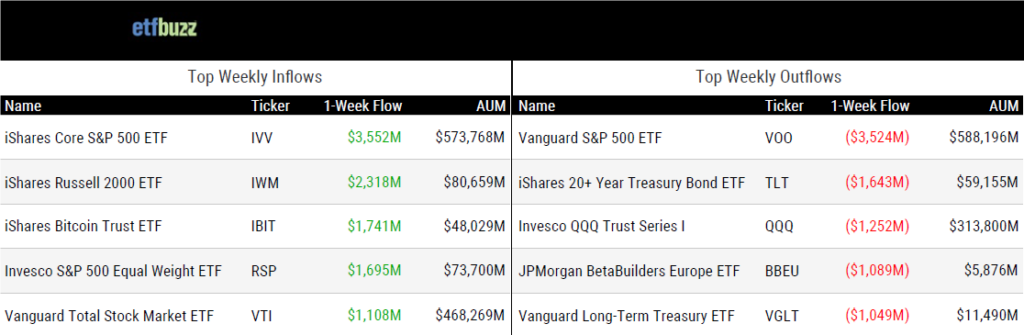

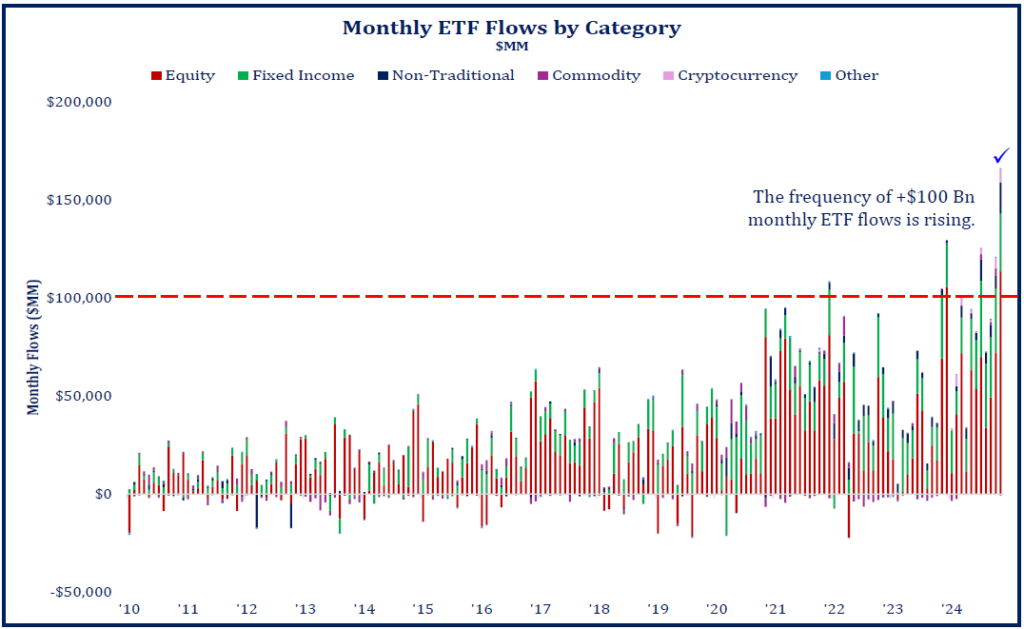

ETF Inflows & Outflows

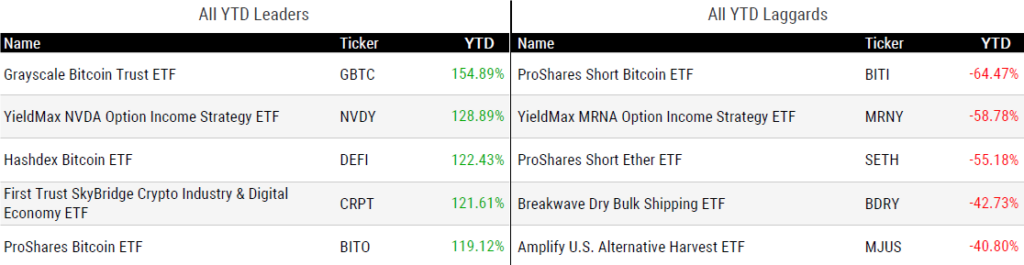

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 12/5/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

ETFs Gone Hollywood? Heavyweights Enter the ETF Fray by Kirsten Chang

“The ETF landscape continues to evolve rapidly, with the likes of Ray Dalio, Tom Lee, and Nouriel Roubini now bringing their unique strategies and star power to the table.”

(Note: You can catch Kirsten and I discussing “ETFs Gone Hollywood” on last week’s ETF Prime.)

Mutual Fund Pioneer MFS Rolls Out its First ETFs by Jeff Benjamin

“One hundred years after creating the first U.S. open-end mutual fund, Boston-based MFS Investment Management stands out as one of the last legacy mutual fund companies to enter the ETF space.”

Active ETFs’ Breakout Year: $257 Billion of Inflows and Hundreds of Fund Launches by Andrew Welsch

“Asset managers that launched actively managed exchange-traded funds may want to crack open the bubbly a little early this holiday season.”

A $500 Billion Haul Reignites Passive Controversy on Wall Street by Lu Wang

“Passive products now account for 62% of US equity fund assets, up from 35% about a decade ago.”

BondBloxx, Virtus each launch private credit CLO ETF and claim ETF market first by Kathie O’Donnell

“The ETF industry has been a force of continuous innovation for investors.”

Will Private Markets Morph Into ETFs? BlackRock Thinks So by Telis Demos

“Just as index has become the language of public markets, we envision we could bring the principles of indexing, even iShares, to the private markets.”

Goldman explores possible sale of ETF client platform, sources say by Suzanne McGee, Saeed Azhar and Manya Saini

“Other firms providing similar solutions, like Tidal Financial Group and Alpha Architect, have been very successful.”

Managers rush to file for ‘risk-averse’ crypto ETFs by Steve Johnson

“If you are not willing to take on the risk/return characteristics of the asset class maybe you shouldn’t be exposed to it? Or just buy less of it.”

Hiccups in ETFs tracking MicroStrategy occurring as bull market fuels trading boom in single-stock funds by Jesse Pound

“The funds are struggling to track the volatile crypto-linked stock on even a daily basis.”

ETF Tweet of the Week

Assets in single stock leveraged ETFs have skyrocketed, primarily on the back of ETFs offering juiced-up exposure to Nvidia, MicroStrategy, and Tesla. For issuers, these ETFs are like lottery tickets. Why? They charge hefty fees, typically around the 1% range (if not more). All an issuer has to do is hit on one single stock leveraged ETF and they’re set. For example, the GraniteShares 2x Long NVDA Daily ETF (NVDL) has around $5.7 billion in assets and charges a 1.06% fee. That implies an annual revenue stream of over $60 million. Not bad! For investors, these products are also like lottery tickets. They might experience a windfall, but are much more likely to lose money.

Here's a time-lapse of net assets in single-stock leveraged long ETFs, broken down by reference stock. Aggregate net assets have risen 12x over past 12 months. Single-stock ETFs referencing NVDA ($7.4B), MSTR ($4.8B), and TSLA ($4.0B) account for ~85% of all assets. pic.twitter.com/nU1yNe1ZQe

— Jeffrey Ptak (@syouth1) December 2, 2024

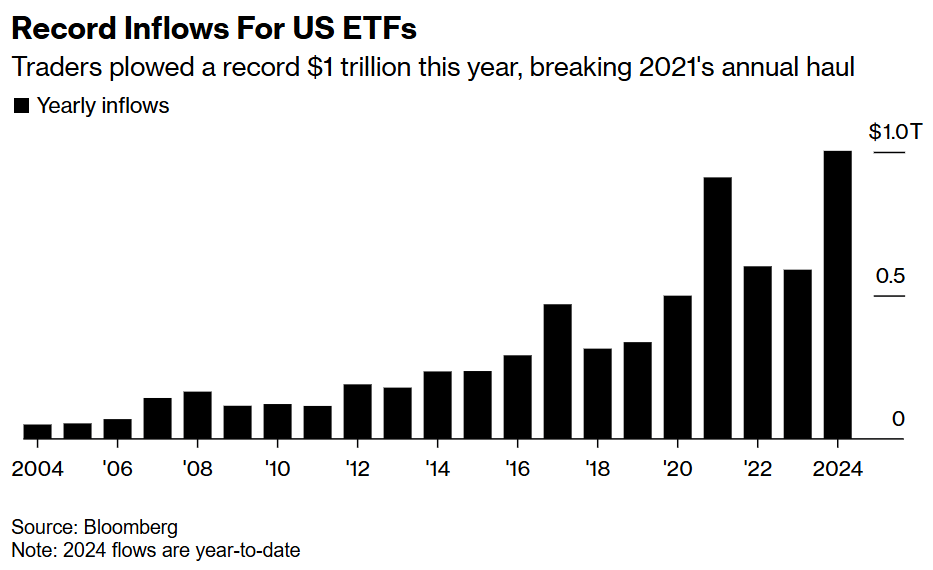

ETF Chart(s) of the Week

After record-breaking inflows in November, ETFs only need a few days in December to cross over the $1 trillion mark for the year!

Source: Strategas’ Todd Sohn

Source: Bloomberg’s Isabelle Lee