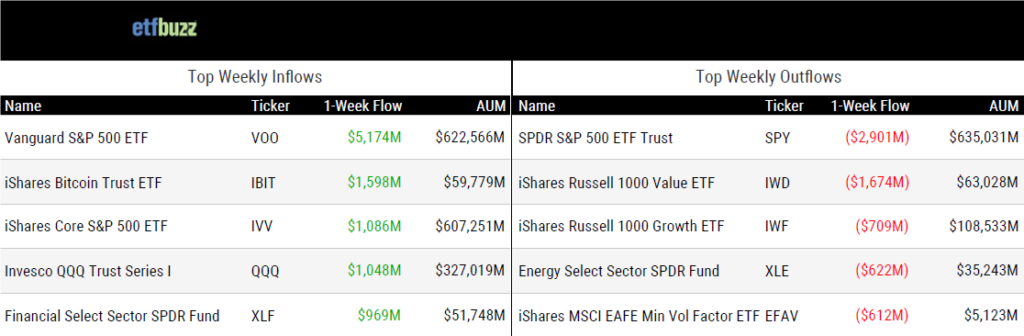

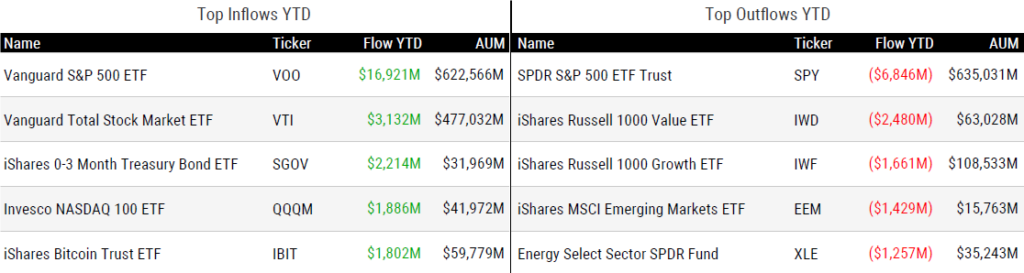

ETF Inflows & Outflows

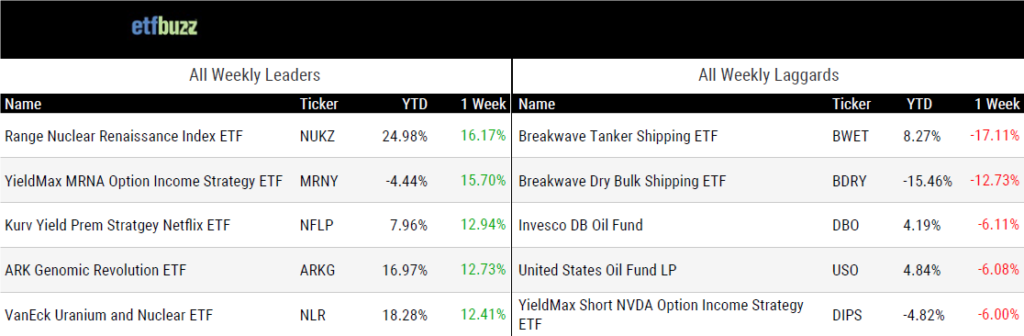

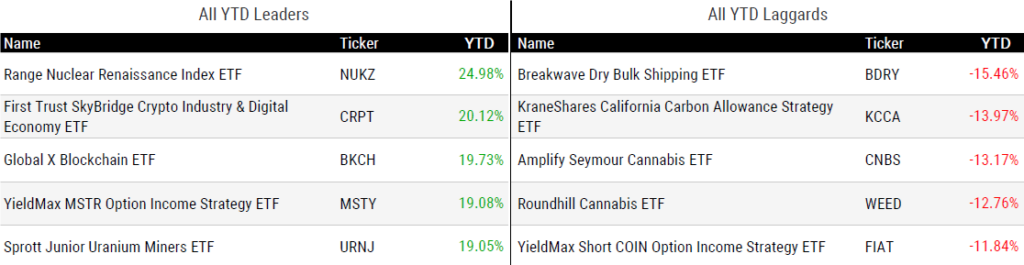

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 1/23/25; performance data excludes leveraged and inverse products

Weekly ETF Reads

A $500 Million ETF Will Be Next Big Launch in Tax-Busting Trend by Justina Lee

“So-called 351 conversions, which are named after the section of the tax code that applies, take advantage of the fact ETFs can flush out appreciated stocks without triggering a capital gains bill.”

From Bogleheads to Gearheads: U.S. ETFs Are Rapidly Increasing in Complexity by Aniket Ullal

“In 2024, 40% of the new ETFs listed in the U.S. used derivatives as a significant component of their investment strategy, up from 20% in 2014.”

Will Your ETFs Miss Out on the Next Big Stock? by Ryan Jackson

“The last two years offered the latest evidence that index growth normally stems from a handful of standouts, not hundreds of companies pulling their weight.”

Vanguard’s S&P 500 Fund Is About to Become World’s Largest ETF by Katie Greifeld

“VOO has the stickiest of sticky investors. These are diamond-hands that would make any crypto person blush.”

You Can Own Elon Musk’s SpaceX. But at What Price? by Jason Zweig

“An ETF that can trade all day is investing in an asset that rarely changes hands. Figuring out what it’s worth is a guessing game.”

ETFs increase efficiency of markets, new study shows by Steve Johnson

“This greater efficiency is most pronounced during periods of volatility, a time when defects in market structure are most likely to be exposed.”

Why Legacy Asset Managers Must Embrace ETFs Right Now by Jeff Benjamin

“Over the past week, no fewer than five well-established asset managers have launched or filed to launch their first exchange-traded funds.”

‘Protected’ Bitcoin ETFs Hitting the Market—Here’s What That Means by André Beganski

“Calamos has built Bitcoin exposure with a safety net, and you can choose how low that safety net goes.”

(Note: Matt Kaufman, Head of ETFs at Calamos Investments, will join me on next week’s ETF Prime to go in-depth on Bitcoin Structured Protection ETFs.)

Solana ETFs: How a 2025 launch could play out by RT Watson and Sarah Wynn

“The elephant in the room is classification. With all other digital assets beyond bitcoin and Ethereum we still have that classification hurdle and that’s what’s been gumming up the works.”

ETF Post of the Week

This past week saw the first memecoin ETF filings, with Rex-Osprey submitting registration statements for TRUMP, BONK, and DOGE ETFs. As Bloomberg’s Eric Balchunas told The Block:

“Today’s satire is tomorrow’s ETF.”

It definitely feels that way now.

(Note: As luck would have it, I visited this week with the individual behind these filings, REX Financial CEO Greg King. You can listen to that conversation below under “ETF Prime”).

Wow. That was fast. @REXShares and Osprey have filed for a bunch of crypto ETFs including memecoins TRUMP, BONK, and DOGE.

— James Seyffart (@JSeyff) January 21, 2025

Also includes ETFs for Bitcoin, Ether, Solana, and XRP. pic.twitter.com/A4FzTdaBOj

ETF Chart of the Week

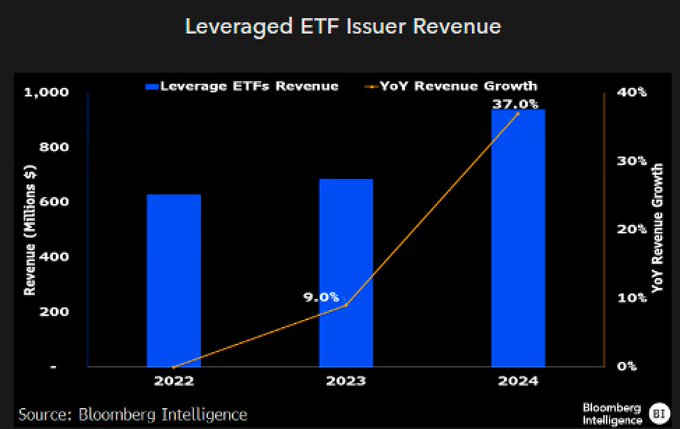

I have previously described how leveraged single stock ETFs are like lottery tickets for issuers. These ETFs charge hefty fees, typically around the 1% range (if not more). All an issuer has to do is hit on one of these and they’re set. For example, the GraniteShares 2x Long NVDA Daily ETF (NVDL) has around $5 billion in assets and charges a 1.06% fee. That implies an annual revenue stream of $53 million!

However, perhaps lottery tickets weren’t the proper comparison. The numbers indicate that more of these products are actually “hitting” and issuers are now building full businesses around them. Total revenue for leveraged ETFs is at a record $1 billion, up 37% from a year ago.

Source: Bloomberg’s Eric Balchunas

ETF Prime Podcast

Last week’s ETF Prime featured REX Financial’s Greg King discussing the firm’s recent crypto ETF filings, including those for TRUMP and DOGE. Greg also expanded on the growth of leveraged single-stock ETFs, such as the T-Rex 2X Long MicroStrategy Daily Target ETF (MSTU). VettaFi’s Zeno Mercer offered a preview of the year ahead for the “Magnificent Seven” stocks and provided a brief tour of the artificial intelligence ETF space.

Crypto Prime Podcast

Alan Austin, Managing Director at Litecoin Foundation, joined me on last week’s Crypto Prime to explain the value proposition of Litecoin and what the future might hold for the digital asset.