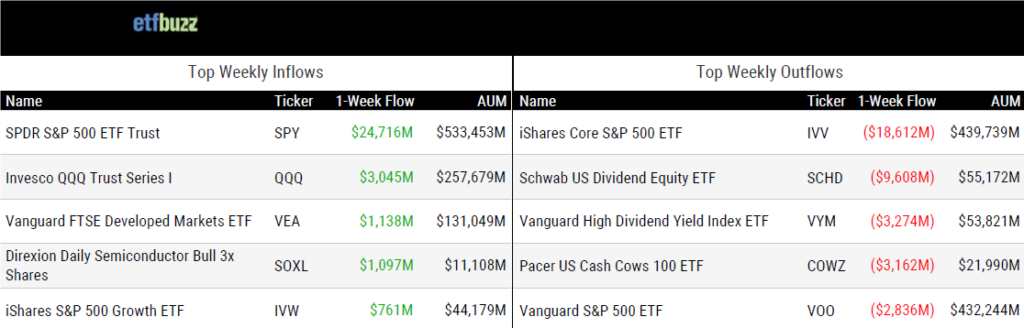

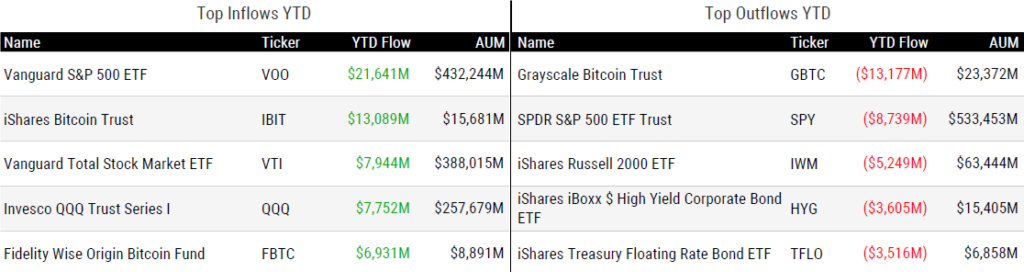

ETF Inflows & Outflows

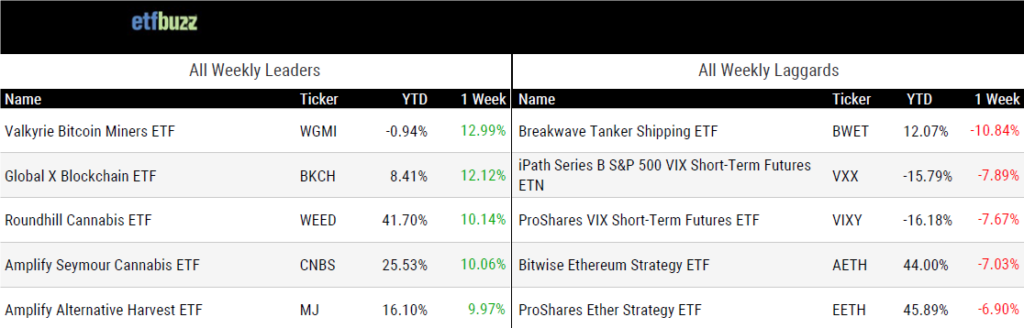

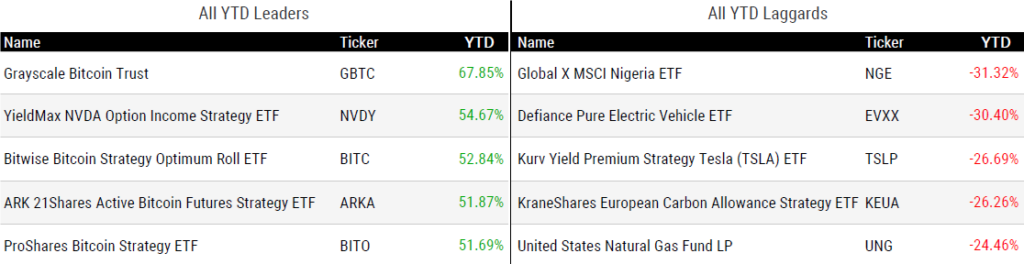

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 3/21/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

The mutual fund at 100: is it becoming obsolete? by Brooke Masters, Will Schmitt, Madison Darbyshire, & Harriet Agnew

“I don’t see what a mutual fund can do better than an ETF. It’s a better mousetrap. Eventually the mutual fund is dead.”

ETFs Seek Breakthrough in 401(k) Plans by Jeff Benjamin

“The majority of innovation in asset management is happening in ETFs, and I have to believe that as a plan sponsor it has got to be increasingly difficult to justify not even considering ETFs.”

2 ETFs, including one on Texas divestment list, to drop ESG from names by Kathie O’Donnell

“With industry and investor attitudes toward the ESG label continuing to evolve, the firm decided to remove the term ESG from the ETFs’ names.”

Uncovering Opportunity in Active ETFs by Cinthia Murphy

“Global active ETF assets have grown more than four-fold in the past four years.”

Strong Performing Covered Call ETFs by Todd Rosenbluth

“They are a great strategy to create income, but a lot of people do not understand the trade-off.”

US asset managers plan to boost ETF sales teams by Alyson Velati

“The recent boom in exchange traded fund product development is prompting some asset managers to increase the number of ETF specialists on their sales and distribution teams.”

Grayscale CEO says fees on its bitcoin ETF will drop over time after outflows hit $12 billion by Ryan Browne

“Sonnenshein said the reason other ETFs have lower fees is that the products ‘don’t have a track record’ and the issuers are trying to attract investors with fee incentives.”

Coinbase legal chief argues SEC has ‘no good reason’ to deny spot Ethereum ETFs by James Hunt

“And we hope they won’t try to invent one by questioning the long established regulatory status of ETH, which the SEC has repeatedly endorsed.”

ETF Tweet of the Week

Bitwise continues to do an excellent job of educating investors on the underlying mechanics of spot bitcoin ETFs. This week, Bitwise President Teddy Fusaro explains exactly how the Bitwise Bitcoin ETF (BITB) acquires bitcoin and creates new shares (click tweet to read entire thread).

As always, a little ETF education goes a long way.

Lots of you asked about how settlement of #bitcoin txns work in bitcoin ETFs, after the ETF buys (or sells) its BTC and how you can follow along.

— Teddy Fusaro (@teddyfuse) March 19, 2024

I'm going to tweet about $BITB specifically in this instance, so for BITB disclosures & prospectus see: https://t.co/tXWwxIzkBX

ETF Chart of the Week

The iShares Bitcoin ETF (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC) have now vacuumed-up investor money for 49 straight days (as of March 21st). Bloomberg’s Eric Balchunas notes this impressive feat has been accomplished by only 30 other ETFs, with none of those putting together a streak starting on day 1 (i.e. launch day).

Among ETFs with active inflows streaks, IBIT and FBTC currently sit in fourth place behind the Pacer US Cash Cows 100 ETF (COWZ), Pacer US Small Cap Cash Cows 100 ETF (CALF), and First Trust SMID Cap Rising Dividend Achievers ETF (SDVY). It will be interesting to see how long IBIT and FBTC can keep their streaks alive, especially given that spot bitcoin ETF inflows overall have waned a bit recently.

Source: Bloomberg’s Eric Balchunas

Exchange Traded People Podcast

I recently had the pleasure of joining Blackwater Founder Mike O’Riordan to discuss the backstory on The ETF Store, ETF Prime, and more. Enjoy!