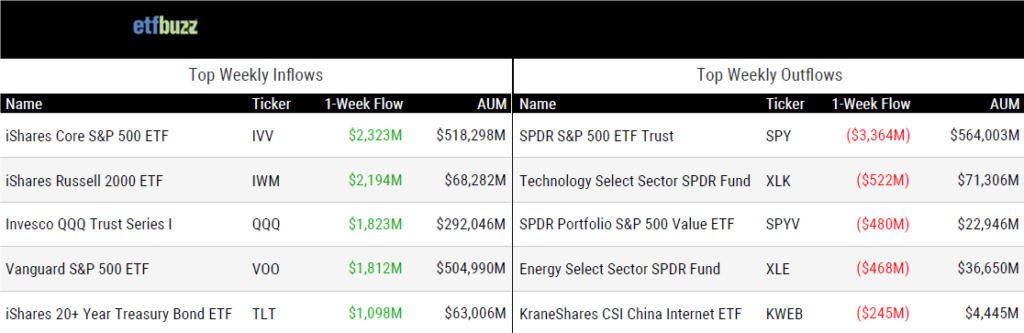

ETF Inflows & Outflows

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 8/22/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

Levered Trade That Blew Up in 2008 Gets a $600 Million ETF Redo by Lu Wang

“A ton of people are doing this in the institutional space so this is not a novel concept. But in the ETF space, we’re really at the forefront.”

(Note: In response to this article, Newfound Research CEO Corey Hoffstein crafted an excellent X thread that offers some additional perspective.)

Record-Breaking ETF Launches in 2024 Surpass 1K Mark by DJ Shaw

“ETFs are a unique product that cuts across all types of clients and offers the same toolbox at a low or cost-efficient fee to everyone.”

Buffer Investing: Understanding Managed Floor vs Defined Outcome ETFs by Cinthia Murphy

“There’s no shortcut to due diligence when it comes to finding the right ETF for a specific investment goal.”

Investors Suddenly Have a Lot More Active Muni ETFs to Choose From by Gabe Alpert

“So far in 2024, 15 active muni bond ETFs have been listed on exchanges, topping the previous record of 12 in 2023.”

Some ETFs Pull A Strange Switcheroo On Investors by Matt Krantz

“An ETF is largely a basket of stocks or bonds, and what’s inside matters a lot.”

Franklin Templeton Files for Crypto Index ETF by Jeff Benjamin

“Spot crypto ETFs have received very positive reception in the U.S. market.”

The next wave of US crypto ETFs is in limbo by Ben Strack

“The SEC has yet to approve a basket product in the form of a digital assets ETF.”

ETF Tweet of the Week

Earlier this week, The Block reported that the SEC was simply not going to entertain Cboe’s 19b-4 filings for spot solana ETFs. That report came a few days after Cboe withdrew their filings to list the VanEck Solana ETF and 21Shares Core Solana ETF. If the SEC had formally acknowledged the filings, that would have started a 240-day clock in which the agency would have to make a decision to approve or deny them.

If you are unfamiliar with the 19b-4 filing process, Bloomberg created a handy flowchart which I’m sure we’ll be referencing again in the not-too-distant future. A little ETF education goes a long way.

(Note: Bloomberg’s Eric Balchunas will be joining me on next week’s ETF Prime to discuss this and much more from the world of ETFs.)

Nice flow chart showing how the Solana ETF filings never made it past Step 2 (the SEC failed to ack them) = DOA. So the exchanges withdrew 19b-4s altho the issuers' S-1s are still active. A snowball's chance in hell of approval unless there's change in leadership via @JSeyff pic.twitter.com/e8BNKT33KH

— Eric Balchunas (@EricBalchunas) August 20, 2024

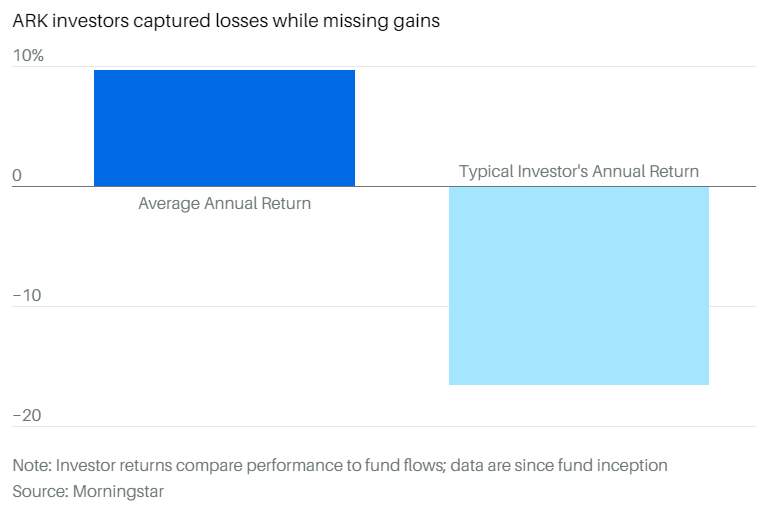

ETF Chart of the Week

The below chart caught my attention this week. It simply depicts two data points: 1) the average annual return from the ARK Innovation ETF (ARKK), and 2) the typical investor’s annual return from ARKK.

“Since its 2014 inception, the fund has returned 9.7% on average per year, according to Morningstar. That’s far below the triple-digit returns that investors once dreamed of, but more or less in line with long-term stock returns.

And for investors, it’s even more bleak: Their average annual return, calculated by Morningstar is -17%.

Morningstar calculates the investor return by tracking money moving into and out of a fund to see what share of the fund’s annual return is actually captured by fundholders.”

In other words, if investors bought ARKK around its peak in February 2021, their annual return would obviously be signficantly worse than an investor who purchased at the beginning of 2020. The difference between a fund’s return and an investor’s actual return from the fund is referred to as the “behavior gap”.

As an aside, Barron’s noted that investors simply buying and holding an S&P 500 index fund over the same time period would have earned 15% a year.

(Note: VettaFi’s Cinthia Murphy will also be joining me on next week’s ETF Prime to discuss this and what ARK Invest’s future might hold.)

Source: Barron’s Senior Writer Ian Salisbury

ETF Video of the Week

Interested in launching an ETF? I highly recommend watching this video courtesy of Corey Hoffstein, CEO of Newfound Research. Newfound Research serves as investment sub-adviser to the Return Stacked ETFs, a unique product suite that has quickly grown to $750 million in assets.