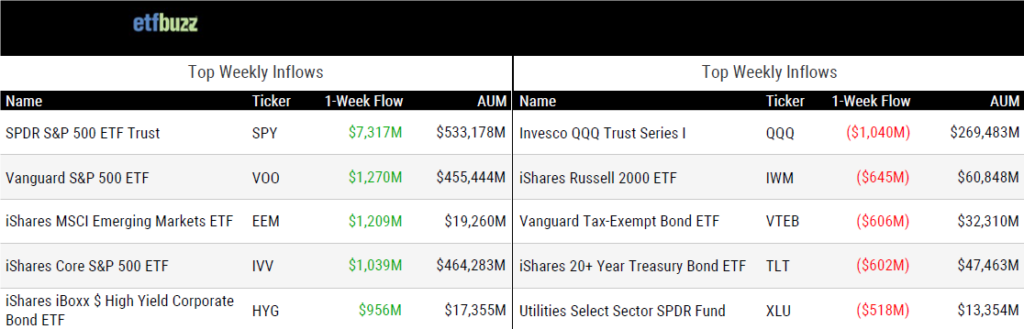

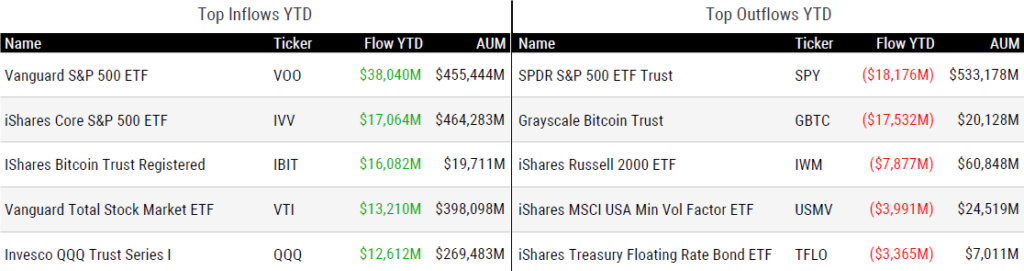

ETF Inflows & Outflows

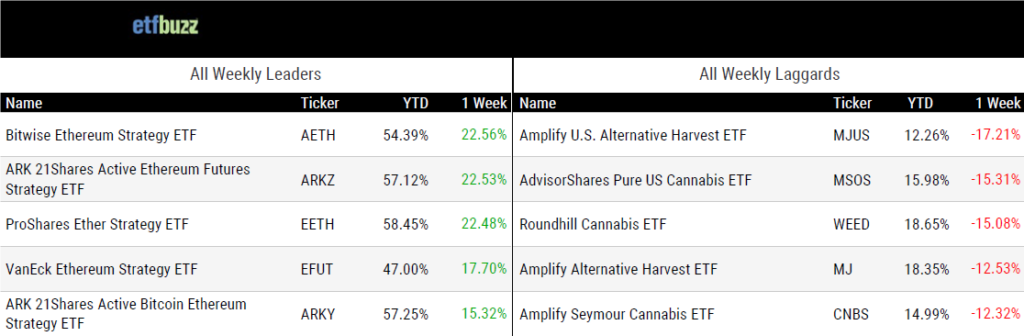

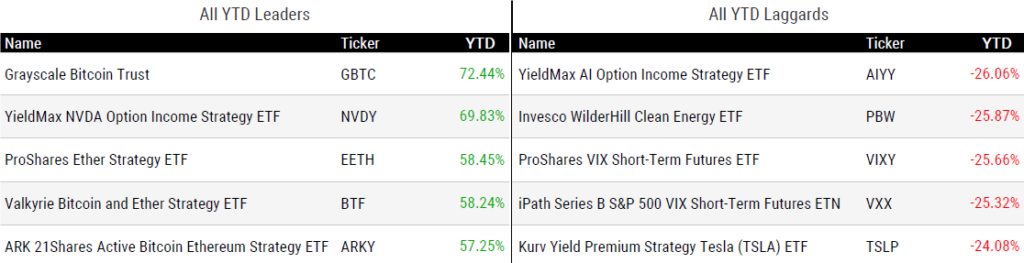

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 5/23/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

An Open Letter to Vanguard CEO, Salim Ramji by Dave Nadig

“You’ve got storied track records in all sorts of strategies, active and passive. Don’t play defense — you’re owned by your shareholders. Play neutral arbiter. Publish facts. Run good academic studies. Host debates. Take the conversation seriously.”

(Note: ETF industry veteran Dave Nadig joined me on last week’s ETF Prime to cover Vanguard’s new CEO and a range of other topics including crypto ETFs, the multi share class fund structure, Fidelity’s “pay-to-play” scheme, meme stock ETFs, and the biggest threat facing American capitalism. You can listen to our conversation here).

Finfluencers loom large in world of ETFs by Daniel Gil

“We’re going to spend money, and I’d rather do a podcast with an influencer than run an ad on CNBC.”

State Street Is Working to Insert ETFs Into the 401(k) System by Katie Greifeld

“While ETFs have been stealing market share and assets from mutual funds for more than a decade, mutual funds have a powerful incumbency advantage as 401(k)s are built to incorporate the wrapper.”

Behind the Rising Tide in Alternatives ETFs by Cinthia Murphy

“The ETF wrapper has in many ways made complexity simple to implement, and simplicity translates to accessibility — the necessary condition for demand to materialize.”

‘It’s absurd’: From Morgan Stanley to the state of Wisconsin, here’s who just poured billions into Bitcoin ETFs by Niamh Rowe

“A good first 13F season would maybe be 10. That’s how hard it is. And so, to have 414 is just bonkers.”

SEC’s lack of internal coordination suggests Ethereum ETF pivot ‘entirely political,’ source says by Sarah Wynn

“This is a 180-degree turn from what the SEC told issuers two weeks ago when the agency showed no interest in the filings.”

Ether ETFs near debut as some Democrats see ‘fervent opposition’ to crypto as political liability by Chris Matthews and Frances Yue

“While the rationale for the SEC’s sudden change of heart is not immediately clear, there is speculation around DC that it is part of a broader White House decision to soften its antagonistic stance toward crypto.”

ETF Tweet of the Week

One short week ago, many experts thought spot ether ETF approval was simply a “hopium” dream. However, on Thursday, the SEC approved 19b-4 filings for multiple issuers. 19b-4s are exchange rule change requests – in this case, Cboe, Nasdaq, and NYSE seeking permission to list and trade spot ether ETFs. In order for spot ether ETFs to actually launch, the SEC will also need to sign-off on the issuer registration statements (S-1s, or S-3 in Grayscale’s case). While the timing on registration statement approval is unclear at this point, I fully expect the SEC to green light these as well and subsequently line up issuers to launch at the same time (similar to how the SEC handled spot bitcoin ETFs).

So, why the sudden change in the SEC’s perceived stance on spot ether ETFs? Was it politics? Were they going to approve these ETFs all along? Join Bloomberg’s Eric Balchunas, Van Buren Capital’s Scott Johnson, and I as we discuss this and everything else surrounding spot ether ETF approval on next week’s ETF Prime!

BOOM!! APPROVED! There it is. The SEC just approved spot #Ethereum ETFs. What a turn of events. It's really happening.

— James Seyffart (@JSeyff) May 23, 2024

h/t @PhoenixTrades_ pic.twitter.com/KQ39mDyCbT

ETF Chart of the Week

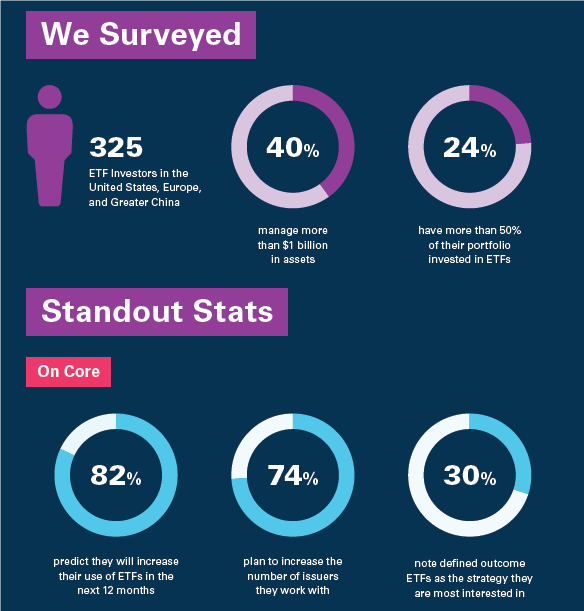

BBH’s latest Annual Global ETF Investor Survey was released last week and is always worth a read. Here’s a brief summary from BBH:

“There is much reason for continued optimism in the ETF industry. This year’s survey shows an overwhelming majority of investors plan to increase their allocation to ETFs in the upcoming year while also expanding the number of ETF providers that they invest with. In terms of product preferences, ETFs have long since moved beyond the early passive equity mandates to include fixed income, alternatives, commodities, defined outcome, active, and thematic strategies. The investors we surveyed indicated continued interest in new and diverse strategies within the ETF wrapper.”

etf.com’s Jeff Benjamin also does a nice job of summarizing some key takeaways, particularly around the growing appetite for active ETFs:

“Financial advisors and institutional investors are zeroing in on actively-managed ETFs as they continue to migrate away from mutual funds.”

Source: BBH