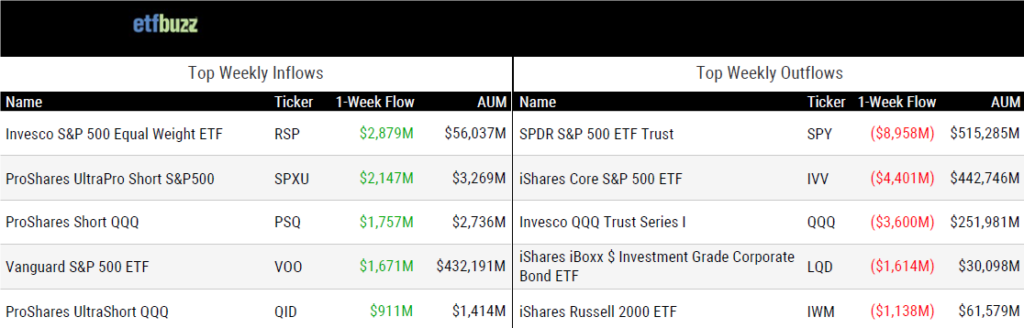

ETF Inflows & Outflows

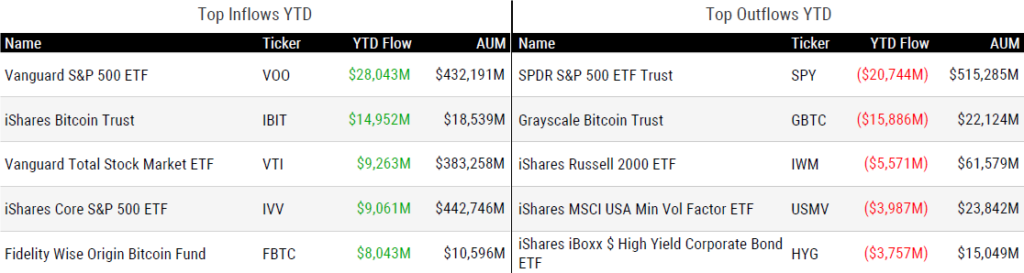

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 4/11/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

Fidelity clawback of ‘free’ ETF trading costs to hit investors by Will Schmitt

“The next ETF we come out with, we’re going to go to the market with the maximum fee we can justify.”

(Note: Thanks to Fidelity’s recent actions, “pay-to-play” is now a hot topic of conversation. VettaFi’s Lara Crigger joined me on ETF Prime to go in-depth on the topic. You can listen to our discussion here. I also offered a few thoughts to etf.com’s Jeff Benjamin.)

Aim Past the Board: Platform fees, ETFs, and connecting with end-clients by Phil Bak

“If you want to have any pricing power at all, if you want platform access, if you want a seat at the table, all you need is for the end clients to demand it.”

For Most Investors, Single-Stock ETFs Are Best Left Alone by Ryan Jackson

“They are flawed, costly, and liable to take more from investors than they give.”

Understanding the hold-up on spot bitcoin ETF options approval by Ben Strack

“We believe the commission should update this outdated approach to approve options on spot commodity-based ETPs that are structured identically to already-approved ETPs.”

Bitcoin ETFs Are a Hit. But Wall Street Might Have a Long Wait for the Next Crypto Funds. by Joe Light

“Some ETF issuers have met with the SEC to talk about their products, but so far, those discussions have largely been one-sided, without the agency giving the companies the critical feedback needed to finalize their products.”

The ETF Flowdown: Q1 2024 by Kirsten Chang

“We’ll be following the flows to see whether these trends spill over into the second quarter and beyond.”

(Note: Kirsten recently joined VettaFi from CNBC. She’ll be joining me on next week’s ETF Prime to discuss ETF flows.)

ETF Tweet of the Week

Bloomberg’s always colorful Eric Balchunas coined the phrase “boomer candy” in reference to the tidal wave of options-based ETFs hitting the market over the past several years. What exactly is “boomer candy”? Balchunas:

“ETFs specifically designed to help older investors stay invested, but with some kind of downside protection built in to calm the nerves.”

Basically, the idea behind these products is to increase income and limit volatility – both of which are mouthwatering goals for many older investors. Boomers have a particular sweet tooth for the JPMorgan Equity Premium Income ETF (JEPI), which has over $33 billion in assets and is the poster child for the options-based ETF category. Defined outcome (or buffer) ETFs also fit the mold.

Leave it to Strategas’ Todd Sohn to take Balchunas’ phrase one step further… an endeavor all ETF nerds will appreciate.

Literal Boomer candy courtesy of @Todd_Sohn who was on the show today to discuss some of these strategies.. A+ ETF nerd gift. pic.twitter.com/Ecz6T4VEeo

— Eric Balchunas (@EricBalchunas) April 8, 2024

ETF Chart of the Week

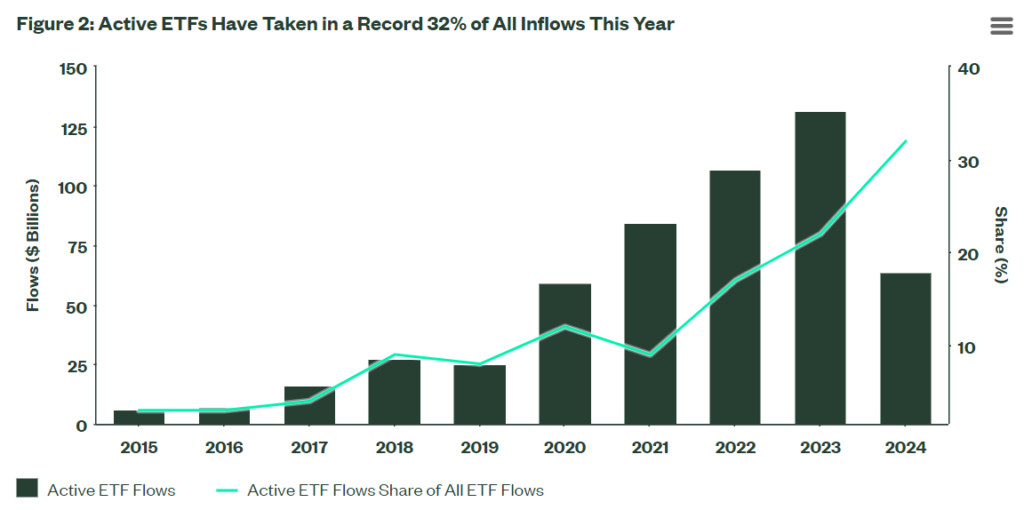

ETFs took in over $200 billion in the first quarter of 2024, including $103 billion in March – the fourth-highest monthly total ever. A meaningful catalyst behind these flows was actively managed ETFs, which continued to punch above their weight. The category only accounts for 7% of industry assets, but brought in a record 32% of all inflows. State Street:

“As of right now, active ETFs account for 32% of all ETF inflows — their highest rate ever and off a 7% share of assets. If the projection of $620 billion for all ETFs holds, and the active share capture remains consistent, that would mean $200 billion into active ETFs this year.”

The record for active ETF inflows is $130 billion, which happened last year. A combination of investors seeking active strategies and asset managers bolstering active ETF offerings has created an enormous tailwind that should continue propelling the category forward.

Source: State Street’s Matt Bartolini