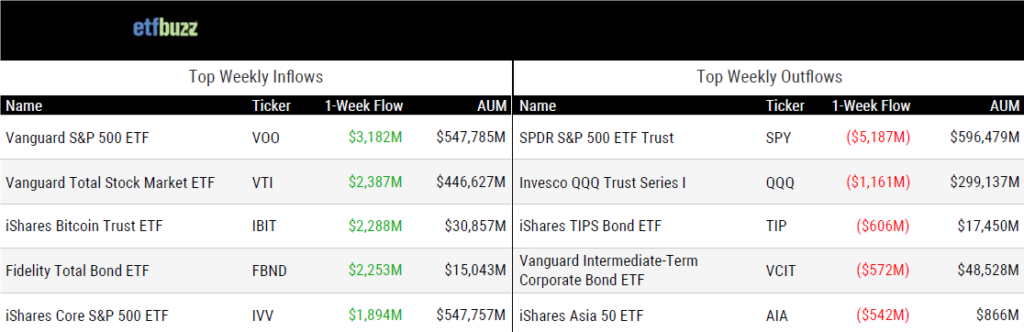

ETF Inflows & Outflows

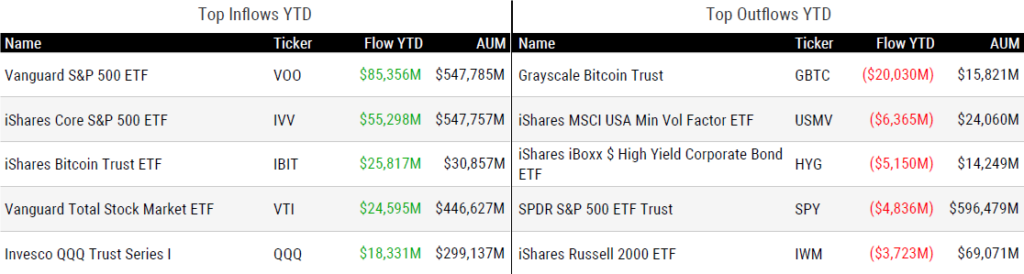

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 10/31/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

Apollo’s Race Toward Private-Credit ETFs to Face SEC Scrutiny by Lydia Beyoud

“The agency may push for more details on how the firms will navigate conflicts of interest and how they select the underlying private credit assets.”

Low-volatility ETFs lose favour as investors jump to buffered peers by Steve Johnson

“Buffer ETFs have had better risk-adjusted performance than low-vol ETFs.”

A Look Back at Crypto ETFs by Roxanna Islam

“Issuers haven’t been holding back with crypto.”

ETFs Are Where the Fun Is by Matt Levine

“Any sort of trade can be packaged into an ETF, as long as you can write a cool elevator pitch for it, and eventually every trade will be.”

Is It Time to Reconsider Dividend Funds? by Daniel Sotiroff

“Income-seeking investors have more options than ever today.”

Worldwide index ETF assets up 24% as BlackRock widens lead over Vanguard by Kathie O’Donnell

“I think that’s why you’ve seen such a huge jump in the assets that ETFs have, a lot of that is institutional.”

Intro to ETF Taxation and 351 Conversions by ETF Architect’s Wes Gray & Team

“ETFs are widely recognized for their tax efficiency, but many investors face the challenge of transitioning low-basis investments into ETF structures in a tax-efficient manner.”

(Note: This is an excellent primer on the tax advantages of ETFs and Section 351 tax-free conversions, which the industry will be hearing much more about. On that note, Cambria’s Meb Faber will join me on next week’s ETF Prime to discuss this as well.)

ETF Tweet of the Week

BlackRock, the world’s largest asset manager, filed this past week for exemptive relief from the SEC to offer an ETF share class of their existing mutual funds. They were followed a day later by State Street, who is seeking to offer a mutual fund share class of their existing ETFs. BlackRock and State Street add to a growing list of name brand fund companies – including Dimensional, Fidelity, Franklin Templeton, T. Rowe Price, and John Hancock – hoping to take advantage of a structure that Vanguard has been using for over 20 years. As I have described previously:

“Vanguard’s multi-share class fund patent expired last May. Very simply, this structure has allowed Vanguard to offer ETFs as a share class of existing mutual funds. For example, the Vanguard S&P 500 ETF (VOO) is a share class of the Vanguard 500 Index mutual fund – it’s the same pool of assets. This structure offers several important advantages, including the ability to better leverage economies of scale, which allows Vanguard to reduce backend costs and charge lower fees to investors. This structure has also helped Vanguard minimize capital gain distributions from its mutual funds since it can wash gains through the ETF share class.”

“Ultimately, the goal for all of these firms is the same. An ETF share class would allow mutual fund companies to maintain their lucrative 401k business while also pursuing the higher growth ETF market (or vice versa in F/m’s case). The challenge will be getting the SEC on board since Vanguard is only approved to use the ETF share class structure for index-based products, whereas these other issuers are seeking to use it for actively managed products. The SEC has expressed concern over what they call share class subsidization where ETF shareholders could be negatively impacted by mutual fund shareholders. An example would be if the mutual fund share class has significant outflows, then that could trigger negative tax consequences and higher transaction costs for ETF shareholders.”

Firms such BlackRock and State Street simply aren’t in the business of submitting SEC filings on a whim. They clearly have some optimism that the SEC will get comfortable with the multi-share class structure for asset managers other than Vanguard. This will be THE story to watch in 2025.

State Street coming in hot with share class relief after BlackRock filed yesterday. What's interesting here is they are just requesting mutual fund share classes on ETFs, citing opportunities in the retirement channel. pic.twitter.com/DpcjTTyxT5

— Jenny Grybowski (@GrybowskiJenny) November 1, 2024

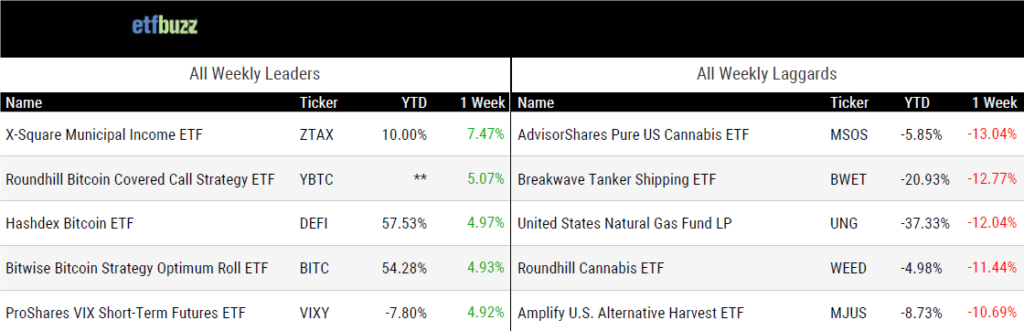

ETF Chart of the Week

A recent Investment News survey found that 42% of financial advisors plan to increase their use of actively managed ETFs or start using them if they weren’t already. Sean Beznicki, Director of Investments at VLP Financial Advisors:

“They’ve been gaining traction because they give you the benefits of both worlds – diversified exposure with a manager’s insights, but without the tax headaches that come with mutual fund distributions. It’s a really efficient way to stay nimble and proactive.”

It doesn’t look like the actively managed ETF train will be slowing down anytime soon.

Source: Investment News’ Emile Hallez