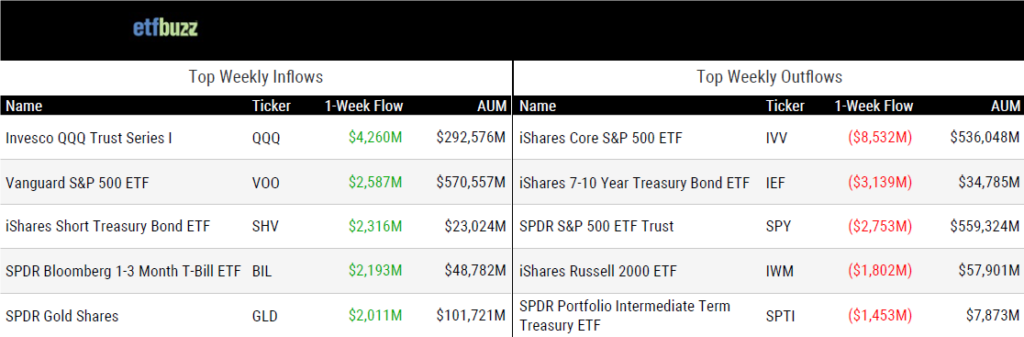

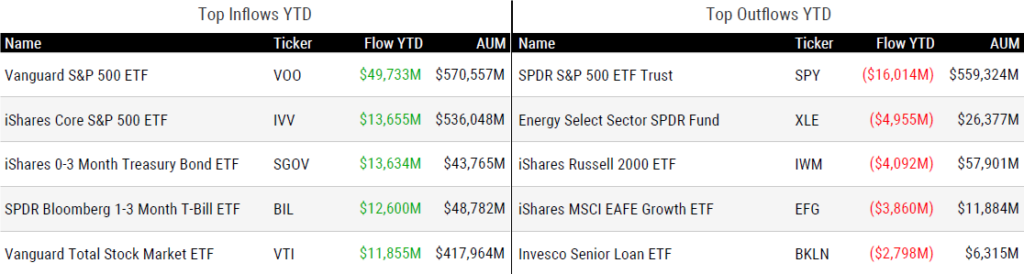

ETF Inflows & Outflows

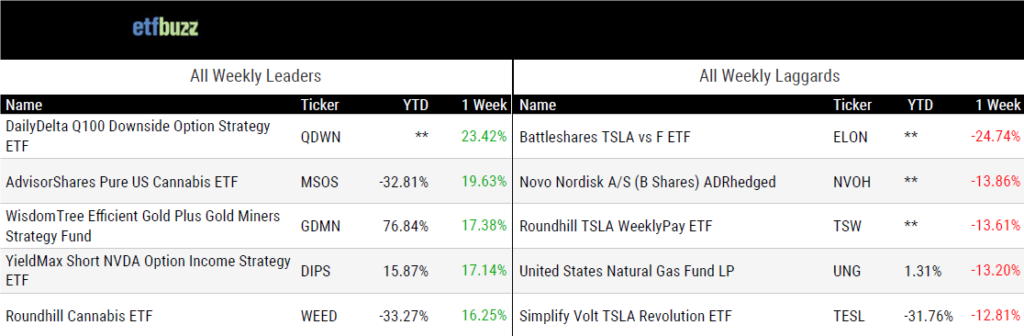

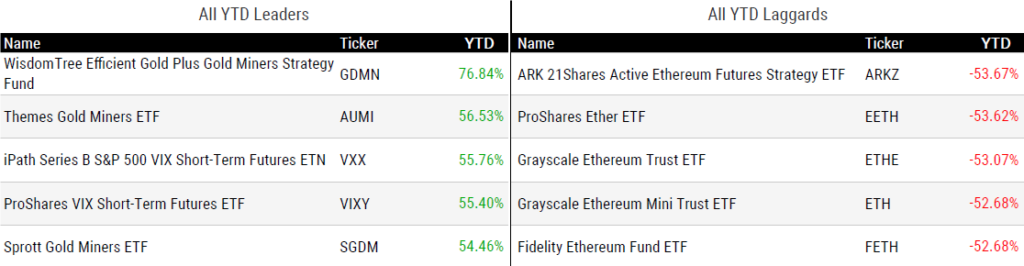

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 4/17/25; performance data excludes leveraged and inverse products

Weekly ETF Reads

The belated CLO ETF stress test by Steve Johnson

“Although no AAA-rated CLO — the tranche favoured by most ETFs — has ever defaulted since their introduction in 1997, fears over defaults make anything with a whiff of credit risk look dicier.”

State Street Private-Debt ETF Scores No New Flows in Weeks by Katie Greifeld and Carmen Arroyo

“We have to remember that PRIV is a pioneer here, so in some ways, we are all learning what the ETF structure can do in the private asset space in real time, together.”

When Beta Meets Buffer: Why Critics Miss the Point—What That Says About the Future of Investing by Karan Sood & Jeff Chang

“It is the same reason why taxis don’t like Uber, hotels don’t like Airbnb, and cinemas don’t like Netflix.”

Buffered ETFs Protect Against Market Drops. They Are Selling Like Hotcakes. by Debbie Carlson

“For investors who otherwise use annuities or structured notes to reduce risk, these ETFs are cheaper, more transparent and flexible.”

Does Anyone Really Know What ETF Share Class Cross-Subsidization Is? by John Crabb

“In the DFA application, which has the SEC staff’s support, cross-subsidization is not eliminated altogether but overseen by the board.”

Conversions of SMAs to ETFs are growing in the US market: Cerulli Associates by Beverly Chandler

“Even if such ETFs are meant only for the firm’s clients, the ETF structure is solving an important operational challenge.”

The Tax Problem with Hyper-Income ETFs by Dave Nadig

“Buyer — and CPA — beware.”

ETF Post of the Week

Crypto exchange Kraken is rolling out ETF trading for its users, a noteworthy development that adds yet another distribution channel for the ETF industry. It’s a particularly relevant move considering crypto investors tend to skew younger, a demographic that has increasingly embraced ETFs. That said, there’s also the broader idea that crypto itself might one day challenge the ETF wrapper entirely. Kraken’s Co-CEO Arjun Sethi:

“Expanding into equities is a natural step for us, and paves the way for the tokenization of assets. The future of trading is borderless, always on and built on crypto rails – and Kraken will continue to lead this shift.”

It’s obviously still extremely early, but expect to hear more about ETF tokenization.

Kraken just became your all-in-one trading powerhouse 💪

— Kraken Exchange (@krakenfx) April 14, 2025

You can now trade stocks, ETFs & crypto side by side — with zero commissions.

Available in select U.S. states

Learn more: https://t.co/H47IHtelPZ pic.twitter.com/CUzjUYssEo

ETF Chart of the Week

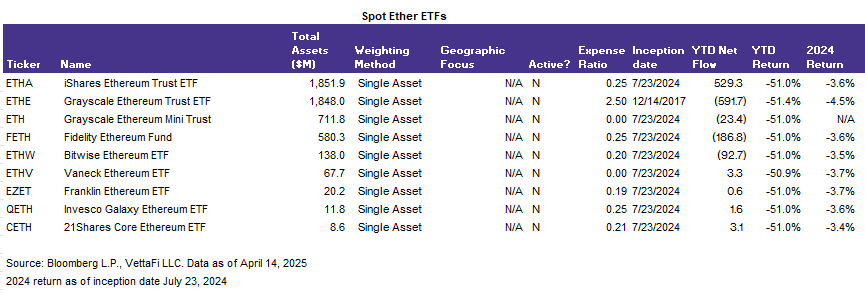

If you haven’t been keeping an eye on the weekly “Performance Leaders & Laggards” above, you might have missed just how dismal spot ether ETF returns have been. And by dismal, we’re talking among the worst performers in the non-leveraged ETF universe. VettaFi’s Roxanna Islam explains:

“At the bottom of the list of 4,000 ETFs are spot ether ETFs. The iShares Ethereum Trust ETF (ETHA) and the Grayscale Ethereum Trust (ETHE), for example, are both down over 50% year-to-date. Prices were pressured in early 2025 due to macro headwinds which evolved into a high volatility market. If tech stocks (including the much loved Magnificent Seven) pulled back, you can imagine why ether pulled back. Unlike its more popular cousin bitcoin, ether doesn’t really have a large inflation element to its story. Bitcoin has (debatable) characteristics as digital gold (but nonetheless, those characteristics are there). Ether, on the other hand, is more of a risk asset and has been trading lower along with the broader equity market.”

In other words, investors seem to be treating ether as a high-beta tech play – perhaps even a leveraged one. With the Technology Select Sector SPDR ETF (XLK) down 17% and the ARK Innovation ETF (ARKK) off 21% year-to-date, it doesn’t take a rocket scientist to see why spot ether ETFs are struggling. Positive returns have vanished into the ether (sorry).

Source: VettaFi’s Roxanna Islam

ETF Prime Podcast

Last week’s ETF Prime featured Cinthia Murphy, Investment Strategist at VettaFi, who looked at several surprising ETF developments from a wild week in the markets. Plus, VistaShares CEO Adam Patti highlighted the firm’s unique approach to ETFs, which includes the VistaShares Target Berkshire Select Income ETF (OMAH).

ETF Pulse

On last week’s ETF Pulse, etf.com Editor-in-Chief Kristin Myers and I discussed crypto exchange Kraken expanding into ETFs, flows into the Vanguard S&P 500 ETF (VOO), China ETF outflows, cracks in CLO ETFs, and a lack of demand for the SPDR SSGA IG Public & Private Credit ETF (PRIV).

Crypto Prime Podcast

Kai Wu, Founder & Chief Investment Officer of Sparkline Capital, joined me on last week’s Crypto Prime to provide an in-depth exploration of crypto factor investing, with a focus on identifying digital assets that are undervalued relative to their intangible assets.