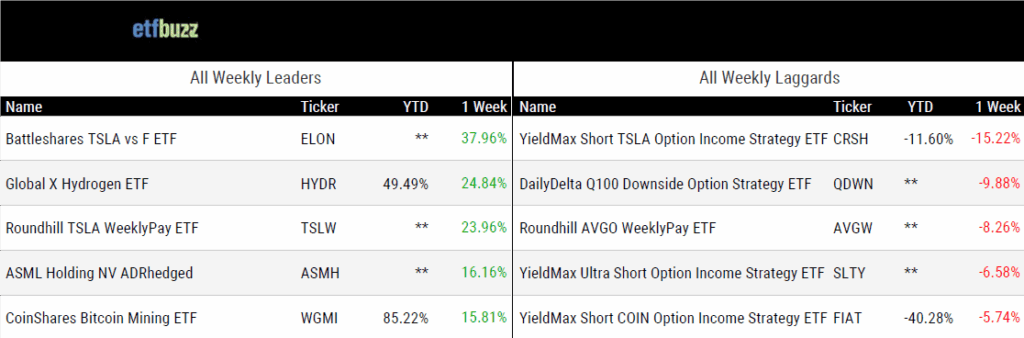

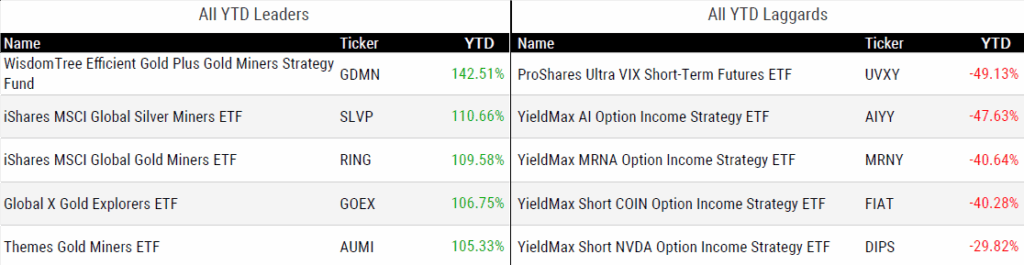

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 9/18/25; performance data excludes leveraged and inverse products

Weekly ETF Reads

Someone has been up to ARKK shenanigans again by Robin Wigglesworth

“It seems like this week’s ARKK surge was simply a failed copycat trade.”

Wish I Was Making This Up by Jeffrey Ptak

“How do investors lose $35 million in an ETF that’s gained nearly 42% per year? By mis-timing their investments.”

Exposure in State Street’s Latest Private Credit ETF ‘PRSD’ Does Not Match its Sales Pitch by Aniket Ullal and Sourav Srimal

“We estimate that, as of Sept. 10, only 9.9% of PRSD’s portfolio was in private credit.”

Just 10 ETFs Dominate 31% Of The Entire Market — Is It Dangerous? by Matt Krantz

“These large funds are typically low-cost and highly liquid, which makes them appealing as more investors embrace ETFs.”

‘End of an era:’ SEC approval of exchanges’ listing standards marks turning point for crypto ETFs by Sarah Wynn

“The approval means that dozens of crypto ETF applications could go live soon.”

Dogecoin ETF to begin trading in ‘watershed moment’ for pro-crypto SEC by Steve Johnson

“I think it’s dangerous.”

From SNL to SEC: Dogecoin Gets ETF as Meme Trades Go Mainstream by Vildana Hajric

“Then there’s this, which was created for fun, as a joke, with absolutely no utility. Dogecoin has no purpose.”

‘Huge category’: Grayscale officially launches GDLC, the first index-based spot crypto ETF by Jason Shubnell

“This launch is more than just another ETP.”

ETF Post of the Week

The big news in the ETF world this past week: the SEC approved new generic listing standards for commodity-based exchange-traded products (ETPs) – including spot crypto ETFs (and yes, I’m sticking with the term “ETFs” for simplicity’s sake).

In short, this new framework significantly streamlines the process for launching spot crypto ETFs, making it much easier to bring these products to market. As long as spot crypto ETF filings meet the newly established standards, approval is essentially a formality – with ETFs potentially being greenlit within just 75 days of filing.

For both the ETF and crypto industries, this approval marks a long-awaited victory. Market participants have been calling for clearer guidelines, and the SEC has finally responded. The Commission deserves credit for acting swiftly and providing the clarity that’s been needed for so long.

SEC Division of Trading and Markets Director Jamie Selway:

“The Commission’s approval of the generic listing standards provides much needed regulatory clarity and certainty to the investment community through a rational, rules-based approach to bring products to market while ensuring investor protections.”

By the way, I hereby proclaim the generic listing standards as the “Crypto ETF Rule”.

The SEC approved generic listing standards for commodity-based ETPs, including spot crypto ETPs: https://t.co/V59r5dSmee and https://t.co/FVnuZIlaWP

— Hester Peirce (@HesterPeirce) September 17, 2025

ETF Chart of the Week

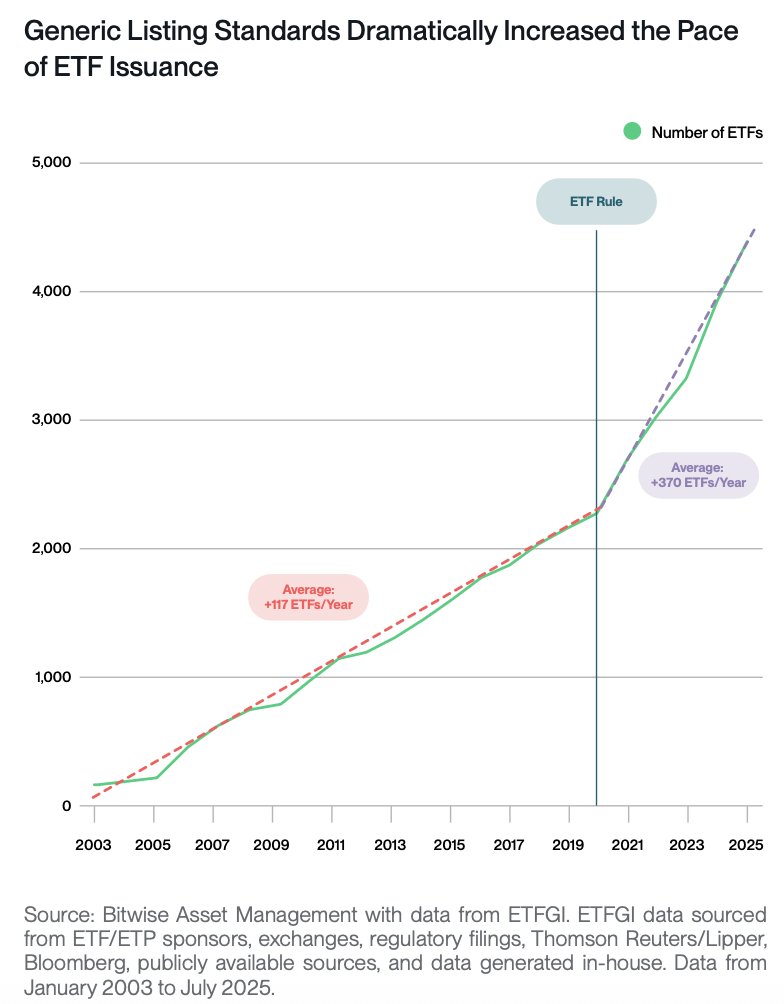

With the “Crypto ETF Rule” now in place, expect a flood of filings and launches in the near future. Bitwise’s Matt Hougan draws the comparison to the “ETF Rule”, which the SEC adopted in 2019:

“Until late 2019, all ETFs—equity ETFs, bond ETFs, etc.—followed the one-by-one regulatory approval approach that crypto ETPs currently follow. But in 2019, the SEC adopted the “ETF Rule,” which created generic listing standards for stock and bond ETPs. What followed was a massive explosion in ETF issuance.

The chart below from ETFGI shows the number of ETFs listed in the U.S. by year. Before the adoption of the ETF Rule, the ETF industry brought on average 117 new ETFs to market each year. Since the ETF Rule went into place, that’s more than tripled to 370 per year.”

Now, with the “Crypto ETF Rule” in effect, expect a similar explosion in crypto ETFs.

Source: Bitwise’s Matt Hougan

ETF Prime Podcast

Last week’s ETF Prime featured Cinthia Murphy, Investment Strategist at VettaFi, recapping the ETF landscape so far in 2025 and sharing her outlook for the rest of the year. Daniel Noonan, Executive V.P. and Head of the Wealth Management Consulting Group at Cohen & Steers, discussed the firm’s entry into the ETF space, the growing momentum behind active management, and ETF strategies focused on real assets and alternative income.

Crypto Prime Podcast

Mirza Uddin, Head of Business at Injective, joined me on last week’s Crypto Prime to highlight the recent Canary Staked INJ ETF filing and share Injective’s vision as the “blockchain built for finance”. Learn how Injective is positioning itself at the forefront of decentralized finance infrastructure.