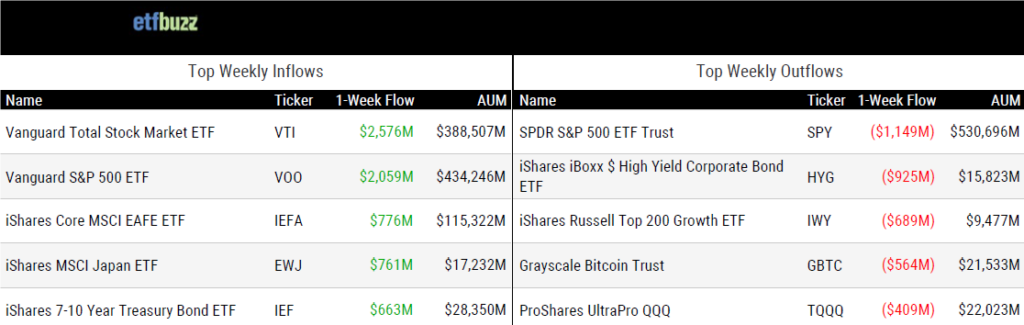

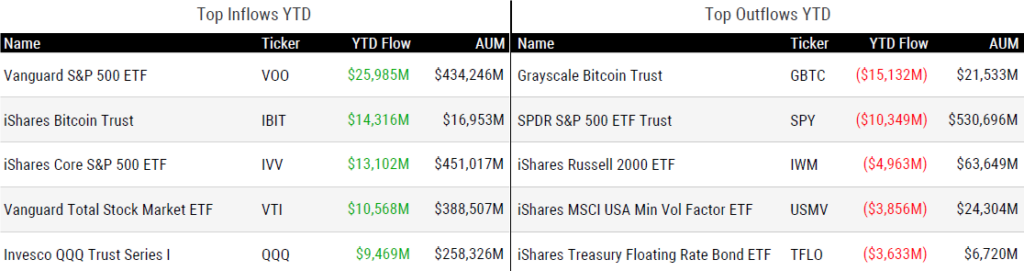

ETF Inflows & Outflows

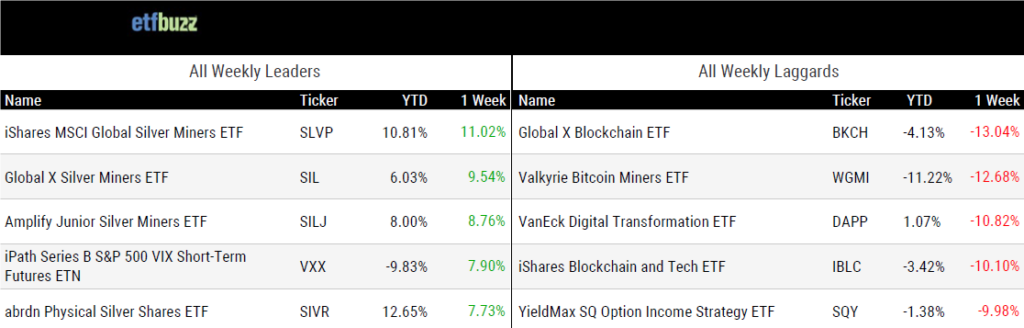

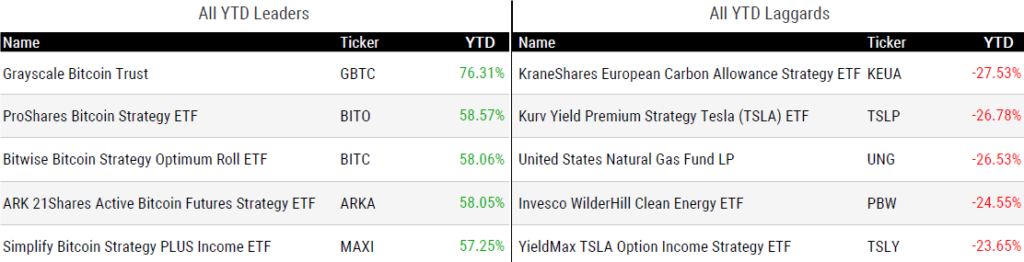

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 4/4/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

Fidelity Adds Surcharge to ETF Platform by Jeff Benjamin

“We’re dammed if we do, and dammed if we don’t.”

Here’s How We Invested a Bundle in a Tiny ETF – and Did it Efficiently by Dan Hallett

“ETF trading volume – the quantity of ETF units traded daily – is one sign of liquidity, but it’s not the most important factor.”

Cboe seeks SEC approval for ETF share class of mutual funds by Suzanne McGee

“Both the number of ETFs and ETF assets could soar.”

S&P 500 trackers hit a record 27% of 2023 equity ETF flows by Steve Johnson

“As ETFs further penetrate the American population and culture these ETFs are likely to be the starting point for many people.”

Why Goldman Sachs is helping its clients launch ETFs by Josephine Rozzelle

“Any number of our clients would tell you, the opportunity cost of not offering ETF products is greater.”

Buffer ETFs May Protect Investors from Outsized Losses. That Comes with a Cost. by Elaine Misonzhnik

“It’s about the use case, and that’s where a little bit more education is needed.”

ETF Tweet of the Week

Last week, I offered some pointed thoughts on Fidelity imposing a $100 “servicing charge” whenever their clients purchase ETFs from nine issuers including Simplify and AXS. I further described the “pay-to-play” dynamics in the ETF industry and their potential negative ramifications:

“While brokerages such as Fidelity are obviously running for-profit operations and should be able to charge for any services rendered, I would argue these types of arrangements also disproportionally punish smaller ETF issuers who may not have the financial wherewithal to participate in pay-to-play. Unfortunately, this has long been a dirty little secret in ETFs. While the industry is clearly the incubator of innovation in asset management – with smaller issuers at the forefront – old school, pay-to-play dynamics on platforms such as Fidelity have gatekept that innovation from investors.”

If you don’t believe that this has a real impact, consider the below comments from Wes Gray, CEO of ETF issuer Alpha Architect and strategic advisor to ETF Architect, who helps bring innovative new products to market.

Thanks to Fidelity’s recent actions, it seems the industry’s dirty little secret is now much more out in the open… which I believe is a good thing.

We get the following question almost every day:

— Wes Gray 🇺🇸 (@alphaarchitect) April 4, 2024

"I went to buy your strategy/MF/ETF at Big Bank’s broker [UBS, MS, GS, Merrill, Wells Fargo, etc.] and they said your ticker is blocked because of “due diligence.” What’s up?"

Answer: We haven’t engaged in their pay-to-play scheme…

ETF Chart of the Week

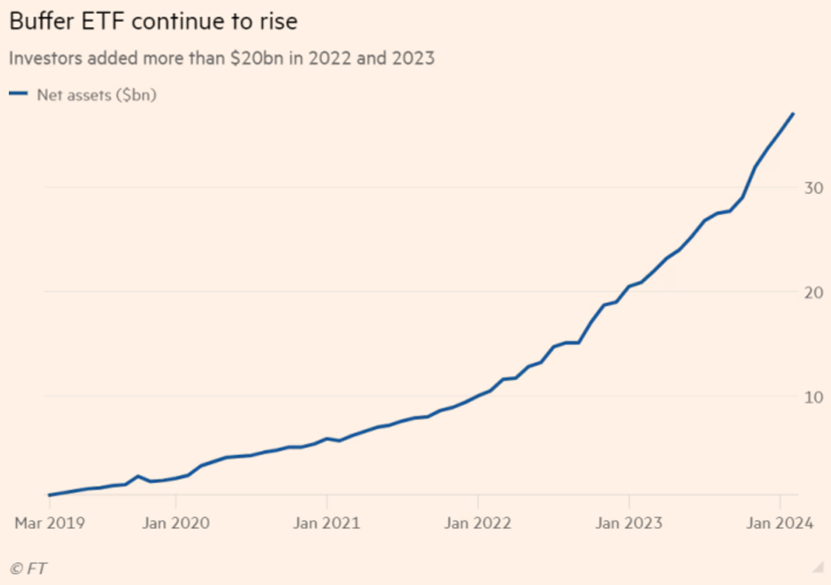

One of the fastest growing ETF categories over the past several years has been defined outcome (or buffer) ETFs. Financial Times notes there are now more than 200 defined outcome ETFs with about $37 billion in assets. The category had only $500 million in assets five years ago.

While these ETFs have pros AND cons (highly recommend reading the last article under “Weekly ETF Reads” above), they are clearly resonating with investors and advisors. Morningstar’s Ben Johnson describes the appeal:

“These products are taking share from other means of getting similar outcomes, notably in the case of structured products and index-linked annuities. As more investors enter or live through retirement, they’re wanting a semblance of control, or at least a feeling of relative security.”

With issuers such as BlackRock now involved in defined outcome ETFs, expect the growth to continue.

Source: FT’s Will Schmitt