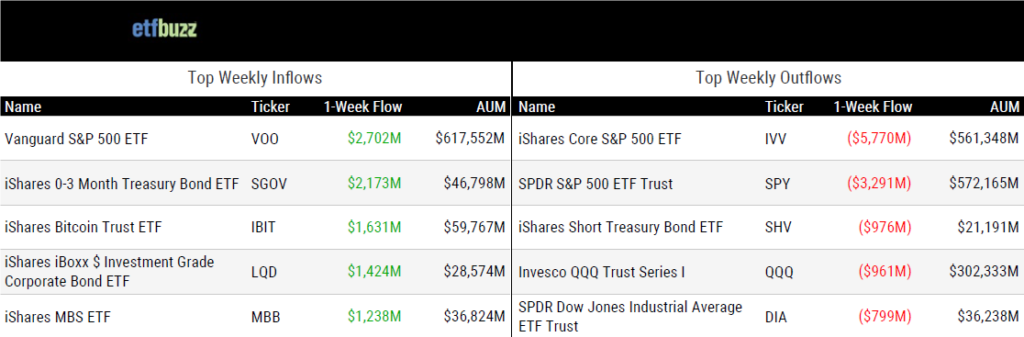

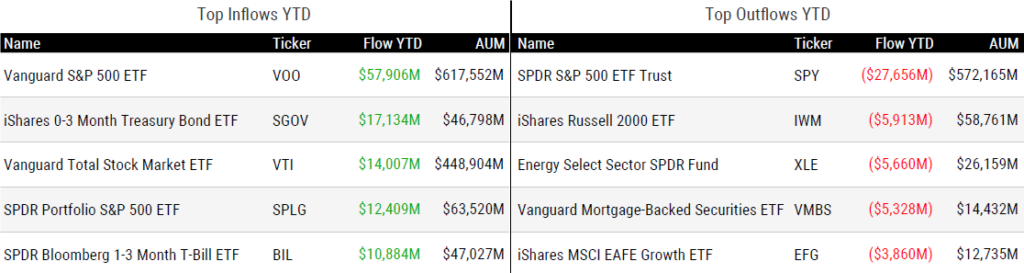

ETF Inflows & Outflows

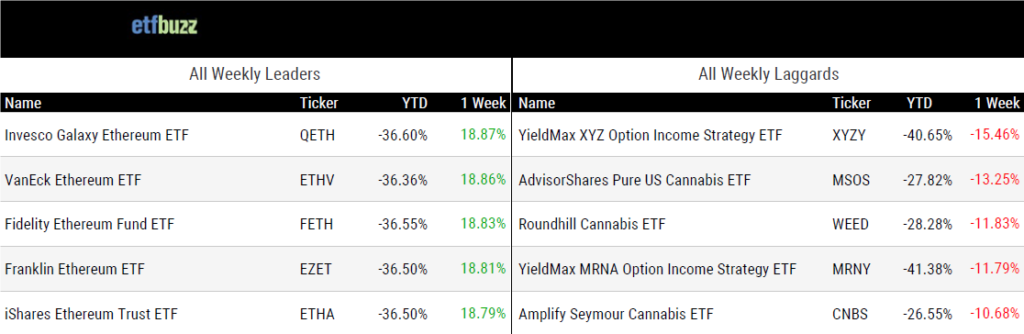

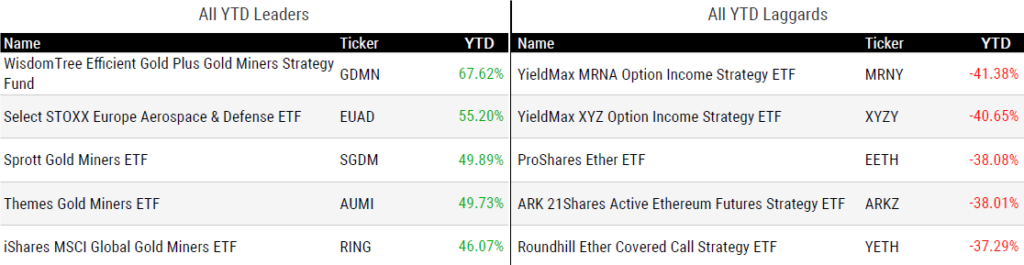

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 5/8/25; performance data excludes leveraged and inverse products

Weekly ETF Reads

Fixed Income ETF Flowdown: Market Jitters Spark Skittish Moves by Kirsten Chang

“Roughly $19 billion poured into Treasury bill and short-duration bond ETFs.”

Expectations growing SEC will approve ETF share classes. Then the real work begins. by Ari Weinberg

“The ETF tech stack will be ready, but several providers looking to issue an ETF share class still need to stand up their ETF operating model and then determine which funds are actually appropriate.”

Wall Street Brokers Risk Losing Billions in Fees on SEC Shift by Emily Graffeo

“Wirehouses and broker dealers risk losing between $15 billion and $30 billion a year in fees that they currently collect from the mutual funds they offer to customers.”

ETF Issuers Try to Benefit from the Berkshire Hathaway Stardust by Aniket Ullal

“Given that BRK.B is differentiated from the large traditional value ETFs, investors may start to consider ETFs like OMAH to get exposure to the Berkshire investment approach, while also generating income.”

All About ETFs with Options by Phil Mackintosh and Robert Jankiewicz

“We tallied over 430 equity ETFs with options, representing over $160 billion in total AUM.”

Buffer Madness by Cliff Asness and Daniel Villalon

“Neither economic theory nor realized returns are on the side of the buffered fund industry.”

Ether ETFs and Institutional Staking: What’s at Stake? by Pablo Larguia

“Institutional funds currently hold about 3.3 million ether (ETH), or roughly 3% of the circulating supply, through exchange-traded funds (ETFs).”

ETF Post of the Week

Bloomberg’s James Seyffart notes that spot bitcoin ETFs have reached a new all-time high in lifetime inflows. The milestone comes as the iShares Bitcoin ETF (IBIT) has posted 19 consecutive days of inflows. In total, spot bitcoin ETFs have seen net inflows on 16 of the past 19 trading days.

After yesterdays inflows, the spot Bitcoin ETFs are now at a new high water market for lifetime flows. Currently at $40.33 billion according to Bloomberg data h/t @EricBalchunas pic.twitter.com/0GKPNlmprs

— James Seyffart (@JSeyff) May 9, 2025

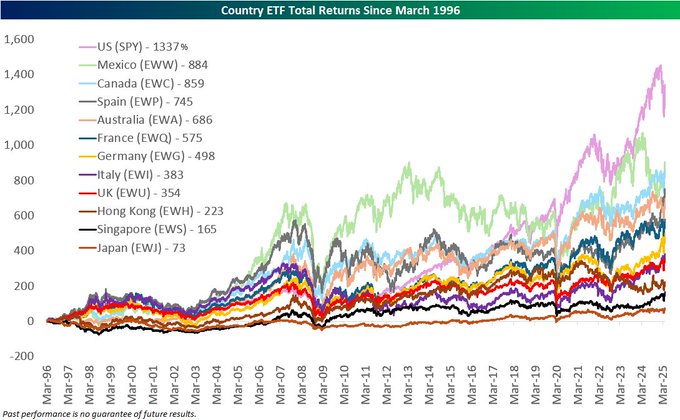

ETF Chart of the Week

With international equity ETFs staging a performance comback this year, this chart stood out to me. It tracks the total return of country-specific stock ETFs since their inception in 1996 – three years after the launch of the first ETF, SPY (the SPDR S&P 500 ETF). While U.S. equities have clearly pulled ahead over the past five years, the recent reversal is worth noting.

(Note: VettaFi’s Roxanna Islam and I will discuss the recent bounce in country specific ETFs on next week’s ETF Prime!)

Source: Bespoke

ETF Prime Podcast

Last week’s ETF Prime featured David Sharp, Director on ETF Capital Markets at Vanguard, marking the firm’s 50th anniversary, exploring recent investor behavior, and highlighting several new fixed income ETFs. VettaFi’s Stacey Morris also analyzed the rollercoaster year for energy ETFs.

ETF Pulse

On last week’s ETF Pulse, etf.com Editor-in-Chief Kristin Myers and I offered perspective on Warren Buffett stepping down as CEO of Berkshire Hathaway. We also discussed short-term Treasury ETF inflows, stocks recovering from April’s “tariff tantrum”, Vanguard’s 50th anniversary, and a unique new ETF from Defiance.

Crypto Prime Podcast

David LaValle, Global Head of ETFs at Grayscale, joined me on last week’s Crypto Prime to break down the demand for spot bitcoin and ether ETFs, the potential for staking in ether ETFs, recent crypto ETF filings, and the broader regulatory backdrop.