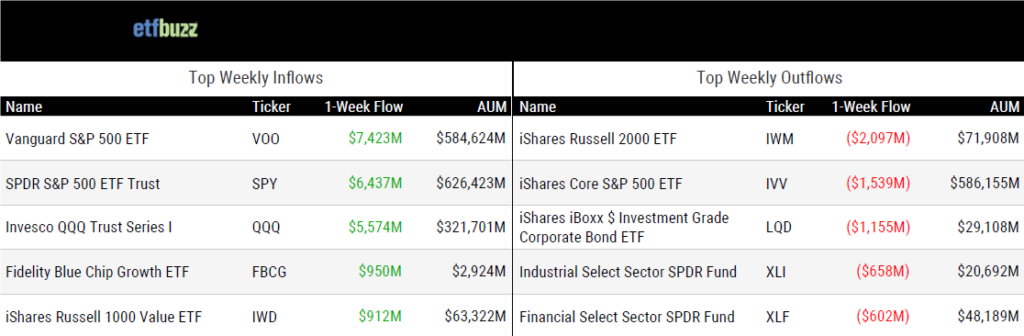

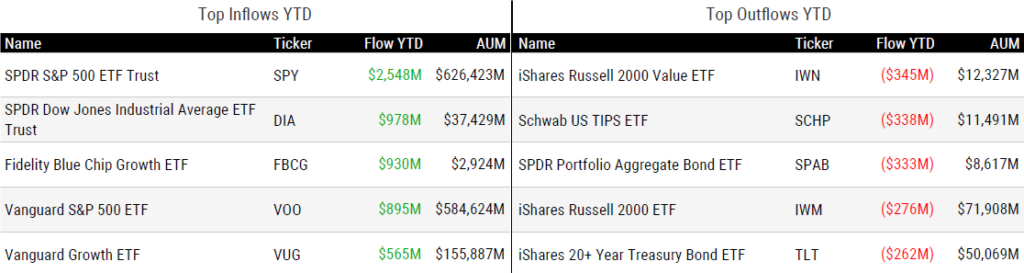

ETF Inflows & Outflows

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 1/2/25; performance data excludes leveraged and inverse products

Weekly ETF Reads

2024 ETF Inflows Topped $1.1T, Shattering Previous Record by Sumit Roy

“Two-thirds of all inflows, or more than $750 billion, went into equity ETFs.”

BlackRock’s bitcoin fund became ‘greatest launch in ETF history’ by Sidhartha Shukla

“IBIT’s growth is unprecedented. It’s the fastest ETF to reach most milestones, faster than any other ETF in any asset class.”

Active ETFs, dual share classes and the ‘Holy Grail’ of wrapping private assets in focus for 2025 by Kathie O’Donnell

“Last year will be a tough act to follow, but there’ll be plenty of topics to watch in 2025.”

The ETF Evolution: 3 Trends to Take Hold in 2025 by DJ Shaw

“Active ETFs are flipping the script on mutual funds.”

ETFs could face obstacles in 2025 after bumper year by Suzanne McGee

“There’s no reason to think that $1 trillion isn’t the new normal for inflows.”

Will 2025 be the year for plain vanilla ETFs or private assets? by Emma Boyde

“The idea of an ETF is the manager can change the number of units outstanding to balance supply and demand. The only way you can do this is to build it out of liquid assets.”

IRS silence allows investors to exploit ETF loophole, study finds by Tobias Salinger

“The expansion of ETFs has provided investors with a new, low-cost tool whereby capital losses can be realized without disturbing an optimal portfolio.”

ETF Companies Are Racing to Launch the Next ‘Hot’ Crypto Fund by Vildana Hajric

“It’s the hot thing — issuers love to strike when the theme is hot. We’ll see crypto everything.”

Solana gets a leveraged ETF filing for non-existent futures by Jack Kubinec

“Many believe that with Paul Atkins as SEC chair, a wider range of products will be possible.”

Plus, don’t miss my latest contribution to etf.com… Bitcoin, $1 Trillion Inflows: 2024’s Top ETF Stories

ETF Post of the Week

Newfound Research’s Corey Hoffstein offers an excellent look at key considerations when launching an ETF. Corey knows a thing or two about the topic as his Return Stacked ETFs have nearly $850 million in assets less than two years after the suite first launched.

Nobody asked for this, but I did a follow up to my original "Launching an ETF" video.

— Corey Hoffstein 🏴☠️ (@choffstein) December 31, 2024

The first video was all about the costs of running the business.

This one is about "ETFs as a product" and the idea of finding "product market fit."https://t.co/Re7Q72gXKI

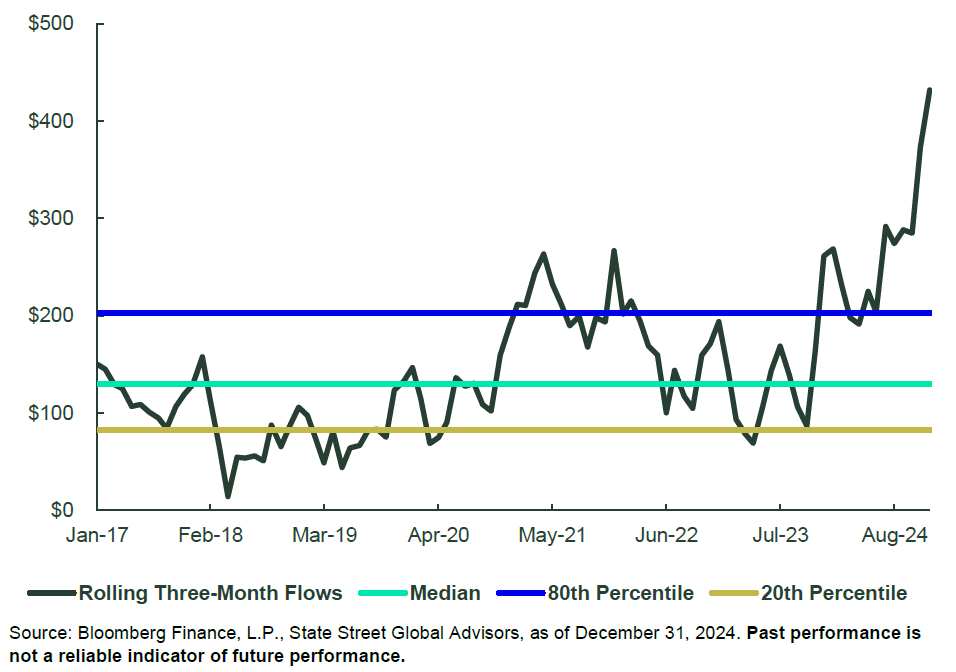

ETF Chart of the Week

ETFs just logged their greatest 3-month inflow total ever after taking in over $430 billion during the fourth quarter of 2024. Inflows in November and December were the two highest monthly totals on record at $160 billion and $150 billion, respectively. 2024 ETF inflows overall eclipsed the $1 trillion mark for the first time ever, finishing at $1.15 trillion. It was a banner year for ETFs…

Source: State Street’s Matt Bartolini