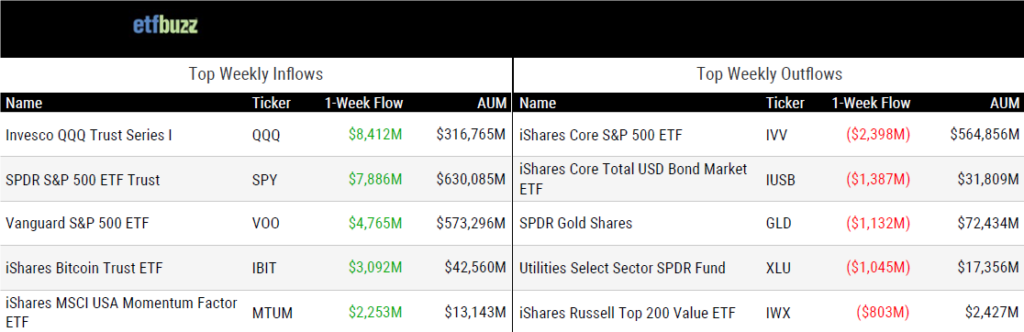

ETF Inflows & Outflows

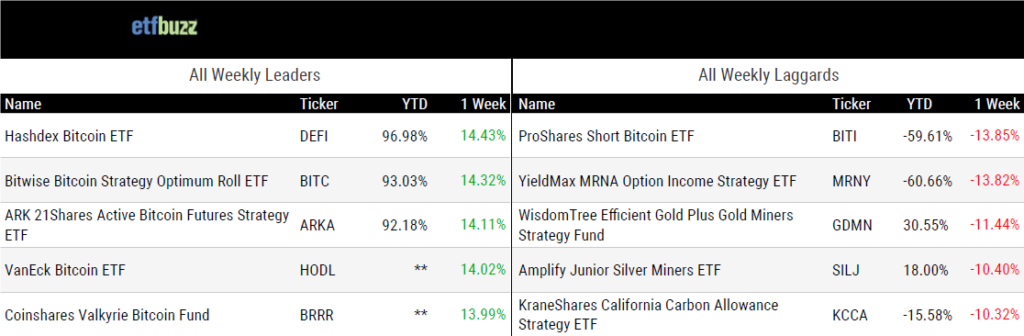

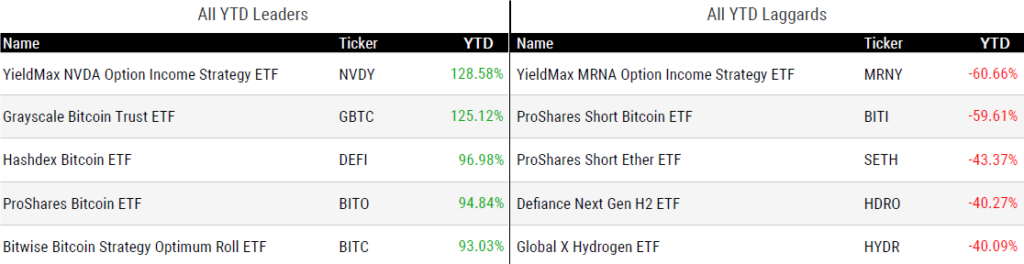

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 11/14/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

BlackRock Targets Money-Market Fund Business in New ETF Push by Katie Greifeld and Emily Graffeo

“Is a fixed NAV overrated? I think so. That’s the case these funds will make.”

(Note: Texas Capital Portfolio Manager Carlos Pena will join me on next week’s ETF Prime to spotlight the first money market ETF, MMKT.)

Proxy choice extended to fund, ETF shareholders at largest index managers by Ari Weinberg

“To the extent of proxy choice, the complexity may overshadow the utility. For some investors, amid an array of choices, it’s just one more form to fill in.”

The First Annual ETF Report: Global Investor Survey by etf.com

“More than 65% of advisors plan to increase allocations to ETFs in portfolios.”

Private Credit ETFs Pose Risks for Retail Investors in Opaque Private Markets that Lack Investor Protections by Better Markets

“Apollo’s role as the originator, buyer, seller and valuation provider of the ETF’s private credit investment presents potential conflicts of interest.”

Top 10 Ways to Screw up a Tax-free Conversion from an SMA to an ETF by ETF Architect

“There are numerous ways to mishandle this intricate transaction.”

Trump victory tipped to break logjam of exotic US crypto ETF filings by Steve Johnson

“The election was a massive win for crypto. It’s a complete game-changer.”

Canary Capital files for first-of-its-kind Hedera HBAR spot ETF with SEC by Sarah Wynn

“These filings also come amid an increased likelihood that current SEC Chair Gary Gensler, who has been critical of crypto, could decide to step down before a new presidential administration rolls in.”

Dogecoin ETFs Aren’t as Crazy as They Sound, Analysts Say by André Beganski

“I’m actually surprised it hasn’t been filed already.”

ETF Tweet of the Week

Bloomberg’s Eric Balchunas goes back-to-back on “Tweet of the Week”, with a post that could easily double as “Chart of the Week” (or Year). The iShares Bitcoin ETF (IBIT) surpassed $40 billion in assets and did so in a record 211 days. I realize some people are fatigued with the never-ending parade of spot bitcoin ETF superlatives, but I have a sneaking suspicion it won’t be ending anytime soon.

JUGGERNAUT: $IBIT has hit the $40b asset mark (a mere two wks after hitting $30b) in a record 211 days, annihilating prev record of 1,253 days held by $IEMG. It's now in Top 1% of all ETFs by assets and at 10mo old it is bigger than all 2,800 ETFs launched in the past TEN years. pic.twitter.com/WTATlpShUq

— Eric Balchunas (@EricBalchunas) November 13, 2024

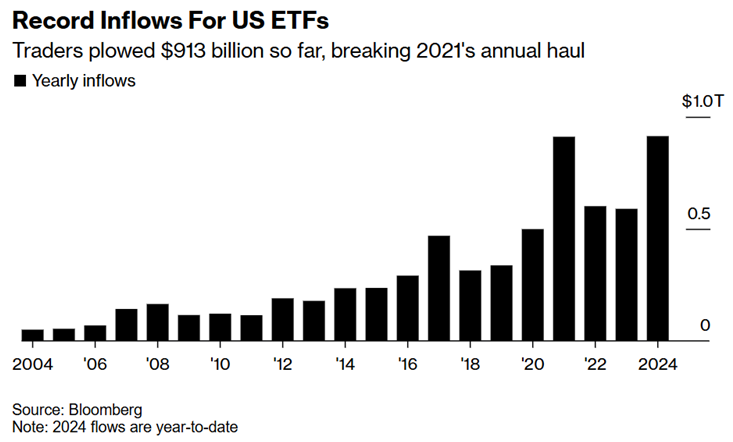

ETF Chart of the Week

U.S. ETF inflows blew past their previous annual record this week, eclipsing the $910 billion haul in 2021. With a month-and-a-half still to go, $1 trillion in inflows now looks like a given. Global ETF inflows have also smashed their previous record, tallying $1.4 trillion through the end of October versus 2021’s $1.33 trillion. While both the U.S. and global totals will need to hold through year-end, that seems highly likely barring a meaningful market downturn.

As an aside, the Vanguard S&P 500 ETF (VOO) has obliterated the annual inflow record for a single ETF, with year-to-date inflows of $94 billion. The previous record was around $50 billion.

As Nasdaq’s Jillian DelSignore described to Bloomberg:

“ETFs continue to be the preferred vehicle providing investors a way to express views in nearly every asset class. ETFs have democratized access to markets.”

Simple, but true.

Source: Bloomberg’s Isabelle Lee