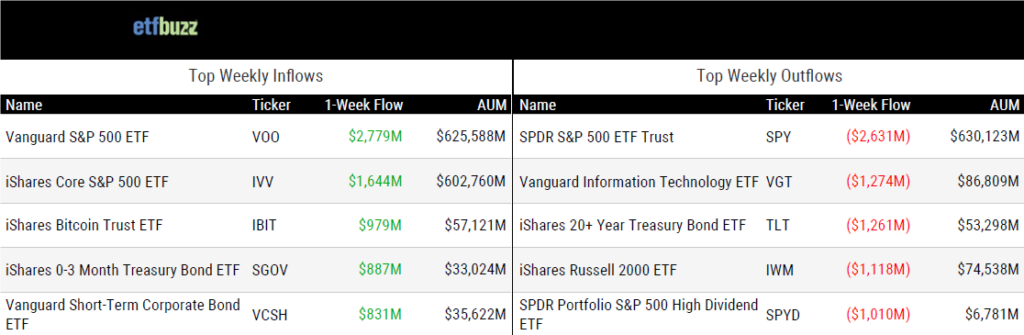

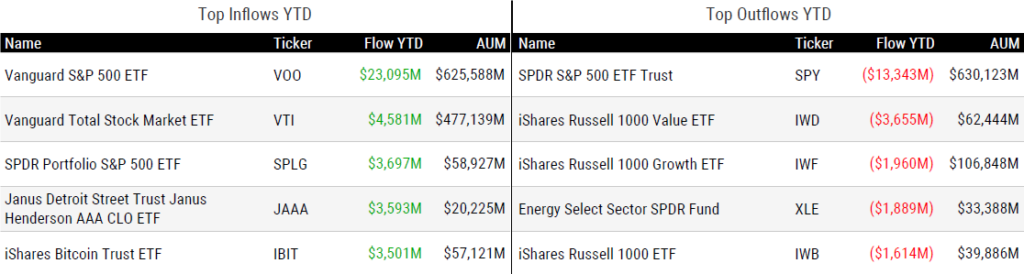

ETF Inflows & Outflows

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 2/6/25; performance data excludes leveraged and inverse products

Weekly ETF Reads

Vanguard’s Average Fee Is Now Just 0.07% After Biggest-Ever Cut by Katie Greifeld

“The larger we become, the lower it goes.”

The Impact of Vanguard’s ETF Fee Cuts Will Vary by Category by Aniket Ullal

“It will be interesting to see how the other leading ETF issuers respond to Vanguard’s aggressive fee reduction strategy.”

Leveraged ETF Investors Scored Gains Last Year. They Probably Also Left Billions on the Table. by Jeffrey Ptak

“It should be enough to give anyone pause.”

Slowly Melting Ice Cubes by Phil Bak

“If people aren’t bragging about owning your funds at a cocktail party, you aren’t going to survive the commoditization of the asset management industry.”

ETFs seeing promise in private assets, but hurdles remain by Ari Weinberg

“ETF issuers want to democratize access to everything for everyone, but there are benefits to investor protection and regulations, particularly around risk and the wide dispersion of outcomes in private markets.”

BlackRock Puts ETF Wrappers on Money Markets by Jeff Benjamin

“There is currently $6.8 trillion invested in traditional money market funds, and Blackrock’s new launch will attempt to attract those investors who want the products in an ETF wrapper.”

Crypto ETF Hopefuls View SEC’s Latest Moves as Change of Pace by Emily Graffeo

“The mere acceptance of the filings into the review process – which is what happened this week – indicates that their view is already changing.”

ETF Post of the Week

Trump Media announced this week that the company had registered trademarks for several Truth.Fi investment vehicles, including the following ETFs: Truth.Fi Made in America ETF, Truth.Fi U.S. Energy Independence ETF, and Truth.Fi Bitcoin Plus ETF. These ETFs will be part of the Truth.Fi brand, which encompasses “financial services and financial technology”. Trump Media CEO Devin Nunes:

“We aim to give investors a means to invest in American energy, manufacturing, and other firms that provide a competitive alternative to the woke funds and debanking problems that you find throughout the market. We’re exploring a range of ways to differentiate our products, including strategies related to bitcoin. We will continue to finetune our intended product suite to develop the optimal mix of offerings for investors who believe in America First principles.”

As an aside, Financial Times raised an interesting point regarding Trump Media’s ETF ambitions potentially encroaching on Strive ETFs’ territory. You may recall that Strive was founded by Vivek Ramaswamy, who until recently was involved with The Department of Government Efficiency.

“Trump Media’s plan to launch investment products including exchange traded funds focused on the ‘patriot economy’ could put it head to head with Strive, the asset manager founded by Vivek Ramaswamy.”

“Such rollouts could compete directly with Strive, which Ramaswamy co-founded and majority owns. Strive vows on its website to ‘always prioritise the shareholder over other stakeholders’ in a declaration that argues that shareholder capitalism has been ‘at risk’ in the US.”

As another aside, there have been some concerns expressed that this announcement by Trump Media violates securities rules. As I understand it, the specific concern is that issuers cannot promote funds before actually filing them for registration with the SEC. Trump Media’s response to these concerns via CityWire:

“TMTG claims that the announcement doesn’t violate any regulations, telling Citywire, ‘any insinuation of violations or wrongdoing by TMTG in these activities is utterly false and likely libelous’.”

Never a dull moment in ETF land.

Trump is going to launch a Bitcoin Plus ETF. Safe to say first-ever POTUS ETF issuer. What a country.. pic.twitter.com/Oak9TyWtaV

— Eric Balchunas (@EricBalchunas) February 6, 2025

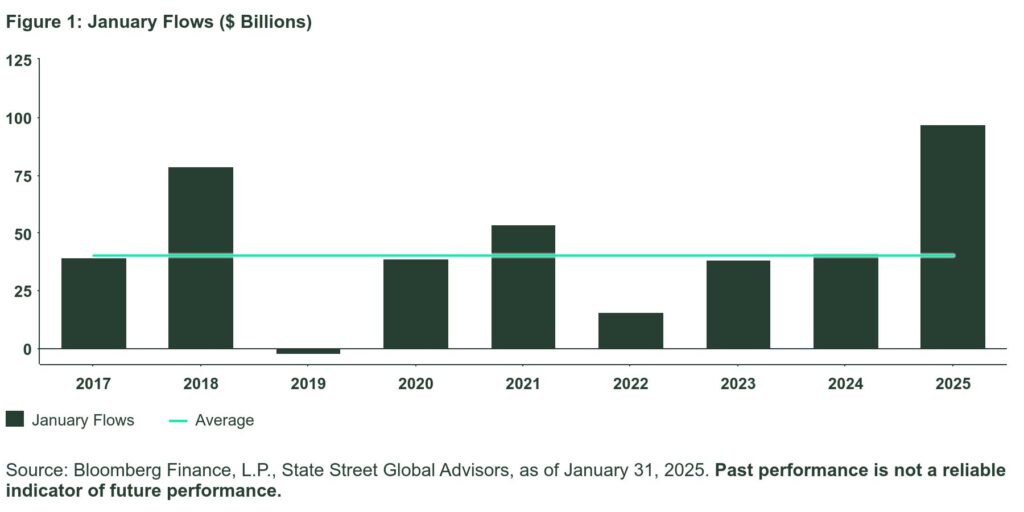

ETF Chart of the Week

January ETF inflows picked-up right where 2024 left off, setting a new monthly record in the process. State Street’s Matt Bartolini:

“Historically, January tends to be a weak month for inflows. Driven by tax-motivated seasonality effects — trends that boost December flows — January has historically had the second-lowest fund flow totals of any month (August is the worst).

But ETFs entered 2025 on a hot streak, taking in more than $100 billion for two consecutive months and registering record flows for all of 2024. In fact, over the past 12 months, flows have averaged $92 billion. And that’s the exact amount ETFs took in this January, as market forces helped them remain on trend.

With supportive markets, January 2025 inflows were 142% greater than the average January and more than $15 billion above the past January record of $77 billion in 2018.”

Is it possible that 2025 could make a run at 2024’s annual inflow record?

Source: State Street’s Matt Bartolini

ETF Prime Podcast

Last week’s ETF Prime featured Nate Conrad, Head of LifeX at Stone Ridge Asset Management, who went in-depth on the $20+ billion asset manager’s suite of LifeX Longevity Income ETFs. Kirsten Chang, Senior Industry Analyst at VettaFi, also took an early look at ETF flow trends in 2025 (nice write-up here as well).

Crypto Prime Podcast

Yehudah Petscher, NFT Strategist & Web3 Analyst at CryptoSlam, joined me on last week’s Crypto Prime to delve into the dynamics of community, value, and regulation within the world of NFTs and memecoins.