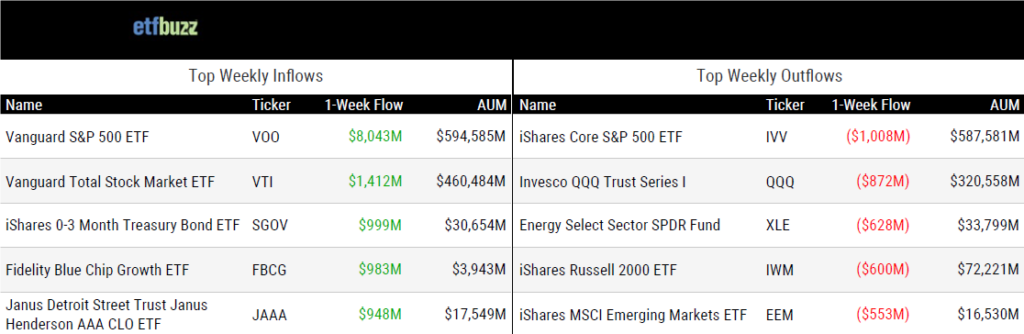

ETF Inflows & Outflows

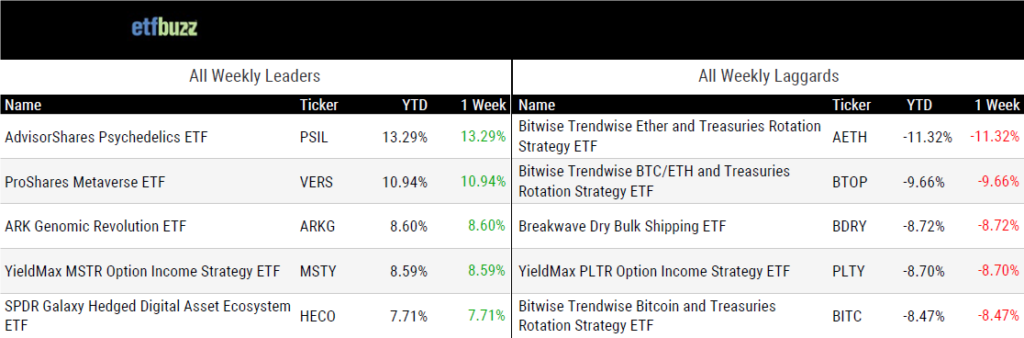

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 1/9/25; performance data excludes leveraged and inverse products

Weekly ETF Reads

Market Predictions & ETF Ideas for a New Year by Cinthia Murphy

“ETFs will remain a tool of choice for portfolio construction.”

(Note: Catch my conversation with VettaFi’s Cinthia Murphy as we unpacked her 2025 ETF predictions. Research Affiliates’ Rob Arnott also joined me to discuss the strategy of investing in companies recently removed from major market indices.)

6 ETF Investing Predictions for 2025 by Zachary Evens

“2025 is sure to be filled with surprises.”

ETFs gaining traction under model portfolio umbrella by Ari Weinberg

“Entry into a model or an allocation shift can send assets surging into individual ETFs.”

What’s Wrong with XOVR and SpaceX by Dave Nadig

“As an XOVR shareholder, I will just have to accept whatever mark the board decides to give me based on whatever rules they came up with which they won’t tell me.”

Fidelity to convert $180mn bond index fund into ETF by Daniel Gil

“The conversion of its index fund would be the first time a US fund manager has filed to refashion such a product into an ETF.”

New ETFs that combine bitcoin exposure and options are coming in 2025 by Jesse Pound

“The fund is essentially bringing a popular equity ETF strategy to crypto investing.”

Cryptoverse: Next wave of US crypto ETFs already in the pipeline by Suzanne McGee

“The only limit on what products emerge will be human creativity.”

Another XIV brewing in crypto? by Kris Abdelmessih

“We think there’s a pretty decent probability – somewhere in the range of 15% to 50% – that these 2x leveraged MSTR ETFs are effectively wiped out in any given year if they are not voluntarily deleveraged or otherwise de-risked sooner.”

Spot Bitcoin ETFs: What Matters to Advisors? by Todd Rosenbluth

“If you had any doubt that 2024 was a massive inflection point for crypto, this year’s Bitwise/VettaFi survey dispels it.”

(Note: VettaFi’s Todd Rosenbluth will join me on next week’s ETF Prime to discuss the results from the latest Bitwise/VettaFi 2025 Benchmark Survey of Financial Advisor Attitudes Toward Crypto Assets.)

And in case you missed it, here are my 5 ETF Predictions for 2025!

ETF Post of the Week

Remember the ESG ETF hype several years ago? The idea was that ETFs selecting companies based on environmental, social, and governance factors would be the next big thing. Now, the category looks left for dead…

ESG is down bad here in the states. Though ESG ETFs did have slight inflows in the 4th quarter and have some inflows so far in 2025. Otherwise it has been pretty much net outflows since 2Q 2022. https://t.co/mLidrqsxPz pic.twitter.com/RYDr42uvo6

— James Seyffart (@JSeyff) January 9, 2025

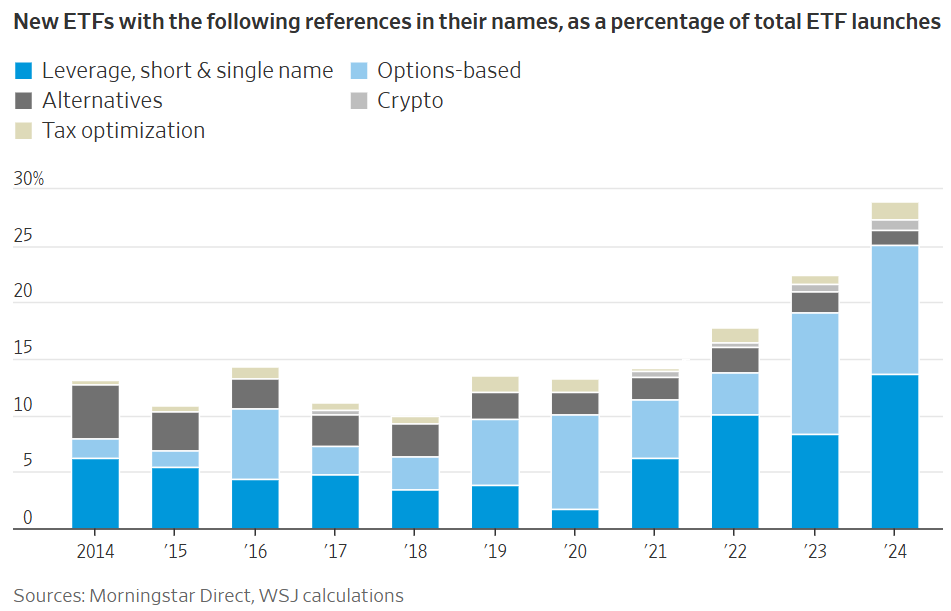

ETF Chart of the Week

I found this chart particularly interesting. It illustrates that an increasing percentage of new ETF launches are coming from more complex categories, such as leveraged single-stock ETFs, options-based ETFs, and crypto ETFs. While this trend is something I’ve observed anecdotally, the visual representation is striking. As ETFs become more complex, the need for investor education becomes even more critical.

Source: Wall Street Journal’s Jon Sindreu

Crypto Prime Podcast

On this week’s Crypto Prime, I was joined by Jay Jacobs, U.S. Head of Thematic & Active ETFs at BlackRock. Jay reflected on the historic first year of the iShares Bitcoin Trust (IBIT), the impressive launch of the iShares Ethereum Trust (ETHA), and the firm’s efforts to advance crypto education. Enjoy!