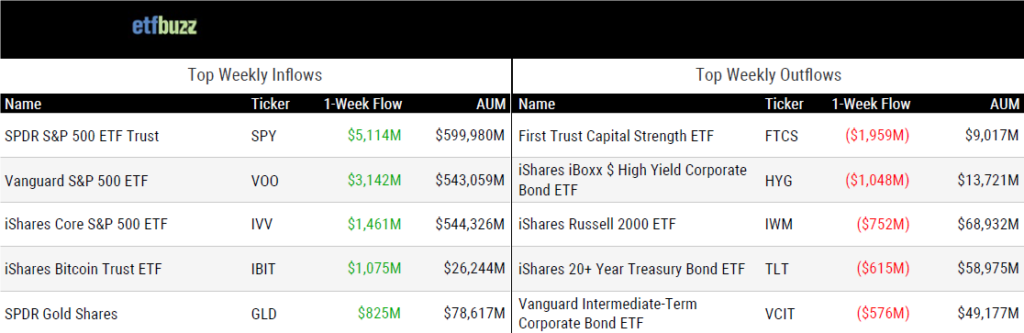

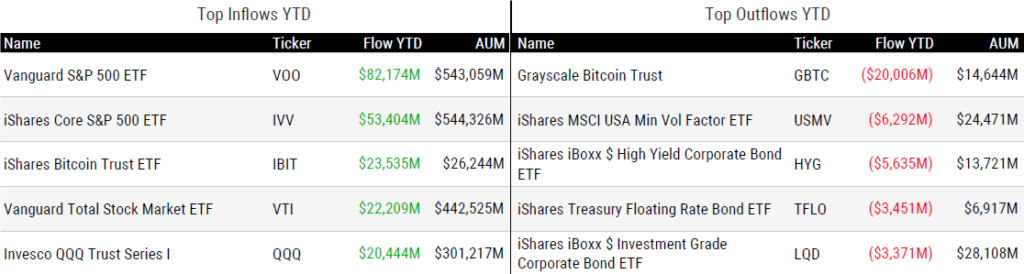

ETF Inflows & Outflows

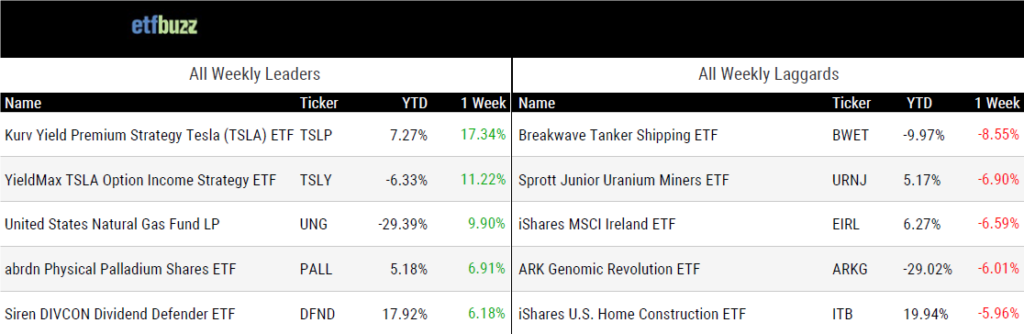

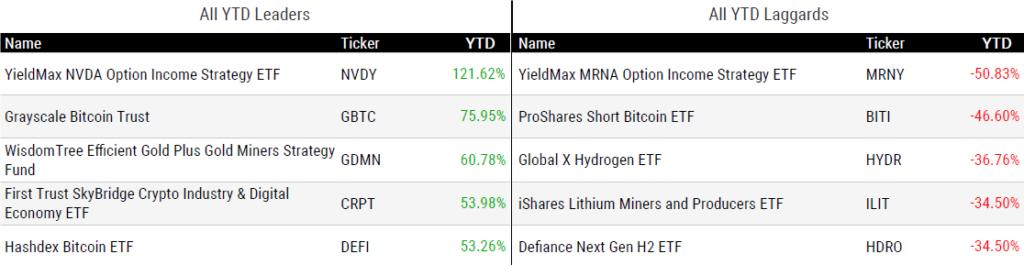

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 10/24/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

The widow-maker ETF by Robin Wigglesworth

“As long as the US economy stays remarkably strong it’s going to be painful.”

Selling Stock Concentration Is the ETF Industry’s New Big Idea by Isabelle Lee

“No one complained on the ride up as these firms dominated the S&P 500 and Nasdaq.”

Investors flee thematic ETFs as stock benchmarks soar by Suzanne McGee

“It’s winter for thematic ETFs right now.”

The Best Small-Cap ETFs by Zachary Evens

“As investor interest moves away from small-caps and towards private equity or large-cap stocks, many small-cap blend and small-cap value ETFs are left undervalued.”

Using 351 Contributions to fund an ETF by Patrick Cleary

“It sounds too good to be true.”

Here’s when exchange-traded funds really flex their ‘tax magic’ for investors by Greg Iacurci

“ETFs come with tax magic that’s unrivaled by mutual funds.”

Crypto ETFs Look Unlikely to Expand Beyond Bitcoin, Ether Under Kamala Harris, Experts Say by Helene Braun

“It won’t happen if Harris wins, regardless of the issuer.”

In case you missed it, here is my most recent contribution to etf.com… ETF Industry Notching Range of Innovations in 2024

ETF Tweet of the Week

The New York Stock Exchange announced plans this week to extend weekday trading on its NYSE Arca equities exchange to 22 hours a day. In addition to all U.S.-listed stocks and closed-end funds, this would include ETFs. Kevin Tyrrell, Head of Markets at NYSE:

“The NYSE’s initiative to extend U.S. equity trading to 22 hours a day, 5 days a week underscores the strength of our U.S. capital markets and growing demand for our listed securities around the world.”

How long until all major trading venues are open 24/7?

We are thrilled to announce plans to extend weekday trading to 22 hours a day on our NYSE Arca equities exchange, underscoring the NYSE's unique leadership role in the global capital markets.

— NYSE 🏛 (@NYSE) October 25, 2024

ETF Chart of the Week

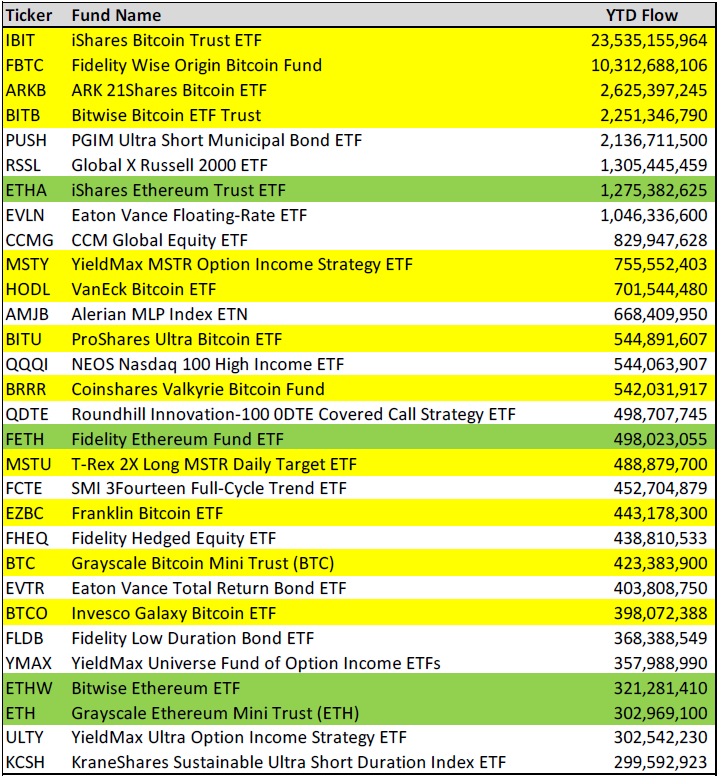

I typically avoid including my own charts and tables in this section, but the below seemed to generate some buzz this week. Out of 576 ETFs launched this year, a staggering 16 of the top 30 by inflows are either bitcoin or ether-related. That includes the top 4 ETF launches of 2024, all of which are spot bitcoin ETFs.

In total, the top 30 launches include 9 spot bitcoin ETFs, 1 leveraged spot bitcoin ETF, 4 spot ether ETFs, and 2 MicroStrategy-related ETFs (MicroStrategy has essentially morphed itself into a leveraged bitcoin proxy).

(Note: VettaFi’s Cinthia Murphy & I will discuss this table and 2024 ETF launches overall on next week’s ETF Prime.)