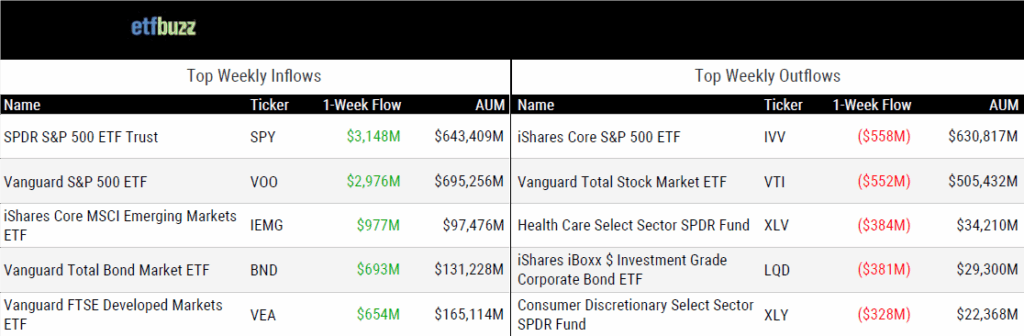

ETF Inflows & Outflows

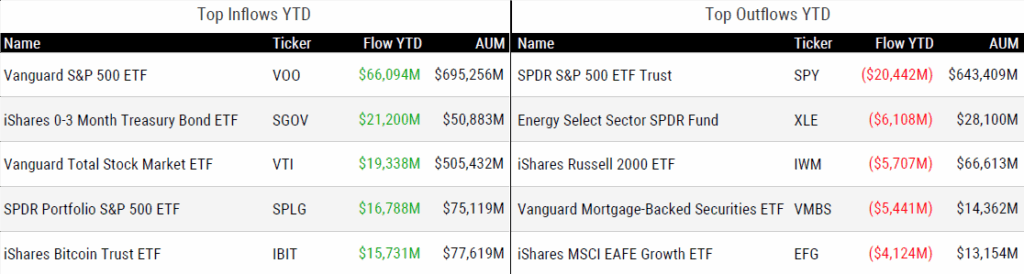

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 7/10/25; performance data excludes leveraged and inverse products

Weekly ETF Reads

Wall Street Builds S&P 500 ‘No Dividend’ Fund in New Tax Dodge by Vildana Hajric

“The ability of ETFs to sidestep capital gains isn’t just a technical quirk anymore — it’s a core selling point, and issuers are leaning into this edge.”

The Active ETFs That Led Inflows During 2025’s First Half by Stephen Welch

“The top 20 ETFs gobbled up more than 35% of the assets.”

Can leveraged ETFs continue to excite investors? by Leo Almazora

“Over 30 leveraged ETFs were launched in the second quarter of 2025 alone, many of them focused on individual stocks.”

Upstart Money Managers Lure Retail-Trader Billions With High-Risk ETFs by Emily Graffeo and Vildana Hajric

“If I want to lose money, I mean, that’s my right as an American.”

How Index-Fund Investing Turned Into an Extreme Sport by Jason Zweig

“The more recently an ETF launched, the fewer stocks it tends to own.”

BlackRock’s Cash-Like ETF Eclipses Infamous Long-Bond Trade by Emily Graffeo and Ye Xie

“T-bill-and-chill.”

US SEC’s guidance is first step toward rules governing crypto ETFs by Suzanne McGee

“It suggests that the SEC acknowledges that crypto ETPs are becoming part of the mainstream and so it’s trying to lay down rules of the road to save both issuers and SEC staff time and hassle.”

Ric Edelman predicts ETFs will disappear by 2030 as tokenized stocks take over by Andrew Cohen

“ETFs, as we know them today, really won’t exist in five years.”

Lastly, a little ETF education goes a long way… The 2025 Intern’s Guide to ETFs by Phil Mackintosh

ETF Post of the Week

Long-time readers of this blog know I’m a sucker for two things: bitcoin ETF milestones and Bloomberg’s iconic “Missile Command” charts. So I simply couldn’t pass up this tweet from Eric Balchunas…

$IBIT blew through the $80b mark last night, fastest ETF to get there in 374 days, about 5x faster than the previous record, held by $VOO, which did it in 1,814 days. Also at $83b it's now 21st biggest ETF overall.. via @JackiWang17 pic.twitter.com/a0LuvfeSek

— Eric Balchunas (@EricBalchunas) July 11, 2025

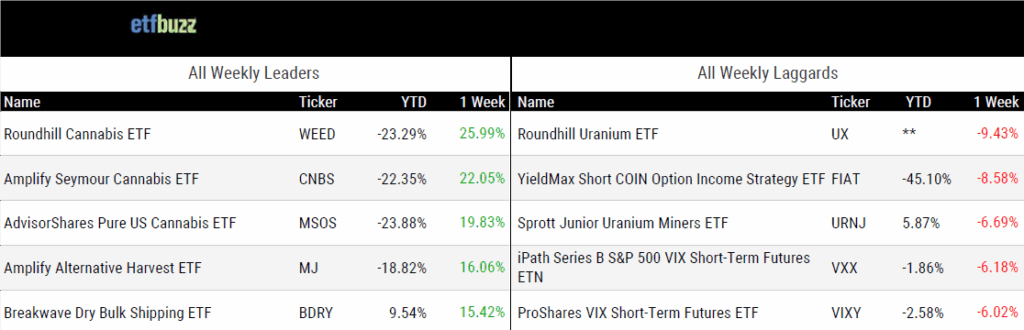

ETF Chart of the Week

While bitcoin ETFs dominate the headlines, gold is quietly posting its strongest ETF inflows in years. In the first half of 2025, global gold ETFs attracted $38 billion – their best semi-annual haul since 2020. Over half of that came from U.S. investors, led by the SPDR Gold Shares (GLD) with $8 billion in inflows. The World Gold Council:

“Spiking geopolitical risks amid the Israel-Iran conflict boosted investor demand for safe-haven assets and supported inflows into North American gold ETFs. Although it held rates steady in June, the US Fed continued to express concerns about slowing growth and rising inflation. Markets are now pricing in three rate cuts by the end of 2025 and an additional two in 2026.

The investor response has been swift: US Treasury yields declined, and the dollar continued to weaken. Persistent policy uncertainty and ongoing fiscal concerns are likely to remain an overhang on the market, which in turn could help support gold ETF demand in the near to medium term.”

Yes, investors are taking notice. Gold has slightly outperformed bitcoin so far this year (28% vs. 27%), and U.S. gold ETFs have actually taken in $5 billion more than their “digital gold” counterparts.

Bitcoin ETFs are stealing the spotlight, but that hasn’t stopped gold ETFs from shining.

Source: World Gold Council

ETF Prime Podcast

Last week’s ETF Prime featured Joel Schneider, Deputy Head of Portfolio Management at Dimensional, discussing the firm’s milestone as the first issuer to surpass $200 billion in actively managed ETF assets. He also delved into the hidden costs of traditional index funds and Dimensional’s pursuit of the multi-share class structure. VettaFi’s Cinthia Murphy broke down the latest filings and launches in the buffer and synthetic income ETF space, spotlighting new offerings from ARK Invest, ProShares, Innovator, and others (excellent written recap here).

ETF Pulse

On last week’s episode of ETF Pulse, I joined etf.com Editor-in-Chief Kristin Myers to cover the latest “tariff tantrum” as stocks hovered near record highs. We also explored new buffer ETF filings from ARK Invest, the SEC’s proposed framework for crypto ETFs, and Trump Media’s plans to launch a crypto index ETF.

Crypto Prime Podcast

Corey Hoffstein, CEO & Chief Investment Officer at Newfound Research and Co-Founder of Return Stacked ETFs, joined me on last week’s Crypto Prime to break down the concept of portable alpha, examine bitcoin’s place in modern portfolios, and offer his take on where crypto might be headed next.