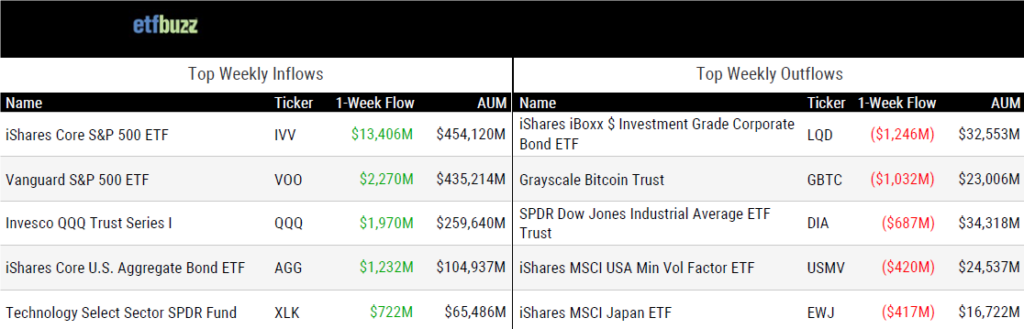

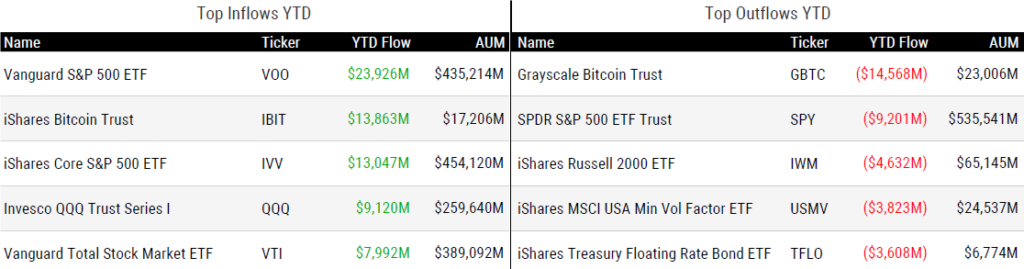

ETF Inflows & Outflows

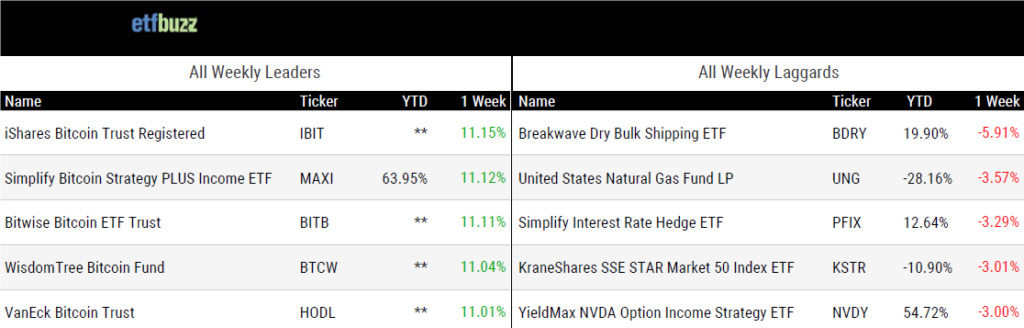

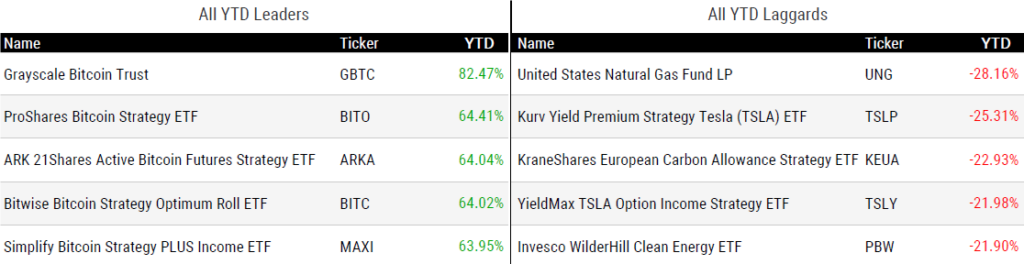

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 3/28/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

Meet the fastest growing ETF firms in the US by Will Schmitt

“We didn’t want to be the same kind of ETF company as the State Streets and Vanguards of the world, where there’s plenty of what you would call ‘cheap beta’ out there.”

TCW seeks OK for ETF shares of mutual funds, mutual fund shares of ETFs by Kathie O’Donnell

“I believe this is the first such filing to request both share-class structures.”

Stifel to Pay $2.3M Over Sales of Complex ETFs by Dinah Wisenberg Brin

“The firm’s reps routinely recommended long-term holdings of funds that reset daily.”

(Note: As always, a little ETF education goes a long way. It appears that Stifel representatives lacked a basic understanding of how leveraged ETFs work. I would be remiss if I didn’t mention that this is exactly the type of problem we are attempting to help solve at The ETF Institute. If you are a financial advisor or ETF industry professional, I would highly encourage you to check out our full ETF educational curriculum at cetf.org.)

How to Choose Great ETFs for the Long Run by Daniel Sotiroff

“Too many options can actually make decisions more difficult.”

ETFs May Be Exciting, But Custodians Hold The Keys To Bitcoin by Sebastian Widmann

“A physical BTC ETF requires 5 key partners: Issuer, Trustee, Administrator, Authorized Participants and Custodian.”

IBIT On Track to Take GBTC’s Spot Bitcoin ETF Crown by Sumit Roy

“The spike in bitcoin’s price has kept the ETF’s AUM from falling more than it has.”

ETF Tweet of the Week

According to Bloomberg, Fidelity will begin imposing a fee whenever clients purchase ETFs from nine issuers including Simplify and AXS. From Bloomberg:

“Under the plan, which will come into force on June 3, investors will face a $100 servicing charge when they place buy orders on a cohort of exchange-traded strategies. The new fee applies to a small minority of firms that don’t participate in a maintenance arrangement with Fidelity.”

When you see the words “maintenance arrangement”, simply replace them with “pay-to-play”. If an issuer wishes to have their ETFs made available on Fidelity’s platform, they must pay for “operational support” to unlock that privilege.

Imagine an investor attempting to purchase say the Simplify Managed Futures Strategy ETF only to find out Fidelity is tacking on a $100(!) surcharge. What year is this?

As Cambria’s Meb Faber pointed out:

“Many investors don’t associate tickers with companies. So this is punishing retail and small investors, not the ETF company. Thousands of little investors are going to buy a few shares, pay $100 commissions, and lose their minds. But they’re going to be furious AT Fidelity not the ETF company.”

While brokerages such as Fidelity are obviously running for-profit operations and should be able to charge for any services rendered, I would argue these types of arrangements also disproportionally punish smaller ETF issuers who may not have the financial wherewithal to participate in “pay-to-play”.

Unfortunately, this has long been a dirty little secret in ETFs. While the industry is clearly the incubator of innovation in asset management – with smaller issuers at the forefront – old school, pay-to-play dynamics on platforms such as Fidelity have gatekept that innovation from investors.

This is bad look for Fidelity.

Big shakeup coming for some ETFs listed on Fidelity’s platform. Story from @emily_graffeo & @kgreifeld.

— James Seyffart (@JSeyff) March 29, 2024

“Under the plan, which will come into force on June 3, investors will face a $100 servicing charge when they place buy orders on a cohort of ETFs” https://t.co/Ti7xdrCZLb

ETF Chart of the Week

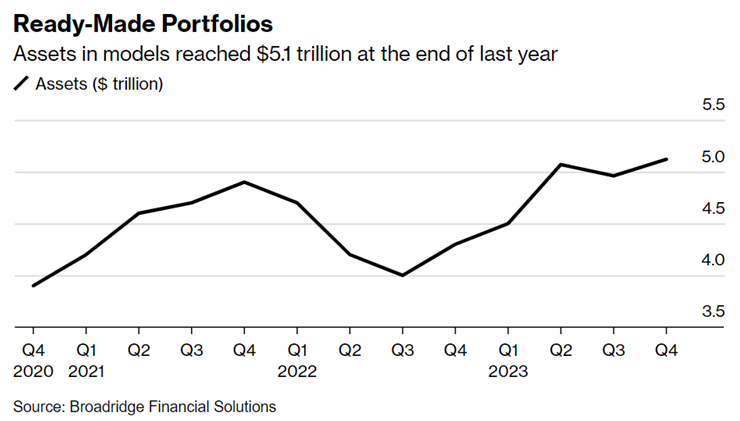

Bloomberg’s Katie Greifeld notes that model portfolios are growing at a 20% annual rate. Financial advisors have taken a liking to pre-packaged portfolios because instead of spending time managing investments, they can focus attention on other aspects of their clients’ financial lives. Plus, clients still receive professional portfolio management – in some cases, from the largest asset managers in the world. Sounds great!

Not only that, but this has been a boon for some ETF issuers, who leverage model portfolios as a key product distribution channel. In other words, guess what you’ll find in BlackRock’s model portfolios? iShares ETFs… surprise!

While model portfolios might sound like a win-win-win for advisors, clients, and ETF issuers, there are some other considerations – many of which I cover in the below podcast (scroll down page) with etf.com’s Jeff Benjamin.

Source: Bloomberg’s Katie Greifeld

etf.com’s Advisor Upside Podcast

I had the pleasure of joining etf.com’s wealth management editor, Jeff Benjamin, for a wide-ranging conversation on building ETF model portfolios, artificial intelligence, spot bitcoin ETFs, and more. Enjoy!