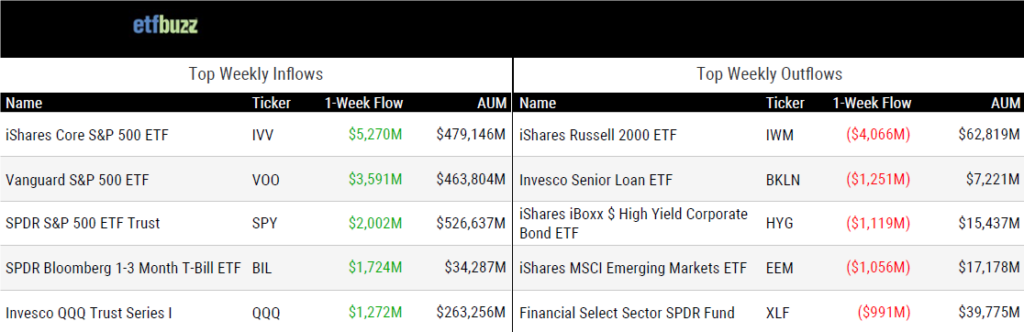

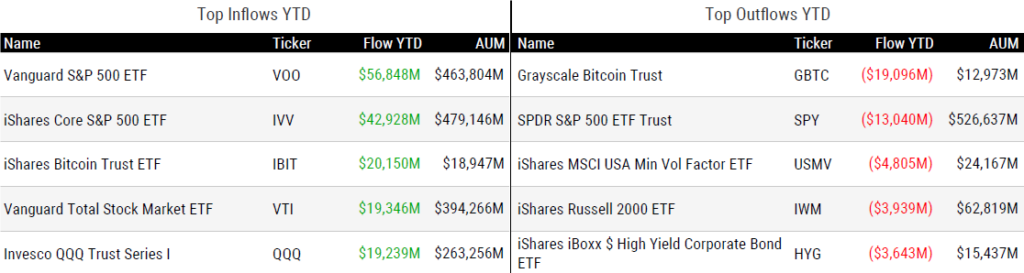

ETF Inflows & Outflows

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 8/8/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

US market volatility puts ‘buffer’ ETFs in the spotlight by Suzanne McGee

“Our inflows last week were probably five or six times what we would see in a typical week.”

(Note: Catch my ETF Prime conversation with VettaFi’s Roxanna Islam, who dives into the world of buffer ETFs. Roxanna also provides a nice primer on these ETFs here.)

Funds offering protection from volatility fail to deliver in sell-off by Nicholas Megaw and Will Schmitt

“They call it an income strategy, but really you’re just selling volatility.”

Why the Active/Passive Debate Matters by Dave Nadig

“While passive investing works, it also perturbs the markets being invested in, and that’s worth exploring.”

In a Post-T+1 World, ETF Servicing is Paving the Way for T+0 by Jeff Sardinha

“This evolution in ETF servicing is paving the way for a future where T+0 becomes the standard.”

BlackRock Rebrands ETFs to iShares, Expanding Product Line by DJ Shaw

“The rebranding comes as Vanguard Group challenges BlackRock’s position as the world’s largest ETF issuer.”

Solana ETFs ‘Inevitable’ in US After Brazil Approval, Says VanEck Exec by Murtuza Merchant

“It appears U.S. regulation needs a soft fork before it can launch and the White House controls the keys.”

Institutional Investors Embrace Next Wave of ETFs by Adam Gould

“The ETF wrapper can play a significant role in changing a market.”

ETF Tweet of the Week

Options trading is STILL not available on spot bitcoin ETFs, which launched on January 11th. However, there is options trading available on the below list of other bitcoin and ether-related ETFs. If someone can intelligently explain this to me, I’m all ears.

We think the #Bitcoin ETF options happen in 4th quarter this year. Final deadline for SEC decision is ~Sept. 21 but there's more steps needed after that from OCC & CFTC.

— James Seyffart (@JSeyff) August 8, 2024

Here are some BTC & ETH related ETFs including leveraged that already have options. cc @EricBalchunas https://t.co/xErD5oPiWb pic.twitter.com/USauv6QaFs

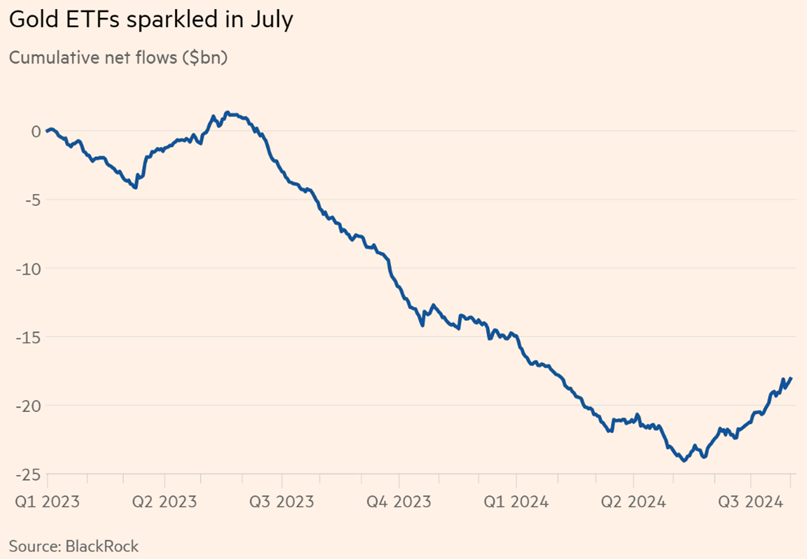

ETF Chart of the Week

One of the great recent ETF mysteries (at least to me) has been outflows from physical gold ETFs over the past several years. While the SPDR Gold Shares ETF (GLD) has outperformed the SPDR S&P 500 ETF (SPY) on a year-to-date, trailing 1-year, and trailing 3-year basis, the physical gold ETF category has experienced MASSIVE outflows. That is highly unusual in the ETF space, where flows typically follow performance.

That said, it appears as if this might FINALLY be turning around with the category taking in nearly a billion dollars over the past three months. Why the recent interest? The World Gold Council:

“July was unprecedented in the political front with the assassination attempt on Trump followed by Biden stepping down from the presidential race. Gold ETF saw inflows around both dates, pointing to increased safe-haven demand. Meanwhile, falling inflation, the cooling labour market and the US Fed Chair Powell’s note that a cut in September is “on the table” during the recent meeting intensified investor expectation of easing soon. In turn, US Treasury yields fell and the dollar weakened, pushing the gold price to a record high during the month and spurring investor interest in gold ETFs. Furthermore, we believe equity market volatilities, especially during the second half of July, also supported gold ETF demand.”

I discussed all of this and much more on last week’s ETF Prime with renowned gold expert, George Milling-Stanley. George is Chief Gold Strategist at State Street Global Advisors and actually helped pioneer GLD back in 2004. With over 50 years of experience in the gold market, his insights are always worth a listen!

Source: FT’s Steve Johnson and Will Schmitt