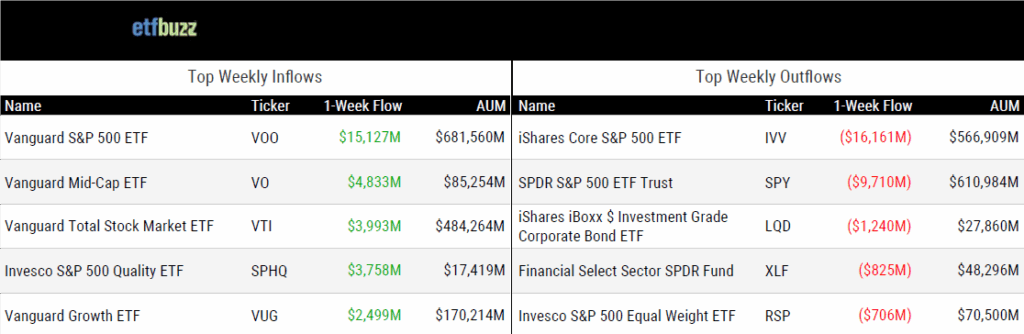

ETF Inflows & Outflows

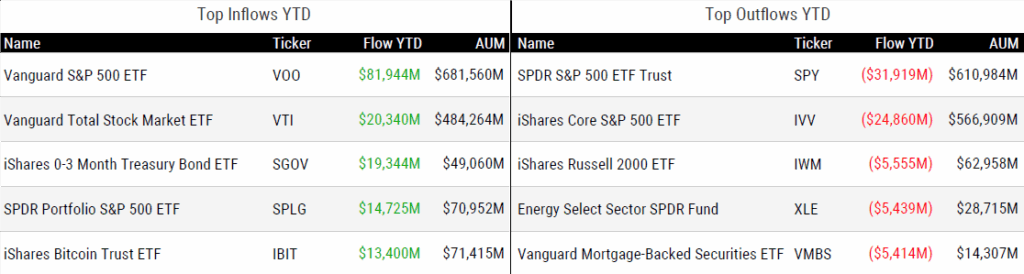

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 6/19/25; performance data excludes leveraged and inverse products

Weekly ETF Reads

Active ETFs Now Outnumber Passive Funds in Industry Watershed Moment by Katie Greifeld

“The number of active ETFs has more than doubled in the past five years.”

Vanguard’s Multi-Class Active ETF Filing Signals Increased Cost Competition in Active Fixed Income by Aniket Ullal

“In the fixed income asset class, the asset-weighted expense ratio for active ETFs was more than 3.5x that of indexed ETFs. Similarly, for equities, active ETFs had 2.8x the asset-weighted fees of indexed equities.”

Morningstar: Model Portfolio Providers Embrace Active ETFs by Mallika Mitra

“Most new model portfolios that have been launched so far this year have primarily featured active funds.”

The Model Movement by Phil Bak

“Model portfolios are becoming the default setting for how capital is allocated in the advisor channel.”

Solana ETFs: Summer of SOL by Roxanna Islam

“Currently, eight issuers have filed S-1s for spot solana ETFs.”

Why ether ETF inflows have come roaring back from the dead by Tanaya Macheel

“With increasing acceptance of crypto on Wall Street, especially now as a means for payments and remittances, investors are being drawn to ETH ETFs.”

ETF Post of the Week

Bloomberg’s Eric Balchunas coined the term “hot sauce” as it pertains to spicing up an investment portfolio. The idea is simple: more than 90% of a prudent investor’s allocation should be in plain-vanilla, low-cost funds – think Vanguard-esque. But some investors like to add a little heat in the remaining 10%. That’s where portfolio “hot sauce” comes in – things like crypto ETFs, leveraged products, thematic bets, and so on. If the Vanguard S&P 500 ETF is bland green pepper, then the Tradr 2X Long QBTS Daily ETF (QBTX) is a Carolina Reaper.

Maybe it’s time we start rating ETFs based on their Scoville score?

Need to start rating ETFs like this pic.twitter.com/qJHKAp5mQN

— Eric Balchunas (@EricBalchunas) June 19, 2025

ETF Chart of the Week

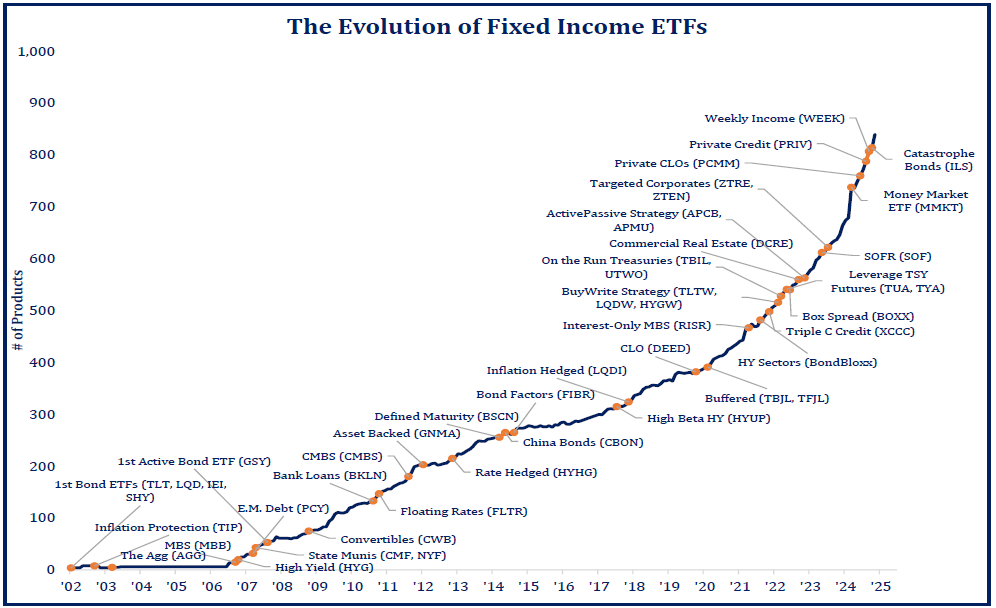

I always enjoy these “evolution of ETFs” charts from Strategas’ Todd Sohn. The pace of innovation in the ETF space continues to astonish, and even the traditionally “boring” fixed income corner isn’t immune. ETF issuers keep pushing boundaries in ways that are genuinely impressive.

Todd points out that there are now 850 fixed income ETFs holding nearly $2 trillion in assets. Strikingly, the number of active bond ETFs has now surpassed that of passive ones – an impressive milestone.

As J.P. Morgan Asset Management’s Jon Maier and Shayan Hussain recently wrote:

“In our view, the rise of active fixed-income ETFs is not just an evolution; it’s a revolution capable of transforming how investors allocate capital.”

I may need to ask Todd to retitle his chart: The Revolution of Fixed Income ETFs.

Source: Strategas’ Todd Sohn

ETF Prime Podcast

Last week’s ETF Prime featured Mike Loukas, CEO of TrueMark Investments, weighing in on the growing debate over buffer products and highlighting TrueShares’ innovative structured outcome ETFs. Plus, VettaFi’s Roxanna Islam covered a range of topics, including Schwab’s fee cuts, Vanguard’s multi-share class filing, the rise of private assets in ETFs, the potential for spot solana ETFs, and arguments around “first-to-file” with the SEC.

Crypto Prime Podcast

What’s liquid staking, and why does it matter for spot ether ETFs? Kean Gilbert, Head of Institutional Relations at Lido Ecosystem Foundation, joined me on last week’s Crypto Prime to break it down and share where he sees Ethereum going next.