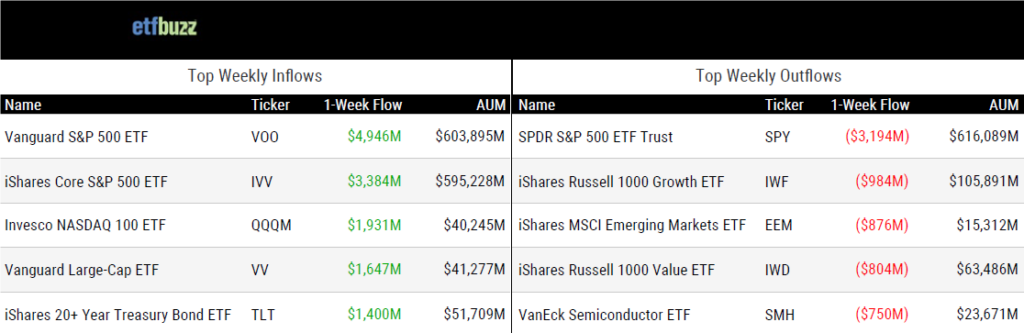

ETF Inflows & Outflows

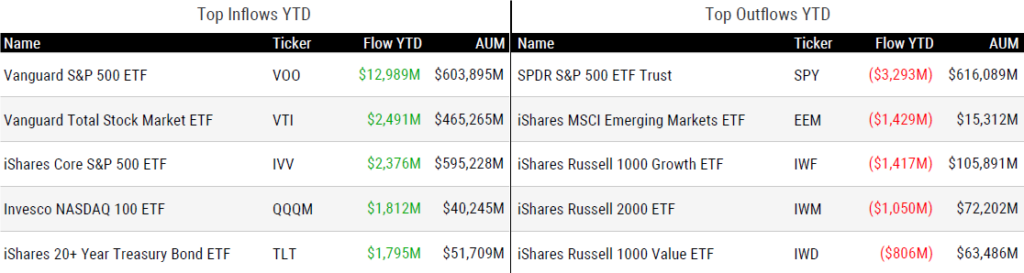

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 1/16/25; performance data excludes leveraged and inverse products

Weekly ETF Reads

Raymond James Own ETFs Coming Soon by Todd Rosenbluth

“Firms like Raymond James Investment Management can build a strong base in part by educating advisors about their active management expertise.”

Asset Manager Lazard Makes ETF Splash With 5 Filings by Jeff Benjamin

“The 175-year-old New York-based asset management firm with nearly $250 billion under management in mutual funds and separate accounts will make its ETF debut.”

BlackRock’s Amped Up ETF Taps Into Wall Street’s Stock Anxiety by Isabelle Lee

“The ETF arena is just becoming more complex.”

Cathie Wood’s ARKK and Other Thematic ETFs Let Investors Take Big Swings. Most Miss. by Ian Salisbury

“People are late to the party.”

ETF flows obliterate previous full-year record to hit $1.5tn by Steve Johnson

“ETFs seem to have a bit of a halo around them.”

Bitcoin’s legitimization, BlackRock shatters records, buy-in soars: Spot bitcoin ETFs mark one-year anniversary by RT Watson

“You just can’t underestimate the importance of that step when that first bitcoin ETF was approved.”

Crypto ETFs have big innovation opportunity in 2025, but demand may be weak by Tanaya Macheel

“You can feel it across the space that some of the regulatory clouds are clearing and there’s blue skies ahead, but there needs to be tempered expectations of the ETFs in the coming year.”

Is Tokenization The Future Of Index And Exchange-Traded Funds? by Alexandra Andhov

“ETFs are step one in the technological revolution in the financial markets. Step two is going to be the tokenization of every financial asset.”

ETF Post of the Week

As always, a little ETF education goes a long way. Benn does an excellent job of breaking down the basics of leveraged and inverse ETFs (click post to read entire thread).

(Note: REX Financial CEO Greg King will join me on next week’s ETF Prime, where we will go in-depth on leveraged ETFs.)

Okay, leveraged ETFs won the poll, so here we are.

— Benn Eifert 🥷🏴☠️ (@bennpeifert) January 13, 2025

Leveraged ETFs are everybody's favorite new thing. In the old days we only had them on equity indices and VIX, now we have them on every speculative meme stock, Bitcoin, you name it.

First let's talk about how they work.

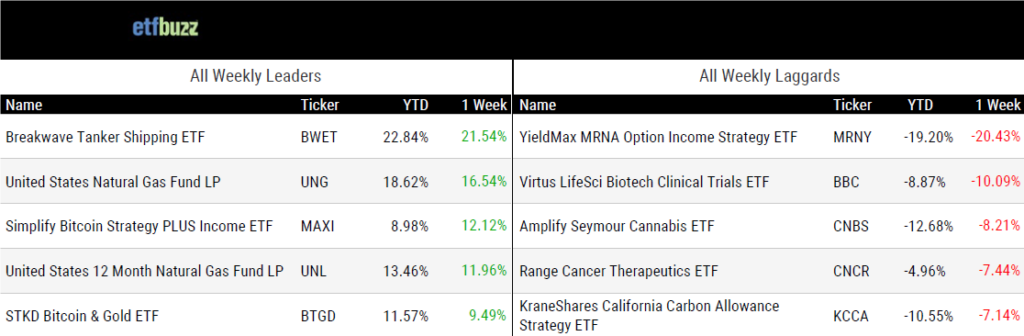

ETF Chart of the Week

Here’s a nice visual on the explosion of actively managed ETFs. Last year, active ETFs accounted for nearly 80% of all ETF launches. I present your ETF stat of the week via Investment News:

“The number of active ETFs now stands at 1,840, just 235 short of passive ETFs. At the current pace, active is expected to surpass passive in the next year or two.”

Or the next month or two.

Source: Morningstar’s Stephen Welch

ETF Prime Podcast

Last week’s ETF Prime featured Aptus’ Brian Jacobs spotlighting the firm’s unique lineup of risk-managed ETFs designed to help clients stay invested through the ups and downs of market cycles. VettaFi’s Todd Rosenbluth also discussed the latest Bitwise/VettaFi Benchmark Survey of Financial Advisor Attitudes Toward Crypto Assets.

Trillions

I recently had the pleasure of joining Bloomberg’s Eric Balchunas, Joel Weber, and Vildana Hajric to discuss my 5 ETF predictions for 2025. Enjoy!

Crypto Prime Podcast

James Seyffart, Research Analyst with Bloomberg Intelligence, joined me on last week’s Crypto Prime to discuss the past, present, and future of crypto ETFs. We pretty much cover it all here…