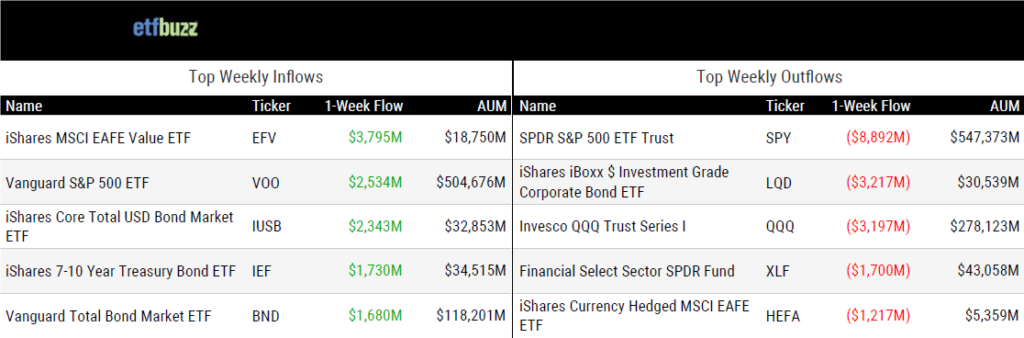

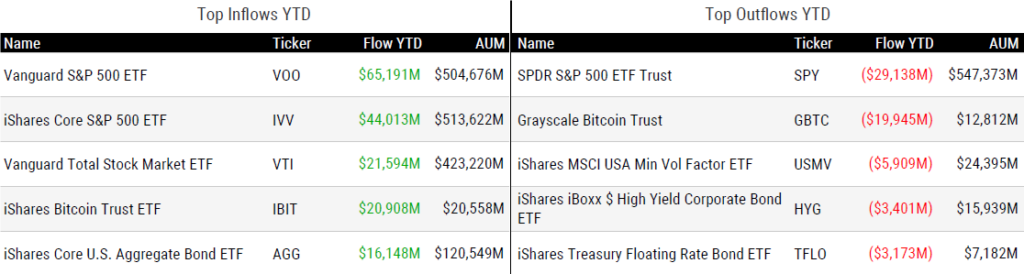

ETF Inflows & Outflows

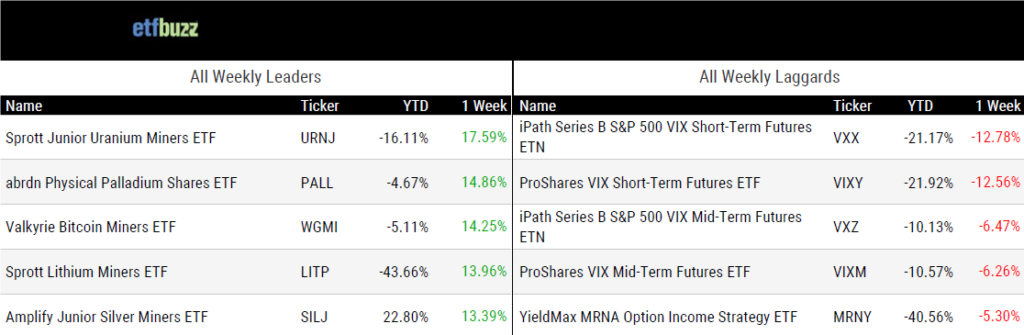

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 9/12/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

The ETF Market: A Zine by Dave Nadig

“The ETF market has grown up.”

(Note: ETF Industry veteran Dave Nadig will join me on next week’s ETF Prime to discuss private assets in ETFs, product proliferation, and much more!)

J.P. Morgan Asset Management Launches Groundbreaking Guide to ETFs by J.P. Morgan Asset Management

“ETFs have become an indispensable investment structure for both individual investors and financial professionals.”

What’s Left to Be ETF’d? by Jason Zweig

“If you’re trying to put illiquid s—in an ETF, it’s never going to work.”

Apollo Moves to Start a Private Credit ETF With State Street by Sonali Basak

“The big challenge has always been: How do you put something illiquid into a liquid wrapper?”

A Closer Look at a Groundbreaking Active ETF Proposal by Brian Moriarty and Ryan Jackson

“There are several issues with this proposed ETF, all of which boil down to the fact that one firm (Apollo) appears to be the valuation provider, originator, buyer, and seller of the fund’s private credit investments.”

The transparency choice for ETFs by Emile Hallez

“The active ETF market in equities has really gone the fully transparent route.”

Jack Bogle Was Right About Stock ETFs. What Investors Should Avoid Doing. by Lewis Braham

“Where do we typically see ETFs being used? Outside of a retirement plan.”

Single-Stock ETFs to Tackle Global Currency Risk by Jeff Benjamin

“It’s an educational process, because most investors, including some professionals, think by buying these ADRs on U.S. exchanges they don’t have currency exposure.”

Watch Your Step With Active Bond ETFs by Lan Anh Tran

“While the premium/discounts on bond ETFs are fairly low across the board, passive bond ETFs enjoy a clear advantage over their active counterparts in all of these categories.”

Volatility, thy name (probably isn’t) leveraged ETF by George Steer

“This isn’t a new freakout.”

ETF Tweet of the Week

Twenty-six(!) fund companies have now filed with the SEC to offer ETF share classes of their existing mutual funds. Vanguard’s patent on the multi share class structure expired in May of 2023 and other issuers now want in. The challenge is that these firms are seeking to use this structure for actively managed strategies, whereas Vanguard only uses it for index-based funds. The SEC has concerns regarding “share class subsidization”, whereby one class of shareholders could be negatively impacted by another. Will the SEC play ball? Here’s what I told Pension & Investments’ Kathie O’Donnell following this week’s Nuveen’s filing (Nuveen was filer #24, followed by Shelton Funds, and then Natixis as Ben highlights below):

“Nuveen is simply the latest in what has become a long line of asset managers seeking to use the ETF share class structure. Many of the most prominent names in asset management are now pursuing this structure and I expect the list of firms to continue growing. While I believe the SEC will ultimately approve these requests, I think the timeframe could extend well into 2025 – if not beyond.”

…26

— Ben Johnson, CFA (@MstarBenJohnson) September 12, 2024

Natixis has just filed to tack ETF share classes onto their mutual funds.

The list of 26 ETF-as-a-share-class filers now includes: Perpetual, DFA, F/m, Fidelity, First Trust, Morgan Stanley, Guinness Atkinson, TCW, PGIM, AB, Neuberger Berman, Northern…

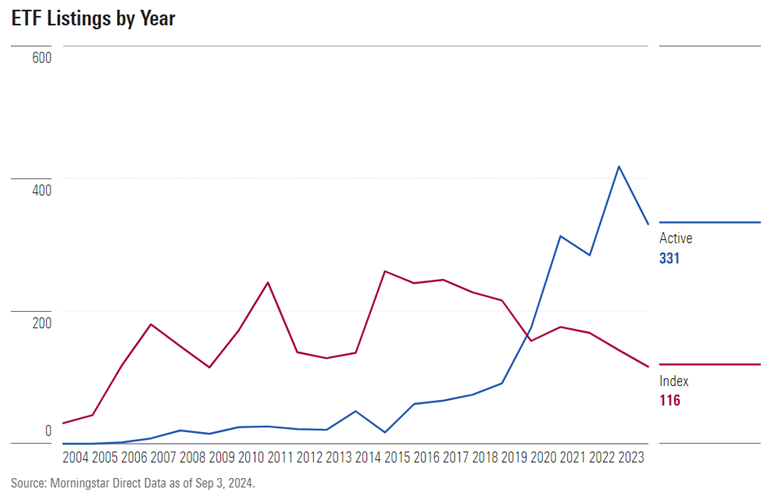

ETF Chart of the Week

A better name for this section might be “Active ETF Chart of the Week” because it has been dominated by all types of graphs and illustrations depicting the rise of active management in the ETF wrapper. While less than 8% of the $9.6 trillion in ETFs is actively managed, these products continue to make up an outsized portion of inflows and new launches. The below chart caught my attention for its simplicity in driving home the future direction of travel. Morningstar’s Gabe Alpert:

“Today, there are 2,149 index-tracking ETFs and 1,619 active ETFs. However, that gap has been narrowing rapidly. So far this year, 331 active ETFs have been listed on US exchanges, following the record 418 active ETF launches in 2023.”

While ETFs’ roots are clearly in passive (which still dominate inflows overall), the industry is rapidly approaching a point where there will be more active than index-based products.

For those of us involved in this space for a while now, it’s both weird and exciting to see.

Source: Morningstar’s Gabe Alpert