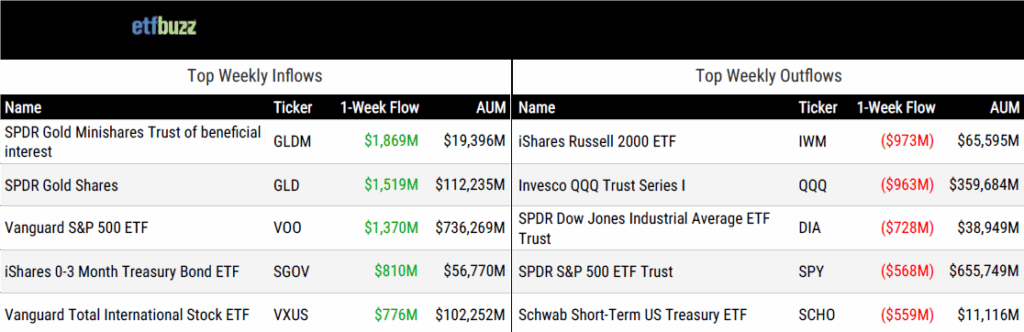

ETF Inflows & Outflows

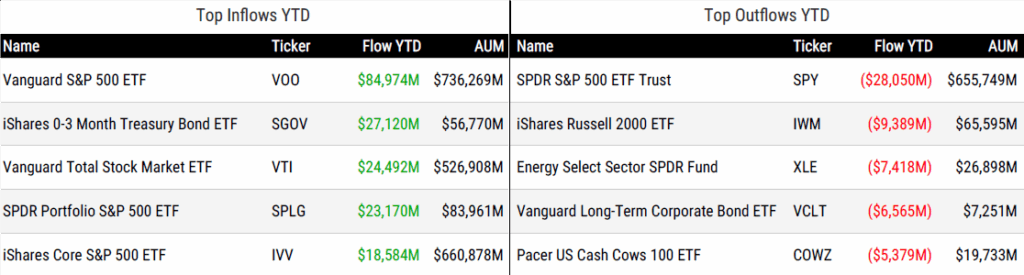

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 9/4/25; performance data excludes leveraged and inverse products

Weekly ETF Reads

The New American Hustle: Dividends Over Day Jobs by Denitsa Tsekova and Vildana Hajric

“Today’s dividend crowd is piling into ETFs offering eye-popping yields generated by complex derivatives.”

Ask Your Advisor These Questions Before Investing in Derivative Income ETFs by Jason Kephart and Susan Dziubinski

“The yield is a good indicator of risk.”

Not All Active Is the Same: An ETF Story by ETF Action

“When you look under the hood, you find a rich narrative about strategy, conviction, and market perspective. Some active managers tell a story of broad, systematic refinement, while others tell a tale of bold, selective bets.”

Active managers struggled ‘mightily’ to beat index funds amid volatility from elections, tariffs, Morningstar finds by Greg Iacurci

“Just 33% of actively managed mutual funds and exchange-traded funds had higher asset-weighted returns than their average index counterparts from July 2024 through June 2025.”

There’s too much of everything. by Bob Pisani

“And now, there may be too many ETFs.”

Not all ETFs will fit your investing diet by Sam Ro

“Peanuts are one of the most beloved ingredients in the culinary world. But it’ll kill those who are allergic to it. I’m not sure if an ETF like that exists, but it may be coming.”

ETF Post of the Week

Gold ETF demand is heating up. Over the past week, the SPDR Gold Shares ETF (GLD) and SPDR Gold MiniShares ETF (GLDM) topped all ETFs in net inflows, continuing a surge that saw $4 billion flow into gold ETFs in August alone.

According to Matt Bartolini, Global Head of Research at State Street, those August inflows marked the tenth-largest monthly total on record, bringing year-to-date inflows to $25 billion.

Just a few days into September, that figure has now surpassed $27 billion for 2025 – well ahead of the $19 billion that has gone into spot bitcoin ETFs, despite “digital gold” capturing more headlines.

In terms of performance, gold has quietly outpaced bitcoin so far this year. Gold is up about 37% year-to-date, compared to 20% for bitcoin.

Aakash Doshi, State Street’s Head of Gold Strategy, says several factors could continue to support gold prices in the months ahead:

• Concerns about U.S. fiscal dominance and Fed independence

• Diverging ETF flows between gold and bitcoin (may foreshadow macro risks)

• Strong diversification benefits as stock-bond correlations remain high

• Gold’s resilience in prior Fed pause/easing cycles

• Rising central bank demand amid de-dollarization trends

Despite the rise of “digital gold” in bitcoin, investors clearly aren’t ready to abandon the real thing – a store of value that’s endured for over 6,000 years.

Cumulative flows for Gold ETFs vs Bitcoins. Gold led early then bitcoin roared back in summer, took lead for a hot minute then gold has regained control. Both doing really good tho at $25b and $19b respectively. We still think bitcoin ETFs ultimately triple gold but it aint gonna… pic.twitter.com/5rfyLzYrbH

— Eric Balchunas (@EricBalchunas) September 4, 2025

ETF Chart of the Week

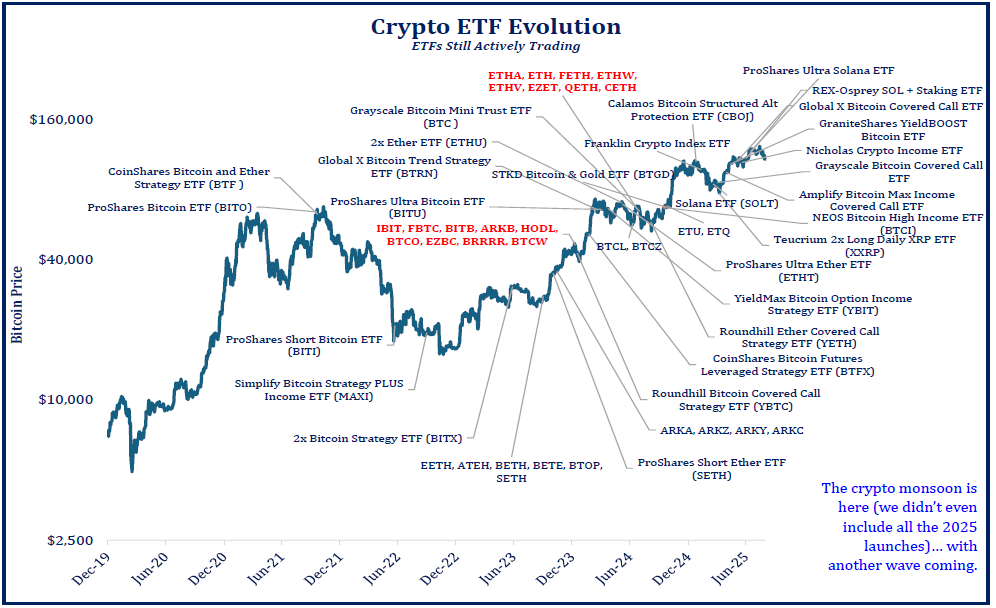

Speaking of bitcoin, Strategas’ Todd Sohn has been dutifully tracking the proliferation of crypto-related ETFs. But with a fresh deluge expected this fall, he says he’s retiring this chart.

Honestly, I don’t blame him.

Source: Strategas’ Todd Sohn

ETF Prime Podcast

Last week’s ETF Prime featured Alex Morris, CEO of F/m Investments, highlighting the firm’s newly launched Compoundr Series ETFs – the first income ETFs specifically designed to tackle dividend tax drag. He also discussed F/m’s efforts to add a mutual fund share class to its existing ETFs. Roxanna Islam, Head of Sector & Industry Research at VettaFi, explored the “ETFs going Hollywood” phenomenon (nice read here) and shed light on the latest trends in ETF closures.

Crypto Prime Podcast

Thomas Uhm, Chief Commercial Officer at the Jito Foundation, joined me on last week’s Crypto Prime to dive into liquid staking tokens, unpack the recently filed VanEck JitoSOL ETF, and offer his take on what’s next for Solana.