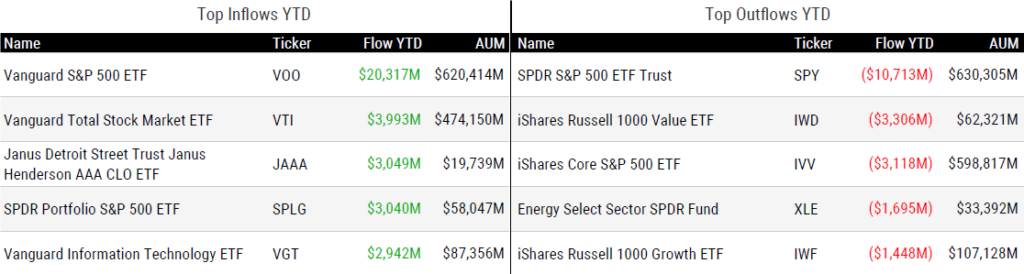

ETF Inflows & Outflows

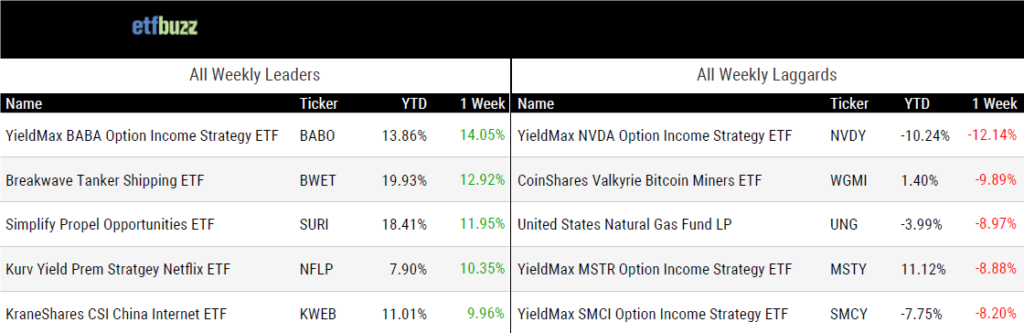

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 1/30/25; performance data excludes leveraged and inverse products

Weekly ETF Reads

ETFs Went Bananas in 2024 by Elisabeth Kashner

“I’m still trying to make sense of it.”

A New Individual ETF King? by Todd Rosenbluth

“We believe having the largest U.S.-listed ETF will be particularly important to the firm.”

Wall Street’s Levered ETF Boom Is Near-$1 Billion Money Spinner by Isabelle Lee

“There are dangers to any products you own. You just have to be aware of what you are holding.”

The “Rebalance Drag” Myth in Leveraged ETFs: What Advisors Need to Know by Corey Hoffstein

“Variance drain is the mathematical fact that an investment’s compounded return is always less than or equal to its simple average return.”

Memecoin ETF filings spark concerns over ‘casino-type’ speculation by Steve Johnson

“This type of speculative instrument might make more sense in a casino than in a stock market.”

Memecoin ETFs and Other Crypto News: What Investors Should Know by Bryan Armour

“The joke turned serious: these coins are now collectively worth around $50 billion.”

The ABCs of ETF liquidity by Vanguard

“ADV is only a small part of an ETF’s total liquidity profile.”

(Note: This is a nice educational piece on ETF liquidity. As always, a little ETF education goes a long way.)

ETF Post of the Week

etf.com released the nominees for their annual awards, which will be announced in April. I’m honored to once again serve as a judge. Reviewing this year’s “ETF of the Year” nominees, I can already tell I’ll have my work cut out for me. You can view the full list of nominees here.

"ETF of the Year" category is stacked https://t.co/yhD8qTaPro pic.twitter.com/kRNRFf9M3C

— Sam Ro 📈 (@SamRo) January 29, 2025

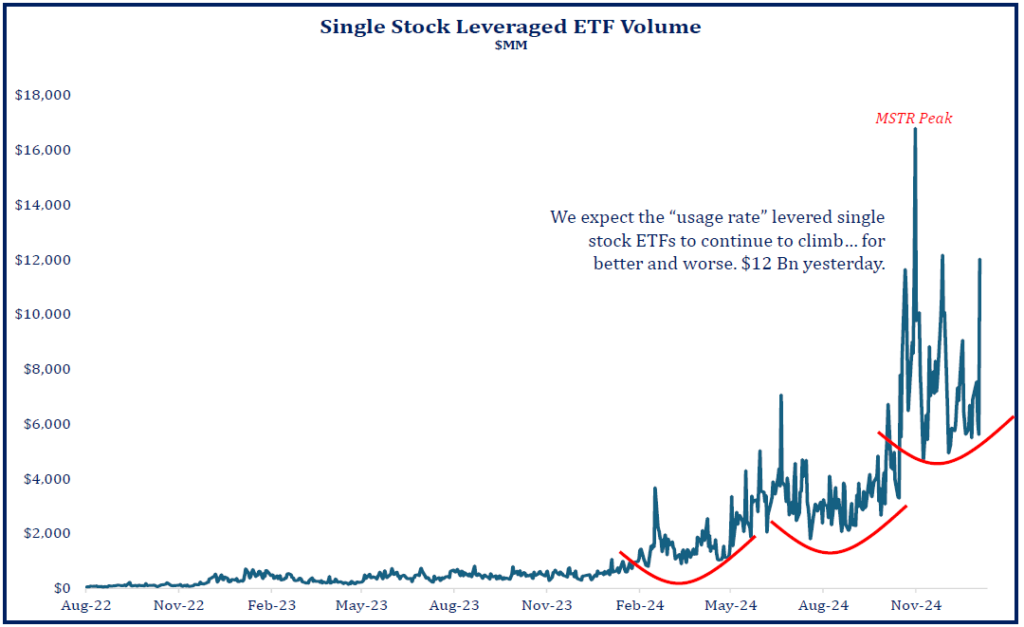

ETF Chart of the Week

Last week, I highlighted how total annual revenue for leveraged ETFs hit a record $1 billion in 2024, up 37% from the prior year. This was primarily driven by a boom in investor usage of leveraged single stock ETFs. Strategas’ Todd Sohn shows that trading volume in these products continues to increase and was particularly heavy this past week, with ETFs such as the GraniteShares 2x Long NVDA Daily ETF (NVDL) and Direxion Daily TSLA Bull 2X Shares (TSLL) leading the way.

Source: Strategas’ Todd Sohn

ETF Prime Podcast

Last week’s ETF Prime featured Matt Kaufman, Head of ETFs at Calamos. Matt explained the mechanics and rationale behind the recently launched Calamos Bitcoin Structured Alt Protection ETF – January (CBOJ). VettaFi’s Roxanna Islam also examined the best-performing ETFs so far this year and discussed a recent surge of legacy asset managers entering the ETF space.

Crypto Prime Podcast

Garrett Paolella, Co-Founder & Managing Partner at NEOS Investments, joined me on last week’s Crypto Prime to go in-depth on the NEOS Bitcoin High Income ETF (BTCI).

Thinking Crypto Podcast

I recently had the pleasure of joining Tony Edwards on the Thinking Crypto Podcast to discuss the explosion of crypto-related ETF SEC filings and much more. Enjoy!