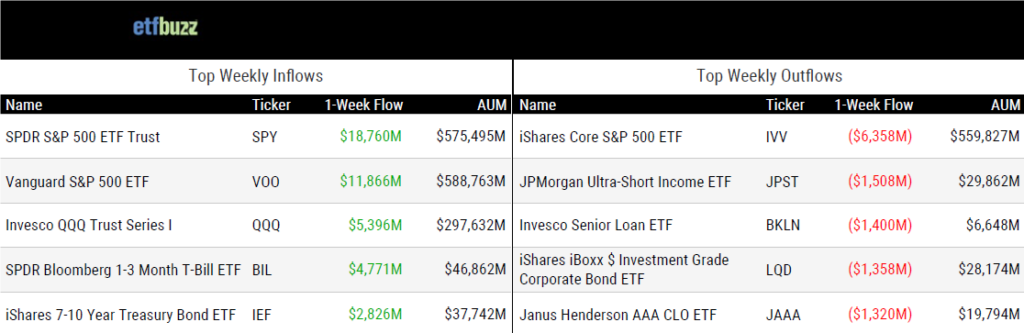

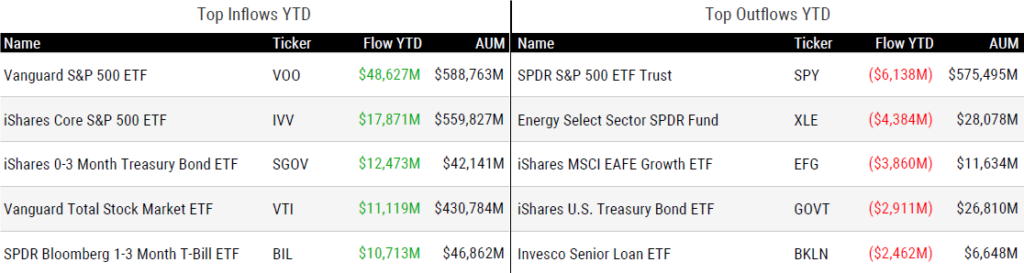

ETF Inflows & Outflows

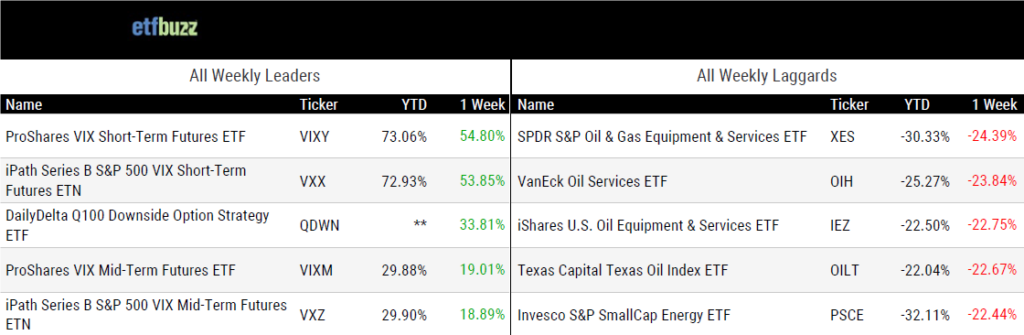

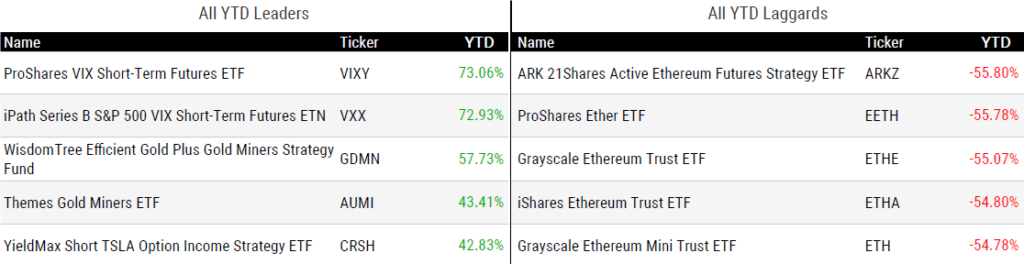

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 4/10/25; performance data excludes leveraged and inverse products

Weekly ETF Reads

Buffer ETFs Have Worked for Investors (So Far) by Jeffrey Ptak

“Even for those taken by buffer ETFs’ attributes, it’s worth remaining mindful of the trade-offs they involve.”

A $576 Billion Stock-ETF Juggernaut Hit by Extreme Dislocations by Vildana Hajric and Bernard Goyder

“It’s a feature of SPY to have the ability to absorb that much liquidity in two-way trading volumes.”

Bonds are back in market crash, but the way investors are buying fixed-income has changed by Meredith Mutter and Eric Rosenbaum

“Buying duration blindly has not had a smooth ride at all.”

SEC tells fund shops to follow DFA’s amended ETF share class application by Tania Mitra

“The SEC has indicated that if our clients amend their application to track the DFA changes then such applications will be approved in short order after the DFA application is approved.”

SEC greenlights options trading on spot Ethereum ETFs including ones from BlackRock, Bitwise and Grayscale by Sarah Wynn

“It’s possible they could be approved for staking early, but the final deadline is at the end of October.”

ETF Post of the Week

Industry veteran Dave Nadig notes that over the five days ending April 9th, it would have made no difference whether an investor bought the 2x long or 2x short Strategy ETF – despite the underlying stock being down over 5%. Nadig:

“Investors shouldn’t be surprised that their performance over the last week in daily-reset levered hot-sauce ETFs hasn’t matched their expectations. No other product presents the opportunity to be right and still lose money like a levered ETF.”

As always, a little ETF education goes a long way:

“The main culprit here is just plain old path dependency. Every single night, these ETFs have to get longer when MSTR goes up, and get shorter when MSTR goes down... Levered and Inverse funds generally perform as expected inside a single days trading. If you’re holding one for a two day window, all bets are off.“

Check out Dave’s full post on this topic here.

Wild that over the last 5 days, it made NO DIFFERENCE in your experience whether you bought the levered or inverse $MSTR ETF. You're still doing worse than the stock: pic.twitter.com/w3mz5P75YB

— Dave Nadig (@DaveNadig) April 9, 2025

ETF Chart of the Week

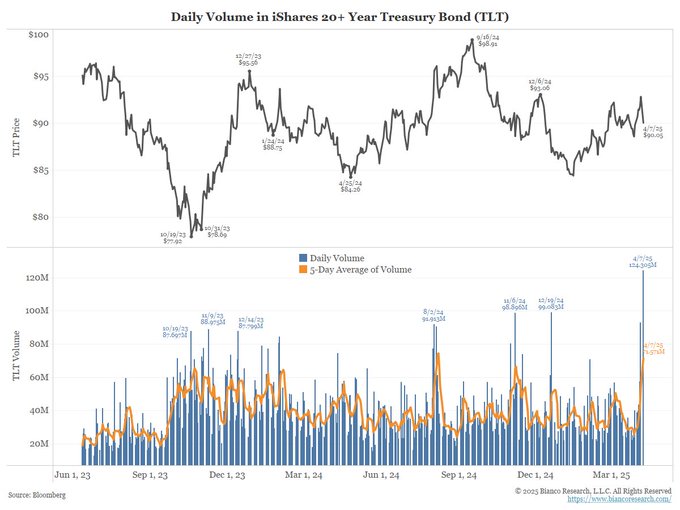

It wasn’t just stocks that went on a wild ride last week. The iShares 20+ Year Treasury Bond ETF (TLT) was down over 6%, while the iShares Core S&P 500 ETF (IVV) surged nearly 6%. Typically, investors flock to the safety of U.S. Treasuries during tumultuous periods. Instead, Treasuries sold-off and yields spiked as bond vigilantes called into question their safe haven status.

TLT, an ETF I call the “widowmaker”, broke its all-time trading volume record on Monday. It then broke it again on Wednesday as traders attempted to position around the surprising move in yields.

Why do I call TLT the widowmaker? Over the past five years, this ETF has taken-in nearly $50 billion in new money. It’s total return over this time? -40%!

Source: Jim Bianco

ETF Prime Podcast

Last week’s ETF Prime featured Emily Dupre, Senior Managing Director – National Sales Manager at MFS, which pioneered the first mutual fund in 1924. MFS recently entered the ETF arena with the launch of five actively managed products. Emily discussed the firm’s decision-making process around launching those ETFs, MFS’s investment capabilities, and the role active management plays in a portfolio. Plus, VettaFi’s Roxanna Islam assessed the ETF impact of the recent tariffs announcement.

ETF Pulse

On last week’s ETF Pulse, etf.com Editor-in-Chief Kristin Myers and I covered the “Tariff Tantrum”, bond ETF flows, the launch of the first U.S.-listed XRP ETF, and the upcoming etf.com awards.

Crypto Prime Podcast

Sal Gilbertie, CEO of Teucrium, joined me on last week’s Crypto Prime to highlight the newly launched Teucrium 2X Long Daily XRP ETF (XXRP), a fund designed to offer leveraged exposure to the daily price fluctuations of XRP.