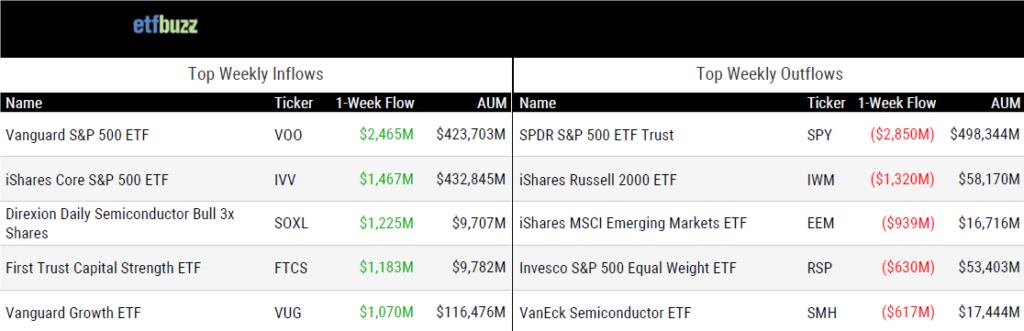

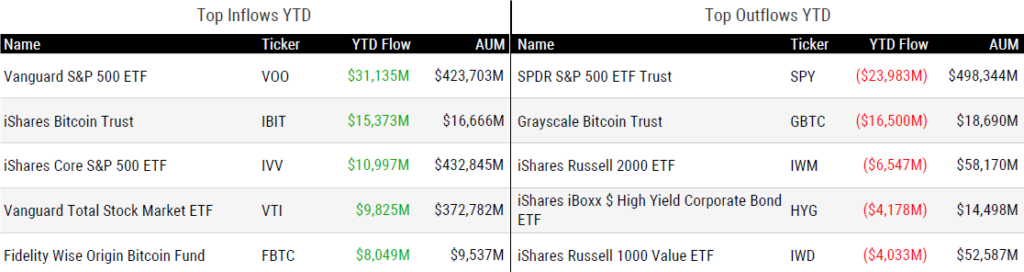

ETF Inflows & Outflows

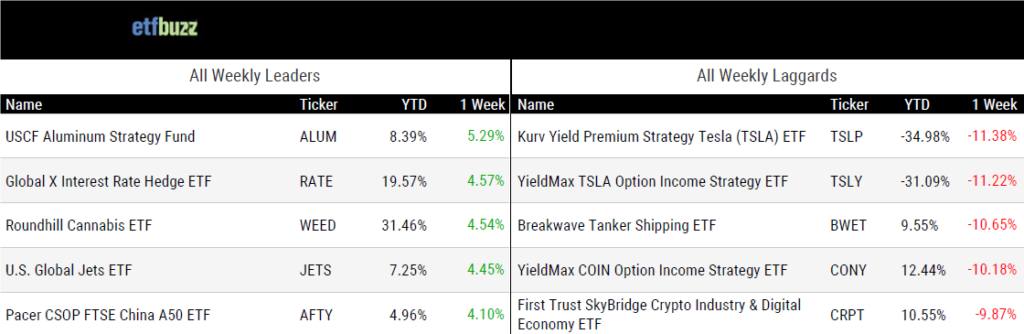

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 4/18/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

ETFs surge to dominant position in US model portfolios by Steve Johnson

“The number of model portfolios that are built purely from ETFs has risen by 30 per cent since the first quarter of 2022.”

The SEC’s Two Masters by Phil Bak

“And this is the story, the biggest story in asset management that no one is talking about.”

After Kicking Off Mutual-Fund Era in 1924, MFS Plans ETF Foray by Katie Greifeld

“With about $630 billion under management at the end of March, MFS is one of the last major firms without an ETF offering.”

Fidelity Reminds ETF Industry It Doesn’t Have To Care by Dave Nadig

“While it is in fact anticompetitive for the ETF industry, I think it’s a tough case to say that a firm can’t preferentially treat different suppliers.”

Crypto ETFs other than Bitcoin and Ethereum funds will ‘100%’ be approved: Grayscale by RT Watson

“I can’t imagine there won’t be another couple currencies that emerge sufficient of scale and size for all of us to participate.”

(Note: I had the pleasure of moderating a panel on digital asset ETFs with an excellent group of experts including NYSE’s Maital Legum, Grayscale’s David LaValle, ProShares’ Simeon Hyman, and Bitwise’s Matt Hougan. The session was held at the New York Stock Exchange and a replay link will be made available soon. The above article does a nice job of capturing several interesting topics we covered.)

ETF Tweet of the Week

The 2024 etf.com Awards were held this past week in New York City. The venue was the Tribeca Rooftop, an amazing location that perfectly reflected the incredible ETF industry talent inside. I was fortunate enough to attend the event and connect in person with many readers of this blog, which was a real treat for this Kansas City-based ETF nerd.

By now, I hope most of you know I am not one to blow my own horn. It’s just not my style. However, I would be lying if I said my chest wasn’t puffed out in pride at The ETF Institute winning “Education Provider of the Year”. The ETF Institute offers the Certified ETF Advisor (CETF®) designation and has been a passion project of mine for several years.

Simply put, the goal is to significantly raise the bar for ETF education across the industry, among financial advisors, media, and end investors. Through our partnership with ETF Central and the New York Stock Exchange, I believe we are doing just that.

It is highly rewarding to have a respected, industry-leading resource in etf.com recognize our efforts. I am extremely excited about what we have in store and welcome any of you to assist us in expanding ETF education.

Thank you to etf.com and CONGRATULATIONS to all of the 2024 winners!

Winner of the “Education Provider of the Year” award goes to The ETF Institute. Congratulations, @ETF_Institute! #etfcomAwards2024 pic.twitter.com/1SddhLuvsw

— etf.com (@etfcom) April 18, 2024

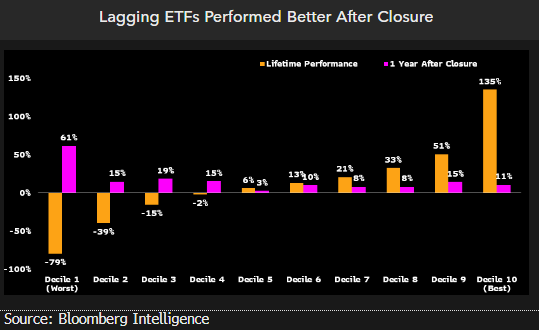

ETF Chart of the Week

This is one of the more interesting ETF charts I’ve come across recently. Bloomberg’s Eric Balchunas notes that, on average, ETFs that closed would have returned double after they shuttered versus when they were alive. Not only that, but their outperformance rates doubled after closure as well. It appears many ETFs close their doors just before performance turns. Of course, performance is a key factor (along with luck and/or timing) in attracting valuable assets. Alpha Architect’s Wes Gray:

“If you don’t have an ETF biz plan that contemplates 5yrs+ in survival capital, you shouldn’t play in the ETF game. At the darkest hours of pain, the light often shines…which we’ve, unfortunately, lived through.”

I actually have a meme specifically for this, which I call “ETF Lifecycle” (follows the below chart).