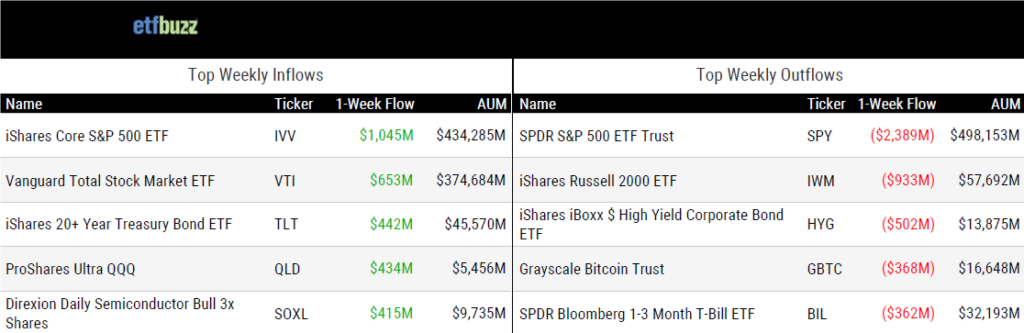

ETF Inflows & Outflows

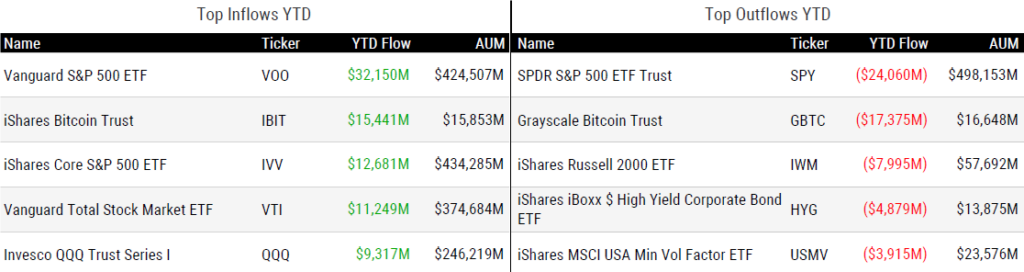

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 5/2/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

Vomiting frogs and other ‘dust’ prove vexing for US bitcoin ETFs by Will Schmitt

“US exchange traded funds that invest directly in bitcoin are building up stores of digital assets they did not buy and cannot sell after inadvertently receiving them as gifts.”

Bank of America Sounds Warning on Options-ETF Boom as Day Traders Plunge In by Emily Graffeo and Denitsa Tsekova

“Over half of the 75 covered call products tracked by Bloomberg have been launched in the last 16 months.”

Avantis Growing Fast For The Right Reasons by Allan Roth

“In a little over four years, Avantis has grown from scratch to be the 15th largest issuer of ETFs.”

Tremblant conversion marks growing hedge fund interest in ETFs by Will Schmitt

“The red velvet rope is now going away.”

U.S.-Domiciled ETFs Could Be Granted Equivalence in U.K. by Theo Andrew

“When it comes to offering U.S. ETFs broadly to our clients in the U.K., we know there is a tremendous amount of interest.”

What Happens If Mutual Funds Can Also Trade as ETFs? by Elaine Misonzhnik

“The approval of a dual-share asset class would be a potential game-changer for both mutual funds and ETFs.”

(Note: Rich Kerr, Partner at K&L Gates, will join me on next week’s ETF Prime to discuss the latest surrounding potential SEC approval of the multi-share class structure.)

ETF Tweet of the Week

The calendar turning to May means one thing for the ETF industry: the SEC has a decision to make on spot ether ETFs. Final rulings are due later this month on several spot ether ETF filings, including VanEck’s on May 23rd. There was a report last week that the SEC and Chairman Gary Gensler have believed ether was a security for at least a year. If correct, that would indicate to me there is *zero* chance for spot ether ETF approval any time soon.

There was also word last week that prospective issuers of leveraged ether futures ETFs have recently engaged in positive dialogue with SEC staff regarding their applications. Could the SEC actually approve leveraged ether futures ETFs before spot ether ETFs, and do so while believing ether is a security?

At this point, if anyone can make sense of any of this and explain how these actions protect investors, you know how to reach me.

🚨SCOOP: Some issuers that have filed with the @SECGov for leveraged $ETH futures ETFs describe “positive dialogue” with SEC staff over applications, one telling me they feel “optimistic” the agency will let the funds go into effect based on the engagement thus far.

— Eleanor Terrett (@EleanorTerrett) April 30, 2024

The…

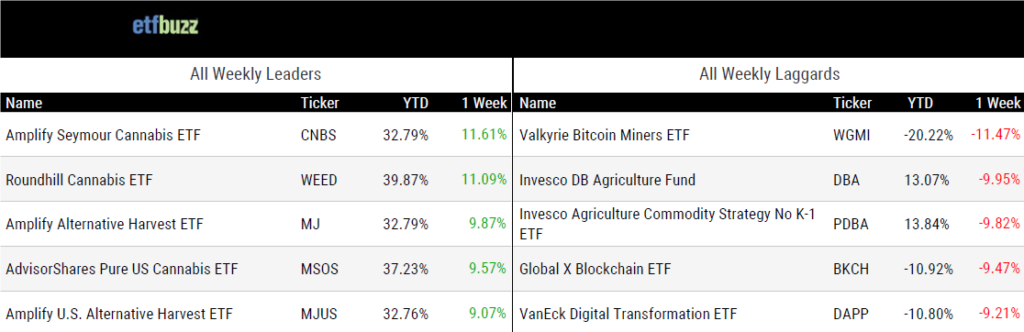

ETF Chart of the Week

Through the end of April, the ten largest constituents in the S&P 500 contributed 77% of the S&P 500’s nearly 6% return. In 2023, the top ten contributed 68% of the index’s 24% return. This high level of return contribution from a handful of stocks presents a major challenge to active managers. If managers are underweight these ten holdings – which now comprise 34% of the S&P 500’s overall weighing – good luck generating outperformance…

Source: Strategas’ Todd Sohn