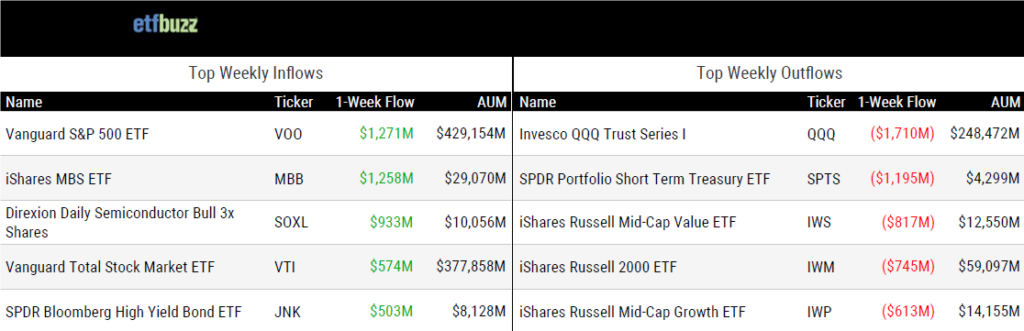

ETF Inflows & Outflows

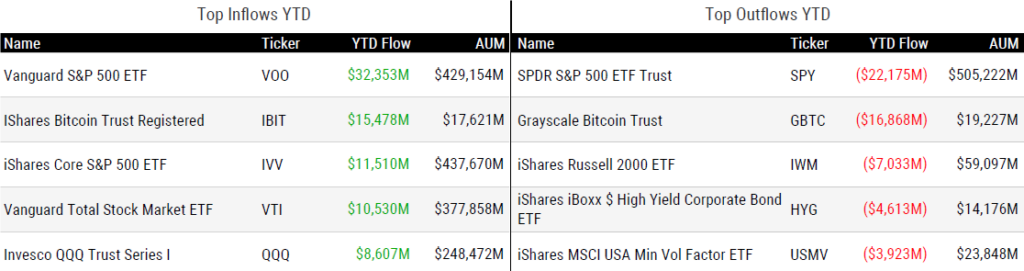

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 4/25/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

New Stock ETFs Offering ‘100%’ Downside Protection Are Coming by Emily Graffeo

“These new funds by Calamos will generally offer less upside exposure but also provide more downside protection.”

Active ETFs are Soaring. Should You Invest? by Bryan Armour

“Since the beginning of 2019, actively managed ETFs’ share of the US ETF market has more than quadrupled.”

BlackRock set for first mutual fund-to-ETF switch by Leo Almazora

“Global investors are telling us they are allocating more to active ETFs.”

Change Is Never Easy: New Global X CEO by Jeff Benjamin

“The garage band phase is over, and we’re now a major player in the ETF space.”

Charles Schwab eyes UK rollout for US-domiciled ETFs by Dom Lawson

“Schwab AM also sees interest in US ETFs among investors in other international markets.”

Morgan Stanley Explores Letting Brokers Recommend Bitcoin ETFs: Sources by Mason Braswell and Miriam Rozen

“We are going to make sure everybody has access to it. We just want to do it in a controlled way.”

US SEC expected to deny spot ether ETFs next month, industry sources say by Suzanne McGee and Hannah Lang

“It’s entirely possible we’ll eventually see ether ETFs. But not until somebody is denied and goes to the courts.”

ETF Tweet of the Week

This week in ETF Unsolved Mysteries? The Opportunistic Trader ETF (WZRD) is closing after launching on March 20th… as in March 20th of 2024(!). Bloomberg’s Katie Greifeld:

“WZRD is a curious one. The ETF has about $25 million, which is fairly impressive for a month-old ETF. In addition, while the fund’s website says it will use “multiple option strategies to hedge risk and capture upside,” the bulk of its portfolio looks like it’s still in cash which had yet to be deployed.”

Katie notes that, over the past five years, the average age of an ETF that shuts its doors is about 4.7 years. Not 4.7 weeks. Let me know if you have any good theories on this one.

This is pretty wild: The Opportunistic Trader ETF ($WZRD) has filed to liquidate. This despite the fact that it launched only about a month ago, on Mar. 19th. It has ~$24MM in net assets and has gained ~2% thus far. Wonder what the story is. https://t.co/Jul0Vdo8yg

— Jeffrey Ptak (@syouth1) April 25, 2024

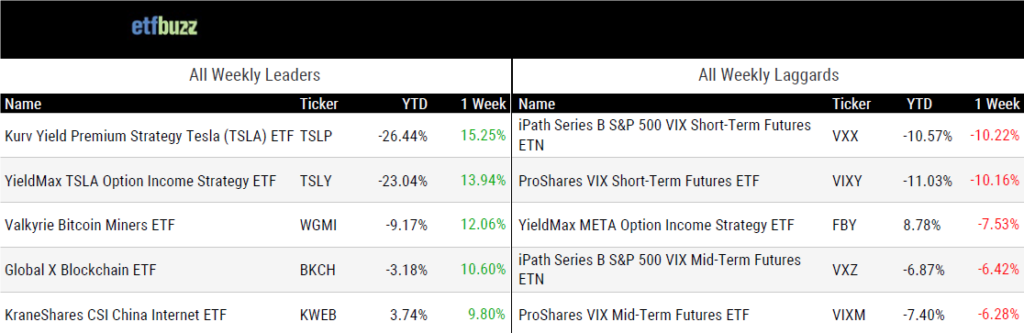

ETF Chart of the Week

A remarkable ETF inflow streak came to an end last week. Since its debut on January 11th, the iShares Bitcoin ETF (IBIT) took in new money for an astounding 71 straight days.

Bloomberg’s Eric Balchunas calculates that IBIT’s feat is good enough to place it in the all-time top 10 longest daily inflows streaks and a record for a new launch.

So, what does the end of this streak mean for spot bitcoin ETFs overall? I offered some thoughts to Fortune here.

Source: Bloomberg’s Sidhartha Shukla

ETF Education Series

As highlighted last week, I recently had the pleasure of moderating a panel on digital asset ETFs with an excellent group of experts including NYSE’s Maital Legum, Grayscale’s David LaValle, ProShares’ Simeon Hyman, and Bitwise’s Matt Hougan. The session was held at the New York Stock Exchange and is part of our Certified ETF Advisor (CETF®) focused collaboration with ETF Central. We covered a number of topics such as the historic debut of spot bitcoin ETFs, bitcoin’s investment case, ETF due diligence, and the future of digital assets in an ETF wrapper. Enjoy!