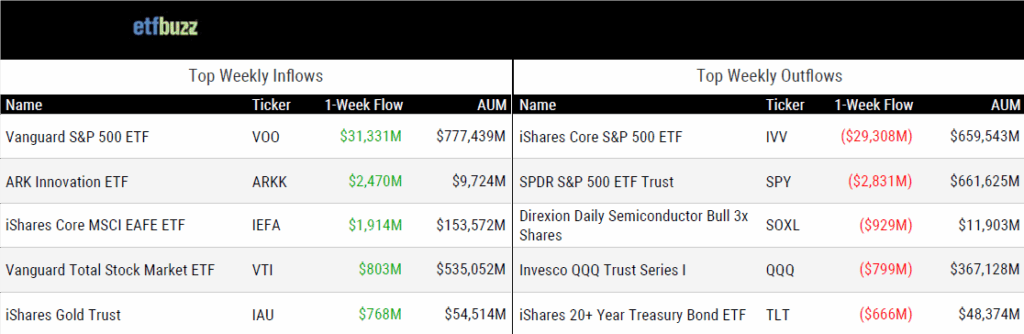

ETF Inflows & Outflows

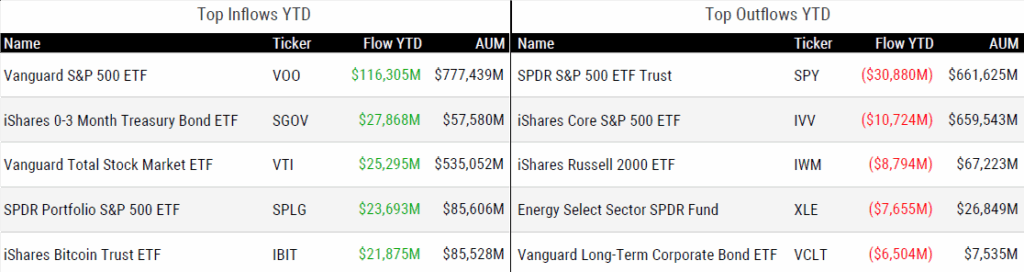

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 9/11/25; performance data excludes leveraged and inverse products

Weekly ETF Reads

SEC Close to Making Decision About Dual-Share-Class Funds by Emily Graffeo

“We’re at the one yard line.”

SEC decision on dual-share class funds nears, with major implications for advisors by Leo Almazora

“If they have the expectation of revenue sharing in an ETF share class, how do they then justify not seeking that on traditional ETFs? That would be so painful.”

Will ETF share classes save mutual funds? Not so fast … by Jeff DeMaso

“Despite the hype, ETF shares of actively managed funds are not a slam dunk.”

The 10 Biggest ETFs in the U.S. by Sumit Roy

“Together, the top 10 represent about 30% of the entire $12.3 trillion U.S. ETF market.”

Nasdaq makes push to launch trading of tokenized securities by Anirban Sen

“Nasdaq on Monday filed a proposal with the U.S. Securities and Exchange Commission to tweak its rules to allow for trading of listed stocks and exchange-traded products on its main market in either traditional digital or tokenized form.”

How Nasdaq is Extending its Use of Tokenization in the U.S. Equities Markets by Tal Cohen

“Blockchain technology opens the door to new post-trade processes and capabilities that can shorten settlement cycles, modernize proxy voting, and offer programmable means to manage corporate actions.”

BlackRock Seeks to Tokenize ETFs After Bitcoin Fund Breakthrough by Olga Kharif

“For ETFs, it could mean trading beyond Wall Street’s set hours, making US products easier to access abroad, and creating potential new uses as collateral in crypto networks.”

ETF Post of the Week

351 exchanges continue to go mainstream in ETF land. So, why are 351 exchanges relevant to ETFs? Here’s how I explained it earlier this year:

“Let’s say an investor has a sizeable individual stock portfolio held in a taxable account. Let’s also assume those stocks have large capital gains overall. If the investor were to sell positions, they would be on the hook for paying taxes to Uncle Sam. A 351 exchange allows this investor to instead contribute those stocks into an ETF. Instead of owning a portfolio of individual stocks, the investor now simply owns ETF shares. Importantly, this investor doesn’t pay any taxes until they actually sell those ETF shares. There’s another benefit. It’s possible (likely) their individual stock portfolio had become overly concentrated because remember… if they sold positions, they paid taxes. However, the ETF shares they now hold can allow for greater diversification via the magic of creation and redemption. Their legacy individual stock holdings will be swallowed into a broader ETF and ultimately purged as necessary. Plus, the investor will receive the tax benefits of the ETF structure itself. Sounds pretty attractive, doesn’t it?”

Alpha Architect has been leading the charge on 351 exchanges. For a deeper dive, check out their comprehensive primer – or get the quick take below from the firm’s president, Ryan Kirlin.

As always, a little ETF education goes a long way.

What is a 351 exchange?

— Ryan Patrick Kirlin 👽 (@RyanPKirlin) September 10, 2025

🟢 IRC Section 351 enables individuals to defer unrealized capital gains if they meet specific diversification tests.

🟢Clients with significant unrealized capital gains in US stocks and ETFs that hold US stocks may be a good fit to consider a 351…

Who could this be for?

— Ryan Patrick Kirlin 👽 (@RyanPKirlin) September 10, 2025

🟢 you’ve done direct indexing for the last 5 years or more and are locked up

🟢 you’re an advisor who won a new client with a mess of a portfolio from his previous advisor relationship. Clean up!

🟢 just through time, you’re an advisor who’s clients have…

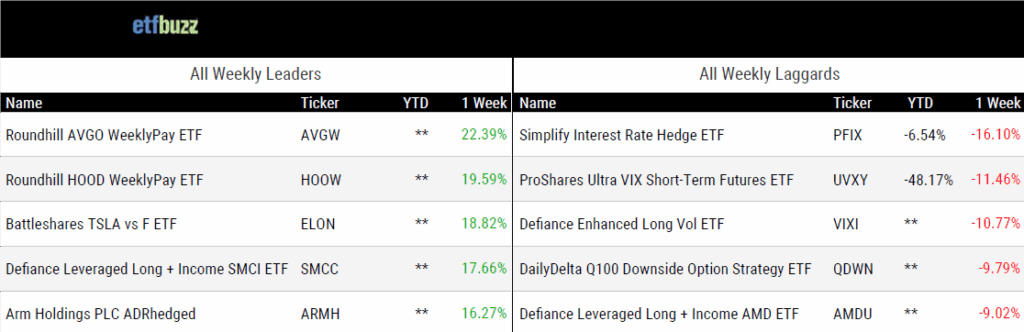

ETF Chart of the Week

Last week, I touched on the growing investor demand for gold ETFs, along with the shiny metal’s impressive performance:

“Gold has quietly outpaced bitcoin so far this year. Gold is up about 37% year-to-date, compared to 20% for bitcoin. Despite the rise of ‘digital gold’ in bitcoin, investors clearly aren’t ready to abandon the real thing – a store of value that’s endured for over 6,000 years.”

While I believe bitcoin ETFs will ultimately surpass gold ETFs in assets, gold isn’t giving up the top spot easily.

That’s what makes this story so interesting. Not long ago, it looked like bitcoin ETFs were a shoo-in to rocket past gold ETFs in short order. But instead of choosing one or the other, investors are plowing money into both.

It feels like the market is trying to tell us something.

Source: Trackinsight’s Rony Abboud

ETF Prime Podcast

Last week’s ETF Prime featured Ben Fulton, CEO of WEBs Investments, highlighting the firm’s suite of Defined Volatility ETFs, which dynamically adjust equity market exposure based on real-time market volatility. Arthur Nowak, Client Portfolio Manager at Alger, discussed the firm’s high-conviction approach to investing in innovation and growth – including the Alger AI Enablers & Adopters ETF (ALAI).

Crypto Prime Podcast

Matthew Tuttle, CEO & Chief Investment Officer of Tuttle Capital Management, joined me on last week’s Crypto Prime to cover a range of topics, including the latest updates on the firm’s crypto ETF filings, his views on the development of crypto ETFs, and the rise of digital asset treasury companies. He also shared his broader perspective on the role of crypto in investment portfolios and the future of tokenization.