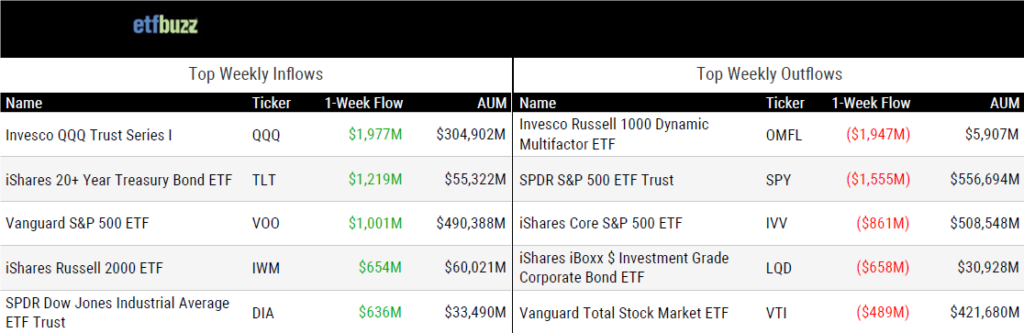

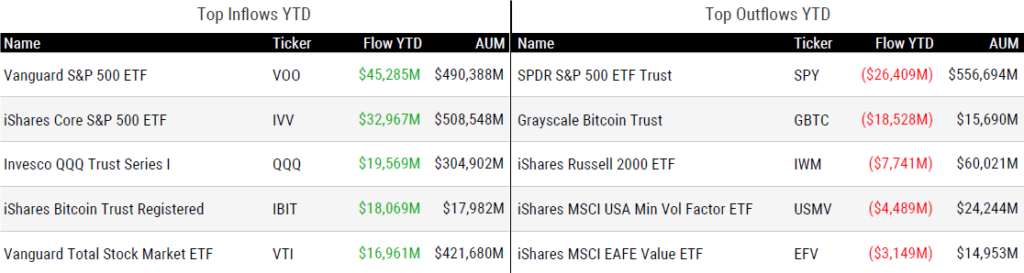

ETF Inflows & Outflows

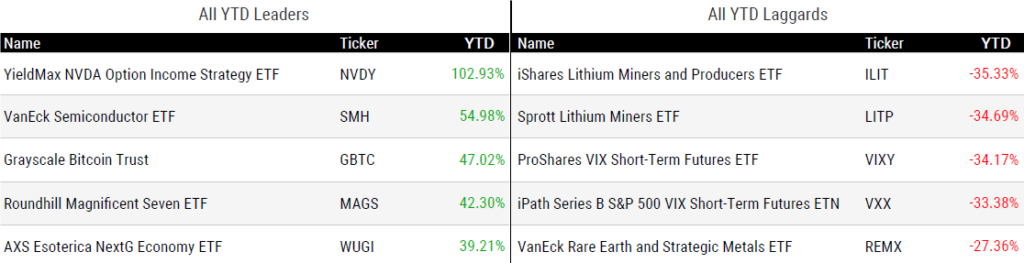

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 7/11/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

Big First-Half ETF Inflows by Matthew Bartolini

“Add the usual 31% bump for second-half ETF flows, and 2024’s flows could be the most ever at $950 billion, with a chance of hitting $1 trillion if the market’s rally continues.”

Fund Fees Are Still Declining—but at a Slower Pace by Zachary Evens

“The fee gap between newly launched mutual funds and ETFs shrank by 71% in the last 10 years: from 0.67% to 0.19%.”

Ramji Takes Over Vanguard Amid Challenges, Tailwinds by Ron Day

“The No. 2 ETF issuer confronts a mix of challenges and tailwinds: as customer service complaints rise, cash is flowing into the company’s funds.”

Cathie Wood nods at Ark’s ‘challenged’ returns but insists on future profits by Will Schmitt

“They appropriately want to refocus attention on the long term and are hoping investors stay loyal.”

The Drivers of Active ETF Adoption by Cinthia Murphy

“Product development across active ETFs has been robust.”

Wall Street’s Black-Box ETFs Snubbed in $136 Billion Active Boom by Vildana Hajric

“Semi-transparent ETFs attempted to take what was basically a free, foundational aspect of ETFs — being able to see holdings every day — and remove that.”

Solana ETFs: The SOL Filings by Roxanna Islam

“Because Solana is so similar to ether, it would make sense that they would eventually have the same classification, but that has not yet been clarified.”

Will ETFs Be Overtaken by Tokenization? by Cloris Chen

“Right now, this infrastructure simply isn’t mature enough to accommodate all ETFs in tokenized form.”

ETF Tweet of the Week

Many investors associate ETFs with “low cost”. That’s an entirely fair association given the weighted average expense ratio for the 3,500+ ETFs in existence is a paltry 0.18%. Investors can build a globally diversified portfolio for the cost of a cup of coffee. However, the average fee on new ETFs continues to climb. So what gives? Well, investors do love low cost ETFs… primarily for the core of their portfolio. But they also like to occasionally spice-up their plain-black cup of Joe. That’s where many of the new – and more expensive – ETFs come in. If investors want to add coconut milk or a few pumps of Dulce de Leche to their portfolio, that’s going to cost them (click tweet to read entire thread).

The # of new ETFs w/ fees >50bps has been skyrocketing, on pace to break last yr's record. This is bc beta is now free so much of the 'innovation' is aimed at the hot sauce bucket of portfolios, which gets smaller allocations = invs way less fee sensitive via @psarofagis pic.twitter.com/OpU95CVhaO

— Eric Balchunas (@EricBalchunas) July 8, 2024

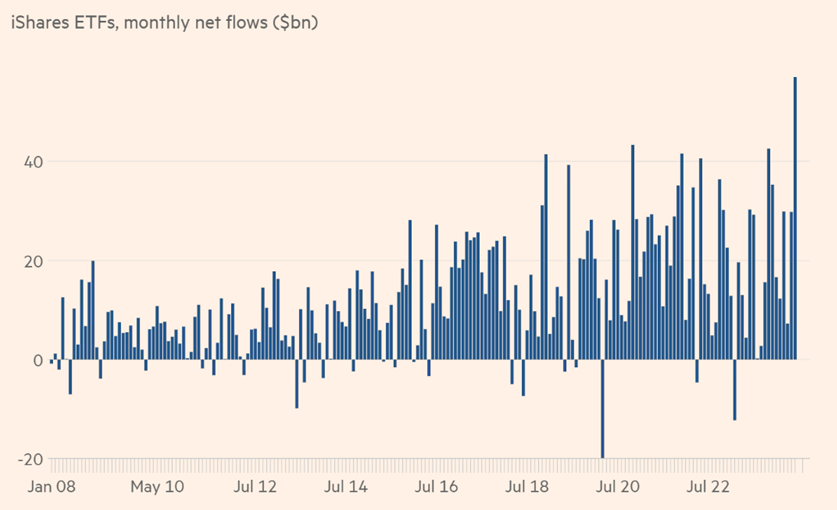

ETF Chart of the Week

iShares just experienced its greatest monthly inflows *ever*. In doing so, they also set a monthly record for *any* issuer. Morningstar’s Ryan Jackson:

“iShares pulled in $47 billion in June—a monthly ETF flows record for any provider. Long-awaited flows into iShares’ stock ETF lineup drove the banner month. iShares equity funds reeled in $29 billion in June after collecting just $5 billion in the prior five months. iShares Core S&P 500 ETF led the charge with an $11 billion intake, and heavy inflows into growth ETFs like iShares S&P 500 Growth ETF IVW bolstered the case. iShares’ bond ETFs have been far more consistent. They collected $12 billion of their own in June, spearheaded by the $4.8 billion that funneled into iShares 20+ Year Treasury Bond ETF.”

As an aside, iShares has only two quarters of outflows since 2008 – an absolutely mind-boggling feat.

Source: FT’s Steve Johnson

CNBC ETF Edge

I had the pleasure of joining CNBC’s Bob Pisani and Bitwise’s Matt Hougan to discuss spot ether ETFs, spot bitcoin ETFs, and the near record pace of ETF inflows. Enjoy!