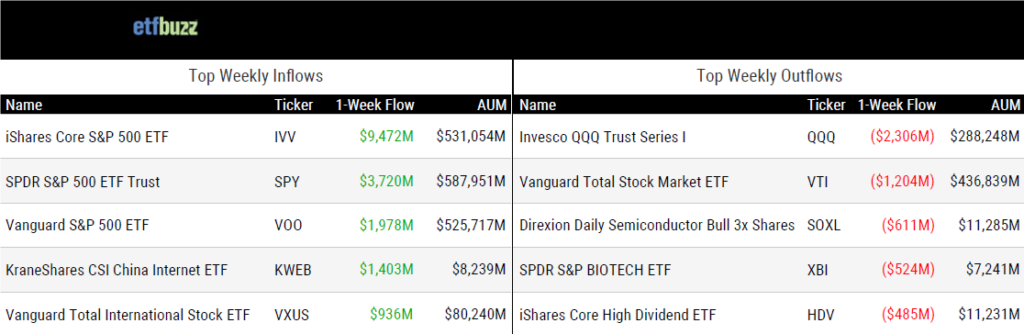

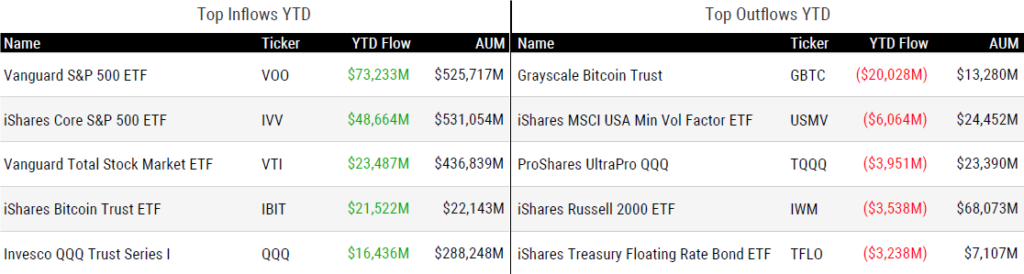

ETF Inflows & Outflows

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 10/3/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

The ETF Flowdown: Q3 2024 by Kirsten Chang

“Talk about closing out the quarter with a bang.”

(Note: Catch my ETF Prime conversation with VettaFi’s Kirsten Chang as we discuss Q3 inflows and several recent milestones for the industry.)

ETF flows smash record in third quarter by Emma Boyde

“Some ETF records aren’t going to be broken this year they’re going to be destroyed.”

4 top reasons why exchange-traded fund growth has ballooned by Greg Iacurci

“The simple fact is, the structure of an ETF is a superior fund structure to a mutual fund, especially for taxable accounts.”

America Risks Running Out of Tickers for Single-Stock ETFs by Katie Greifeld

“It’s a growing concern in the ETF arena given that catchy tickers are serious business.”

Vanguard Wants to Shake Up Investing Again. Its New CEO Has Big Plans. by Andrew Welsch

“ETFs are a key area of expansion.”

Apollo, State Street Strive to Prove Private-Debt ETFs Can Work by Vildana Hajric

“Whoever can bridge the gap between all that private stuff and the retail investor is probably going to make out big time.”

How Nvidia’s Monster Rally Broke Your Tech ETF by Jack Pitcher

“This is the first time you’ve ever had three stocks with a market cap over $3 trillion in the same sector.”

Crypto asset manager Bitwise files for first XRP exchange-traded fund by Eleanor Terrett

“The Bitwise XRP ETF filing comes at a pivotal time, as the SEC’s deadline to appeal the Ripple ruling is Oct. 7.”

ETF Tweet of the Week

As always, a little ETF education goes a long way. I would encourage everyone to closely read the below from ETF Architect’s Wes Gray (click tweet to view entire thread) and then consider this press release regarding the upcoming launch of the Cambria Tax Aware ETF (TAX):

“TAX allows individual investors to seed the launch of the ETF with their separate account investments and exchange their existing investment holdings for the new, tax-efficient ETF. By leveraging ETF technology, Cambria and ETF Architect have created a streamlined and accessible solution that may address the challenges associated with traditional tax-loss harvesting strategies.”

ETF innovation at its finest!

How you considered dropping your managed accounts ("SMAs"), mutual funds, or private funds, and joining the tax-party in ETF land?

— Wes Gray 🇺🇸 (@alphaarchitect) October 1, 2024

Reader: "Sure, great idea, Wes. I'll pay a monster tax bill to transition into an ETF. Thanks, but no thanks."

Wes: "Hear me out. What if we can… pic.twitter.com/rEgTiam2BG

ETF Chart of the Week

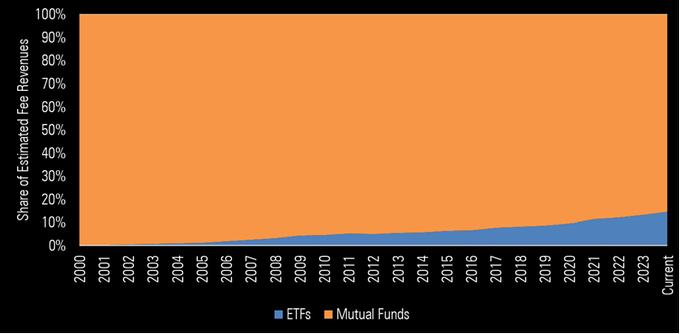

Morningstar’s Ben Johnson notes that, as of the end of August, ETFs claimed a 32.3% share of the overall fund market (ETFs + Mutual Funds). However, because the average ETF fee is only 0.16% versus 0.42% for mutual funds, ETFs’ share of overall estimated fee revenue was only 14.7%.

However, something to watch moving forward is the growing popularity of actively managed ETFs which typically have a higher price point. Active ETFs have accounted for nearly 30% of net inflows in 2024 despite only representing 8% of total ETF assets. Financial Times:

“Thanks to their far higher fees, this has translated into active ETFs grabbing 72% of the management fee income emanating from the $588bn of fresh money piling into US ETFs in the first eight months of the year, according to calculations by Morningstar.”

With 58% of advisors intending to increase their use of active ETFs over the next 12 months, expect this chart to evolve in the coming years.

Source: Morningstar’s Ben Johnson

Crypto Prime Podcast

I am very excited to announce the launch of a new podcast, Crypto Prime! Many of you know that I have hosted ETF Prime for going on fourteen years with the simple goal of helping to promote ETF education. That won’t change.

The goal of Crypto Prime is also very simple: help serve as a bridge between traditional and decentralized finance by promoting crypto education. The podcast will feature true experts from around the world and cover bitcoin, crypto, NFTs, web3, regulation, etc.

This week’s episode featured Bitwise Chief Investment Officer Matt Hougan, who discussed several real-world use cases for crypto including stablecoins, tokenization, and prediction markets. Enjoy!