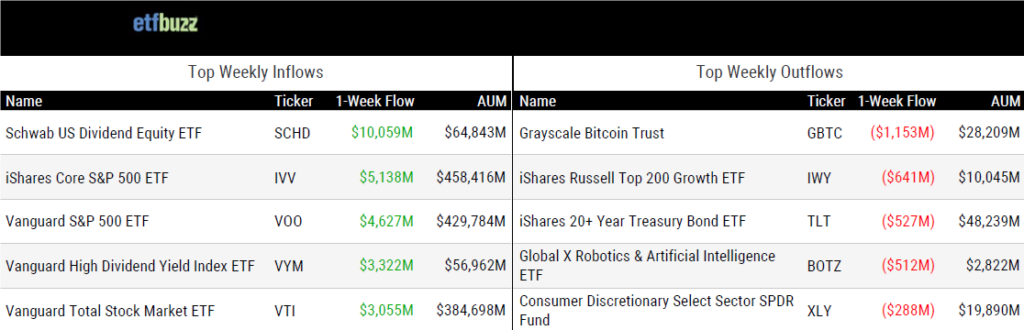

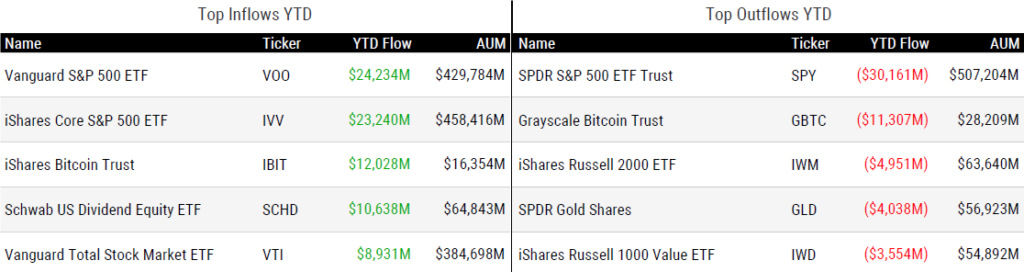

ETF Inflows & Outflows

Performance Leaders & Laggards

Source: ETF Action; flows and performance data as of 3/14/24; performance data excludes leveraged and inverse products

Weekly ETF Reads

One of the Most Infamous Trades on Wall Street Is Roaring Back by Lu Wang & Justina Lee

“Their new form largely takes the shape of ETFs that sell options on stocks or indexes in order to juice returns.”

Learn How Vanguard Seeks to Cut the Cost of Index Tracking Error by Vanguard

“Low expense ratios are eye-catching, and can be an asset, but if a relatively inexpensive ETF also has significant tracking error, that advantage can be eroded.”

DFA undergoes a sea change — literally — with a fancy yacht soirée, cigars and champagne as it attempts to sail away from its mutual fund image into the world of ETFs by Oisin Breen

“Three years after launching its first ETF, Dimensional (DFA) now manages 18% of its AUM through 38 ETFs.”

(Note: Rob Harvey, Co-Head of Product Specialists at Dimensional, will join me on next week’s ETF Prime to discuss the firm’s growth, along with offering a comparison between traditional indexing and a systematic, active investment approach.)

A BTC ETF Pricing Anomaly! by Dave Nadig

“When an AP is deciding how wide to let an ETF run, what they’re really doing is managing their risk.”

Grayscale files to launch low-fee GBTC spinoff to help appease investors: ‘This is a way to throw them a bone’ by Niamh Rowe

“Existing GBTC investors would automatically be opted in for it, and a portion of their shares would be subjected to lower fees without them needing to pay capital gains taxes to transfer into the new fund.”

Bloomberg analysts substantially lower likelihood of spot Ethereum ETF approval in May to 30% by Tim Copeland

“We started to see movement with the spot bitcoin ETF applications in October for their January 10 approval, and we haven’t seen that with the spot Ethereum ETFs yet.”

ETF Tweet of the Week

Women in ETFs (WE) celebrated its 10-year anniversary this past week. WE now boasts over 10,000 members across the globe. Who is WE?

“Founded in January 2014, WE is a non-profit organization that brings together women and men, in chapters in major financial centers across the globe to further the careers of women by leveraging our collective skill and ambition. WE achieves this by organizing events at our chapters globally that support our goals of education, networking, philanthropy.”

VettaFi’s Todd Rosenbluth offers a nice look at WE and its 10th anniversary here.

We were delighted to have four Women in ETFs founders on stage this morning for our 10-Year Anniversary Event.

— Women In ETFs (@WomeninETFs) March 14, 2024

We thank them for their leadership, inspiration, and commitment to inclusivity in the ETF industry. #WEis10 pic.twitter.com/jKSPOtlZkY

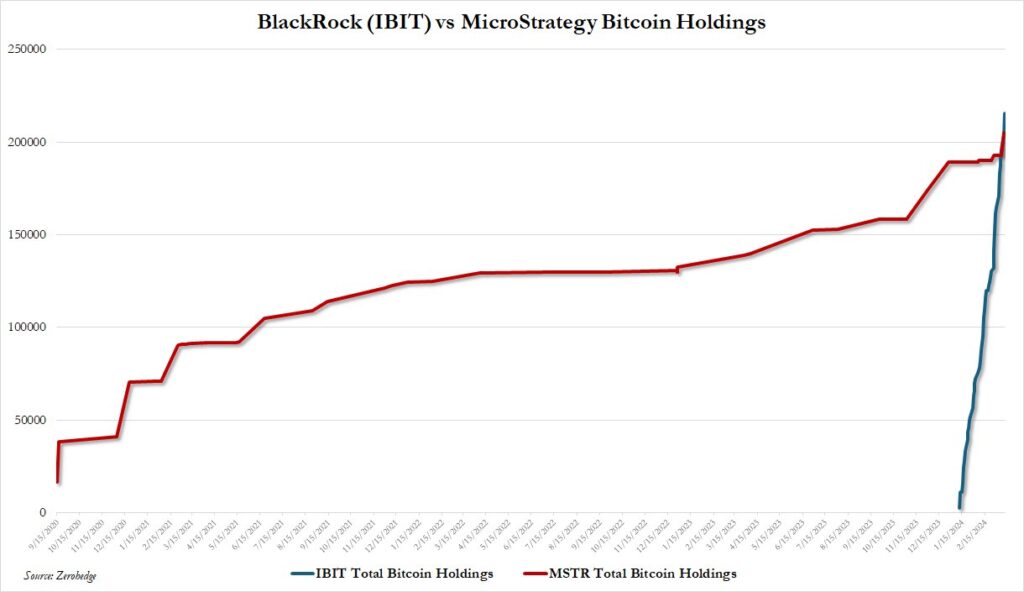

ETF Chart of the Week

The iShares Bitcoin ETF (IBIT) now holds more bitcoin than Michael Saylor’s MicroStrategy, a company that essentially turned itself into a spot bitcoin ETF proxy back in August 2020. IBIT accomplished the feat in about two months.

IBIT likely won’t be the only ETF to surpass MicroStrategy. Fidelity’s Wise Origin Bitcoin Fund (FBTC) currently holds nearly 140,000 bitcoin. Spot bitcoin ETFs overall hold 850,000+ bitcoin, approximately 470,000 of that in the nine new spot bitcoin ETFs (the remainder is in the Grayscale Bitcoin ETF).

Source: Zerohedge