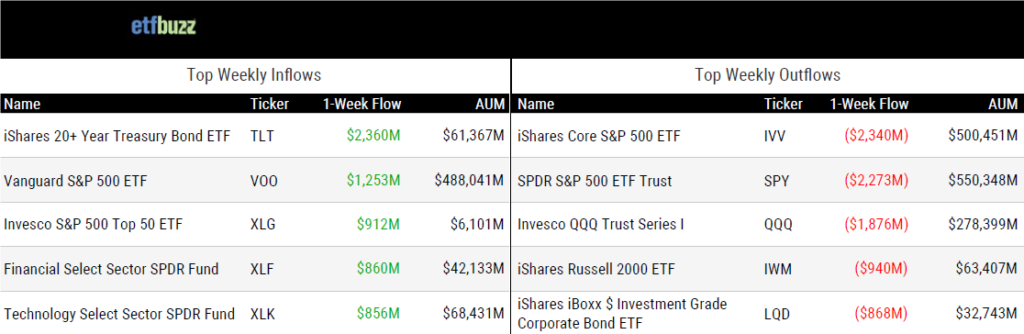

ETF Inflows & Outflows

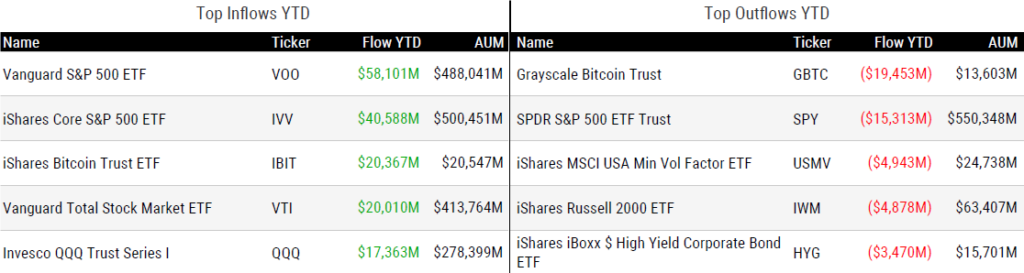

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 8/15/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

ETFs’ huge appetite extends to SMAs by Steve Johnson

“I think we are at the beginning of this trend.”

Vanguard CEO Ramji: ‘Criticism Will Make Us Better’ by Allan Roth

“Vanguard must look through the lens of our clients. But I want more innovation.”

Wall Street Just Got Its Most Volatile ETF as Risky Bets Boom by Vildana Hajric and Isabelle Lee

“There is a reason why the front page of this fund’s prospectus is covered with disclosure in black bold print.”

ETF share classes of mutual funds stand better chance if Republicans win election — attorney by Kathie O’Donnell

“The upcoming election will essentially determine which party controls the Securities and Exchange Commission and that can have a real impact on ETFs.”

High Yield Bond ETFs Have New Asset Leader by Cinthia Murphy

“USHY’s asset-gathering success reminds us that similar ETFs may serve different application goals.”

Downside protected ETF battle continues to heat up by Gregg Greenberg

“The primary reason for the surge in demand for these new ETF offerings is flat-out fear.”

‘Dr Doom’ files to launch ETF based on his calamitous outlook by Steve Johnson

“There has been an oversupply of speculative ETFs, whereas the more defensive part of the market has been underserved.”

ETF Tweet of the Week

Institutional investment managers with greater than $100 million in Section 13(f) securities (primarily equities) must file a Form 13F with the Securities and Exchange Commission. Those 13F filings for the second quarter of 2024 were due by August 15th and offered further insight into who is buying spot bitcoin ETFs. Bitwise’s Matt Hougan provides a nice recap of what he found within the filings (you can read my thoughts via CoinDesk here). The “too long, didn’t read”: institutional adoption of spot bitcoin ETFs continues to accelerate.

A few initial thoughts after reviewing the Q2 Bitcoin 13-F filings:

— Matt Hougan (@Matt_Hougan) August 14, 2024

1) The Institutions Are Still Coming; Total Filings Are Up: I count 1,924 holder<>ETF pairs across all 10 ETFs, up from 1,479 in Q1. That's a 30% increase; not bad considering prices fell in Q2.

Of course, this…

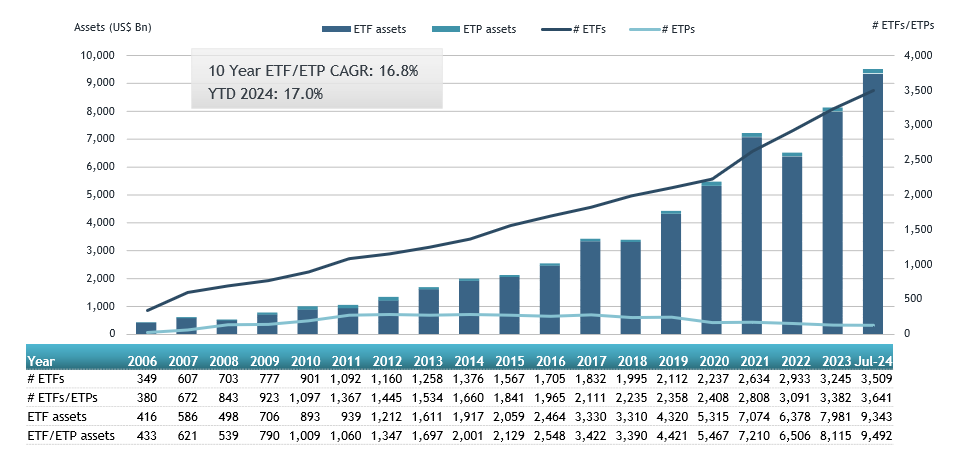

ETF Chart of the Week

ETFs hit a new record high of nearly $9.5 trillion in assets at the end of July. There are now nearly 3,650 ETFs from over 330 issuers. With a little help from the markets, the industry could soon be popping champagne to celebrate hitting the $10 trillion milestone.

Source: ETFGI