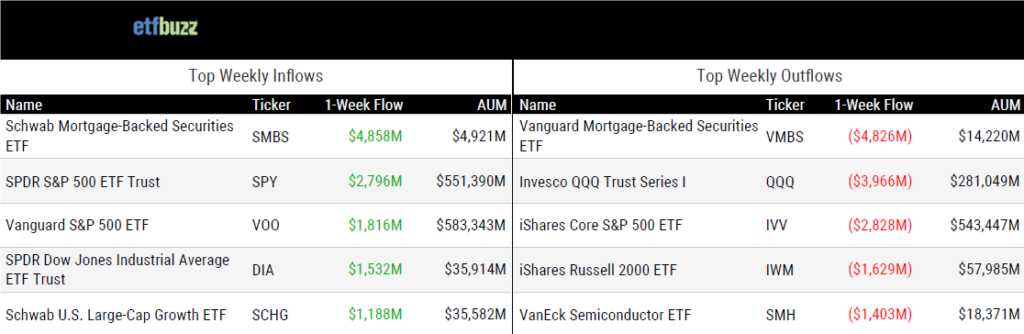

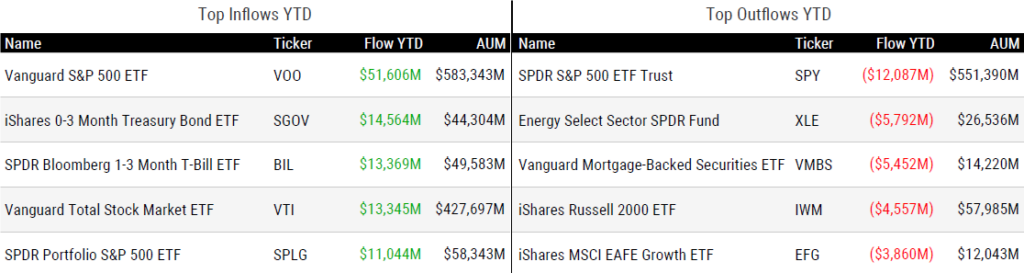

ETF Inflows & Outflows

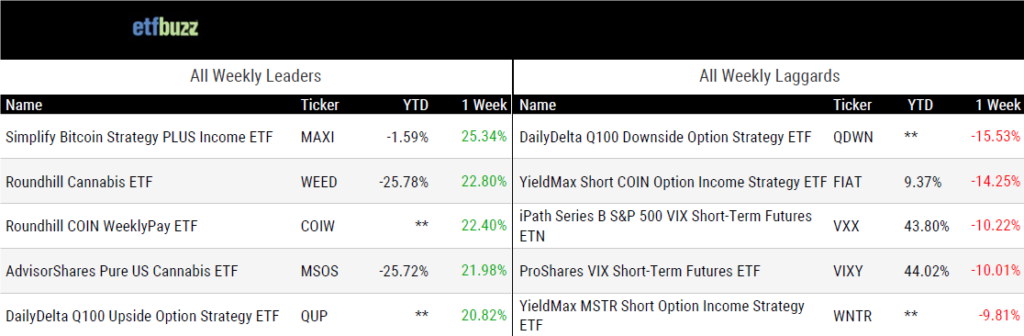

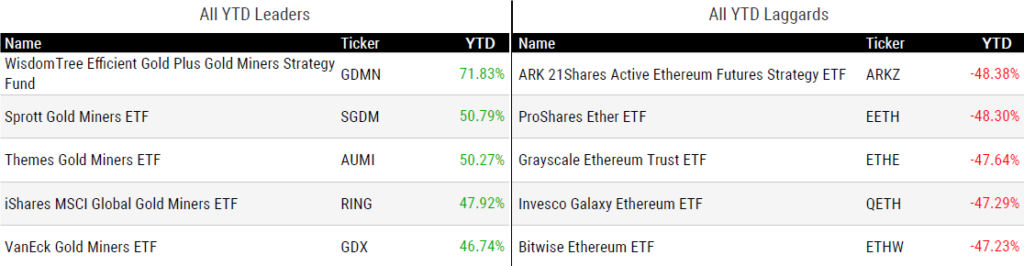

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 4/24/25; performance data excludes leveraged and inverse products

Weekly ETF Reads

The Secret Fees Behind $9.7 Trillion in Passive ETFs by Lan Anh Tran

“Index licensing fees dictate how low an ETF’s fees can fall and how big (or small) the profit margins will be.”

“They’ve functioned more or less as designed and investors don’t appear to be mis-using them.”

ETFs are turning credit into a monthly market by Robin Wigglesworth

“ETFs have transformed fixed income trading.”

White Hat Bond ETFs: F/m & LifeX Get It Right by Dave Nadig

“Somewhere along the way, we stopped asking if products were designed for investors or for marketing decks.”

Fixed-Income ETF Assets to Hit $6T by 2030: BlackRock by Mallika Mitra

“Equity ETFs represent 10% of its respective underlying market while fixed-income ETFs represent just 2%.”

Tariff Impact on Stock Dispersion Creates New Opportunities for ETF Investor, Issuers by Aniket Ullal

“As with sector ETFs, factor ETFs also have limitations in capturing differentials between stocks in this new economic regime.”

Embracing Market Volatility With Leveraged ETFs by Roxanna Islam

“In most cases, these ETFs are only meant to be held for one day, which means that they need to be managed closely.”

Is Your International Fund a U.S. Fund in Disguise? by Debbie Carlson

“It has taken what might have been a somewhat diversified global index-based strategy and turned it into a closet U.S. equity strategy.”

ETFs for ERISA Plans: Operational Barriers and Potential Benefits by Elizabeth Goldberg and John J. O’Brien

“A plan fiduciary that is considering introducing ETFs into a plan’s lineup may want to consider these potential challenges and evaluate the role ETFs may play in the plan’s and plan participants’ overall investment strategy.”

Institutional investors and the future of digital asset ETFs by Anika Sidhika

“We certainly see flows continuing to grow in the digital assets ETF space.”

ETF Post of the Week

The winners of the 2025 etf.com Awards were unveiled this past week during a first-class event held at the Tribeca Rooftop in New York City. I had the pleasure of attending the festivities and greatly enjoyed connecting with many of you who follow this blog. As I wrote prior to the event:

“With categories reflecting both mainstay and emerging trends, along with a rigorous selection process for nominees and winners, the etf.com Awards are the benchmark for excellence in the ETF space. As I stroll down the red carpet on Wednesday, I will feel extremely grateful to participate in an industry that doesn’t just champion innovation but celebrates it.”

Extremely grateful I was.

It’s finally time to announce the winners of the 2025 https://t.co/jShNsrPP6J Awards! Thank you to everyone who submitted nominations and came to join us in-person tonight to celebrate!

— etf.com (@etfcom) April 24, 2025

And now drumroll please… 🥁🥁🥁#etfcomAwards pic.twitter.com/Pxvn6eHfw0

ETF Chart of the Week

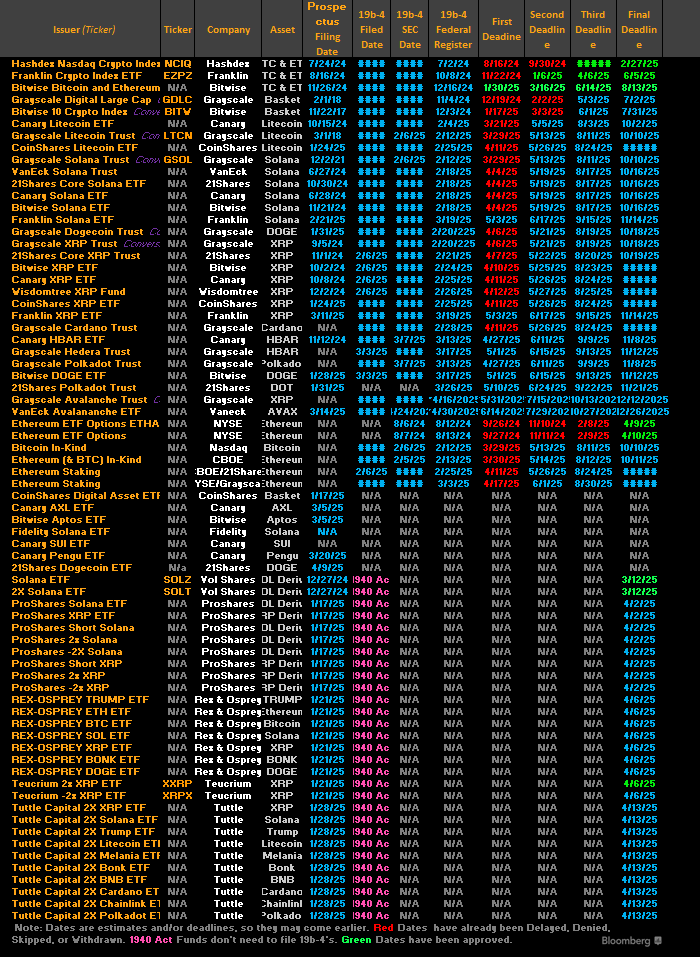

There are now a mind-boggling 70+ crypto-related ETF filings with the Securities and Exchange Commission. At the beginning of this year, I predicted that at least 50 crypto-related ETFs would launch in 2025. I should have said 500.

Source: Bloomberg’s Eric Balchunas and James Seyffart

ETF Prime Podcast

Last week’s ETF Prime featured Ben Slavin, Global Head of ETFs at BNY Asset Servicing, who provided an in-depth look at recent ETF trading and flows, and unpacked the latest on the ETF share class structure and product innovation. VettaFi’s Kirsten Chang also highlighted five noteworthy ETF launches.

ETF Pulse

On last week’s ETF Pulse, etf.com Editor-in-Chief Kristin Myers and I discussed long-term outperformance by the SPDR Gold Shares (GLD), recent market volatility and the flight to safe haven ETFs, Charles Schwab readying direct spot crypto trading, and the etf.com awards.

Certified ETF Advisor (CETF®)

As I always say, a little ETF education goes a long way. That’s especially true as products grow more complex:

“From buffered and defined outcome strategies to actively managed exposures, today’s ETFs are no longer simple, static wrappers. They are sophisticated instruments at the core of modern portfolio design — and they’re reshaping how investors think about diversification, risk, and market access. Yet, with innovation comes an educational gap: more strategies, more structures, and more need for fluency in market mechanics.”

If interested in learning more about the CETF® designation, I would highly recommend checking out this recent article by the ETF Central team: The CETF® Revolution: Why ETF Fluency Is No Longer Optional. I also offer a few thoughts in this brief video with Bilal Little, NYSE’s Director of Exchange Traded Products.